Feature/OPED

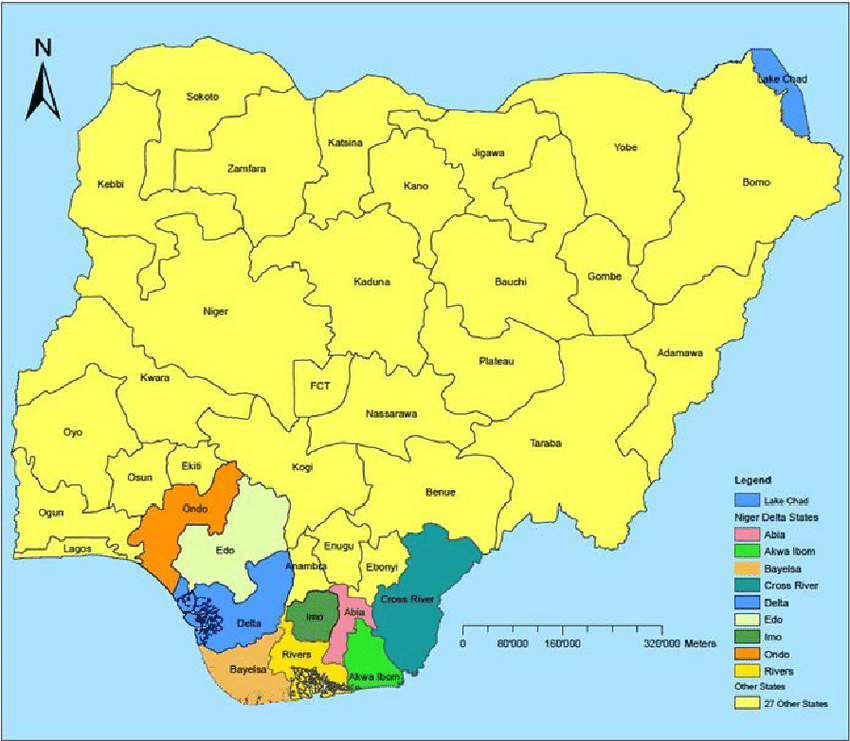

Niger Delta, NHRC and PIB

By Jerome-Mario Utomi

I never had expected that opinion articles about the Niger Delta, a region bedevilled by tremendous odds with an improbable chance of survival, will precisely in a space of four days come from me in this quick succession as I have other pressing concerns to comment on.

But this particular one stems from a reaction by a reader to the earlier one entitled Why Niger Delta is troubled. The piece, which had the resonated chant of a crude oil spill in Polobubo/Opuama Communities, Warri North Local Government Area of Delta as its central plot, among other things, classified the critical issues confronting the region as follows.

First, the existence of multiple but an absolute regulatory framework that characterises the oil and gas exploration and production in Nigeria and fuels International Oil Companies (IOCs’) reluctance to adhere strictly to the international best practices as it relates to their operational environment.

Secondly, the unwillingness of successive administrations to identify the Niger Delta as a troubled spot that must be regarded as a special area for purposes of development-as recommended by the colonial government long before independence.

While commending efforts made by the people of Polobubo/Opuama community, particularly lawyers under the umbrella of the Gbaramatu Lawyers Association (Gbaramatu Oloutomo-Abu Gbolei), who in an open letter dated March 8, 2021, issued a 14-day ultimatum to the owners of the facility to address the present challenge, the said reader (mentioned above) lamented that such efforts will continue to be frustrated by both national and foreign media as they will not accord it the needed attention/prominence.

He, therefore, advised that to make such an effort most rewarding, the community should approach/ petitions National Human Right Commission (NHRC).

NHRC, he explained, was established by the National Human Right Act 1995, to; create an enabling environment for extra-judicial recognition, promotion, protection and enforcement of human rights, in addition to providing a forum for public enlightenment and dialogue on human rights while facilitating the implementation of Nigeria’s various international and regional treaty obligations on human rights issues.

Though I was totally disoriented by his position on the National Human Rights Commission, I tried not to betray my disagreement with such position. Alas! I could not pretend for too long that I was flowing for he soon observed the utter confusion and frustration raging in my mind.

To douse the nagging helplessness enveloping me as regards his suggestion about going to NHRC, I explained to him that the reservation in my view does not reflect a lack of respect for the Commission. Rather, it is predicated on the memories of their not too deeds towards the region which about a year ago formed a similar intervention, entitled; Re-thinking the National Human Rights Commissions (NHRC) roles in the Niger Delta.

As a background, the plight of the people of the Niger Delta region explains a painful consequence of prostrated neglect and low investments in the region by our leaders and in order words, act as an essential step towards understanding action-decision, or error of judgment that currently perpetuates poverty, consolidates powerlessness and promotes restiveness in the region.

In the same vein, there are many institutional failures that have kept the region on its knees.

But among these failures, the inability of the National Human Rights Commission to rise onto its constitutional responsibility to the people of the region. A failure that has resulted in the generation of misinformation, disinformation, innuendos, falsehood and outright assault on reason(s) fuelling the backward nature of the Niger-Delta regions.

Notably, so many families in the region have witnessed so many disappointing moments as a result of the government’s insensitivity. The government on its part has made so many speeches and excuses without adopting or abiding by the basic principles that helped other nations grow in social cohesion or through equitable sharing of benefits from the mineral deposits from the region.

And in the face of these verifiable violations and deprivations, the National Human Rights Commission failed to inform the government that it is only through equity, justice, and restructuring of the nation that the country would enjoy economic and social progress that flows from stability.

The stunning thing about the commission’s inaction is that it is happening when the global community is aware that communal rights to a clean environment and access to clean water supplies are being violated in the region, with aquifers and other water supply sources being adversely affected by industrial or other activities without the communities being adequately compensated for their losses. And the oil industry by its admission has abandoned thousands of polluted sites in the region which need to be identified and studied in details.

Shockingly ‘interesting’ is that despite the not too impressive performance of NHRC, The commission is not without supporters.

While many argue that the commission cannot be blamed for environmental woes resulting from oil exploration and production in the Niger Delta region as the agency cannot investigate without complaint or petition from either group or individual- as wading in without invitation amounts to descending into the arena.

Some expressed the views that the plight of the Niger Deltans resulting from faulty/weak legal framework should be directed to the National Assembly as the commission is not the legislative arm of the government.

To others, expecting the commission to enforce compliance will translate to waiting till eternity as they are neither staffed with security operatives like the Economic and Financial Crimes Commission (EFCC) nor equipped with technical knowledge like the Federal Ministry of environment, to detect when organisations are not applying international best practices in their operations.

Though clear enough, this point cannot hold water when faced with a number of embarrassing facts.

Fundamentally, separate from the belief that ‘the environment is as important to the nation’s well-being as the economy and should deserve similar attention, their arguments remain sophistry looking at the functions and powers of the commission as provided in Section 5 of its enabling Act.

It provides that the commission shall deal with all matters relating to the promotion and protection of human rights as guaranteed by the constitution of the Federal Republic of Nigeria and other human rights instruments to which Nigeria is a party; Monitor and investigate all alleged cases of human rights violations in Nigeria and make appropriate recommendation to the federal government for the prosecution and such other actions as it may deem expedient in each circumstance. And assist victims of human rights violation to seek appropriate redress and remedies on their behalf.

Admittedly, NHRC may not have the power to make laws as argued by some commentator, but it can engineer people-purposed oil exploration and production regime by collaborating with the National Assembly through sponsorship of Bills and Memoranda; NHRC may be technically disempowered to investigate or detect operators non-adherence to the international best practice, but have the power to productively partner with other government Ministries and agencies that perform this task both effectively and efficiently; the Commission may not be capped with the task force to enforce standards, but can assist communities where such violation has taken place with legal actions against such violator. The vitality of such support will enrich litigation in favour of the communities; deepen the respect for the Commission among the operators while lifting litigation cost from communities.

There are other similar but separate examples.

Without going into specifics, concepts, provisions and definitions, it’s been identified that oil exploration and production in Nigeria are guided by so many laws. Yet, available data and our mind’s eye testify that these laws/Acts in question are no longer achieving their purpose.

Against this backdrop, Nigerians would have expected NHRC as a responsive and responsible organization to ask; if truly these laws are fundamentally effective and efficient, why are they not providing a strong source of remedy for individuals and communities negatively affected by oil exploration and production in the coastal communities as the lives of the people in that region currently portrays? If these frameworks exist and have been comprehensive as a legal solution to the issues of oil-related violations, why are they not enforceable?

While the watching world expects answers to these questions, this piece, believes that signing the Petroleum Industry Bill (PIB) and not NHRC will save the region.

To explain this fact, going by what industry watchers are saying, the Bill, if passed to law, will engineer the development of host communities in ways that entail all-encompassing improvement, brings a process that builds on itself and involves both individuals and social change. Attracts growth and structural change, with some measures of distributive equity, modernization in social and cultural attitudes, foster a degree of transformation and stability, bring an improvement in health and education and an increase in the quality of lives and employment of the people.

This claim is ‘more pronounced in sections on community relations provisions such as Section 241 which among other provisions mandates that Settlors (a holder of an interest in a petroleum prospecting licence or petroleum mining lease or a holder of an interest in a licence for midstream petroleum operations, whose area of operations is located in or appurtenant to any community or communities) shall incorporate a trust for the benefit of the host communities.

The constitution of each host community development trust, the bill added, shall provide that the applicable host community development trust fund be used exclusively for the implementation of the applicable host community development plan.

There is also another ingrained way of how the Bill will assist in clearing the Augean Stable in the Niger Delta. This has to do with the Prohibition of Gas Flaring in section 104. Going by its provisions, the Bill in a bid to fulfil its obligations under the United Nations Framework Convention on Climate Change (UNFCCC) and similar conventions, demands strict adherence to a gas flaring plan.

A licensee or lessee, it explained, producing natural gas is expected to, within 12 months of the effective date; submit a natural gas flare elimination and monetization plan to the commission, which shall be prepared in accordance with regulations made by the commission under this Act. A Licensee or Lessee who fails to adhere to the provision shall pay a penalty prescribed pursuant to the Flare Gas (Prevention of Waste and Pollution) Regulations.

With these and other provisions, there is no doubt that if the Federal Government is interested in serving and saving the people of the Niger Delta region, they are left with no other option than to pass and sign the PIB to law.

Since its objectives will foster sustainable prosperity within host communities and provide direct social and economic benefits from petroleum operations to host communities while enhancing peaceful and harmonious co-existence among licensees or lessees and host communities.

Jerome-Mario Utomi is the Programme Coordinator (Media and Public Policy), Social and Economic Justice Advocacy (SEJA), Lagos. He could be reached via [email protected] or 08032725374.

Feature/OPED

The Future of Payments: Key Trends to Watch in 2025

By Luke Kyohere

The global payments landscape is undergoing a rapid transformation. New technologies coupled with the rising demand for seamless, secure, and efficient transactions has spurred on an exciting new era of innovation and growth. With 2025 fast approaching, here are important trends that will shape the future of payments:

1. The rise of real-time payments

Until recently, real-time payments have been used in Africa for cross-border mobile money payments, but less so for traditional payments. We are seeing companies like Mastercard investing in this area, as well as central banks in Africa putting focus on this.

2. Cashless payments will increase

In 2025, we will see the continued acceleration of cashless payments across Africa. B2B payments in particular will also increase. Digital payments began between individuals but are now becoming commonplace for larger corporate transactions.

3. Digital currency will hit mainstream

In the cryptocurrency space, we will see an increase in the use of stablecoins like United States Digital Currency (USDC) and Tether (USDT) which are linked to US dollars. These will come to replace traditional cryptocurrencies as their price point is more stable. This year, many countries will begin preparing for Central Bank Digital Currencies (CBDCs), government-backed digital currencies which use blockchain.

The increased uptake of digital currencies reflects the maturity of distributed ledger technology and improved API availability.

4. Increased government oversight

As adoption of digital currencies will increase, governments will also put more focus into monitoring these flows. In particular, this will centre on companies and banks rather than individuals. The goal of this will be to control and occasionally curb runaway foreign exchange (FX) rates.

5. Business leaders buy into AI technology

In 2025, we will see many business leaders buying into AI through respected providers relying on well-researched platforms and huge data sets. Most companies don’t have the budget to invest in their own research and development in AI, so many are now opting to ‘buy’ into the technology rather than ‘build’ it themselves. Moreover, many businesses are concerned about the risks associated with data ownership and accuracy so buying software is another way to avoid this risk.

6. Continued AI Adoption in Payments

In payments, the proliferation of AI will continue to improve user experience and increase security. To detect fraud, AI is used to track patterns and payment flows in real-time. If unusual activity is detected, the technology can be used to flag or even block payments which may be fraudulent.

When it comes to user experience, we will also see AI being used to improve the interface design of payment platforms. The technology will also increasingly be used for translation for international payment platforms.

7. Rise of Super Apps

To get more from their platforms, mobile network operators are building comprehensive service platforms, integrating multiple payment experiences into a single app. This reflects the shift of many users moving from text-based services to mobile apps. Rather than offering a single service, super apps are packing many other services into a single app. For example, apps which may have previously been used primarily for lending, now have options for saving and paying bills.

8. Business strategy shift

Recent major technological changes will force business leaders to focus on much shorter prediction and reaction cycles. Because the rate of change has been unprecedented in the past year, this will force decision-makers to adapt quickly, be decisive and nimble.

As the payments space evolves, businesses, banks, and governments must continually embrace innovation, collaboration, and prioritise customer needs. These efforts build a more inclusive, secure, and efficient payment system that supports local to global economic growth – enabling true financial inclusion across borders.

Luke Kyohere is the Group Chief Product and Innovation Officer at Onafriq

Feature/OPED

Ghana’s Democratic Triumph: A Call to Action for Nigeria’s 2027 Elections

In a heartfelt statement released today, the Conference of Nigeria Political Parties (CNPP) has extended its warmest congratulations to Ghana’s President-Elect, emphasizing the importance of learning from Ghana’s recent electoral success as Nigeria gears up for its 2027 general elections.

In a statement signed by its Deputy National Publicity Secretary, Comrade James Ezema, the CNPP highlighted the need for Nigeria to reclaim its status as a leader in democratic governance in Africa.

“The recent victory of Ghana’s President-Elect is a testament to the maturity and resilience of Ghana’s democracy,” the CNPP stated. “As we celebrate this achievement, we must reflect on the lessons that Nigeria can learn from our West African neighbour.”

The CNPP’s message underscored the significance of free, fair, and credible elections, a standard that Ghana has set and one that Nigeria has previously achieved under former President Goodluck Jonathan in 2015. “It is high time for Nigeria to reclaim its position as a beacon of democracy in Africa,” the CNPP asserted, calling for a renewed commitment to the electoral process.

Central to CNPP’s message is the insistence that “the will of the people must be supreme in Nigeria’s electoral processes.” The umbrella body of all registered political parties and political associations in Nigeria CNPP emphasized the necessity of an electoral system that genuinely reflects the wishes of the Nigerian populace. “We must strive to create an environment where elections are free from manipulation, violence, and intimidation,” the CNPP urged, calling on the Independent National Electoral Commission (INEC) to take decisive action to ensure the integrity of the electoral process.

The CNPP also expressed concern over premature declarations regarding the 2027 elections, stating, “It is disheartening to note that some individuals are already announcing that there is no vacancy in Aso Rock in 2027. This kind of statement not only undermines the democratic principles that our nation holds dear but also distracts from the pressing need for the current administration to earn the trust of the electorate.”

The CNPP viewed the upcoming elections as a pivotal moment for Nigeria. “The 2027 general elections present a unique opportunity for Nigeria to reclaim its position as a leader in democratic governance in Africa,” it remarked. The body called on all stakeholders — including the executive, legislature, judiciary, the Independent National Electoral Commission (INEC), and civil society organisations — to collaborate in ensuring that elections are transparent, credible, and reflective of the will of the Nigerian people.

As the most populous African country prepares for the 2027 elections, the CNPP urged all Nigerians to remain vigilant and committed to democratic principles. “We must work together to ensure that our elections are free from violence, intimidation, and manipulation,” the statement stated, reaffirming the CNPP’s commitment to promoting a peaceful and credible electoral process.

In conclusion, the CNPP congratulated the President-Elect of Ghana and the Ghanaian people on their remarkable achievements.

“We look forward to learning from their experience and working together to strengthen democracy in our region,” the CNPP concluded.

Feature/OPED

The Need to Promote Equality, Equity and Fairness in Nigeria’s Proposed Tax Reforms

By Kenechukwu Aguolu

The proposed tax reform, involving four tax bills introduced by the Federal Government, has received significant criticism. Notably, it was rejected by the Governors’ Forum but was still forwarded to the National Assembly. Unlike the various bold economic decisions made by this government, concessions will likely need to be made on these tax reforms, which involve legislative amendments and therefore cannot be imposed by the executive. This article highlights the purposes of taxation, the qualities of a good tax system, and some of the implications of the proposed tax reforms.

One of the major purposes of taxation is to generate revenue for the government to finance its activities. A good tax system should raise sufficient revenue for the government to fund its operations, and support economic and infrastructural development. For any country to achieve meaningful progress, its tax-to-GDP ratio should be at least 15%. Currently, Nigeria’s tax-to-GDP ratio is less than 11%. The proposed tax reforms aim to increase this ratio to 18% within the next three years.

A good tax system should also promote income redistribution and equality by implementing progressive tax policies. In line with this, the proposed tax reforms favour low-income earners. For example, individuals earning less than one million naira annually are exempted from personal income tax. Additionally, essential goods and services such as food, accommodation, and transportation, which constitute a significant portion of household consumption for low- and middle-income groups, are to be exempted from VAT.

In addition to equality, a good tax system should ensure equity and fairness, a key area of contention surrounding the proposed reforms. If implemented, the amendments to the Value Added Tax could lead to a significant reduction in the federal allocation for some states; impairing their ability to finance government operations and development projects. The VAT amendments should be holistically revisited to promote fairness and national unity.

The establishment of a single agency to collect government taxes, the Nigeria Revenue Service, could reduce loopholes that have previously resulted in revenue losses, provided proper controls are put in place. It is logically easier to monitor revenue collection by one agency than by multiple agencies. However, this is not a magical solution. With automation, revenue collection can be seamless whether it is managed by one agency or several, as long as monitoring and accountability measures are implemented effectively.

The proposed tax reforms by the Federal Government are well-intentioned. However, all concerns raised by Nigerians should be looked into, and concessions should be made where necessary. Policies are more effective when they are adapted to suit the unique characteristics of a nation, rather than adopted wholesale. A good tax system should aim to raise sufficient revenue, ensure equitable income distribution, and promote equality, equity, and fairness.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN