Feature/OPED

How Africa Can Ensure Its Food Security

By Professor Maurice Okoli

At least, African leaders gradually recognise the need to work collectively to ensure food security. Food supply has seriously been exacerbated by the Russia-Ukraine conflict, Africa’s persistent internal ethnic conflicts and a series of natural disasters. But more fascinating are the latest arguments over the interconnection between utilising resources for increasing and improving food production and taking adequate measures toward shedding import dependency.

The month of June 2023 was a busy month for African leaders. South African President Cyril Ramaphosa headed the Africa Peace Initiative to Kyiv and St. Petersburg, famous cities in Ukraine and Russia. Then later, he joined his colleagues at the New Global Financial Pact summit in Paris, France. While these trips could not be considered ordinary, the most controversial issues inseparably relate to Africa’s economic development, trade and investment, and sustainable welfare of the population.

As a development economist and researcher, scanning through several reports, Ramaphosa and his colleagues raised one significant question, among others, during their discussions in Paris. And that is the issue of ensuring food security. In practical terms, it has been part of government policy on improving food production and supply to the increasing population, especially in Africa, which stands at an estimated 1.4 billion. Of course, the world’s population is growing, but Africa’s exponential growth has acute challenges, including healthcare, employment and food security.

By halfway through this century, that is, 2050, Africa’s population is estimated to be 2.5 billion, and urban or megacities across Africa will continue experiencing enormous stress or pressure due to massive migration from under-developed parts of African countries. With Russia’s special operation in Ukraine and the sanctions in the history of mankind slammed on Russia by Western and European states, these have sufficiently been acknowledged as drivers of skyrocketing commodity prices and, ultimately, the cost of living. In effect, it’s described as a terrible global instability.

With all these trends even ceaselessly occurring now, Ramaphosa’s preferential steps toward food security, as described in his presentation, that the war has a ‘negative impact’ on the African continent and many other countries. It is, however, an acceptable fact that Africa, which generally depends on massive food imports, has suffered from all-year-round supply interruptions — diverse discussions ceaselessly awash the media landscape over these. For most African leaders, it is the question of food supply or how to sustain or preserve food import dependency. There is no alternative to reconnecting to regular supplies from Russia and Ukraine for these African countries.

During the New Global Financial Pact summit in Paris, African leaders expressed sceptical sentiments, as Ramaphosa and other leaders vehemently reiterated that external pledges and funding have unsuccessfully supported sustainable development goals, including food security in Africa.

Ramaphosa raised the structure of financial institutions, global currency, climate change and economic poverty, that there should be more cooperation and coordination, no fragmentation. There should be reforms in multinational institutions to address development issues, especially in the Global South. Africa should not be treated as beggars but as equals. It does not depend on donations and generosity. Africa should be allowed to be a key player on the global stage.

In stark reality, the global geopolitical processes are now offering the grounds to re-initiate and seek suitable alternatives that depend on century-old approaches and methods to solve national questions. Therefore, development critics may argue how the changes bring it closer to achieving the Sustainable Development Goals (SDGs) and how it will simultaneously bolster Africa’s role in the multipolar world.

Factors Influencing Food Production

Interestingly factors negatively influencing local production, including the agricultural sector, are commonly listed and extensively discussed. Researchers, academics and politicians already recognize them as retarding expected progress and making headways in attaining that status of food self-sufficiency. Some of these factors are drought and climatic extremes, low budget allocation and inappropriate agricultural policies in Africa, poor storage and preservation facilities, poor land tenure system and reduced soil fertilities, inadequate irrigation facilities and poor methods of pest and disease control.

Some aspects of traditional African culture related to food production have become less practised in recent years. But state attitudes are not stimulating either in this direction. Across Africa, the consumption culture is tied to foreign imported products as it is widely interpreted as status-symbol, considered as belonging to a well-defined upper class in the society. Thus this consumer culture becomes a driving factor towards continuity in importing food that fills modern shopping malls in Africa.

The most popular rhetoric, more or less chorus, is that although it has abundant natural resources, Africa remains the world’s poorest and least-developed continent, resulting from various causes that may include deep-seated political corruption. According to the United Nations Human Development Report in 2003, the bottom 24 ranked nations (151st to 175th) were all African states.

Thambo Mbeki, former South African President, has argued these aspects in his reports on illicit capital flows abroad. In a recently published analysis, Mbeki underlined that loans obtained for undertaking development infrastructure, including agricultural and related industrial sectors, are siphoned back to foreign banks for politicians.

Basic geography teaches us that Africa has enormous resources, encompassing the vast landmass, vegetation, and water resources, including the lakes and rivers. The Congo, Nile, Zambezi, Niger and Lake Victoria are among its rivers. Yet the continent is the second driest in the world, with millions of Africans suffering yearly from water shortages. It requires mechanising agricultural practices, offering specialised short training and adequate support for local farmers as aspects of measures and steps toward import substitution.

Addressing food security challenges in Africa

Economists argue that possibly adopting, to some degree, import substitution policies are not directed at escaping international trade. It is an attempt to utilise, at the maximum, the untapped available resources in the production sector and, secondly, redirect budgetary finances into needy significant economic sectors. Understandably, Africa depends on food imports to feed its population. It has become a common rules-based practice across Africa.

On the other hand, potential exporting foreign states generate revenues for their budget. This is also an undeniable fact as many countries around the world make conscious efforts to increase the export of commodities to foreign markets. According to Agriculture Ministry’s AgroExport Center, Russia targets $33 billion per year (annually) as revenue through massive export of grains and meat poultry to Africa.

By increasing grain exports to African countries, Russia aims to enhance the competitiveness of Russian agricultural goods in the African market. On the contrary, several international organisations have also expressed that African leaders must adopt import substitution mechanisms and use their financial resources to strengthen agricultural production systems.

At the G7 Summit in June 2022, President Joe Biden and G7 leaders announced over $4.5 billion to address global food security, over half of which will come from the United States. This $2.76 billion in U.S. government funding will help protect the world’s most vulnerable populations and mitigate the impacts of growing food insecurity and malnutrition by building production capacity and more resilient agriculture and food systems worldwide and responding to immediate emergency food needs.

U.S. Congress allocated $336.5 million to bilateral programs for Sub-Saharan African countries, including Burkina Faso, the Democratic Republic of the Congo, Ethiopia, Ghana, Guinea, Kenya, Liberia, Madagascar, Malawi, Mali, Mozambique, Niger, Nigeria, Rwanda, Senegal, Sierra Leone, Somalia, South Sudan, Tanzania, Uganda, Zambia, and Zimbabwe and regional programs in southern Africa, west Africa, and the Sahel.

Using Zimbabwe as a Classical Example

Compared to food-importing African countries, Zimbabwe has increased wheat production, especially during the current Russia-Ukraine crisis. This achievement was attributed to efforts in mobilising local scientists to improve the crop’s production. Zimbabwe is an African country under Western sanctions for 25 years, hindering imports of much-needed machinery and other inputs to drive agriculture.

At the African Green Revolution Forum (AGRF) summit held from September 5 to 9, 2022, in Rwanda, President Emmerson Mnangagwa told the gathering that “we used to depend on importation of wheat from Ukraine in the past, but now we have been able to produce our own. To a considerable extent, the crisis in that country has not affected us. There is an urgent need to adopt a progressive approach and re-purpose food policies to address the emerging challenges affecting our entire food systems in Africa.”

As much as there are classical admirable lessons to learn from Zimbabwe, African leaders ignore these. Zimbabwe shares the same negative consequences of colonialism with many African countries. But in an additional case, it has struggled with sanctions imposed on the land, making conditions harder. Zimbabwe has been looking for foreign partners from other countries to transfer technology and industrialise its ailing economy in the southern African region.

While several African countries largely depend on Russia and Ukraine for their regular supply of wheat and grains, even despite the persistent geopolitical warring situation, Zimbabwe has recorded its highest wheat harvest during the last agricultural production in 2022. It emerges as one of the few African countries with an import substitution agricultural policy and strategically working self-sufficiency. Worth suggesting that African leaders have to learn from Zimbabwe – a landlocked southern African country.

Looking for Inside Solutions

At least over the past few years, even long before the Russia-Ukraine crisis, there have been glowing signs from two African banks calling for increased food production. African Development Bank (AfDB) and the African Export-Import Bank (Afreximbank) have gained increasing prominence for their work with the private sectors within Africa. These two banks support the agricultural sectors, but more is needed to meet the highest target.

At the Paris summit, AfDB President Akinwumi Adesina, African and European heads of government and representatives of development partners on the sidelines held discussions about the Alliance for Green Infrastructure in Africa. The key aim is accelerating the financing of transformational climate-resilient and greener infrastructure projects in Africa and attracting new partners and financiers. Adesina, formerly Nigeria’s Minister of Agriculture and Rural Development, now the 8th President of the African Development Bank, has consistently been pushing for increased domestic agriculture to attain food self-sufficiency and ensure food security on the continent.

Of particular concern is that over 900 million people are still impoverished on the continent. Over 283 million Africans suffer from hunger, including over 216 million children who suffer from malnutrition. The situation is more serious due to climate change, including severe droughts, floods and cyclones that have devastated parts of Africa. Today, much of the Horn Africa and the Sahel last had rain several seasons ago. The resources Africa needs need to be there, explains AfDB President Akinwumi Adesina.

“I am excited about what the bank is doing to support farmers to adapt to climate change through our flagship program —Technologies for African Agricultural Transformation (TAAT). It is a platform implemented through partnerships with national and regional agricultural research institutions and the private sector. It is the largest ever effort to get technologies at scale to millions of farmers across Africa,” he wrote in his report.

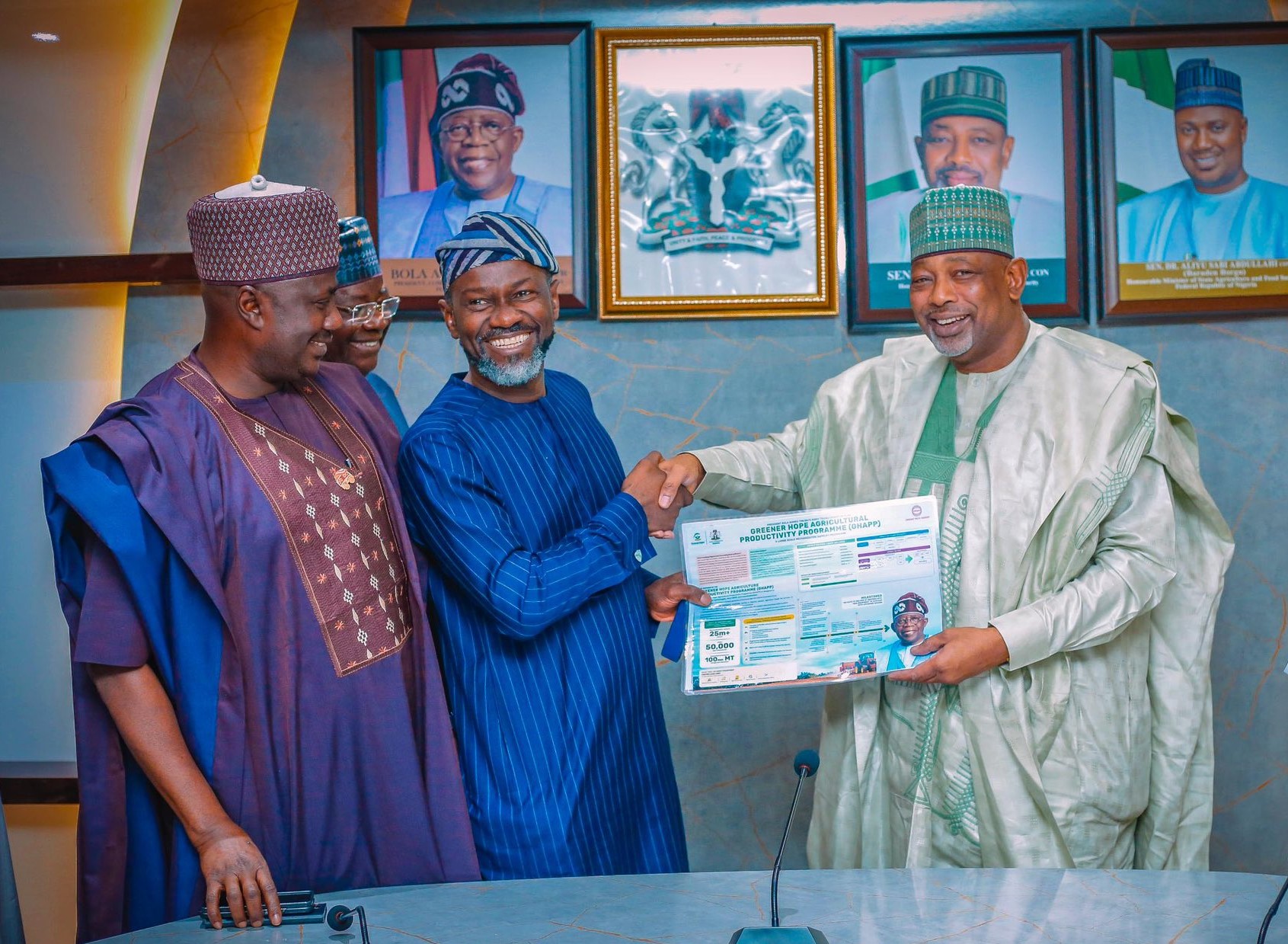

Over the past three years, TAAT delivered climate-resilient agricultural technologies to 25 million farmers or 62% of the 40 million farmer target. The depth of consistent work of this bank is to enhance food processing, value addition and competitiveness of agricultural supply chains across Africa. The bank is committing resources for the establishment of Special Agro-Industrial Processing Zones. With its partners (including the Islamic Development Bank and International Fund for Agricultural Development), the bank has invested more than $1.5 billion to establish these zones in eleven countries.

Africa’s ability to feed nine billion people by 2050 is not a foregone conclusion; it is a call to action. We must harness our strengths, confront challenges, and work relentlessly towards our shared vision. Therefore, let us rise to this grand challenge. Let us forge ahead, knowing that our efforts today will determine the future of food in the world. It is necessary to unlock Africa’s potential in agriculture. Africa must feed itself.

The Wake-Up Bell for Action

It may take us by surprise when we know that 81% of the sub-Saharan African population lives on less than $2.50 (PPP) per day in 2023, compared with 86% for India. China and India are populous but are moving faster than Africa. China has a more substantial global economic influence than India, but Africa still needs to progress in various economic sectors.

The latest economic trend is that Africa is now at risk of being in debt once again, particularly in sub-Saharan African countries. It receives the most external funds for its development from Development funding sponsors such as the United States, Europe, China, France and Britain or multilateral blocs such as G7 states, the International Monetary Fund (IMF) and the World Bank. Other institutions and organisations, such as Millennium Challenge Corporation (MCC) and International Development Finance Corporation (DFC), also engage with Africa. In addition, the Asian and Arab Banks are showing practical actions. The cry for the National Development Bank of the BRICS has yet to think of Africa.

In this article, it is necessary in our discussions to appreciate the geographical facts that Africa is the world’s second-largest and second-most-populous continent, after Asia, in both aspects. Despite a wide range of natural resources, Africa is the least wealthy continent per capita and second-least wealthy by total wealth, behind Oceania. Scholars have attributed this to different factors, including geography, climate, tribalism, colonialism, neocolonialism, lack of democracy, and worse Africa-wide corruption. Despite this low concentration of wealth, recent economic expansion and the large and young population make Africa a crucial financial market in the broader global context.

In a nutshell, adopting measures for establishing food security is crucial to sustainable development. Addressing food security, therefore, is one of the keys for Africa in this 21st century. From the above perspectives, African leaders have to focus and redirect both human and financial resources toward increasing local production as the surest approach in ensuring sustainable food security for the estimated 1.4 billion population in Africa, and this most possibly falls within the framework of the Agenda 2063 of the African Union.

By Professor Maurice Okoli is a fellow at the Institute for African Studies and the Institute of World Economy and International Relations, Russian Academy of Sciences. He is also a fellow at the North-Eastern Federal University of Russia

Feature/OPED

Tax, Inflation, and Still Broke: The Economic Divide

By Chiamaka Happiness Madueke

What’s worse than being taxed? Being taxed invisibly and twice.

When the government tightens monetary policy; hikes taxes, and removes subsidies, all in one breath, you would expect the economy to breathe easier. But in Nigeria, the air seems to feel thinner.

Over the past few years, Nigeria has embraced a series of bold economic reforms; floating the Naira, removing fuel subsidies, and pushing revenue generation targets. These actions can generally signal fiscal discipline and long-term growth.

For example, the Nigerian government reportedly saved N3.6 trillion from subsidy removal in just the second half of 2023, but beneath the policy headlines lies a quieter story: one where debt servicing, inflation, taxation, and informal charges collide to create an invisible burden on everyday transactions.

Yes, between visible taxes, invisible inflation, and unofficial levies collected by everyone and no one, low-income Nigerians allegedly seem trapped in a system that squeezes them from every direction.

Let me digress for a second, but I’ll bring it back in a bit, I promise.

At first glance, taxation and inflation may seem like two separate forces: one a fiscal tool, the other a macroeconomic consequence. But in Nigeria’s current climate, they’re colliding in real time, shaping the daily experience of citizens and businesses alike.

The Taxation Puzzle

Nigeria’s tax-to-GDP ratio remains among the lowest globally; just 10.86 per cent as of 2022, according to the Federal Inland Revenue Service (FIRS). That’s well below the 15–25 per cent global average, and even lower than the African average. Yet, the informal economy, which contributes nearly 58 per cent to GDP, bears much of the untracked tax burden through local levies and fees.

This mismatch reveals a chronic revenue problem and this challenge becomes even more critical when you consider the growing cost of debt. But borrowing isn’t inherently bad; in fact, strategic debt can stimulate growth if channelled into things like power, roads, manufacturing, or digital infrastructure, projects that have a way of boosting the economy.

In an interview with Arise News, the CEO of Sterling Bank, Mr Abubakar Suleiman, said, “If you are not collecting enough revenue to service a debt, that is a problem”. But it is even worse when you’re not using that debt for productive, economic reasons; that’s a structural problem.

Then I ran the numbers, in 2022, Nigeria reportedly spent a large per cent of its revenue on debt servicing. That means most of what we earn do not go to schools, hospitals, or industrial development, they go to paying back interest. That’s like living on a credit card and using it to buy lunch, not build a business that would make profit.

In 2023, 64.5 per cent of the federal government’s total revenue was used for debt servicing, according to a BusinessDay analysis of data from the Budget Office.

Although this was higher than the 48.5 per cent in 2022, it was still less than the 71.8 per cent in 2021. In 2023, actual revenue was N11.88 trillion, slightly above the predicted N11.05 trillion, while actual debt service costs were N7.66 trillion, 16.9 per cent higher than the projected N6.56 trillion.

In comparison, Nigeria’s revenue for the fiscal year 2022 was N7.76 trillion, falling short of the N9.97 trillion projection. The fact that debt servicing increased to N3.76 trillion from an anticipated N3.69 trillion in spite of this shortfall shows that debt obligations are an unavoidable burden even in cases where revenues are below budget.

This pattern emphasizes how little financial flexibility the government has, particularly when it comes to financing infrastructure or social projects.

By September 30, 2024, Nigeria’s total public debt had climbed to N142.3 trillion, reflecting a N8.02 trillion increase from N134.3 trillion in June 2024. This 5.97 per cent rise was attributed not only to additional borrowing but also to the depreciation of the Naira, which significantly inflated the naira value of external debt.

The surge in debt has not been matched by a proportional increase in productive investment, raising questions about the sustainability and strategic intent of government borrowing.

Adding to the concern, the total debt service cost reached an estimated N3.57 trillion in just the third quarter of 2024 alone.

With limited income from formal taxation, the government allegedly struggles to adequately fund infrastructure, education, healthcare, and essential services.

In response, efforts are underway to:

- Widen the tax base by formalizing more of the informal sector,

- Improve compliance through digital platforms and data integration,

- Rationalize outdated and inefficient tax incentives.

However, increasing tax pressure and its enforcement especially now can be politically unpopular and economically dangerous. Why? Because inflation is already eating through household budgets.

The Inflation Squeeze

Nigeria’s inflation rate has remained stubbornly high, largely driven by the rising cost of food prices, currency depreciation, removal of fuel subsidy and Monetary policies like floating the Naira.

As of early 2024, inflation was between 28–30 per cent, with core inflation also climbing. This diminishes buying power, worsens poverty, and increases the expenses of conducting business.

Essentially, inflation operates as an unnoticed tax, one that hits the vulnerable the hardest, especially low and middle-income earners whose wages aren’t keeping pace.

One key statement caught my attention in recent times, “We must choose between Taxation or Inflation.”

At first, that sounded a bit extreme. But the more I thought about it, the more it made sense.

Taxation is visible, structured, and can be progressive. Inflation, on the other hand, is unpredictable and regressive, a silent thief that spares no one, but affects the poor more because they have less to spend.

For low-income Nigerians, a controlled tax system paired with targeted public investment, might be more manageable than the current wave of inflation that raises the price of garri, beans, and palm oil every other week for Aunty Onyeka and thousands like her.

The “Other” Taxes We Don’t Talk About

But this brings me to a creeping question. What about the unofficial taxes? The ones no one talks about?

How are the indirect taxes collected from public transporters by local levy collectors accounted for? The levies collected from Mama Basirat who hawks around Oshodi market selling cooked food has watched the price of palm oil jump three times in six months while still paying a N500 “market ticket” every morning before selling a single plate of rice. Who tracks that revenue?

Yes, the most shocking revelation for me has been realizing that even hawkers – hawkers, who sell sachet water or fruit walking down roads and the street corners are being taxed in some areas.

Or rather, charged daily levies by local agents. And no, I am not condemning that, just that this issue raises some serious questions in my head:

- Where does this money go?

- Is it remitted to any official government account?

- What public service is being provided in return?

If we zoom out, the irony becomes obvious. We keep saying Nigeria’s tax-to-GDP ratio is too low. Yet, many of the poorest Nigerians are already being taxed, just not in ways that show up in FIRS data.

They’re taxed by local councils, market unions, transport associations, and sometimes even self-appointed local revenue agents. Is this form of taxation? It’s neither progressive nor transparent, nor accountable.

So, What Are We Really Talking About?

When we push for increasing tax revenue, we often picture corporate profits or high-net-worth individuals. But the reality? Many of the levies, fees, and informal charges disproportionately hit those in the informal sector; drivers, traders, hawkers, the same people inflation is already punishing the most. It’s a vicious cycle.

Drivers hike transport fares to meet the levies. Hawkers bump up prices to stay afloat and somewhere in the middle, people start paying more for food, transport, and basic needs. So, yes, taxation may be more beneficial than inflation but only if it’s fair, formal, and genuinely

used to improve lives. Until then, we seem to remain stuck in a system where the poorest pay the most, twice over: Once through rising prices that their income can barely meet, and again through levies that don’t even show up in the books. The informal sector is already contributing indirectly through taxes and levies. But where that money goes, that’s the real mystery.

The discussion about taxation in Nigeria must expand beyond the official tax system to consider these informal levies. And that, more than anything, is what really got my thinking juices flowing.

Maybe the conversation shouldn’t just be about taxing more, but taxing better, and ensuring value for those already overburdened.

Feature/OPED

How Nigerian Businesses Can Leverage Agentic AI for Growth and Efficiency

By Kehinde Ogundare

Artificial Intelligence (AI) is revolutionising industries globally, and Nigeria is no exception to this trend. Businesses in Nigeria are increasingly exploring AI-driven automation to enhance efficiency, drive innovation, and remain competitive. However, AI adoption remains relatively low, as many businesses struggle to identify practical use cases that deliver measurable ROI.

A key emerging trend addressing this challenge is Agentic AI–a more advanced form of AI that enables businesses to create autonomous digital agents capable of handling complex tasks, optimising workflows, and improving decision-making. Unlike traditional AI models that react to user inputs, Agentic AI proactively learns, makes decisions, and automates entire processes, making it a game-changer for businesses looking to scale productivity.

The Rise of Agentic AI in Business

Globally, AI adoption has grown, but many businesses still hesitate due to concerns over cost, implementation complexity, and lack of clear ROI. According to McKinsey & Company, organisations that have successfully integrated AI-driven automation report efficiency improvements ranging from 20–30%. The key to unlocking AI’s full potential lies in specialised AI models designed for specific business functions–precisely where Agentic AI excels.

For example, in customer service, AI-powered agents can automate repetitive tasks, resolve issues faster, and enhance customer satisfaction. Studies have shown that nearly 88% of Nigerian consumers consider customer experience critical to their purchasing decisions. Agentic AI can help businesses meet these expectations by providing instant, personalised support.

In sales, AI-driven Sales Development Representative (SDR) Agent can analyse customer interactions, identify sales opportunities, and suggest targeted outreach strategies. Research highlights that businesses using AI in sales automation experience increase conversion rates and higher sales productivity.

Similarly, Human Resources (HR) operations are being transformed by AI-powered automation. Tasks such as leave management, employee onboarding, and performance tracking can be effectively handled by Agentic AI, allowing HR professionals to focus on strategic employment engagement. Deloitte indicates that AI-powered HR automation reduces administrative workload significantly, enhancing employee satisfaction and operational efficiency.

In IT operations, AI-powered Help Desk Agents streamline troubleshooting, diagnose issues, and execute quick fixes. This reduces downtime and significantly improves operational continuity and productivity.

How Zoho is Innovating with Agentic AI

At Zoho, we recognise the potential of Agentic AI and have developed Zia Agents for specific use cases within various products. Unlike generic AI models, Zia Agents provide contextual intelligence, real-time decision-making, and deep business-specific insights. Additionally, Zoho ensures that Zia agents operate within a secure infrastructure, fully compliant with various global privacy regulations, making it a trusted solution for businesses handling sensitive data.

We have also launched Agent Studio, an AI-powered platform that enables our customers, partners, and independent developers to create specialised agents for their specific needs. These can be hosted on Agent Marketplace, where they can be monetised. Nigerian businesses can utilise Agent Studio to build hyperlocal agents for various industries.

The Future of Business with Agentic AI

The shift towards Agentic AI is inevitable as businesses increasingly seek smarter, more autonomous systems to drive efficiency and growth. Organisations that embrace AI-driven today will be better positioned to compete in Nigeria’s evolving digital economy.

For Nigerian businesses looking to scale efficiently, Agentic AI offers a practical and results driven approach to automation. By leveraging Zoho’s Zia Agents, companies can achieve higher productivity, ensuring long-term success in a competitive marketplace.

Kehinde Ogundare is the Country Head for Zoho Nigeria

Feature/OPED

If Data is the New Oil, Where is the Refinery?

By Timi Olubiyi, PhD

Internet users are growing at an unprecedented rate, and in Nigeria, for instance, internet users have expressed concerns and frustration over the data price increase in recent times, with many feeling its negative impact on their budgets and mobile smartphone usage.

Major networks such as MTN, Airtel, and Glo have seen a close to 50 per cent increase in Nigerian mobile data prices, with no known alternative available. This shows the significance of data and internet usage, highlighting its role in the digital age and the rapid growth of data and content creation across Africa.

From mobile phone data and e-commerce activities to social media interactions and government services, vast amounts of information are being created daily, which is accessible through internet usage.

The economic and technological landscape of Africa has been undergoing significant evolution recently. The continent is inhabited by over 1.4 billion individuals, and a larger portion of them create, use, and feed on data— which is a digital transformation.

The convergence of rising mobile phone usage, enhanced internet accessibility, and a youthful, technologically adept demographic has positioned Africa at the forefront of global discussions around technology innovation and data generation.

Recently, the phrase “data is the new oil” has gained significant traction in discussions related to technology, business, and the digital economy. But it is public knowledge that when it comes to oil, its availability is limited to certain areas of the world.

On the other hand, tech giants like Google, Facebook, Netflix, Amazon, Microsoft, and Apple control most of the world’s data.

According to a study by Sandvine in 2021, these companies are responsible for about 57 per cent of global data flow, and they have all commodified data. The huge amount of data controlled by these mega-companies is bigger than most small businesses and corporations. But, anyway, this would be another story piece for another time.

In the view of the author, if we want to know if data is really the “new oil”, we need to first look at how it builds value. Data by itself is not useful, just like in the case of oil. Raw data, without any processing or analysis, is merely a collection of information that requires interpretation.

For instance, an online store might keep track of what customers do, like what links they click on, how long they stay on product pages, and what they bought in the past.

However, this data remains mostly useless until it undergoes processing, analysis, and transformation into actionable ideas. Business managers in Africa should follow this path and should adhere to a mindset of ‘facts superiority over opinion’.

As businesses expand, an increasing number of individuals express ideas regarding the actions to be undertaken. However, it is beneficial to employ a data-insight mentality. All company metrics can be tested, measured and improved upon.

It is important to note that business owners/managers must have real-time access to the most important data in their business. Understanding which Key Performance Indicators (KPIs) affect revenue and profit is significantly more crucial than the revenue and profit figures themselves.

When data is cleaned up and analysed, it becomes really useful. Similar to refining oil to produce petrol, diesel, and other products, processing data yields beneficial outcomes. This is where Google and Facebook shine. They have put a lot of money into technologies like machine learning and big data analytics that can turn huge amounts of raw data into personalised ads, recommendation engines, and models that can predict the future. In this way, they make money for both their users and their owners.

In Africa, the idea of “data as the new oil” is particularly appealing because it could help the continent skip ahead in the normal stages of economic growth. Mobile phones let African countries get around the need for landline infrastructure.

Similarly, data technologies could help African economies get past older, resource-heavy ways of growing, leading to new ideas and long-term growth in fresh ways. In agriculture, for instance, data analytics and satellite imaging can help farmers figure out how the weather will behave, get the most out of their crops, and make harvest supply lines work better. Data-driven solutions in healthcare, like electronic health records (EHRs) and predictive analytics, can help find diseases, control outbreaks, and make healthcare better.

In the same way, data-driven education platforms can give students personalised learning experiences and give teachers and managers useful information about how students are doing and what they need. More so, businesses could be data-driven by setting up special internal research units on data, where insights can be generated to improve on decision-making.

Looking ahead, there are evident similarities between data and oil; much like crude oil, data is valuable. Data is not a naturally occurring resource like oil; it is a by-product of human activity. Oil is a limited resource, whereas data is plentiful and perpetually increasing. Raw data must be processed and analysed to derive significant insights and facilitate informed decision-making.

This is where artificial intelligence (AI) is relevant. AI acts as the ultimate data refinery, enabling the conversion of extensive information into meaningful insights. In contrast to oil, which is extracted and processed by a limited number of firms, data is more extensively disseminated, including various stakeholders in its collection, analysis, and utilisation.

Anticipating the future, data will probably witness ongoing advancements in many domains because it is a strategic asset for business and economic growth. With it, people, organisations, and governments can make better decisions. Good luck!

How may you obtain advice or further information on the article?

Dr Timi Olubiyi is an entrepreneurship and business management expert with a PhD in Business Administration from Babcock University, Nigeria. He is a prolific investment coach, author, seasoned scholar, chartered member of the Chartered Institute for Securities and Investment (CISI), and a Securities and Exchange Commission (SEC)-registered capital market operator. He can be reached on the Twitter handle @drtimiolubiyi and via email: drtimiolubiyi@gmail.com, for any questions, reactions, and comments.

The opinions expressed in this article are those of the author, Dr Timi Olubiyi, and do not necessarily reflect the opinions of others.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN