Education

From Okeho Ahoro to Okeho Ile: A Review of the Okeho Exodus

By Mutiat Titilope Oladejo

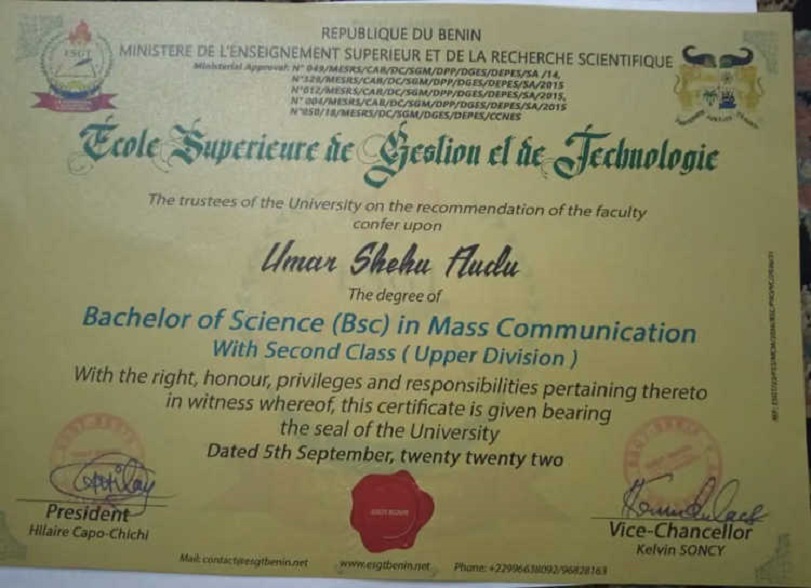

Title: Okeho Exodus: Regicide, Revolt, Relocation: A Historical Play

Playwright: Olutayo Irantiola

Publisher: Peo Davies Communications

Year of Publication: 2022

Reviewer: Dr Mutiat Titilope Oladejo

As a historian, I find it interesting to read Olutayo Irantiola ‘s book on The Okeho Exodus. I reviewed the book, and I am pleased to say that we have our story, and it is good that we can recreate them for our pleasure and for the future.

While lecturing at Emmanuel Alayande College of Education, I had the cause to visit Okeho to supervise students in teaching practice. I also visited other towns in Oke-Ogun. In my travels around Oke-Ogun, I am distraught by the level of development in that region of Oyo State. I even wonder if Ibarapa and Oke Ogun regions are ever on the map of development in Oyo State.

Okeho, a typical Yoruba town, maintained its identity to survive the nineteenth-century turmoil tensioned by the transition from the illegitimate commerce of the slave trade to the legitimate commerce of the Bible and plough.

Olutayo Irantiola’s play fiction, the Okeho-Iseyin uprising of 1916 to narrate the everyday realities of major events that aggravated the chaos. It is pertinent to note that it coincided with the period of the first World War. Britain, at this time, used colonial laws to encapsulate the colonies.

The book gave the impression that encounters with the Fulani and Dahomey already influenced the internal security issues of the town and its environs. This can’t be downplayed because the Fulani and even Nupe have years of integration into the Oke-Ogun region. Of course, Prof. Babatunde Ayeleru’s inaugural lecture gives us the impression that the Dahomey/French influence remains relevant in some parts of the Oke-Ogun region. Some doctoral students are also investigating the cross-border trade between Nigeria and Benin Republic via Oyo north.

The threats, then, made Oba Arilesire call for a common political identity between Okeho and the towns around. There was a merger that enabled cooperation against enemies. However, the death of the king and the emergence of Onjo Owolabi Olukitibi as the new king changed the status quo. Although the book gave the impression that the Ajele created havoc at this time, I disagree a bit because the Ajele was a revenue collection institution that existed since the eighteenth century. Little or nothing can the Onjo do to stop it. It is only the British policy of indirect rule that reinforced the Ajele. Taxation should not be the issue; the people were just estranged from the colonial influence on everyday life.

The uprising also emanated from rancour and mischief among the Baale. Pointedly, Baale Olele, Balogun Atilola, Alasia and Ba’Ogan were fingered as opposition to the reign of Onjo Owolabi Olukitibi. They wanted him out because he was considered an agent of colonial imposition.

The schema headed by Baale Olele was possible because the citizens preferred the traditional lifestyle. The book gave the impression that there was opposition to colonial rules against open defecation, thus compelling them to build toilets in their homes. Vaccination of children was also considered taboo as it was believed that it would affect their brains.

Courts were established, and it was considered a big threat to the existing gender relations. Women used the courts to snap out of oppression as they sought a divorce. To men, oppression is normal and should not be questioned. Statistics from the archives I used in my book: The Women Went Radical: Petition Writing and Colonial State in Southwestern Nigeria, 1900-1953, attest to this because Okeho and Iseyin had high rates of divorce in the 1940s.

Furthermore, Christianity was a threat as the custodian of traditional religion believed that the missionaries were causing havoc to the belief system. Men worked as labourers to survive the colonial economy, and the scope of authority that gave powers to the police angered them. The policemen (Akoda) were considered traitors.

Scholars have opinions on the issues, but the book sets us into an interesting fiction. Mofeyisara Oluwatoyin Omobowale, in “Okeho Uprising” in the International Encyclopedia of Revolution and Protest, concluded that the uprising was brutally suppressed. Prof. J. A. Atanda, in the article: “The Iseyin-Okeiho Rising of 1916: An Example of Socio-Political Conflict in Colonial Nigeria,” published in the Journal of Historical Society of Nigeria, 1969, affirms that taxation was not the problem but just a revolt against colonial imposition to all spheres of life.

The schema extended to Iseyin as the uprising was jointly executed to wipe out Onjo Olukitibi, the queen and the prince. Captain Ross responded swiftly by mobilizing the colonial army to capture Baale Olele and cohorts. They were sentenced to death by hanging.

The chaos led to the disruption that made colonial rule more pronounced. The people were compelled to move from Okeho Ahoro, the site of the uprising, to Okeho Ile to ensure effective monitoring by the colonial state.

I appreciate my friend for his patriotism in writing this book, the playwright and I attended Abadina College, the University of Ibadan, the University of Ilorin for undergrads and back to the University of Ibadan for postgraduate programmes.

I will like to mention that I appreciate my friends at the University of Ilorin who chose to return home after their studies. A number of them insisted they would be back home to teach, farm or work with the local government. I appreciate their patriotism! It also dawned on me that I also feel the same way about Ibadan city as my home.

Long live Oyo State!

Dr Mutiat Titilope Oladejo is of the Department of History, University of Ibadan

Education

Hallos Launches Learning247 Summit

By Adedapo Adesanya

Live-learning and creator-economy platform, Hallos, as part of its expansion drive, has unveiled plans to equip millions of youths and women with digital skills and monetisation opportunities through the Learning247 Hallos Summit, aimed at integrating Nigeria’s South-East into the rapidly expanding global creator economy.

At a sensitisation and stakeholder engagement forum in Enugu, the organisation also called for stronger strategic partnerships with government agencies, educational institutions, development organisations, media houses and private-sector stakeholders to advance the creator economy as a credible engine for mass employment, youth prosperity and inclusive economic growth.

The chief executive of Hallos, Mr Alexander Oseji Uzoma, renewed the call for increased investment in internet penetration, reliable power supply, digital infrastructure, creative studios and youth-focused innovation hubs across Nigeria, especially the South-East.

Describing the creator economy as one of the most accessible and scalable employment frontiers globally, he noted that with basic tools such as a smartphone, internet access and creative skills, young people can build audiences, monetise knowledge and generate sustainable income without heavy capital investment or long career pathways.

According to Mr Uzoma, the creator economy offers low-barrier entry into diverse professions, including content creation, social media influencing, live tutoring and digital coaching, video production, podcasting, graphic design, music and performance arts, digital marketing, merchandise design, e-commerce and community management. These activities support a broader value chain spanning production, distribution, technology and management.

The Hallos co-founder also explained that global projections place the creator economy in the hundreds of billions of dollars, with millions of creators worldwide earning sustainable incomes, stressing that Hallos is focused on localising these opportunities to ensure African youths can participate meaningfully and compete globally.

He further noted that Hallos operates a live-learning and creator-focused platform that integrates education, gamified quizzes, merchandising and voluntary fan donations into a single ecosystem. Through the platform, creators can host live learning sessions and masterclasses, earn from quizzes and challenges, sell branded merchandise, receive voluntary donations, build communities around their expertise and organise monetisable podcasts.

Mr Uzoma said the creator economy, driven by social media platforms, streaming services, digital commerce and content monetisation tools, has evolved into a major global industry capable of generating wealth, creating jobs and expanding export earnings.

He stressed that social media should no longer be viewed as a recreational space but as a viable business environment for wealth creation.

“The focus should not just be on content creation alone but on building businesses around content. It is about value creation and structured digital entrepreneurship,” he said.

He disclosed that Hallos intends to reach about 10 million youths nationwide, with over 5,000 already engaged across its programmes, while placing strong emphasis on bridging the gender gap by empowering women and girls through targeted digital training, mentorship and access to monetisation platforms.

As the digital economy continues to expand, Hallos said the creator economy stands out as a practical and scalable solution to youth unemployment, offering low entry barriers and global earning potential.

The company reaffirmed its commitment to bridging the gap between talent and income, enabling young Africans to earn well above minimum wage through creativity, knowledge and structured participation in the global digital economy.

Education

Bayero University PG Students to Enjoy Dangote’s N1.5bn Scholarship

By Modupe Gbadeyanka

Post-graduate students of Bayero University Kano (BUK) will benefit from a scholarship worth about N1.5 billion from the Aliko Dangote Foundation (ADF).

The businessman put down the funds to support eligible MBA, entrepreneurship, and management postgraduate students of the institution under an initiative known as MHF Dangote Graduate Business Scholarship.

At a ceremony on Tuesday, the foundation and the school signed a Memorandum of Understanding (MoU) at the auditorium of the Dangote Business School, Kano.

The deal is to provide N300 million annually over five years as scholarship awards to the beneficiaries, who will receive N150,000 each per session, beginning with the 2024/25 academic session. This is equivalent to 50 per cent of the current N300,000 fee paid by the post-graduate students. There are 1,225 students in the Business School (696 fresh and 529 returning students).

One of the beneficiaries, Mr Khalid Bababubu, who is into manufacturing and specialises in MBA, Finance and Investment, thanked the organisation for the gesture.

“We are happy to be beneficiaries of this initiative. Education is the bedrock of national development, and we will not take this scholarship for granted,” he said.

A representative of ADF, Ms Mariya Aliko Dangote, said, “Our vision at the Foundation is to build human capital that translates into economic opportunity.

“Strengthening business and entrepreneurship education is critical to turning knowledge into enterprise, innovation, and jobs. This scholarship deepens our commitment to Dangote Business School by investing directly in the next generation of business leaders and change-makers.”

On his part, the Vice Chancellor of Bayero University Kano, Prof. Haruna Musa, said, “This support comes at a critical time for many families. Beyond financial relief, it strengthens the Business School’s role as a centre for developing entrepreneurial and management talent, particularly for women who are increasingly taking leadership roles in enterprise.”

It was explained that newly admitted students will receive automatic tuition reductions during registration, and returning students who have already paid in full will receive rebates. The N300 million allocation is structured to cover all eligible postgraduate students based on current enrolment capacity.

Any unutilised balance in the first year will be retained within the Dangote Business School development envelope to strengthen learning infrastructure and digital academic capacity, ensuring continued enhancement of the academic environment.

The MHF Dangote Graduate Business Scholarship is distinct from ADF’s recently announced nationwide STEM education interventions.

Education

Entries for InterswitchSPAK 8.0 Begin, Over N40m up for Grabs

By Aduragbemi Omiyale

Senior secondary school students across Nigeria have been invited to apply and demonstrate their academic excellence on a national stage in the eighth edition of the prestigious national science competition known as InterswitchSPAK.

The contest is organised by Interswitch, Africa’s leading technology company focused on creating solutions that enable individuals and communities prosper.

Registration for InterswitchSPAK 8.0 via www.interswitchspak.com has opened and will close on Friday, May 24, 2026. For the first time, in addition to group registrations through schools, parents can also register their individual children for the competition.

This year’s edition features a scholarship pool exceeding N40 million, with Interswitch expanding the prize structure to ensure broader impact.

The overall winner will receive a N15 million tertiary scholarship, including monthly stipends. The first runner-up will be awarded a N10 million scholarship, including monthly stipends; while the second runner-up will receive a N5 million scholarship, also including monthly stipends. All scholarships are payable over 5 years. Also, the top 9 finalists will all receive brand new laptops and other exciting prizes.

In addition to the top prizes, Season 8 introduces enhanced rewards for student finalists ranked 4th to 9th, as well as increased recognition for teachers supporting qualifying students from 1st to 9th place. This expanded structure reinforces Interswitch’s commitment to rewarding academic excellence and recognising the critical role educators play in shaping student success.

“At Interswitch, we strongly believe that Nigeria’s future will be shaped by how well we nurture today’s young minds. InterswitchSPAK goes beyond competition; it is a long-term commitment to empowering students and supporting teachers who are laying the foundation for innovation, problem-solving, and national development.

“As we launch Season 8, we remain focused on creating opportunity, rewarding merit, and inspiring excellence across Nigeria,” the Executive Vice President for Group Marketing and Communications at Interswitch, Ms Cherry Eromosele, said.

Designed to empower young minds in the Science, Technology, Engineering, and Mathematics (STEM) areas, InterswitchSPAK identifies, nurtures, and rewards students while equipping them with the skills and knowledge required to excel in STEM fields and drive innovation.

Over the past seven seasons, InterswitchSPAK has positively impacted thousands of students across the country, offering full university scholarships, mentorship opportunities, and national recognition for outstanding academic performance.

Beyond these rewards, the programme has consistently reinforced the importance of STEM education as a critical driver of innovation, problem-solving, and sustainable national development.

Through a transparent, technology-enabled selection process, InterswitchSPAK has also promoted educational equity by providing students from diverse socio-economic backgrounds with equal access to opportunity, ensuring that performance and merit remain central to success.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn