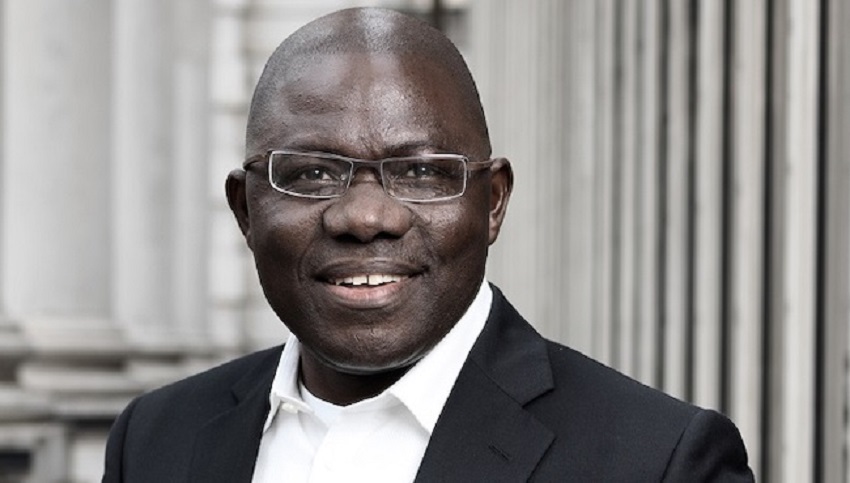

Jobs/Appointments

Remi Babalola Quits FBN Holdings as Chairman

By Dipo Olowookere

The Chairman of FBN Holdings Plc, Mr Remi Babalola, has exited his position barely nine months after he was appointed to occupy the seat.

The former Minister of State for Finance was appointed by the Central Bank of Nigeria (CBN) on April 29, 2021, to head the board of directors of the organisation.

This followed the removal of Mr Oba Otudeko from the position by the apex bank after a boardroom crisis threatened the financial institution.

It is unclear why Mr Babalola has decided to resign from the position, though the financial services group is yet to formally announce the development.

The exit of the Chairman from the firm is coming a few days after it was confirmed that Mr Femi Otedola has made a significant investment in FBN Holdings with the acquisition of additional 200 million shares of the organisation, raising his stake to over 7 per cent.

It is not certain if this development will affect the share price of FBN Holdings at the Nigerian Exchange (NGX) Limited next week.

When the market closed for the week on Friday, the price of the company’s stock rose by 0.42 per cent or 5 kobo to sell for N12.00.

The equity value has been on a roller coaster lately with heavy transactions through cross deals as the battle for who controls the company between Mr Otedola and Mr Tunde Hassan-Odukale thickens.

The CBN has seen the silent tussle as a good development and has expressed happiness with this because according to the Governor of the apex bank, a few years ago, First Bank shares were not attractive to investors.

“Six years ago, as I said, because of an aggressive build-up of NPLs, the share price of First Bank was about N2. We took it up. Then, everybody was running away from the shares of First Bank.

“We have cleaned the balance sheet now, people are seeing that the money-making machine, First Bank, is back on its feet. They are in the race for profitability. They are now competing for the shares of First Bank. As of the last time I checked over the weekend, the share price was more N11.

“Why should I quarrel about that? “I am happy to see that they are competing for the shares. Of course, we all know that First Bank is so large that no single person can own it. In running the banks, they should see themselves as representing others,” he had told newsmen in Abuja last month.

It is believed that Mr Otedola, being the new single largest shareholder of the bank, will likely nominate someone to become chairman of FGN Holdings.

Business Post cannot immediately confirm if this will happen soon or the CBN will appoint an acting chairman for the company to fill the vacant position left by Mr Babalola.

In the coming days, a former CEO of Fidelity Bank, Mr Nnamdi Okonkwo, is expected to take over as the Group Managing Director of FBN Holdings, replacing Mr U.K Eke, who retires on December 31, 2021.

Jobs/Appointments

Tinubu Appoints Ogunjumi Acting Accountant General as Madein Retires

By Adedapo Adesanya

President Bola Tinubu has appointed Mr Shamseldeen Babatunde Ogunjimi as the Acting Accountant General of the Federation (AGF).

This was contained in a statement on Tuesday by presidential spokesman, Mr Bayo Onanuga.

“His appointment is effective immediately following the pre-retirement leave of the incumbent AGF, Mrs Oluwatoyin Sakirat Madein,” a part of the statement read.

“In announcing Madein’s successor, President Tinubu ensures a seamless transition in the administration of Nigeria’s treasury and consolidates the implementation of the present administration’s treasury policy reforms,” the statement added.

Mr Onanuga said Mr Ogunjimi brings over 30 years of extensive experience in financial management across the public and private sectors.

He described the appointee as a career civil servant and the most senior director in the Office of the Accountant General of the Federation (OAGF),

“He has held significant positions, including Director of Funds at the OAGF and Director of Finance and Accounts at the Ministry of Foreign Affairs.

“A chartered accountant, certified fraud examiner, chartered stockbroker, and chartered security and investment specialist, Mr Ogunjimi’s academic qualifications include a Bachelor of Science (BSc) in Accountancy and a Master’s in Finance and Accounting,” the statement added.

According to Mr Onanuga, President Tinubu expressed his confidence in his appointment, saying, “The Office of the Accountant General of the Federation is pivotal to our nation’s treasury management operations. Mr Ogunjimi’s wealth of experience and notable competence will ensure the continued effectiveness of this vital institution as we advance our economic reform agenda.”

President Tinubu also commended the outgoing Accountant General of the Federation, Mrs Madein, for her dedication and selfless service to the nation.

After reaching the civil service’s statutory retirement age, Mrs Madein is retiring effective March 7, 2025.

Jobs/Appointments

CBN Denies Forceful Mass Retirement Amid Restructuring

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has dismissed claims of forced mass retirement as part of efforts by Governor Yemi Cardoso to restructure the workforce of the organisation.

In a statement released on Wednesday, the Acting Director of Corporate Communications, Mrs Hakama Sidi Ali, clarified that its Early Exit Package (EEP) is entirely voluntary and without any negative repercussions for eligible staff.

According to the statement, the decision to implement the exercise was the outcome of extensive consultations with the bank’s Joint Consultative Council (JCC), a body representing staff interests.

Mrs Sidi Ali explained that the EEP, a longstanding policy previously accorded to the executive cadre, has now been made available to eligible staff at all levels.

“For some time, staff representatives through the JCC had called on management to approve the early exit package for all cadres. Following these discussions, management decided to meet this popular demand,” she said in the statement.

Addressing concerns about potential repercussions for staff who decline the package, Mrs Sidi Ali reaffirmed management’s commitment to supporting employees’ professional growth and well-being, describing the concerns as unfounded.

She further emphasized that the initiative is an internal corporate matter designed to promote career development for staff.

According to wide spread reports, there have been plans to retire approximately 1,000 employees by the end of the year with a payoff estimated to cost over N50 billion.

The mass retirement, which was announced in a circular issued three weeks ago, mandates affected employees to apply for the Early Exit Package (EEP).

The statement allegedly warned employees with less than one year of service or unconfirmed appointments to refrain from applying for the program, noting that the application would remain open until December 7, with an effective exit date of December 31, 2024.

It was reported that the entire EEP was valued at N50 billion.

Jobs/Appointments

CBN Okays Appointment of Benson Ogundeji as Greenwich Merchant Bank CEO

By Modupe Gbadeyanka

The Central Bank of Nigeria (CBN) has approved the appointment of Mr Benson Ogundeji as the chief executive of Greenwich Merchant Bank Limited.

The board of the financial institution for businesses had picked Mr Ogundeji as its substantive CEO but awaited the authorisation of the banking sector regulator.

He brings over three decades of extensive banking experience to this role as a seasoned financial services professional, who previously served as Executive Director at Greenwich Merchant Bank from July 2020, where he played a pivotal role in the bank’s successful transition from the legacy Greenwich Trust Limited to a merchant bank.

In this capacity, he provided oversight for Corporate Banking, Treasury and Global Markets.

Throughout his career, Mr Ogundeji has demonstrated exceptional expertise in business development and operational excellence.

Before joining the firm, he held various senior leadership roles at prominent financial institutions, including Ecobank Nigeria, GTBank, and other notable banks, where he consistently displayed exceptional leadership skills.

His appointment comes at a crucial time as Greenwich Merchant Bank commences the next phase of its growth plans. Having related closely with the new CEO, as an Executive Director and acting CEO in the last four years, the board has expressed confidence about his ability to lead the bank in delivering our strategic goals.

“The board is pleased to announce the appointment of Benson Ogundeji as our Managing Director/Chief Executive Officer,” the chairman of Greenwich Merchant Bank, Mr Kayode Falowo, stated.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN