Jobs/Appointments

20% of Full-Time Workers in Nigeria Lost Jobs in 2020—Report

By Adedapo Adesanya

A new report has disclosed that at least 20 per cent of full-time workers in Nigeria lost employment during the COVID-19 pandemic in 2020.

The report tagged The Impact of COVID-19 on Business Enterprises in Nigeria was jointly released by the United Nations Development Programme (UNDP) and the National Bureau of Statistics (NBS) on Tuesday.

Sampling 3,000 businesses via in-depth interviews across both formal and informal sectors in major industries of the economy, the report assessed the impact of COVID-19 on business enterprises in the country.

“While there have been promising signs of recovery this year, COVID-19 has had an outsized socio-economic impact on Nigeria,” it said.

“From disruptions in supply chains to ongoing supply and demand shocks and a drop in consumer confidence, these challenges are expected to leave a lasting impact on the businesses and enterprises that make up the backbone of the economy,” it added.

The report also highlighted the significant decline in revenue faced by enterprises and establishments across the country due to the pandemic.

It indicated that 81 per cent of enterprises interviewed, experienced a decline in revenue and 73 per cent stated that they faced liquidity challenges due to secondary impacts of the pandemic in 2020.

Data from the report showed that the median loss in revenue remained at 44 per cent, in comparison to 2019 revenues while about 60 per cent of enterprises surveyed experienced an increase in operational costs, with the price of raw materials and logistics being the top two contributors to the increase.

Other operational challenges included access to credit and capital, high expenditure on utilities, and inadequate social safety net, especially for informal enterprises.

In addition, the report revealed that one in three business enterprises surveyed indicated that some businesses have permanently closed due to operational challenges resulting from the pandemic.

According to the report, businesses are likely to continue experiencing the impact of the pandemic even after the easing of public health measures.

Despite reduced restrictions at the time of the interviews, 74 per cent of enterprises still reported a decrease in production levels when compared to the same time in 2019.

In his remarks, the new Statistician-General of the Federation and Head of the NBS, Mr Simon Harry, highlighted the importance of the survey results.

“As the economy begins to show signs of gradual growth, this report contains important information that can guide policymakers in their interventions to mitigate the negative socioeconomic impacts of COVID-19 in the country,” he said

“I wish to thank UNDP for collaborating with the National Bureau of Statistics on this important report and I urge other development partners to emulate this worthy endeavour by partnering with the Bureau in matters relating to data generation in the country.

“Although the report findings highlight the complex challenges the economy continues to face because of COVID-19, it also tells a powerful story of innovation, resilience, and strength as Nigerian businesses leverage their ingenuity to adjust to this new normal,” he added.

On his part, UNDP Resident Representative, Mr Mohamed Yahya said, “As Nigeria mobilises to recover from the devastating health and socio-economic impact of the pandemic, this report will be a critical tool in informing targeted policymaking and programme interventions for both medium and long-term planning as the country rebuilds.”

Jobs/Appointments

Olaniyan to Serve as NGX Group Chief Strategy Officer

By Aduragbemi Omiyale

Ms Jumoke Olaniyan has been appointed as the Chief Strategy Officer of the Nigerian Exchange (NGX) Group Plc.

In her new role, Ms Olaniyan will lead enterprise-wide strategy formulation and execution across the organisation, driving initiatives aligned with its ambition to deepen market liquidity, expand product innovation, broaden investor participation, and enhance long-term stakeholder value.

The role is central to strengthening cross-functional alignment and organisational effectiveness as NGX Group continues to evolve its integrated market infrastructure model.

NGX Group, in a statement, said it strengthened its executive leadership with the appointment of Ms Olaniyan to advance its next phase of strategic growth, digital transformation, product innovation and market development.

Her appointment underscores the company’s continued focus on disciplined strategy execution, strong governance and sustainable value creation.

It also reflects the group’s deliberate effort to strengthen its leadership structure through broader representation at the executive level, ensuring that women continue to play influential roles in shaping the evolution of Nigeria’s capital markets while contributing meaningfully to national economic development.

Before joining NGX Group, Ms Olaniyan held senior leadership roles at FMDQ Group Plc and FDHL Group, where she played key roles in business development, market expansion, and product innovation across the fixed income, currencies and derivatives markets.

With over two decades of experience spanning financial markets, strategy, consulting, and banking, she brings extensive expertise in market structure, stakeholder engagement, and enterprise transformation.

She holds a degree in Accounting as well as an MBA from INSEAD Business School and has built a reputation for driving growth, strengthening market participation, and delivering innovative financial market solutions that enhance transparency, efficiency, and market resilience.

Jobs/Appointments

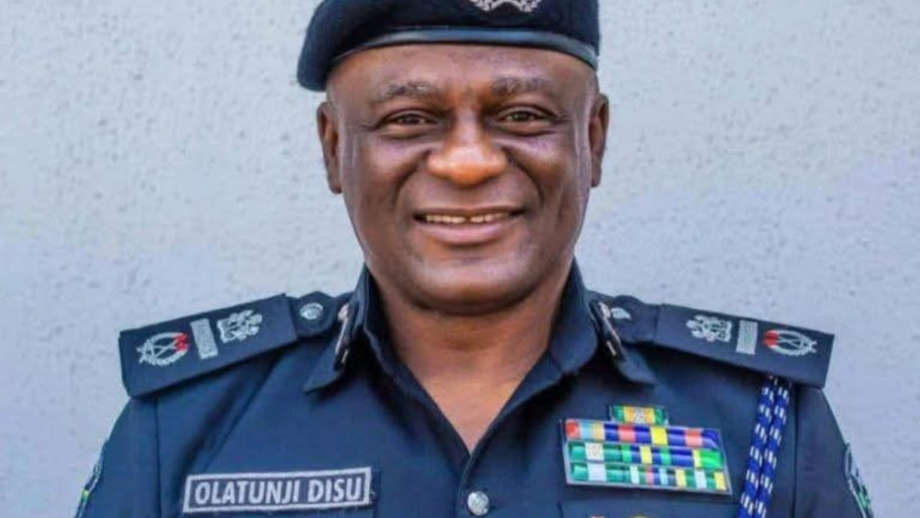

Tinubu to Swear in Tunji Disu as IGP Wednesday After Police Council’s Nod

By Modupe Gbadeyanka

The appointment of Mr Tunji Disu as the substantive Inspector-General of Police (IGP) has been ratified by the Nigeria Police Council (NPC).

The endorsement of the acting police chief was done on Monday at the council’s meeting held at the State House in Abuja, and chaired by President Bola Tinubu.

In attendance were Vice President Kashim Shettima, state governors and the Chairman of the Police Service Commission, Mr Hashimu Argungu.

Others in attendance were the Secretary to the Government of the Federation, Mr George Akume; the National Security Adviser, Mr Nuhu Ribadu; the Chief of Staff to the President, Mr Femi Gbajabiamila; the Minister of Police Affairs, Mr Ibrahim Gaidam; the FCT Minister, Mr Nyesom Wike; and the head of service, Mrs Esther Didi Walson-Jack.

Mr Disu was praised for his outstanding service to the nation through various means. He has held critical operational, investigative, and strategic command positions nationwide. His last position was as Assistant Inspector-General of Police (AIG) in charge of the Special Protection Unit and the Force CID Annex, Lagos.

The endorsement of his appointment on Monday paves the way for his swearing-in by Mr Tinubu on Wednesday. The ceremony will take place during the Federal Executive Council (FEC) meeting, scheduled for the same day.

The President appointed Mr Disu as the new police chief, following the resignation of the former occupier of the seat, Mr Kayode Egbetokun.

Mr Disu was born on April 13, 1966, in Lagos State and joined the Nigeria Police Force on May 18, 1992, as a Cadet Assistant Superintendent.

He rose through the ranks with multiple qualifications in public administration, forensic investigation, criminology, security, legal psychology, and entrepreneurship-credentials that reflect his commitment to knowledge-driven, modern policing.

His state governor, Mr Babajide Sanwo-Olu, lauded Mr Disu for his exemplary services as a policeman, especially when he served as the Commander of the Rapid Response Squad (RRS) in Lagos State between 2015 and 2021, where his tenure earned him and the RRS recognition for excellence in crime control.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn