Feature/OPED

Why ‘Half Of A Yellow Sun’ Didn’t Make It

Isedehi Aigbogun

Being an English teacher all my work-life, it would be a huge shame on me if I were able to, somehow, approach the criticism of the movie, Half of a Yellow Sun, from a biased point of view. So, like my colleagues and I would normally do for essays, I will list out a couple of criteria that will be used in “marking” this movie.

Remember in secondary school, where C, O, E, MA (or whichever kind is used—we have a variety of this mark scheme) stands for Content, Organization, Expression, and Mechanical Accuracy? Well, in this case, I’ll be using PTDCP (my coinage) which stands for Premise, Theme, Dialogue, Character, and Pacing.

I’m being modest here; there are over 10 criteria in the more serious international screenwriting world, and a million other points of analysis!

Let me enlighten you a bit: a lot of people do not know that a learned screenwriter can look beyond the pictures of a movie and see the script! Yes, the script! After all, Alfred Hitchcock, the Master of Suspense, has said that “to make a great movie, you need three things: the script, the script, and the script.”

There are set rules for writing a movie script; which is different from the rules Biyi Bandele used to write his screenplay; which is also extremely different from the rules Chimamanda uses to write her novels, and without wasting further time, we’ll get to some parts of it!

PREMISE:

One thing I learnt teaching English is to always give positive feedback first; so that the learner doesn’t feel entirely bad about his essay. While marking, we appreciate little aspects of the essay such as the child’s use of punctuation in some parts of the essay; his choice of words (even if it’s just one fantastic word, we dwell on it); or if there’s nothing to appreciate about the essay at all, we make comments such as “your noble intentions are appreciated, however, essay writing requires much more”. This is exactly the kind of comment I would make for this movie!

Half of a Yellow Sun details the events of a civil war in Nigeria in the midst of a love story; a story about two lovers caught up in the midst of war. Fantastic! Everyone wants to watch a love story, everyone wants to see how the troubles of our environment—the real movie—affect us domestically, economically; affect our relationship, and what have you. This is definitely deep and well appreciated, thanks to the writer of the original story, Chimamanda. Honestly, this movie could have been internationally successful if this were the only requirement.

Unfortunately for this Half of a Yellow Sun crew, screenwriting requires much more.

For these aforementioned reasons, and especially because the screenwriter is not the originator of the premise, I’ll give this aspect 8/10.

THEME:

I tried my best to follow through with the major messages that could be got from this movie. The more I tried to follow through, the more disappointments I got. A number of themes can be identified in this movie apart from War and its Effects: Love, Familial Expectations, Friendship, Wealth and Business Opportunities, Ethnic Bias, Charity, Academia, Death, and so much more. The script appears to be ambitious in its evaluation of theme, yet not encompassing in such a way that the audience feels nothing experiencing them.

This, unknown to the screenwriter is very distracting especially because he always disconnects the audience from the major story when he isn’t telling the major story, and almost like an attempt to tell different other almost disconnected stories. My point may not be clear at the moment; this is because I just might need to explain clearly what I mean with how the characters of the movie are portrayed.

If your audience is placed in a situation whereby they have to make the effort to meet you half way in your story-telling, then you’re getting some things wrong. 4/10

CHARACTERS:

I could write a 10-page essay on why all the characters in this movie do not work! One major reason is how flat they are. They are the same from the beginning to the end. Their reactions to certain situations are expected, and so there isn’t any element of surprise in the nature of the characters.

They start off all nice and noble, continue, and end the same way.

There are instances in the movie where I hoped they would change: take charge, recluse, rebel, create some tension for us, make us wait for the unexpected, but that never happens. The characters are nothing but pawns in the story; helplessly hopped around on the chess board, and not actively doing anything to change the world they live in. And this includes the major characters.

Oh, wait! I see what happened here. The movie crew probably thought that if Hollywood stars played the major roles in the movie, everyone would be mesmerized, and no one would notice just how weak the characters really are. Majority of Nigerians who applaud this movie could be fooled, but I couldn’t, and certainly not the international world!

There’s a screenwriting trick to helping you get your characters take charge and do more, and it’s as simple as creating conflict in every scene.

A screenplay has basically 40-70 scenes, and something pushy must happen in every of those scenes. These things would naturally form the base of your THEME (see above)—but nothing ever really happens in this script. The characters walk around as though they are a surprise bomb (which never explodes); like they are having the audience experience some sort of suspense, but really, they are, in fact, plain annoying, and that’s because they don’t have enough substance to enable us care about them.

Take a look at the dirty maid Odenigbo had to sleep with, for instance—from where to where?! The audience feels more surprised and disgusted (seems good, but isn’t, given the circumstance) in Odenigbo than solely disappointed; such behaviour was never hinted in his character from the start, and the Mom didn’t seem quite convincing either.

Maybe the maid should have been portrayed as truly tempting, you know, like a video vixen. That would have worked, but guess what, that would have changed the whole story as well, which to me would have been a better choice; a screenwriter doesn’t have to reproduce the novel’s characters verbatim; there is what is called creative license, A.K.A. tweaking. Come on, Biyi, Chimamanda has more space to create tension with such character in her novel than you do with your screenplay!

Not to forget, at some point in the movie, it appears the audience are waiting for something to happen till finally the explosion occurs at the wedding, which no character is responsible for—why the hell not? Then there is a dramatic display of Olanna caring about some lecturer friend we only met once, and who never said anything worthwhile. An explosion kills him and the audience is expected to care with Olanna?!

To crown it all, what movie doesn’t have an antagonist? I’m not even sure I met any of the villains apart from my darling Hakeem Kae-Kazim (Captain Dutse) whose character was distastefully under-developed, and unfairly allowed to be hated by the audience. Some villains can be loved by the audience too! Did you know? I’ll just stop here. 2/10

DIALOGUE:

This screenplay makes all the mistakes a script could possibly make in the aspect of dialogue. Even though there are a few memorable lines; these lines feel like perfect lines poached from the novel, or maybe, just maybe, the stubborn decision of the Hollywood actors in the movie to switch things up a bit. One of such lines would be when Odenigbo says “I’m too old to die young from smoking”, maybe Biyi Bandele wrote this himself, maybe not. But I’ll settle with not, going by the majority of dialogue lines that exist in the movie that aren’t in the same category as this.

However, the message in the dialogue of this script is always acceptable in terms of grammatical or stylistic correctness. But I guess we have to give this credit to the actors.

Most times in this movie, though, as with all our Nollywood movies, the dialogue’s too on-the-nose: too precise, saying things that are too straightforward, too explicit, or more regrettably repeating the same information again and again; letting us know so many times that the war is between two tribes; or Odenigbo’s mother continually asking for a kid and quoting traditions the audience already has a lead on. The worst mistake a screenwriter can make is saying what the audience already knows!

Except it’s going to be ambiguous, dialogue in movies should have, embedded in them, connotations with a plethora of meanings that just blows the mind of the audience either in a humorous or in a thought provoking manner.

The dialogue in this movie is a sure sign that Biyi is a pure playwright and nothing more. It is only in a play that you need to say things over and over again; maybe because of the stage set up— to avoid confusion. However, in this script, it appears the dialogue exists to take up some time, and lengthen the movie like how it’s done in a play script. When in actual fact, more action and story beats would have helped this screenplay. Or better still, punchier, quotable lines.

At some point, the script gets obsessed with making use of talking heads; people sitting around talking, with no associating action. Boring! The dialogue most times are long—quite understandably for a first draft—but that’s why it’s a first draft: the first of the other rewrites that need to be written. The dialogues could have, instead, been rewritten to achieve the “lean and mean” mantra of international screenwriting in subsequent drafts.

It is important to keep in mind that the international world is a hungry place, and movies are a learning ground; people learn to talk pretty from movies, and replicating what happens in real life in a movie dialogue isn’t going to give one that privilege of having one’s lines adopted, and when people don’t remember one’s lines, they don’t remember one! 5/10.

PACING:

This is the most overlooked aspect of film making/screenwriting in Nollywood, and I’ll show you how. Firstly, have you noticed how those block buster movies in Hollywood has your heart racing with expectations at as early as 15 minutes? You already have been introduced to all the major characters and situations have already been established by 20 mins. This tempo carries on till the end of the movie, and you can’t believe you just finished watching a 2-hour movie in what felt like 45 minutes. That’s pacing. It basically means not wasting time, going straight to the point, being mean, finishing it off, getting in as late as possible and leaving as early as possible, and what have you.

Yes, half of a Yellow Sun does that with the first 10 minutes, kinda, which makes us continue watching the movie with great hopes and with an open mind, before things stop happening, and the pacing drops till the movie ends.

There’s a process of writing movies to be fast paced. There are rules. It might not make much sense here because we are looking at the movie, and not the script. But take it from me, executing pacing is easy peasy. 4/10.

Five criteria. One screenwriter. Other screenwriters may have more to say with other criteria (I intentionally left out “Plot” because I didn’t want to score this movie any lower), but I guess this should be more than enough to help us understand why Half of a Yellow Sun didn’t stand a chance at the international level. 23/50

Percentage: 46%

Grade: D

Isedehi Aigbogun (ISD)

B.A., M.A., PhD (in view), English Language, UNILAG.

International Screenwriter, Script Analyst, Movie Critic

Feature/OPED

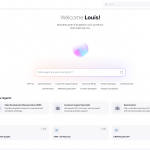

How Digital Tools Are Democratising Wealth Creation

By Olufemi Yoloye

I vividly remember my first investment experience. It was 2008, and I was concluding my SIWES program in one of the leading Oil & Gas companies. Armed with three months’ salary and a burning desire to grow my wealth, I walked into the imposing headquarters of a leading stockbroking firm in Abuja. The marble floors, suited executives, and hushed tones immediately made me feel like I was intruding on a private club.

After waiting for nearly two hours, I was finally ushered into a wood-panelled office where a broker, barely looking up from his newspaper, asked for my minimum investment of ₦500,000 – equivalent to about $3,700 at the time. When I explained I only had ₦19,000, he dismissed me with a wave of his hand, suggesting I “come back when I was serious about investing.” That day, I learned that wealth creation wasn’t just about having money; it was about having access to the right networks, information, and platforms.

Two decades later, the investment landscape has undergone a seismic shift. The digital revolution that transformed how we communicate, shop, and work has finally reached Nigeria’s capital markets. Today, a fresh graduate in Ibadan can open an investment account from her phone, buy shares of blue-chip companies with as little as ₦100, and access the same real-time market data that was once the exclusive preserve of institutional investors.

The Digital Advantage: Real-Time Democracy

Digital investment platforms have fundamentally democratised three critical aspects of wealth creation: access, information, and cost. In the past, investing often meant physically visiting a stockbroking office during business hours. Today, digital platforms operate round the clock, offering unprecedented flexibility. Where investors once waited for next-day newspaper updates or quarterly statements, real-time data now delivers market insights instantly, placing decision-making power directly in the hands of everyday users.

Consider the transformation in information access. In the pre-digital era, research reports were expensive, exclusive documents shared only among high-net-worth clients. Today, algorithmic analysis, automated portfolio recommendations, and comprehensive market research are standard features on most investment apps. The playing field has levelled in ways that would have been unimaginable just a decade ago.

The convenience factor cannot be overstated. Digital platforms have eliminated the intimidation factor that kept many potential investors away from capital markets. Users can now learn about investing through gamified experiences, practice with virtual portfolios, and gradually build confidence before committing real money. This educational approach addresses one of Nigeria’s most persistent challenges: the knowledge gap that historically drove people toward riskier, informal investment schemes.

Cost efficiency represents another revolutionary change. Traditional wealth management services typically required minimum investments of millions of naira and charged hefty fees. Digital platforms have shattered these barriers, allowing fractional ownership of expensive assets and charging minimal fees through automated processes. Commercial paper, government bonds, and equity funds that were once accessible only to institutional investors are now within reach of the average Nigerian.

The Friction Points: Where We Still Fall Short

Despite these advances, significant challenges continue to hinder widespread adoption of digital investment tools in Nigeria. The statistics are sobering: despite a population exceeding 200 million, fewer than 1% of Nigerians participate in collective investment schemes like mutual funds. This represents not just a missed opportunity, but a fundamental failure to create an inclusive financial ecosystem.

The first major friction point is fragmentation. The current landscape requires users to juggle multiple applications for different investment needs. Someone might use one app for stock trading, another for mutual funds, a third for fixed deposits, and yet another for insurance. This scattered approach creates confusion, increases transaction costs, and ultimately discourages participation. The cognitive load of managing multiple platforms, each with its own interface and requirements, can be overwhelming for new investors.

Payment infrastructure remains another significant barrier. While mobile apps have revolutionized basic financial services, the integration between payment systems and investment platforms often lacks seamlessness. Users frequently encounter failed transactions, delayed settlements, and complex reconciliation processes that erode confidence in digital investing.

Low financial literacy continues to plague the sector. Consider this: the total size of Nigeria’s public mutual fund industry is just under ₦6 trillion, with fewer than 900,000 unit holders – in a country of over 200 million people. In contrast, over ₦1.3 trillion was recently lost to a single high-profile Ponzi scheme. This stark contrast highlights the scale of financial literacy and trust challenges we still face. It’s not just a trust gap – it’s a trillion-naira opportunity cost. While digital platforms have made information more accessible, they haven’t necessarily made it more comprehensible. Many apps overwhelm users with technical jargon, complex charts, and investment options without adequate explanation. The result is that potential investors either avoid the platforms entirely or make uninformed decisions that lead to losses and further discourage participation.

Trust and security concerns compound these challenges. High-profile cases of fintech failures, unauthorized transactions, and data breaches have made many Nigerians wary of digital financial services. The nascent regulatory frameworks for digital investment platforms create additional uncertainty. Users want assurance that their funds are protected, their data is secure, and they have recourse if something goes wrong.

Cultural factors also play a role. Many Nigerians still prefer the human interaction and perceived security of traditional banking relationships. The concept of “digital-first” investing conflicts with established patterns of financial behaviour, particularly among older demographics who control significant portions of investible assets.

The Access More Solution: Where Trust Meets Seamless Integration

This is where Access More represents a paradigm shift in how Nigerians can approach wealth creation. Rather than asking users to manage multiple platforms and providers, Access More offers a unified ecosystem for wealth creation. Its greatest strength? Deep integration within Access Bank’s secure and regulated infrastructure.

In financial services, trust isn’t a nice-to-have benefit. It’s the bedrock of all innovation. When users know their investments are backed by a regulated, established financial institution with decades of operational history, they can focus on building wealth instead of worrying about platform failures.

From a single interface, users can access a wide range of investment options – from stocks and bonds to mutual funds, fixed deposits, treasury bills, and even insurance products. This eliminates the complexity of managing multiple relationships and provides a cohesive view of one’s entire financial portfolio. The platform’s unified approach means users can easily move funds between different investment vehicles as their needs and market conditions change.

The payment integration is seamless because it’s built on Access Bank’s robust banking infrastructure. Users can fund their investments directly from their bank accounts, and receive real-time updates on their portfolio performance. The friction that typically accompanies cross-platform transactions is eliminated, making it easier for users to maintain consistent investment habits.

The security framework is enterprise-grade, leveraging Access Bank’s existing cybersecurity infrastructure and regulatory compliance systems. Users benefit from the same security standards that protect institutional banking relationships, including multi-factor authentication, encryption, and fraud detection and prevention. This addresses one of the primary concerns that prevent the adoption of standalone fintech solutions.

Perhaps most importantly, while the platform is designed for digital-first interaction, users can access relationship managers, investment advisors, and customer service representatives when they need personalized assistance. This hybrid approach combines the efficiency of digital tools with the reassurance of human expertise.

Building Tomorrow’s Wealth Creators

The democratisation of wealth creation through digital tools represents more than a technological advancement; it’s a fundamental shift toward financial inclusion. Nigeria’s demographic dividend – with 62% of the population under 24 years old – creates an unprecedented opportunity to build a generation of investors who view capital market participation as normal and accessible.

Digital platforms like Access More are not just making investing easier; they’re reshaping the very concept of who can be an investor. The young entrepreneur in Kano, the teacher in Enugu, and the civil servant in Abuja now have access to the same investment opportunities and information that were once available only to the wealthy elite in Lagos and Abuja.

The key to unlocking this potential lies in creating platforms that are not just digital, but comprehensive, trusted, and integrated. The future of wealth creation in Nigeria will be built by those who can provide holistic financial solutions within secure, regulated environments. Access More represents this future – where technology serves not just to digitize existing processes, but to fundamentally expand access to wealth-building opportunities.

As we move forward, the question isn’t whether digital tools will democratise wealth creation, but how quickly we can scale these solutions to reach Nigeria’s vast population of potential investors. The infrastructure is in place, the technology is proven, and the opportunity is immense. What remains is the execution – and the commitment to building platforms that truly serve the needs of everyday Nigerians.

The boy who was turned away from that stockbroking office in 2003 would find a very different landscape today. More importantly, his children will inherit a financial system where wealth creation is accessible, transparent, and available to all. That transformation is not just good for individual investors – it’s essential for Nigeria’s economic future.

Olufemi Yoloye is the CEO of Coronation Wealth and a champion of financial inclusion in Nigeria’s capital markets

Feature/OPED

Rebuilding the Nigerian Dream: How NOA is Forging a New Social Contract

By Victor Benjamin

For years, a pervasive sense of disillusionment has shadowed the vibrant spirit of Nigeria. Eroding trust in governance, fueled by misinformation and a disconnect between policy and public understanding, has cast a long shadow over national progress. However, a significant shift is underway, spearheaded by the National Orientation Agency (NOA). Under the astute leadership of Mallam Lanre Issa-Onilu, NOA is actively working to mend these fractures, acting as a crucial bridge between government aspirations and the people’s commitment. This vital mission aligns seamlessly with President Bola Tinubu’s administration, which profoundly recognizes that the success of any government policy ultimately hinges on the psychological and emotional investment of its citizens.

The Tinubu government isn’t merely observing NOA’s efforts; it’s actively championing them. The administration understands that Nigeria’s journey towards prosperity isn’t solely about economic reforms or administrative directives. It’s fundamentally about fostering a collective embrace of national values and civic duties by every Nigerian. This holistic approach forms the bedrock of a renewed national consciousness, aiming to ignite a sense of ownership and shared responsibility for the country’s destiny.

A cornerstone of this ambitious agenda is the forthcoming National Values Charter, an initiative poised to redefine the relationship between the government and its citizens. Expected to be formally unveiled by President Bola Tinubu himself, this Charter is designed as a foundational social contract. It will meticulously articulate the responsibilities of both the government and its citizens in the arduous yet rewarding task of nation-building.

The Charter will enshrine the “Nigerian Promise”—the government’s unwavering commitment to core principles such as equality, democracy, entrepreneurship, peace, inclusivity, freedom, and meritocracy. This promise outlines the vision for a just and equitable society where opportunities abound for all. Complementing this, the Charter will also introduce a comprehensive “Citizen’s Code.” This code will serve as a clarion call to all Nigerians, urging them to embrace fundamental virtues like discipline, duty of care, tolerance, ethical leadership, accountability, environmental awareness, and resilience. By clearly defining both rights and responsibilities, this comprehensive approach aims to cultivate a deeper sense of belonging and dignity among Nigerians, fostering a citizenry that is not only aware of its entitlements but also deeply committed to its obligations.

In direct support of President Tinubu’s audacious economic reforms and the overarching “Renewed Hope Agenda,” NOA has rolled out several impactful initiatives, designed to demystify complex policies and showcase tangible progress.

One such crucial initiative is The Explainer. Launched in early 2024, this weekly policy-focused publication serves as an invaluable tool for simplifying complex economic shifts. It breaks down intricate topics such as the fuel subsidy removal and exchange rate unification, translating economic jargon into accessible language. The Explainer illuminates how these market-driven reforms are strategically designed to stimulate national productivity, unlock doors for private investment, and enhance Nigeria’s global competitiveness. It clarifies the potential long-term benefits for ordinary Nigerians, including job creation, increased investor confidence, and improved public services. Crucially, the publication also proactively addresses public concerns and immediate challenges, countering the pervasive tide of misinformation and building a much-needed bridge of understanding between the government and its citizens.

Beyond explanation, NOA is diligently working to showcase tangible progress and flip the narrative of cynicism that often plagues public discourse. The agency actively promotes positive stories of ordinary Nigerians who are directly benefiting from recent reforms. This includes heartwarming examples such as students accessing loans from the Nigeria Education Loan Fund, a critical initiative that restores hope and dignity to countless families striving for educational advancement. It also highlights vehicle owners successfully transitioning to Compressed Natural Gas (CNG) as a more affordable and sustainable energy source, and small business owners securing vital loans from the Bank of Industry to fuel their entrepreneurial dreams. NOA emphasizes consistent and transparent communication to counter negativity, demonstrating that “Hope Renewed” is not merely a slogan but is backed by concrete results, including vital improved infrastructure and a commitment to transparent governance through the discontinuation of opaque oil subsidy regimes.

NOA’s efforts extend far beyond direct policy explanations. The agency employs a wide and innovative array of channels to instill a profound sense of ownership and responsibility within the Nigerian populace.

In the digital realm, NOA leverages cutting-edge tools to enhance citizen engagement. The Mobiliser app, for instance, incorporates a vital “Say Something” feature that enables anonymous crime reporting, empowering citizens to contribute to public safety without fear. Furthermore, CLHEEAN, an innovative AI platform, provides real-time, accurate information on critical national issues, notably in local languages, making vital data accessible to a broader audience. CLHEEAN also facilitates anonymous reporting of criminal activities, reinforcing the commitment to a safer society. An interactive, AI-powered website with intelligent chat assistants and an AI engine dubbed “The Curator” further engages citizens, addressing their policy questions and providing access to national data, fostering an informed and participatory citizenry.

Complementing its digital outreach, NOA conducts extensive on-the-ground sensitisation campaigns nationwide. Dedicated NOA teams traverse the country, engaging communities on diverse issues ranging from human rights and tax reform to crucial security awareness and flood prevention. These campaigns utilize dynamic approaches such as roadshows, community forums, and interactive school sessions, ensuring that essential messages resonate and reach every segment of society, from bustling urban centers to remote rural communities.

Strategic partnerships form another critical pillar of NOA’s multi-faceted approach. The agency actively collaborates with the education sector to embed citizenship studies directly into the school curriculum, aiming to instill national values and civic pride in children from a tender age. This foundational approach seeks to mold future generations into responsible and patriotic citizens. NOA also partners with the Voice of Nigeria (VON) to combat the proliferation of misinformation and promote authentic Nigerian narratives, safeguarding the integrity of public discourse. Furthermore, a crucial partnership with the Economic and Financial Crimes Commission (EFCC) facilitates nationwide campaigns against cybercrime, promoting financial literacy and ethical entrepreneurship, particularly among vulnerable youth who are often susceptible to such illicit activities.

Through these comprehensive and multi-faceted approaches, the National Orientation Agency is not just informing Nigerians; it is striving to ensure they are emotionally and intellectually invested in the country’s growth. By fostering a culture of excellence, patriotism, and civic responsibility, NOA is fundamentally transforming how the government communicates with its people. Its ultimate aspiration is to build a just, united, and value-driven Nigeria—a nation built on shared purpose, collective agreement, and a renewed sense of hope.

Victor Benjamin is the West/South South Director of YP4T

Feature/OPED

An Open Letter to Comrade Festus Osifo, National President, PENGASSAN

By Concerned Members of PENGASSAN

Dear Comrade Festus Osifo,

It is with great concern, deep disappointment, and an unshakable sense of duty to over 523 members of the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) Branch, that we write to call the attention of the National Leadership of our great union to the continued assault on principles, transparency, and constitutional order within our Union—which has clearly infringed on the right of members to have a union that respects members’ viewpoints on those who will stand as their elected representatives.

We know our great union stands for justice and fairness to all members. But the recent imposition of an illegal Caretaker Committee (CTC) on our Branch without due process, consultation, or respect for the PENGASSAN Constitution is not just a disregard for our collective intelligence—it is a blatant subversion of the laws and values upon which PENGASSAN was built. As we know, the vision of our great union is to be the most influential trade union by providing excellent services to its members, building strong relationships with social partners and stakeholders, and positively influencing national decisions.

As a reminder, Comrade President, our Branch’s 3-year PENGASSAN tenure expired on May 27, 2025. In line with our constitutional provisions and best practices, a Branch Congress was duly convened on June 14, 2025, where a valid Electoral Committee (ELECO) was constituted to oversee elections. However, rather than supporting this transparent process, national leadership chose to unilaterally and undemocratically impose a Caretaker Committee chaired by your known associate, Comrade Tony Iziogba—a man with no mandate from the Branch Congress and no legitimacy under our Constitution.

“Your siding with illegal actions are in gross violation of the PENGASSAN constitutional provisions of : Rule 20.1 states clearly that elected officers hold office for a term of three years. Nowhere in this rule is it provided that a Caretaker Committee shall take over automatically after tenure expiration. Rule 31.4 provides that a Caretaker Committee may only be constituted after the dissolution of a BECOM through disciplinary procedures—not simply due to tenure expiration. Rule 32.7 mandates that an Ethical Practices, Grievance and Disciplinary Committee (EGDC) at the Branch level must consist of two elected BECOM members and three nominated members, chaired by the Branch IRO. None of these conditions were met in your Caretaker Committee setup.”

Schedules 3.3 and 3.5 clearly outline the process for resolving Branch disputes through the CWC and NEC—not by unilateral directives or external imposition. Rule 3.7, which speaks of inspiring discipline and professionalism, has been repeatedly ignored in this ongoing crisis.”

The issue we raise to the leadership of the Union is the even more troubling fact that a disciplinary letter was issued to comrades who dared to question the legitimacy of this illegal process—a direct attempt to silence dissent and criminalize free expression within a union that should be a bastion of democracy. This is not the first time our Branch has faced anti-democratic practices. When the NMDPRA Branch was first formed three years ago, it began not with an election but with an imposed caretaker committee. That committee handpicked successors without consulting members. Now, history is repeating itself. Comrade Ayo was imposed then. Now, Comrade Tony is being imposed again.

We concerned that members will not succumb to any intimidation or to recycling the same faces, ideas, and loyalties while ignoring the democratic rights of over 523 unionized staff. We are not asking for much. We simply demand what is just, constitutional, and democratic.

We, the concerned members, demand the reinstatement of the ELECO constituted at the June 14 Congress. We call for a hybrid Branch election that allows inclusive participation—especially for members across Nigeria who have never had a voice in the leadership of the Branch.

We, the concerned members, urge respect for the provisions of the 2022 PENGASSAN Constitution. End all harassment, intimidation, and victimization of members who speak out. Stop using national offices to reward loyalty and suppress dissent. And, most urgently, allow the will of the people—the 2/3 majority of Congress—to determine their own leadership.

We, the Concerned Members of PENGASSAN, know the Union is not your personal property, Comrade President. The Constitution is not subject to your discretion. And the voice of the Congress cannot be replaced by political convenience or backroom arrangements. In a nation grappling with democratic challenges, we had hoped our Union would set the example. Sadly, under your leadership, it is instead mimicking the worst of political suppression, godfatherism, and impunity.

The time for appeasement has passed. The time for silence has ended. The time for constitutional order, justice, and democracy is now. We will not relent. We will not be silenced. And we will never allow our Union to descend into a dictatorship of convenience.

In solidarity with hope for a better PENGASSAN, we stand for an end to dictatorship perpetrated by National leadership. Let’s NMDPRA Breathe.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN