Economy

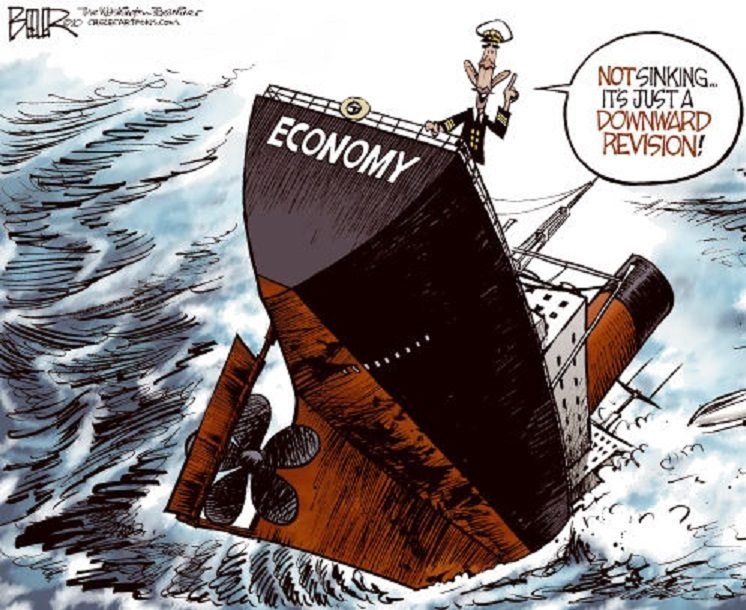

Why the Nigerian Economy Requires Immediate Reforms

Not too long ago, Bola Ahmed Tinubu won the presidential election. He will take over the presidency of Nigeria in May 2023 and will have the difficult challenge of reviving the weak Nigerian economy by implementing many crucial changes.

GDP Growth Rate

The National Bureau of Statistics’ latest data on Nigeria’s Gross Domestic Product (GDP) shows a decrease in the annual GDP growth rate to 3.10% in 2022, compared to 3.40% in 2021. However, in the 4th quarter of 2022, the economy grew by 3.52%, in contrast to the 2.25% in the previous quarter.

Non-oil sectors were responsible for most of the growth. More precisely, 95.66%, while Nigeria’s oil sector contributed 4.34%. Daily oil production increased to 1.34 million barrels per day in Q4, up from the previous quarter’s 1.20 million barrels. However, it is still lower than the 1.50 million barrels per day recorded in the same quarter of 2021.

The services sector was also one of the main reasons for growth, contributing 56.27% to the GDP in the 4th quarter of the year.

Furthermore, the information and communication sector also played a significant role. It caused a 16.22% growth in the 4th quarter, compared to 15.35% in the 3rd quarter and 15.21% in the 4th quarter of 2021.

Another sector that helped with the GDP growth was the trade sector. It added 13.20% to the GDP in Q4, higher than the 12.45% in Q3. Although the sectors mentioned above had a positive effect on the GDP, there are still some sectors that lowered it.

Agriculture’s contribution to the GDP in the 4th quarter was 24.90%, a bit lower than the previous quarter’s 27.55%. Severe flooding across the country significantly set back agriculture, causing the sector to record a 0.94% decrease.

Manufacturing’s contribution to real GDP in 2022 was 8.40%, lower than 15% in 2021. So, the new president can work on expanding labour productivity through education to improve the country’s GDP.

Socio-Economic Issues

Mrs Zainab Ahmed, the Minister of Finance, Budget, and National Planning, mainly worries about the government’s ability to fund important programs due to low tax compliance among Nigerians. In the past, citizens paid taxes, but this changed since Nigeria became an oil-based economy. But, perhaps quite surprisingly, Nigeria’s gambling industry could provide a good source of revenue as it is relatively advanced compared to other African countries.

In general, governments tax the gambling industry to generate revenue, which also applies to Nigeria. However, with the online gambling world remaining largely unregulated in Nigeria (as well as in the vast majority of African countries), Nigeria is missing out on a significant potential source of income, not to mention that Nigerian citizens gambling online remain primarily unprotected due to the lack of regulation in the country.

With no deposit bonuses and other enticing offers brought about by the rise of online gambling attracting more and more players each year, it’s crucial to address the problem of the lack of legislation in this sector – for both players’ and the country’s sake.

And although tax collection has increased significantly from N6 trillion in 2021 to N10 trillion in 2022, the government still needs to address the growing expenditure that outpaces revenue growth by almost double annually.

Improving the Transmission Infrastructure

Power transmission is a huge issue for Nigerian citizens. Despite installing almost 13 GW of grid power-producing capacity, only an average of 3.4 GW reaches customers.

According to Prof. Kingsley Moghalu, the next government must increase revenue and address waste and corruption in governance by bringing in competent professionals to manage the economy. In addition, the new president must take direct ownership and leadership of the power sector, and mandate key players, to enhance transmission infrastructure.

The CEO of Proton Energy, Mr Oti Ikomi, emphasizes the need for a single individual who is accountable and takes instructions from the president, who must take ownership and not just hold a titular position. This individual must have technical, administrative, and supervisory responsibilities and meet regularly with the president.

He cited the example of Egypt, where the President had weekly meetings, which improved the transmission infrastructure. He added that Siemens Energy, a giant global energy corporation, is willing to work with Nigeria, but the country must also be ready to expedite things.

Domestic Debts

Dr Baba Musa, the Director-General of the West African Institute for Financial and Economic Management, finds Nigeria’s large debt a major challenge. He highlights the need to remove fuel subsidies and increase revenue through innovative means, such as cancelling tax relief.

Dr Musa also emphasizes the importance of spending only on essential items until revenue improves. He calls for coordination between the fiscal and monetary authorities and suggests evaluating the quality of fiscal spending.

In contrast, Mrs Zainab Ahmed states that the main issue with the Nigerian economy is the lack of ability to generate sufficient revenue rather than the current debt situation. Therefore, domestic revenue needs to be increased to reduce reliance on borrowing.

All in all, the new Nigerian president, Bola Ahmed Tinubu, must tackle the various economic challenges by implementing critical reforms that will ensure sustainable recovery.

The president must prioritize fiscal management, establish a unified and stable market-based exchange rate, and put an end to fuel subsidies. These measures are necessary to navigate the country toward economic prosperity.

Economy

Quidax, Lisk to Unlock Stablecoins, On-chain Financial Opportunities

By Aduragbemi Omiyale

A partnership designed to expand access to stablecoins and on-chain financial opportunities for everyday users and businesses has been entered into between Quidax and Lisk.

The partnership provides a critical gateway for the developer community, as builders on the Lisk network can now leverage Quidax’s robust digital asset infrastructure to access stablecoins and local currencies at competitive rates.

This institutional-grade infrastructure is designed to power “future-forward” financial products, ranging from neobanks and cross-border payment platforms to regional exchanges and global fintech solutions. It will also allow Quidax customers to trade and move value seamlessly using USDT, USDC, LSK, and Ether (ETH) on the Lisk network.

The collaboration will also accelerate the adoption of Web3 solutions that solve real-world financial challenges for millions of customers across Africa by combining Quidax’s deep local liquidity and compliant framework with Lisk’s scalable L2 technology.

In 2024, Quidax became the first crypto exchange to receive a provisional operating license from Nigeria’s Securities and Exchange Commission (SEC).

“The partnership with Lisk enables us to extend our platform to serve more people and cater to the increasing demand from products and services that want to integrate our stablecoin and digital assets product to build products across Africa,” the Chief Infrastructure Officer at Quidax, Mr Morris Ebieroma, said.

Also commenting, the Ecosystem Lead for Africa at Lisk, Ms Chidubem Emelumadu, said, “Africa represents one of the most critical frontiers for blockchain innovation, where the demand for reliable and inclusive financial tools is urgent.

“Our partnership with Quidax expands access to stablecoins and on-chain financial opportunities for everyday users and businesses. At the same time, it gives founders building on Lisk the critical infrastructure they need to create solutions that can scale meaningfully across the continent,” she added.

Economy

Customs Urges Freight Forwarders to Adopt Automated Licence, Permit System

By Adedapo Adesanya

The Nigeria Customs Service (NCS) has urged freight forwarders to adopt its automated Licence and Permits Processing system to reduce the cost of doing business.

This advice was given by the Assistant Comptroller-General of Customs, Mr Muhammed Babadede, during a stakeholders’ engagement on automation held in Lagos on Monday.

He noted that the reform responds to longstanding demands for faster, more transparent and simpler procedures for industry stakeholders, disclosing that Comptroller-General of Customs, Mr Bashir Adeniyi, has approved the full automation of the service’s licences and permits processes.

“For years, stakeholders dealt with paperwork, long queues and uncertainty from manual processing. Those days are coming to an end.

“This sensitisation is across all zones. The goal is to ensure stakeholders understand the automated system before implementation,” Mr Babadede said.

He said automation would enable applications and renewals from offices or mobile phones, eliminating visits to customs formations, assuring stakeholders of a fair and consistent process, and reducing errors associated with manual documentation.

He said automation would improve record-keeping, supervision and service delivery without increasing pressure on officers.

The Deputy Comptroller-General, Tariff and Trade, CK Naigwan, also represented by Mr Babadede, reiterated management’s commitment to seamless implementation.

Meanwhile, the Comptroller of Customs for Licence and Permit Unit, Mrs Ngozika Anozie, praised the Comptroller-General for driving innovation within the Service, saying the automation aligns Customs procedures with global best practice and strengthens institutional efficiency.

According to her, the reform reflects the three-point agenda of the Chairman of the World Customs Organisation, Mr Adeniyi, centred on consolidation, collaboration and innovation.

She said the system would enhance the ease of doing business in the maritime sector and boost national revenue generation.

“Automation will cut business costs and reduce travel risks for stakeholders

“They will no longer travel repeatedly to Abuja, paying for transport, hotels and feeding to process licences and permits,” she said, adding that the platform would automatically reject fake documents and accept genuine submissions, curbing fraudulent practices.

“The CGC is determined to sanitise the system, and we are committed to achieving that objective,” Mrs Anozie said.

On his part, the Assistant Superintendent of Customs, Mr Ibrahim Usman, said the Licence and Permit Unit operates under the Tariff and Trade Department.

He explained that the unit ensures proper issuance of licences and permits and compliance with import regulations.

Mr Usman said all licences and permits expire on December 31 of their issuance year.

He added that the portal would become fully operational after nationwide sensitisation, with stakeholders duly informed.

Customs Area Controller, Tincan Island Command, Mr Frank Onyeka, thanked stakeholders for their continued support.

He urged them to take the exercise seriously to achieve seamless processing across Customs operations.

Stakeholders raised concerns about online payment integration and potential technical disruptions.

Officials addressed the questions and pledged continued engagement to ensure smooth implementation nationwide.

Economy

Oyedele Links Nigeria’s Stock Market Surge to Fiscal Reforms

By Adedapo Adesanya

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, has linked the surge in the nation’s stock market to ongoing fiscal reforms aimed at strengthening investor confidence and stabilising the economy.

Speaking at the 3rd PUU Capital Market Colloquium on Monday in Abuja, Mr Oyedele described the ongoing reforms as one of the most consequential fiscal resets in Nigeria’s modern history, noting that they are designed to build trust in the economy, stimulate inclusive growth, and foster a more investment-friendly environment.

According to him, the impact of these reforms is already visible on the trading floor of the Nigerian Exchange (NGX) Limited. As of mid-February 2026, the All-Share Index recorded a 25.3 per cent return within the first seven weeks of the year, while market capitalisation crossed the psychological N100 trillion mark in January before reaching an all-time high of over N125 trillion by February 20.

On January 13, 2026, the index reached an all-time high of 165,837.33 points, extending a rally that had already delivered a 51.2 per cent return in 2025, the strongest performance in nearly two decades.

Mr Oyedele linked the strong performance to structural reforms that had improved transparency, enhanced foreign exchange liquidity, and provided greater predictability in tax administration.

“The results of these policies are already evident on the trading floor. As of mid-February 2026, the Nigerian Stock Exchange (NGX) showed exceptional performance with the All-Share Index (ASI) recording a robust 25.3 per cent return in just the first seven weeks of the year, with market capitalisation crossing the psychological N100 trillion mark in January, and reaching an all-time high of over N125 trillion by 20 February 2026.

“Confidence continues to grow from both foreign and domestic investors, driven by the structural reforms and strong performance in key sectors like energy, industrial and financial services,” he said.

He explained that historically, Nigeria’s tax system had been fragmented and costly to comply with, discouraging investment and limiting efficient capital allocation.

“To address this, the new tax framework provides a unified, transparent and predictable environment where businesses can plan effectively, and investors can price risk appropriately,” he said.

He outlined several provisions in the new tax laws aimed at deepening the capital market. These include a full Capital Gains Tax exemption on proceeds reinvested in Nigerian shares within the same year, higher tax-exempt thresholds for small and retail investors, and a legal framework to reduce corporate income tax from 30 per cent to 25 per cent.

Other measures include the removal and reduction of certain transaction taxes, such as stamp duties on share transfers and withholding tax on bonus shares, as well as provisions that protect foreign investors from being taxed on naira gains without accounting for foreign exchange losses.

He emphasised that the ultimate goal is not merely to celebrate rising market indices but to translate financial market growth into tangible economic development, including financing for infrastructure, factories, innovation and job creation.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn