World

Why World Bank Stopped Ease of Doing Business Report

By Adedapo Adesanya

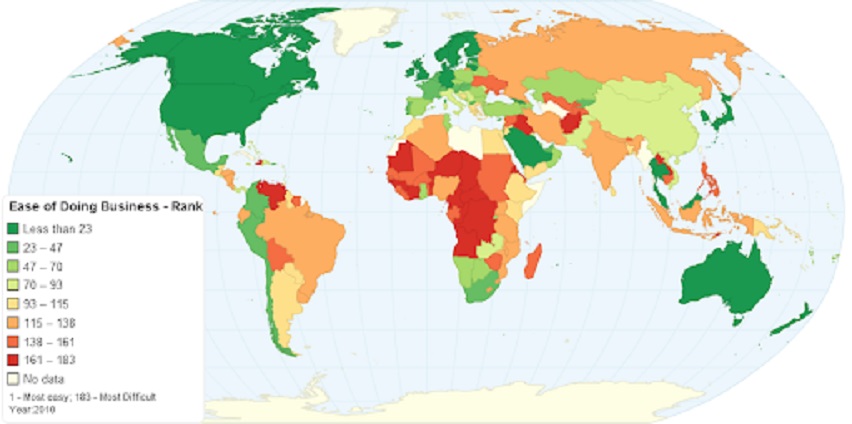

The World Bank Group has discontinued the publishing of its Ease of Doing Business report after 18 years. The report measures regulations directly affecting the ease of doing business in 190 countries.

The Bretton Wood institution said it reached the decision to discontinue the report after “internal reports raised ethical matters, including the conduct of former board officials as well as current and/or former bank staff.”

It was reported that an independent investigation document found that Ms Kristalina Georgieva, who served as the bank’s chief executive officer from 2017 to 2019 and is now the managing director of the International Monetary Fund (IMF), applied “pressure” to have China ranked more favourably.

Ms Georgieva, however, disagreed with the findings, noting in a statement that, “I disagree fundamentally with the findings and interpretations of the Investigation of Data Irregularities as it relates to my role in the World Bank’s Doing Business report of 2018.”

The global lender noted that “trust in the research of the World Bank Group is vital” in continuing the issuance of the report.

“After reviewing all the information available to date on Doing Business, including the findings of past reviews, audits, and the report the Bank released today on behalf of the Board of Executive Directors, World Bank Group management has taken the decision to discontinue the Doing Business report,” World Bank Group said in a statement.

The World Bank Group, however, said it remains firmly committed to advancing the role of the private sector in development and providing support to governments to design the regulatory environment that supports this.

World Bank Group said it is aware that the research informs the actions of policymakers, helps countries make better-informed decisions, and allows countries and private stakeholders – civil society, academia, journalists, and others to measure economic and social improvements more accurately.

However, the bank said it discovered some “data irregularities on Doing Business 2018 and 2020 were reported internally in June 2020, World Bank management paused the next Doing Business report and initiated a series of reviews and audits of the report and its methodology.”

Going forward, the World Bank Group said it will be working on a new approach to assessing the business and investment climate.

The ease of doing business index was, above all, a benchmark study of regulation in 190 countries. The survey consisted of a questionnaire designed by the Doing Business team with the assistance of academic advisers. The questionnaire centred on a simple business case that ensures comparability across economies and over time.

As the Ease of Doing Business wraps up, the World Bank Group said it is deeply grateful to everyone that worked diligently to advance the business climate agenda” and it looks “forward to harnessing their energies and abilities in new ways.”

The report is influential in many countries with it being a primary index used by investors seeking to invest in any country.

In Nigeria’s case, the country was last ranked 131 on the 2020 Ease of Doing Business ranking with a general score of 56.9. The highest scores were obtained in the fields of starting a business, dealing with construction permits, and getting credits.

On the other hand, Nigeria’s performance in other fields was low, for instance in registering properties, trading across borders, and resolving insolvencies.

The Nigerian government has always said its economic policies were aimed at helping it improve on the Ease of Doing Business index.

World

AfDB Attracts $2.2bn for Nigeria’s Special Agro-industrial Processing Zones

By Modupe Gbadeyanka

Investors are interested in investing about $2.2 billion in the Special Agro-Industrial Processing Zones Nigeria Phase II project.

This was recently facilitated by the African Development Bank Group (AfDB) at the Africa Investment Forum.

The initiative is expected to revolutionize Nigeria’s agricultural sector, as it will create agro-industrial hubs that drive productivity, enhance food security, raise living standards and create jobs.

Those interested in the project include Arise IIP, Arab Bank for Economic Development in Africa, Africa Export-Import Bank, Sahara Farms, BPI France, Africa50, and the US Development Finance Corporation.

They engaged the Nigerian government at a meeting on Wednesday, December 4, 2024.

The SAPZ Nigeria Program is a country-wide government-enabled and private-sector-led investment program that will, (i) provide infrastructure for the establishment of agro-industrial zones, (ii) strengthen institutional capacity and business environment for agro-industrial development and (iii) support agricultural productivity, skills, and private investment across value chains.

SAPZs are established in areas with high agricultural production potential. They are provided with infrastructure, common services, and supported by policy incentives to integrate agricultural and industrial businesses. Through value-added manufacturing, they have the potential to trigger the long-delayed structural transformation that revitalizes rural areas, enhance food security, improve employment, and boost regional and international trade.

Phase I Nigerian States benefiting from the program are Cross River, Imo, Ogun, Oyo, Kaduna, Kwara and Kano, and the Federal Capital Territory. SAPZ Nigeria Phase II is underway to expand to an additional 24 States in Nigeria in the next 3 years and will link Nigeria’s agriculture to agro-industrialization to drive economic growth.

The president of AfDB, Mr Akinwumi Adesina, said, “This is a defining moment for Nigeria’s agricultural transformation.”

“The Nigeria SAPZ II project will create millions of jobs, empower smallholder farmers, and position Nigeria as a leader in agro-industrialization. These investments exemplify the power of collaboration to achieve sustainable development in Africa,” he added.

The bank’s Director General for Nigeria, Mr Abdul Kamara, said, “I am pleased to see this whopping investment interest and commitments by our financing partners for Nigeria, at a time when the country is ramping up efforts to attract investments into the agriculture sector to address food security, create job opportunities and boost economic growth.”

World

Russia, Africa Establish Cultural Telebridge

By Kestér Kenn Klomegâh

Russia and Africa have moved one more step forward in their bilateral relations by establishing a cultural telebridge dedicated to the formation and development of the Museum of African Cultures in Moscow. The cultural telebridge between Russia and Africa was organized by the Russian-African Club of Lomonosov Moscow State University (MSU) with the support of the Secretariat of the “Russia-Africa Partnership Forum” under the Ministry of Foreign Affairs of the Russian Federation.

The telebridge was held on three main platforms – in Moscow (Russia), Ouagadougou (Burkina Faso), and Yaoundé (Cameroon), and included participants from Morocco, Guinea, Benin, Côte d’Ivoire, Zambia, Burkina Faso, South Africa, and Egypt.

The main speakers of the telebridge included representatives of the ministries and cultural authorities of Russia and African countries, diplomats, museum specialists from Russia and Africa, private collectors, universities, NGOs, journalists, and members of the African diaspora.

The event was opened by Ilya Ilyin, Dean of the Faculty of Global Processes and First Vice-President of the Russian-African Club at MSU. He highlighted the topic of the telebridge on the development of the Museum of African Cultures which was deliberately chosen for discussion. The need to expand humanitarian cooperation with African countries was specifically emphasized at the second summit of the “Russia-Africa Partnership Forum” as well as at the Russia-Africa Ministerial Conference held in Sochi in November 2024. Work in this direction is being carried out in accordance with the priorities outlined by Russian President Vladimir Putin on March 30, 2020, under the “Priority Steps in Africa” decree. Among the key initiatives in the humanitarian field is the idea of creating the Museum of African Cultures, which will be the only museum outside of the African continent officially dedicated to African themes. The museum will be established at the renowned State Museum of Oriental Art.

Ilya Ilyin noted as a significant achievement the agreement to establish a branch of the Russian-African Club in Burkina Faso, and work on this initiative is ongoing. He expressed gratitude to Daniel Sawadogo, former cultural attaché of Burkina Faso’s Embassy in Russia, who participated in the telebridge, for his efforts in strengthening cooperation between Burkina Faso and Russia.

Ilyin reminded the audience that the year 2025 will mark the 270th anniversary of Moscow State University and the 220th anniversary of the Moscow Society of Naturalists, chaired by MSU Rector V.A. Sadovnichy. Additionally, in 2025, the Faculty of Global Processes of MSU will celebrate its 20th anniversary. The most significant event of 2025 will be the 80th anniversary of the Great Victory. In this regard, the Dean proposed continuing the tradition of holding a memorial event involving Russian-African youth at Poklonnaya Gora, as was done in 2023 and 2024.

Tatiana Dovgalenko, Ambassador-at-Large of the Ministry of Foreign Affairs of the Russian Federation and head of the Secretariat of the Russia-Africa Partnership Forum spoke about the active work being carried out in conjunction with the Ministry of Culture of Russia, Rossotrudnichestvo, cultural institutions, and civil society circles in hosting thematic exhibitions, theatre festivals, cultural days, concerts, film screenings, and lectures in Africa. Significant projects are being implemented by the Russian Institute of Theatre Arts (GITIS), the Inopraktika Foundation, and the Moscow Conservatory. These and other initiatives demonstrate the explosive interest of Africans in Russian culture. The demand among African students for creative education in Russia continues to grow. Today, citizens from 20 African countries are studying in Russian cultural universities.

The Museum of African Cultures will immerse the Russian audience in the richness of African culture and peoples. It will display the collected artefacts housed in Russia, primarily African art pieces from the State Museum of Oriental Art. This collection comprises more than 1,100 items and is continuously replenished through scientific research expeditions, temporary exhibitions, and private collections donated by prominent Russian Africanists. T.E. Dovgalenko expressed confidence in the museum’s role as a profound cultural bridge.

The museum will become a significant platform in Russia for hosting educational, cultural, and business events, implementing educational programs, and conducting scientific research in the field of African studies, as well as simply a space of creative power.

The lead moderator of the telebridge, Alexander Berdnikov, Executive Secretary of the Russia-Africa Club of Lomonosov Moscow State University, introduced the co-moderators from the Russian side – Louis Gouend, Ilya Shershnev, and Inga Koryagina. He emphasized that the opening of the Museum of African Cultures is a highly important issue for both Russian and African societies.

In his opinion, it is also critical during the telebridge to address the prospects of communication with African countries in the field of humanities, particularly related to museums. The speaker reminded attendees about the “Russia Calling!” forum held on 4th December in Moscow, during which Russian President Vladimir Putin stated that Russia will develop new tools for advancing comprehensive cooperation with African countries. The Museum of African Cultures is one such new tool for collaboration in the humanitarian sphere.

The museum is being established as a multifunctional institution, also tasked with educational and expert goals, African studies training, and other functions.

Research Associate of the State Museum of Oriental Art and Africanist, Darya Vanyukova, emphasized at the beginning of her speech that no museum collection, no matter how large, can encompass the immense richness and diversity of the artistic culture of African countries. Therefore, as the expert noted, the idea of creating an exploratory museum must be approached honestly and openly. The speaker stressed the importance of developing long-term projects within the museum, which can serve as a foundation for a cultural program, allowing visitors to gain a deeper understanding of the African continent.

A key aspect of preparing for the museum’s opening involves creating a concept and designing the permanent exhibition. The expert shared plans for projects scheduled for 2025, including exhibitions dedicated to the Republic of Cameroon and the Republic of Mali. Vanyukova also mentioned that the Museum of Oriental Art’s team is counting on support from colleagues in African countries. She explained the museum’s plans to request artefacts from Russian and African museums for long-term storage, with a view to returning these valuable art pieces to their home countries once the established agreements expire.

Yuri Zaitsev, Head of Rossotrudnichestvo’s representative office in Tunisia, emphasized the importance of maintaining close ties with the African community and museum experts from the continent when establishing the museum. He expressed his hope that North Africa would be broadly represented in the museum. Additionally, Zaitsev offered comprehensive assistance and support from North African countries. He noted that the Russian House in Tunisia also supervises several countries without Rossotrudnichestvo representation, including Algeria, Libya, and Niger. This allows for facilitating communication with museum communities in those nations.

The expert proposed creating branches of the museum or exhibition complexes at VDNH or in other districts. He highlighted Tunisia’s rich historical heritage, including aspects that connect Tunisia and Russia, such as the history of the Russian Squadron and the work of artist Rubtsov, which, according to Zaitsev, should also be represented in the Museum of African Cultures.

Alla Stremovskaya, Associate Professor at the Department of Eastern Political Studies of the Faculty of Global Processes at Moscow State University, spoke about the role of museum diplomacy in international relations. She presented a report on online projects by key Russian museums. According to Stremovskaya, museum diplomacy is a form of cultural diplomacy that historically served as a strategic tool used by national governments to advance their foreign policy goals. Various countries have supported museum initiatives to disseminate their national values and ideas abroad.

Today, these functions are also fulfilled by museum online projects. Stremovskaya highlighted international online projects by the Russian Museum, the Hermitage, the Tretyakov Gallery, and the State Museum of Fine Arts. These projects combine a range of multimedia centre functions, including virtual tours, online lectures, and visits to exhibition compositions. She also mentioned major international museum online projects such as “European” and “Latino.” The expert stated that knowledge of these projects will help in creating a similar initiative for the new Museum of African Cultures.

Louis Gouend, Telebridge Moderator and Head of the Commission on Diaspora and Media Relations at the Russian-African Club of Moscow State University, expressed gratitude on behalf of the entire African community for the idea of establishing a Museum of African Cultures in Moscow, calling it a “cherished topic” for all Africans.

Gouend introduced the participating experts from the telebridge studios in Cameroon and Burkina Faso. The moderators for the telebridge in Cameroon were historian Professor Njock Nyobe Pascal, former Director of the Douala Maritime Museum, and Professor Jean-Baptiste Nzoge. The first speaker from Cameroon, Madame Rachel Mariembe, an expert in historical and cultural heritage, spoke about the work of the Douala Museum, whose collection is constantly being expanded, thanks to well-established connections with other museums, not only in Cameroon but also in other countries, as well as through collaboration with private museums.

Cameroonian museologist, Professor Michel Ndoh, expressed the opinion that the Museum of African Cultures in Moscow should represent a unique opportunity for Africans to establish strong ties with Russia. The success of the future museum in Moscow, according to the expert, depends on its programmatic policy.

The speaker highlighted that the primary mission of the museum should be showcasing Africa as a whole, while taking into account the uniqueness of each country on the continent. Africa itself must take the initiative and present its proposals, concluded Michel Ndoh.

His Majesty Mbombog Malet Ma Ndjami, Director General of the Palace of Culture and African Art, noted that a museum is a guardian of memory. According to the speaker, collaboration with Russia will provide the African continent with new opportunities to preserve its memory. Cameroonian museums were established following a model created in the 19th century, and it is from that period that the perspectives through which Africans view their memory — namely, Eurocentric perspectives — originate, noted the expert. He believes that cooperation with Russia will allow Africans to view their historical reality from a different perspective, through masterpieces of national African art. Africa shares a common memory with Russia, and together, we can embody this memory through museum partnerships.

Ndo, a museologist from Cameroon, considers the museum to be a lever for diplomacy. Diplomacy, he stated, is the interaction of all participants in the process. Therefore, the expert emphasized the importance of hearing from Russian colleagues about the specific types of support they expect from African specialists in the museum field. He proposed that mutual exchanges of conceptual ideas are crucial.

The telebridge was then passed to Burkina Faso, where the moderators were Moktar Sanfo, Director General of Culture and Arts (DGCA), and Sabari Christian Dao, Director General of the National Museum of Burkina Faso.

Christian Dao welcomed the participants of the telebridge and introduced his colleagues, gathered at the web studio in the National Museum of Burkina Faso, with a total of 20 people present. The speaker expressed collective excitement at the opening of the Museum of African Cultures in Moscow.

The first expert from Burkina Faso to speak was Juliette Congo, Director of the Women’s Museum in Kolgwendiese, founded in 2008. The Women’s Museum is a unique project as it not only showcases collections but also conducts educational programs. These initiatives highlight the role of women in African society and their contributions to national and cultural wealth. The museum houses collections dating back to the era of the Moro Kingdom, where women served as a ruling force.

Alassane Samura, Director of the Water Resources Museum, presented the concept of his museum, which is built on the idea that water permeates all of human history across all aspects of life; without water, there is no life. In Africa, where tremendous effort is often required to access water, people hold this natural resource in high regard. This is why the Water Museum was established. It features collections of ancient water storage containers and vessels, as well as tools for retrieving water.

Assane Romba, curator of the Georges Ouedraogo Museum of Music, described his museum as a “living place” where exhibits come to life. He spoke about the constant interaction with visitors through the universal language of music. The museum’s collection includes objects that serve sacred functions and are emblematic of Africa’s cultural heritage.

Sinali Djibo, Director of Exhibitions and Mediation at the National Museum of Burkina Faso, outlined the training of specialists in various areas of museum activities. The expert also shared his vision for organizing temporary exhibitions at the future Museum of African Cultures in Moscow. According to Djibo, such exhibitions must be accompanied by explanations for visitors, and he suggested using film as a tool for this purpose. He pointed out that this approach has already been implemented in Europe and parts of Africa.

Dr. Hoda Al-Saati, a representative of the Journalists’ Union of Alexandria (Egypt) and an active participant in cultural and historical events between Russia and Egypt, praised Russia’s efforts in preserving and developing the cultural heritage of African countries. She contrasted this with Western countries, which often regard Africa merely as a source of profit. The speaker supported the idea proposed by Russian and African colleagues that the museum should also function as an educational institution.

Swinni Driss, a representative of the National Museum of Morocco, spoke about the museum’s activities, and educational and cultural projects, in particular, the exhibition of postage stamps, which has become an interesting and popular event in the country.

Ernest Kpan, an expert from Côte d’Ivoire and head of the local branch of the International Council of Museums, believes that establishing a successful project requires defining the shared and fundamental foundations of the museum initiative. It is essential to know the budget allocated for the project and understand its base—both material and scientific. Another critical issue, according to the speaker, is the potential involvement of African specialists in the museum’s operations.

Tatyana Tudvaseva, President of the “Gatingo” Association and chief curator of the international art project “Africa’s World Today, Tomorrow, Yesterday,” stressed the need to include items of contemporary African art among the museum’s exhibits. The paintings of African artist-philosophers—singers of their culture and traditions—are filled with symbolism, meaningful ideas, and interest in human individuality and the surrounding nature. The speaker expressed confidence that these works of art would deeply move the Russian audience.

Moktar Sanfo, Director General for Culture and Arts and moderator in the webinar studio in Burkina Faso requested representatives of the Russian-African club to inform African colleagues about opportunities for advanced training at Moscow-based universities and the areas covered within this framework.

Suleiman Sedogo, President of the Association of Museum Professionals of Burkina Faso, stated that the primary goals of their organization are to improve the quality of museum practices in the country, develop new directions, and support collaboration between private museums and the state.

Daniel Sawadogo, former cultural and scientific advisor to the Embassy of Burkina Faso in the Russian Federation, emphasized the undeniable importance of this telebridge, which has become a significant platform for exchanging expert opinions and practical proposals between museum specialists in Russia and Africa.

Ali Degee, an expert from Burkina Faso and a graduate of a Soviet university, highlighted the exceptional importance of professional staff training in the museum field. The speaker expressed hope that such training would become accessible to the current young generation from African countries. For instance, graduates of museum studies courses organized in Burkina Faso could be sent to Russia for further education.

In conclusion, A.F. Berdnikov, the lead moderator, thanked all participants of the telebridge and noted that the event was productive and constructive. He supported the idea of making this telebridge format regular, as it would provide an excellent opportunity for the mutual exchange of proposals and concrete recommendations, not only for developing the Museum of African Cultures but also for fostering museum-sector cooperation between Russia and Africa as a whole.

World

John Mahama Wins Presidential Poll to Return as Ghana’s President

By Adedapo Adesanya

Former President of Ghana, Mr John Dramani Mahama of the National Democratic Congress (NDC), has won a historic comeback election victory on Sunday as voters pushed out the ruling New Patriotic Party (NPP) over its management of economic crisis in the West African country.

NPP candidate and current Vice President Mahamudu Bawumia to incumbent President Nana Akufo-Addo today conceded defeat in the weekend presidential election after failing to shake off widespread frustration over high costs of living.

Results showed that Mr Mahama won 56.3 per cent of the vote against 41.3 per cent for Bawumia.

Mr Mahama, who ruled as president from 2012-2017, will return to lead the country on his third attempt to reclaim the nation’s top post after falling short in 2016 and 2020 elections.

Ghana’s two main parties, the NPP and NDC, have alternated in power equally since the return to multi-party politics in 1992.

The country’s economic woes dominated the election after the continent’s top gold producer and the world’s second-largest cocoa exporter went through a crisis of default and currency devaluation, ending with a $3 billion bailout from the International Monetary Fund (IMF).

Meanwhile, President Bola Tinubu has congratulated Mr Mahama on his victory in the December 7 general election.

In a telephone call to Mr Mahama, President Tinubu hoped that Mahama’s ascension to power for the second time would further bring stability to the Economic Community of West African States (ECOWAS).

According to a statement by presidential spokesman, Mr Bayo Onanuga, the Nigerian President commended the people of Ghana for their commitment to democracy, which was demonstrated through the peaceful and successful conduct of both the presidential and parliamentary elections.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN