World

Significance of African Energy Week

By Kestér Kenn Klomegâh

After extensive preparations and negotiations these several months, the South African-based African Energy Chamber (AEC) is proud to hold African Energy Week, considered one of the world’s largest and continental energy gatherings, from October 18 – 21 in Cape Town. The African Energy Week primarily aims at discussing all aspects of exploration, collaboration and utilization of Africa’s energy resources in scaling up energy security, drastically reducing energy imports and its role in driving socioeconomic growth in Africa.

It will also address the energy infrastructure development and energy monetization initiatives in partnership with global players, foreign investors and governments. As Africa’s biggest gathering for energy ministers, energy policymakers, companies and investors – it will therefore be crucial for shaping discussions to find a pragmatic approach around the key role the continent’s massive yet largely unexplored hydrocarbon resources play in driving making energy poverty history while triggering newfound socioeconomic growth.

In partnership with leading renewable energy companies, the four days of networking and serious discussions around the energy renewable sector becomes extremely crucial for Africa. With over 800 million people across the African continent living in energy poverty and 900 million without access to clean cooking solutions, the need to accelerate the deployment and exploitation of the continent’s vast yet untapped natural gas, solar, wind, hydropower and green hydrogen resources has expanded.

The African Energy Chamber’s special report titled “State of African Energy Q2 2022 Report” will be presented during the conference. According to the report seen by this author, increasing energy, including oil and gas activity and a record number of new discoveries, have set the stage for significant industry growth in the second half of 2022.

According to the report, increasing oil and gas activity and a record number of new discoveries have set the stage for significant industry growth in the second half of 2022. The future depends on sustaining the longevity of the industry. The report outlines unprecedented new oil and gas discoveries on the African continent. The simple, staggering fact that more than half of sub-Saharan Africans lack access to electricity means priority must continue to end energy poverty. With Africa’s population projected to exceed two billion by 2040, generation capacity must be doubled by 2030 and multiplied fivefold by 2050.

Do you want to find out more about Africa’s exploration potential? Are you interested in connecting with exploration & production (E&P) companies active across the continent? Africa needs more exploration, the rapid development of oil and gas reserves and improved exploitation to meet local demand. Through companies such as TotalEnergies, Chevron, ExxonMobil, bp, Africa Oil Corp, Kosmos Energy, Marathon Oil, CNPC, CNOOC and many more, the future of Africa’s energy sector is unequivocal, incontestable and undeniable.

By exploring the benefits and challenges associated with these exploration campaigns, investors play a unique role in sustainable development, as Africa has roughly 40 billion undeveloped barrels of oil and gas reserves in the energy industry. According to the World Bank, Russia also holds the world’s largest natural gas reserves, the second-largest coal reserves, and the eighth-largest oil reserves. With the Russia-Ukraine crisis and Russia’s leading energy supplier redirecting its search markets in the Asian region, it has brought good opportunities for new partners for Africa.

Over the past years after the Soviet collapse, Russia has expressed heightened interest in exploring and producing oil and gas in Africa. Emboldened African leaders and industry executives have accepted proposals and signed several agreements with Russian companies, but little have been achieved in the sector. With the rapidly changing geopolitical conditions and economic fragmentation fraught with competition and rivalry, African leaders have to understand that Russia might not heavily invest in the oil and gas sector, not even in the needed infrastructure in this industry.

During June 2021 interview discussions with NJ Ayuk, Executive Chairman of the African Energy Chamber, a pan-African company that focuses on research, documentation, negotiations and transactions in the energy sector, he expressed the urgent necessity for scaling up Africa’s production capacity in order to achieve universal access to energy. He further noted the challenging tasks and pointed strongly to the need for a transformative partnership-based strategy (that requires transparency, good governance and policies that could create a favourable investment climate) and that aims at increasing access to energy for all Africans.

Natural gas, affordable and abundant in Africa, has the power to spark significant job creation and capacity-building opportunities, economic diversification and growth. Sustainable development of African economies can only be attained by the development of local industry – by investing in Africans, building up African entrepreneurs and supporting the creation of indigenous companies. It requires cooperative efforts by Africans.

Can there be a unified approach to collaborating on issues of energy projects in Africa? NJ Ayuk observes that Africa has already made an indelible mark in the oil and gas industry. Africans must therefore become more accountable and plan better in the energy sectors. Some potential external investors, such as Russia, have shown interest in this sector for many decades but have not delivered promptly on their promises and signed agreements.

Some experts believe Europe can look to Africa as the preferred energy supplier. Africa is ready to welcome investors currently pulling out of Russia if they can genuinely invest in developing oil and gas infrastructure, which Africa seriously lacks in this industry. For Africa at this point, that’s a real opportunity. Understandably, Russia aspires to be the leading supplier on the global market and therefore seeks to marginalize potential producers such as Africa. In practical terms, it is very cautious making financial commitments in Africa.

“The demand for oil and gas from Africa is on the rise, especially as we expect domestic usage to rise significantly, driven by a growing population and corresponding economic activity. It is, therefore, key for countries across the continent to leverage existing oil and gas infrastructure to fast-track the development of assets that would otherwise have been stranded,” said Verner Ayukegba, Senior Vice President of the African Energy Chamber. “We are delighted to continue working with interested investors and researchers to bring forward vital data that allows decision makers to drive investments in Africa’s energy sector, ultimately leading to ending energy poverty in Africa by 2030.”

According to Ayukegba, the African Energy Chamber continues to investigate how the accelerated investment and development of Africa’s infrastructure landscape will be key for ensuring oil and gas discoveries translate into long-term developments. Currently, there exists an infrastructure gap across the continent, a gap which significantly impacts exploration initiatives, bringing newfound challenges to project take-off and completion. Therefore, during the panel, speakers will explore this gap while making a strong case for an alternative, expert-backed solutions.

If Africa is to make energy history in Africa by 2030, the continent needs to maximize utilizing all available resources. As such, African countries with energy resources have the potential to change the continent’s energy landscape, especially at this time of unprecedented global changes and large-scale developments set to establish a multipolar system. In spite of these, Africa needs to boost its energy security and work consistently towards energy self-sufficiency within the framework of the Sustainable Development Goals (SDGs) and within the African Union Agenda 2063.

World

Iranian Supreme Leader Ali Khamenei Dies After Air Strikes

By Dipo Olowookere

Iranian Supreme Leader, Mr Ayatollah Ali Khamenei, has died after coordinated airstrikes carried out by the United States and Israel on Tehran on Saturday morning.

His death was confirmed on Sunday morning by Iranian state media, which also disclosed that his daughter and grandchild were among those killed in the bombardment, which destroyed his compound.

Mr Khamenei was killed during a meeting with top leaders of the Middle East country yesterday, including the Defence Minister Amir Nasirzadeh and Revolutionary Guard commander Mohammad Pakpour, who reportedly died too.

His elimination has sparked mixed reactions, with some Iranians on the streets celebrating his demise, and others condemning the joint air strikes.

The President of the United States, Mr Donald Trump, described the late Iranian leader as “one of the most evil people in history,” expressing satisfaction at the action, which he said was “successful,” as it represented justice for both Iranians and Americans.

Meanwhile, Tehran has vowed to further respond to the attacks after initially firing missiles at six neighbours, including Qatar, Saudi Arabia, Kuwait, UAE, Bahrain, and Jordan.

Flight operations in the region have been disrupted because of the retaliatory action of Iran over the weekend, though most of the missiles were intercepted.

World

AfBD, AU Renew Call for Visa-Free Travel to Boost African Economic Growth

By Adedapo Adesanya

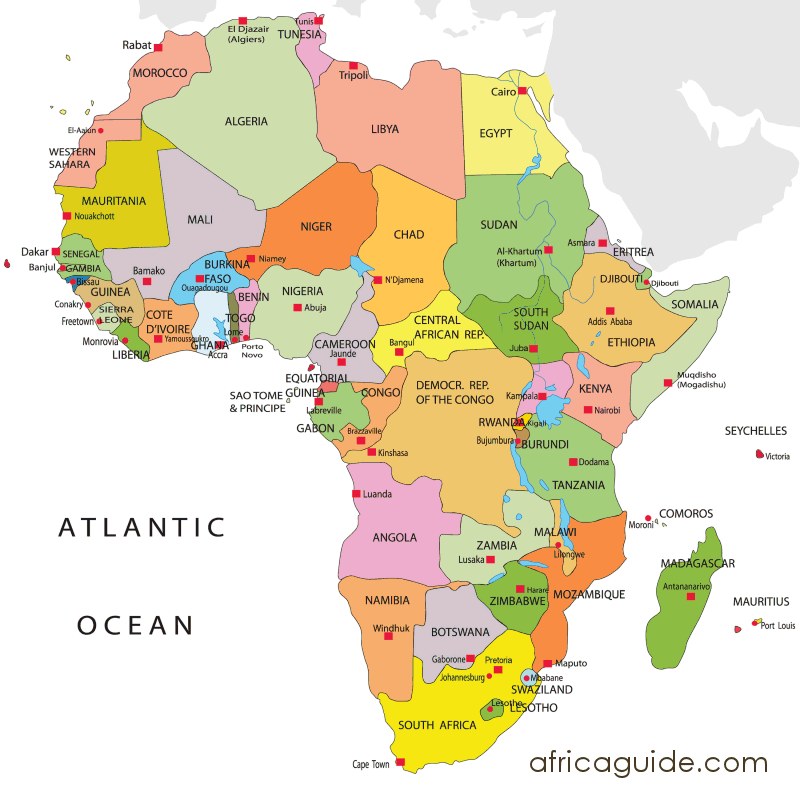

The African Development Bank (AfDB) and the African Union have renewed their push for visa-free travel to accelerate Africa’s economic transformation.

The call was reinforced at a High-Level Symposium on Advancing a Visa-Free Africa for Economic Prosperity, where African policymakers, business leaders, and development institutions examined the need for visa-free travel across the continent.

The consensus described the free movement of people as essential to unlocking Africa’s economic transformation under the African Continental Free Trade Area (AfCFTA).

The symposium was co-convened by AfDB and the African Union Commission on the margins of the 39th African Union Summit of Heads of State and Government in Addis Ababa.

The participants framed mobility as the missing link in Africa’s integration agenda, arguing that while tariffs are falling under AfCFTA, restrictive visa regimes continue to limit trade in services, investment flows, tourism, and labour mobility.

On his part, Mr Alex Mubiru, Director General for Eastern Africa at the African Development Bank Group, said that visa-free travel, interoperable digital systems, and integrated markets are practical enablers of enterprise, innovation, and regional value chains to translate policy ambitions into economic activity.

“The evidence is clear. The economics support openness. The human story demands it,” he told participants, urging countries to move from incremental reforms to “transformative change.”

Ms Amma A. Twum-Amoah, Commissioner for Health, Humanitarian Affairs and Social Development at the African Union Commission, called for faster implementation of existing continental frameworks.

She described visa openness as a strategic lever for deepening regional markets and enhancing collective responses to economic and humanitarian crises.

Former AU Commission Chairperson, Ms Nkosazana Dlamini-Zuma, reiterated that free movement is central to the African Union’s long-term development blueprint, Agenda 2063.

“If we accept that we are Africans, then we must be able to move freely across our continent,” she said, urging member states to operationalise initiatives such as the African Passport and the Free Movement of Persons Protocol.

Ghana’s Trade and Industry Minister, Mrs Elizabeth Ofosu-Adjare, shared her country’s experience as an early adopter of open visa policies for African travellers, citing increased business travel, tourism, and investor interest as early dividends of greater openness.

The symposium also reviewed findings from the latest Africa Visa Openness Index, which shows that more than half of intra-African travel still requires visas before departure – seen by participants as a significant drag on intra-continental commerce.

Mr Mesfin Bekele, Chief Executive Officer of Ethiopian Airlines, called for full implementation of the Single African Air Transport Market (SAATM), saying aviation connectivity and visa liberalisation must advance together to enable seamless travel.

Regional representatives, including Mr Elias Magosi, Executive Secretary of the Southern Africa Development Community, emphasised the importance of building trust through border management and digital information-sharing systems.

Ms Gabby Otchere Darko, Executive Chairman of the Africa Prosperity Network, urged governments to support the “Make Africa Borderless Now” campaign, while tourism campaigner Ras Mubarak called for more ratifications of the AU Free Movement of Persons protocol.

Participants concluded that achieving a visa-free Africa will require aligning migration policies, digital identity systems, and border infrastructure, alongside sustained political commitment.

World

Nigeria Exploring Economic Potential in South America, Particularly Brazil

By Kestér Kenn Klomegâh

In this interview, Uche Uzoigwe, Secretary-General of NIDOA-Brazil, discusses the economic potential in South America, particularly Brazil, and investment incentives for Brazilian corporate partners for the Federal Republic of Nigeria (FRN). Follow the discussion here:

How would you assess the economic potential in the South American region, particularly Brazil, for the Federal Republic of Nigeria? What investment incentives does Nigeria have for potential corporate partners from Brazil?

As the Secretary of NIDOA Brazil, my response to the questions regarding the economic potentials in South America, particularly Brazil, and investment incentives for Brazilian corporate partners would be as follows:

Brazil, as the largest economy in South America, presents significant opportunities for the Federal Republic of Nigeria. The country’s diverse economy is characterised by key sectors such as agriculture, mining, energy, and technology. Here are some factors to consider:

- Natural Resources: Brazil is rich in natural resources like iron ore, soybeans, and biofuels, which can be beneficial to Nigeria in terms of trade and resource exchange.

- Growing Agricultural Sector: With a well-established agricultural sector, Brazil offers potential collaboration in agri-tech and food security initiatives, which align with Nigeria’s goals for agricultural development.

- Market Size: Brazil boasts a large consumer market with a growing middle class. This represents opportunities for Nigerian businesses looking to export goods and services to new markets.

- Investment in Infrastructure: Brazil has made significant investments in infrastructure, which could create opportunities for Nigerian firms in construction, engineering, and technology sectors.

- Cultural and Economic Ties: There are historical and cultural ties between Nigeria and Brazil, especially considering the African diaspora in Brazil. This can facilitate easier business partnerships and collaborations.

In terms of investment incentives for potential corporate partners from Brazil, Nigeria offers several attractive incentives for Brazilian corporate partners, including:

- Tax Incentives: Various tax holidays and concessions are available under the Nigerian government’s investment promotion laws, particularly in key sectors like agriculture, manufacturing, and technology.

- Repatriation of Profits: Brazil-based companies investing in Nigeria can repatriate profits without restrictions, thus enhancing their financial viability.

- Access to the African Market: Investment in Nigeria allows Brazilian companies to access the broader African market, benefiting from Nigeria’s membership in regional trade agreements such as ECOWAS.

- Free Trade Zones: Nigeria has established free trade zones that offer companies the chance to operate with reduced tariffs and fewer regulatory burdens.

- Support for Innovation: The Nigerian government encourages innovation and technology transfer, making it attractive for Brazilian firms in the tech sector to collaborate, particularly in fintech and agriculture technology.

- Collaborative Ventures: Opportunities exist for joint ventures with local firms, leveraging local knowledge and networks to navigate the business landscape effectively.

In conclusion, fostering a collaborative relationship between Nigeria and Brazil can unlock numerous economic opportunities, leading to mutual growth and development in various sectors. We welcome potential Brazilian investors to explore these opportunities and contribute to our shared economic goals.

In terms of this economic cooperation and trade, what would you say are the current practical achievements, with supporting strategies and systemic engagement from NIDOA?

As the Secretary of NIDOA Brazil, I would highlight the current practical achievements in economic cooperation and trade between Nigeria and Brazil, alongside the supporting strategies and systemic engagement from NIDOA.

Here are some key points:

Current Practical Achievements

- Increased Bilateral Trade: There has been a notable increase in bilateral trade volume between Nigeria and Brazil, particularly in sectors such as agriculture, textiles, and technology. Recent trade agreements and discussions have facilitated smoother trade relations.

- Joint Ventures and Partnerships: Successful joint ventures have been established between Brazilian and Nigerian companies, particularly in agriculture (e.g., collaboration in soybean production and agricultural technology) and energy (renewables, oil, and gas), demonstrating commitment to mutual development.

- Investment in Infrastructure Development: Brazilian construction firms have been involved in key infrastructure projects in Nigeria, contributing to building roads, bridges, and facilities that enhance connectivity and economic activity.

- Cultural and Educational Exchange Programs: Programs facilitating educational exchange and cultural cooperation have led to strengthened ties. Brazilian universities have partnered with Nigerian institutions to promote knowledge transfer in various fields, including science, technology, and arts.

Supporting Strategies

- Strategic Trade Dialogue: NIDOA has initiated regular dialogues between trade ministries of both nations to discuss trade barriers, potential markets, and cooperative opportunities, ensuring both countries are aligned in their economic goals.

- Investment Promotion Initiatives: Targeted initiatives have been established to promote Brazil as an investment destination for Nigerian businesses and vice versa. This includes showcasing success stories at international trade fairs and business forums.

- Capacity Building and Technical Assistance: NIDOA has offered capacity-building programs focused on enhancing Nigeria’s capabilities in agriculture and technology, leveraging Brazil’s expertise and sustainable practices.

- Policy Advocacy: Continuous advocacy for favourable trade policies has been a key focus for NIDOA, working to reduce tariffs and promote economic reforms that facilitate investment and trade flows.

Systemic Engagement

- Public-Private Partnerships (PPPs): Engaging the private sector through PPPs has been essential in mobilising resources for development projects. NIDOA has actively facilitated partnerships that leverage both public and private investments.

- Trade Missions and Business Delegations: Organised trade missions to Brazil for Nigerian businesses and vice versa, allowing for direct engagement with potential partners, fostering trust and opening new channels for trade.

- Monitoring and Evaluation: NIDOA implements a rigorous monitoring and evaluation framework to assess the impact of various initiatives and make necessary adjustments to strategies, ensuring effectiveness in achieving economic cooperation goals.

Through these practical achievements, supporting strategies, and systemic engagement, NIDOA continues to play a pivotal role in enhancing economic cooperation and trade between Nigeria and Brazil. By fostering collaboration and leveraging shared resources, we aim to create a sustainable and mutually beneficial economic environment that promotes growth for both nations.

Do you think the changing geopolitical situation poses a number of challenges to connecting businesses in the region with Nigeria, and how do you overcome them in the activities of NIDOA?

The changing geopolitical situation indeed poses several challenges for connecting businesses in the South American region, particularly Brazil, with Nigeria. These challenges include trade tensions, shifting alliances, currency fluctuations, and varying regulatory environments. Below, I will outline some of the specific challenges and how NIDOA works to overcome them:

Current Challenges

- No Direct Flights: This challenge is obviously explicit. Once direct flights between Brazil and Nigeria become active, and hopefully this year, a much better understanding and engagement will follow suit.

- Trade Restrictions and Tariffs: Increasing trade protectionism in various regions can lead to higher tariffs and trade barriers that hinder the movement of goods between Brazil and Nigeria.

- Currency Volatility: Fluctuations in the value of currencies can complicate trade agreements, pricing strategies, and overall financial planning for businesses operating in both Brazil and Nigeria.

- Different regulatory frameworks and compliance requirements in both countries can create challenges for businesses aiming to navigate these systems efficiently.

- Supply Chain Disruptions: Changes in global supply chains due to geopolitical factors may disrupt established networks, impacting businesses relying on imports and exports between the two nations.

Overcoming Challenges through NIDOA.

NIDOA actively engages in discussions with both the Brazilian and Nigerian governments to advocate for favourable trade policies and agreements that reduce tariffs and improve trade conditions. This year in October, NIDOA BRAZIL holds its TRADE FAIR in São Paulo, Brazil.

What are the popular sentiments among the Nigerians in the South American diaspora? As the Secretary-General of the NIDOA, what are your suggestions relating to assimilation and integration, and of course, future perspectives for the Nigerian diaspora?

As the Secretary-General of NIDOA, I recognise the importance of understanding the sentiments among Nigerians in the South American diaspora, particularly in Brazil.

Many Nigerians in the diaspora take pride in their cultural roots, celebrating their heritage through festivals, music, dance, and culinary traditions. This cultural expression fosters a sense of community and belonging.

While many individuals embrace their new environments, they often face challenges related to cultural differences, language barriers, and social integration, which can lead to feelings of isolation.

Many express optimism about opportunities in education, business, and cultural exchange, viewing their presence in South America as a chance to expand their horizons and contribute to economic activities both locally and back in Nigeria.

Sentiments regarding acceptance vary; while some Nigerians experience warmth and hospitality, others encounter prejudice or discrimination, which can impact their overall experience in the host country. NIDOA BRAZIL has encouraged the formation of community organisations that promote networking, cultural exchange, and social events to foster a sense of belonging and support among Nigerians in the diaspora. There are currently two forums with over a thousand Nigerian members.

Cultural Education and Awareness Programs: NIDOA BRAZIL organises cultural education programs that showcase Nigerian heritage to local communities, promoting mutual understanding and appreciation that can facilitate smoother integration.

Language and Skills Training: NIDOA BRAZIL provides language courses and skills training programs to help Nigerians, especially students in tertiary institutions, adapt to their new environment, enhancing communication and employability within the host country.

Engaging in Entrepreneurship: NIDOA BRAZIL supports the entrepreneurial spirit among Nigerians in the diaspora by facilitating access to resources, mentorship, and networks that can help them start businesses and create economic opportunities.

Through its AMBASSADOR’S CUP COMPETITION, NIDOA Brazil has engaged students of tertiary institutions in Brazil to promote business projects and initiatives that can be implemented in Nigeria.

NIDOA BRAZIL also pushes for increased tourism to Brazil since Brazil is set to become a global tourism leader in 2026, with a projected 10 million international visitors, driven by a post-pandemic rebound, enhanced air connectivity, and targeted marketing strategies.

Brazil’s tourism sector is poised for a remarkable milestone in 2026, as the country expects to welcome over 10 million international visitors—surpassing the previous record of 9.3 million in 2025. This expected surge represents an ambitious leap, nearly doubling the country’s foreign-arrival numbers within just four years, a feat driven by a combination of pent-up global demand, strategic air connectivity improvements, and a highly targeted marketing campaign.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn