Jobs/Appointments

Nigeria’s Unemployment Rate Declines to 4.3% in Q2 2024

By Adedapo Adesanya

The unemployment rate in Nigeria declined to 4.3 per cent in the second quarter of 2024, according to the latest report released on Monday by the National Bureau of Statistics (NBS).

This rate is lower than the 5.3 per cent recorded in Q1 2024, reflecting a gradual recovery from the 5.0 per cent in Q3 2023.

According to global standards introduced by the International Labour Organisation (ILO), an employed person is defined as anyone working at least one hour a week, unlike the old methodology where a person had to work at least 20 hours a week to be considered employed.

The methodology introduced other fresh benchmarks as well. The sample size was widened to 34,250 as against 33,000. Also, the data will be gathered weekly as against quarterly in the previous method.

The NBS, in the latest Nigeria Labour Force Survey (NLFS), said a statistical survey designed to collect comprehensive data on employment, unemployment, and other characteristics of the population labour force. It provides quarterly estimates of the main labour force statistics with sufficient precision at the national level.

The Labour Force Participation Rate rose to 79.5 per cent, up from 77.3 per cent in the previous quarter, highlighting increased workforce engagement, as the Employment-to-Population Ratio also showed significant improvement, climbing to 76.1 per cent in Q2 2024 from 73.2 per cent in Q1 2024, indicating that a higher proportion of the working-age population was gainfully employed during the period.

Also, self-employment remained dominant, accounting for 85.6 per cent of total employment, an increase from 84 per cent in the preceding quarter.

Informal employment also rose slightly to 93.0 per cent, highlighting the economy’s reliance on informal jobs, as urban unemployment stood at 5.2 per cent, a reduction from 6.0 per cent in Q1 2024, while rural areas recorded an even lower unemployment rate of 2.8 per cent, compared to 4.3 per cent in the previous quarter.

This disparity highlights the continued role of agriculture and informal activities in rural employment, contrasting with the urban dependence on formal and service-driven jobs.

The youth unemployment rate (ages 15–24) dropped significantly to 6.5 per cent, compared to 8.4 per cent in Q1 2024.

The report further revealed gender disparities, with the unemployment rate for females at 5.1 per cent, compared to 3.4 per cent for males, suggesting a need for targeted gender-inclusive policies to bridge the employment gap.

“The unemployment rate is defined as the share of the labour force not employed but actively searching for and available for work.

“Unemployment is one of the components of labour underutilisation. The unemployment rate for Q2 2024 was 4.3 per cent, showing an increase of 0.1 percentage point compared to the same period last year,” the report stated, noting that the unemployment rate among males was 3.4 per cent and 5.1 per cent among females.

“By place of residence, the unemployment rate was 5.2 per cent in urban areas and 2.8 per cent in rural areas. Youth unemployment rate was 6.5 per cent in Q2 2024, showing a decrease from 8.4 per cent in Q1 2024,” the NBS said.

Time-related underemployment, which measures workers seeking additional hours, dropped to 9.2 per cent in Q2 2024 from 10.6 per cent in Q1.

Labour underutilisation metrics also improved, with LU2 (unemployment and time-related underemployment) decreasing to 13.0 per cent from 15.3 per cent in the previous quarter.

LU3 and LU4 metrics, which include potential labour force participation, also recorded declines to 5.9 per cent and 14.5 per cent, respectively.

The participation rates between males and females are nearly the same, with males at 79.9.5 per cent and females at 79.1 per cent.

This minimal difference suggests a balanced level of engagement across genders, indicating that gender is not a significant factor in labour participation.

Participation rates show notable differences by residence and disability status. In rural areas, participation is higher at 83.2 per cent compared to 77.2 per cent in urban areas.

A more significant gap existed between those with and without disabilities.

While 80.0 per cent of individuals without disabilities participate in labour-related activities, only 36.7 per cent of those with disabilities do, highlighting the need for greater inclusivity and targeted support to improve engagement among persons with disabilities (PWDs).

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

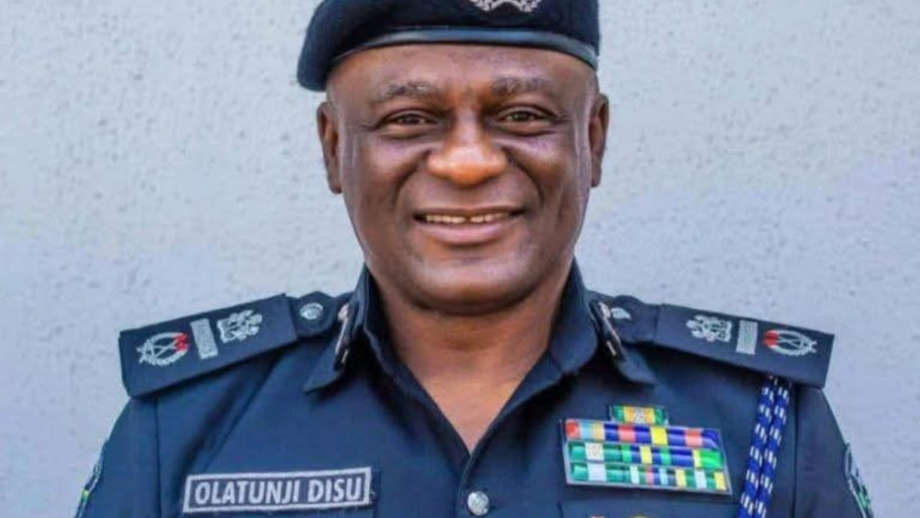

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn