Feature/OPED

Fani-Kayode And His Apocalyptic Pessimism

By Akingbade Thomas

I have followed the opinion articles of Femi Fani-Kayode since he started publishing in different news media.

At first, his opinions seem to me to be inspired by patriotism. After some time, he gradually descends into ethnical and partisanship inspired writings. His recent writings have now been conceived in the womb of Judeo-Christian theology.

In his opinion, the root cause of virtually all the challenges confronting national and international community is nothing but the religious conflict amongst the Abrahamic religions (Judaism, Christianity and Islam), and that the solution to these challenges is the ultimate triumph of the Judeo-Christian over Islam.

This easy solution is not original to Fani-Kayode, he has probably just found likeness for this illusionary, apocalyptic and pessimistic solution which is original to the Judeo-Christian theology, which originally evolved from cultural fabric of the Haranites and indigenous Canaanites, the ethnic groups from where the Israelites got their origin genealogically.

I particularly found it amusing that a man who claimed to be soundly educated will now begin to derive inspiration from religious beliefs (as organized into Judeo-Christian theology) that fundamentally, essentially and largely derived it source from superstitions, myths, historical distortions and irrational fears.

Below are excerpts from his article titled: “What Donald Trump will not do,” published by The Eagle Online on August 2: “During the coming election debates, he should do the Nigerian people a favour and ask Hillary Clinton one question. That question is: Why did she and President Barack Obama refuse to designate Boko Haram as a terrorist organisation until late 2014? This was after they had slaughtered over 100,000 innocent Nigerians in a space of four years. If the victims had been Americans, would they have taken so long to designate them as terrorists? Is Nigerian blood not red and do Nigerian lives not matter?

“Donald Trump would never have made such a mistake or tolerated such evil. If he had been the POTUS for the last seven years and not Barack Obama, Boko Haram would have been designated a terrorist organisation five years ago. Unlike Hillary Clinton and Barack Obama, when it comes to foreign policy, Donald Trump is incapable of tolerating and accepting evil from those who espouse terrorism and the cold-blooded murder of women and children as a way of life.

“That is the difference between him and them. He knows what to do to the Islamist terrorists and he will support any foreign government that will take a hardline against those that slaughter innocents in the name of their god. He will crush those that wish to establish a new world caliphate in which non-Muslims and moderate Muslims are slaughtered or turned into slaves. Unlike Barack Obama, he will not pamper the terrorists, encourage them in some parts and treat them with kid gloves. Instead he will wage a hard, full-scale, relentless and comprehensive war against them.

“He will, like Russia’s Vladimir Putin, see it as a battle of the forces of light against the citadels of darkness. He will view it as an end-time war between the sons and daughters of God and the emissaries and agents of Satan. He will decimate the ranks of the Philistines, the Amalekites, the Midianites and all the other vultures, vampires and blood-thirsty barbarians in our midst. He will not support a Nigerian government that has a clear-cut religious and ethnic agenda, that seeks to shame and dehumanise Christians and that is attempting to restrict the spreading of the gospel of Christ.”

The question Femi wished to ask Hillary Clinton is belated and a misdirected one. On September 11, 2001, the day terrorist group touched American soil, George Bush, the then president, in his broadcast, said: “We will either bring the terrorists to justice or take justice to the terrorists.” The fulfilment of this promise was immediate and completed when Osama Bin Laden was killed. George Bush didn’t wait for categorization before he acted as president should. My question to Femi is: why didn’t the president and Commander in Chief of Nigeria act decisively in 2010? What justification does Femi have for the Father Christmas acts of the Office of National Security Adviser, from where monies meant for the prosecution of the war against Boko Haram were shared to persons (among whom Femi is alleged to be prominent), who used it to prosecute personal vanities? I am not surprised, therefore, that he’s not still seeing the former president as the person largely responsible for all the atrocities committed by Boko Haram as itemized by Femi earlier. The president had the gun and the dry gun powder (apology to Governor Ayodele Fayose), he just didn’t release fire on Boko Haram for reasons that ranged from ineptitude to wicked political considerations. The sharing of the arms procurement money was taken to a ridiculous level, when, according to the revelation by the Economic and Financial Crimes Commission, among those alleged to have been beneficiaries of this heinous act, are prayer merchants who were given millions of naira for the purpose of what the friends of Femi called ‘special’ prayer, which they went to offer at some places in Asia and Europe. Since Femi now claims to be an end time revivalist, may I ask him the rationale behind the dubious rigmarole to Asia and Europe to go offer ‘special’ prayer for Nigeria, to a God that the bible and Quran says is omniscient, omnipotent and above all omnipresent.

If Nigeria was so corrupt and dark then, to warrant God taking sabbatical in Asia and Europe, thereby making it impossible for him to hear and answer the prayers of these merchants, the likes of Femi forced God on the exodus. I wonder the kind of god Femi is claiming to know and serve. Could this god be author of schemes, tricks and bold face with which persons who were co-power brokers with Femi in the last government raped, plundered, and squandered the commonwealth of this nation? If he is, then this type of god that Femi is high on, is nothing other than primitive, corrupt and vain. These are the very attributes of the persons who had in past years conspired to retrogressively develop Nigeria.

The allegation of ethnic and religious agenda against this present government by Femi is stale and of no useful effect on the mind of Nigerians who know the shallow places Femi is speaking from. How come Femi has forgotten in a hurry how some religious groups and centres went almost berserk while they were promoting malicious ethnic and religious sentiments against President Muhammadu Buhari during the 2015 electioneering campaign. If this sinister propaganda couldn’t stop Buhari from winning the election, how can this ridiculous gist of Femi now be of any effect? Femi appears to be living in Nigeria of five years ago. If not, he would have sought other critical and logical basis to engage this government, other than this lifeless sentiment.

The business of managing and addressing the present challenges that confront the national and internal communities is a serious one and requires hard thinking, hard action, urgency and eternal vigilance. The answers to the challenges created by the inevitable conflicts of interests, culture and ideology of societies around the world can’t possibly be found in the easy but fatalistic theology of adherents of organized religious movements.

If in the thinking of Femi is the idea that the myriads of challenges that confront the world today can easily be resolved if we all just pessimistically succumb to the predetermined outcome concocted in the body of the teaching of eschatology, there is no need therefore for him to pretend to be writing about a better Nigeria when his bible has prophetically predetermined that one of the Abrahamic religions will ultimately prevail on the other in Armageddon. He should just patiently wait for the appointed time of fulfilment.

Thomas writes from [email protected].

Feature/OPED

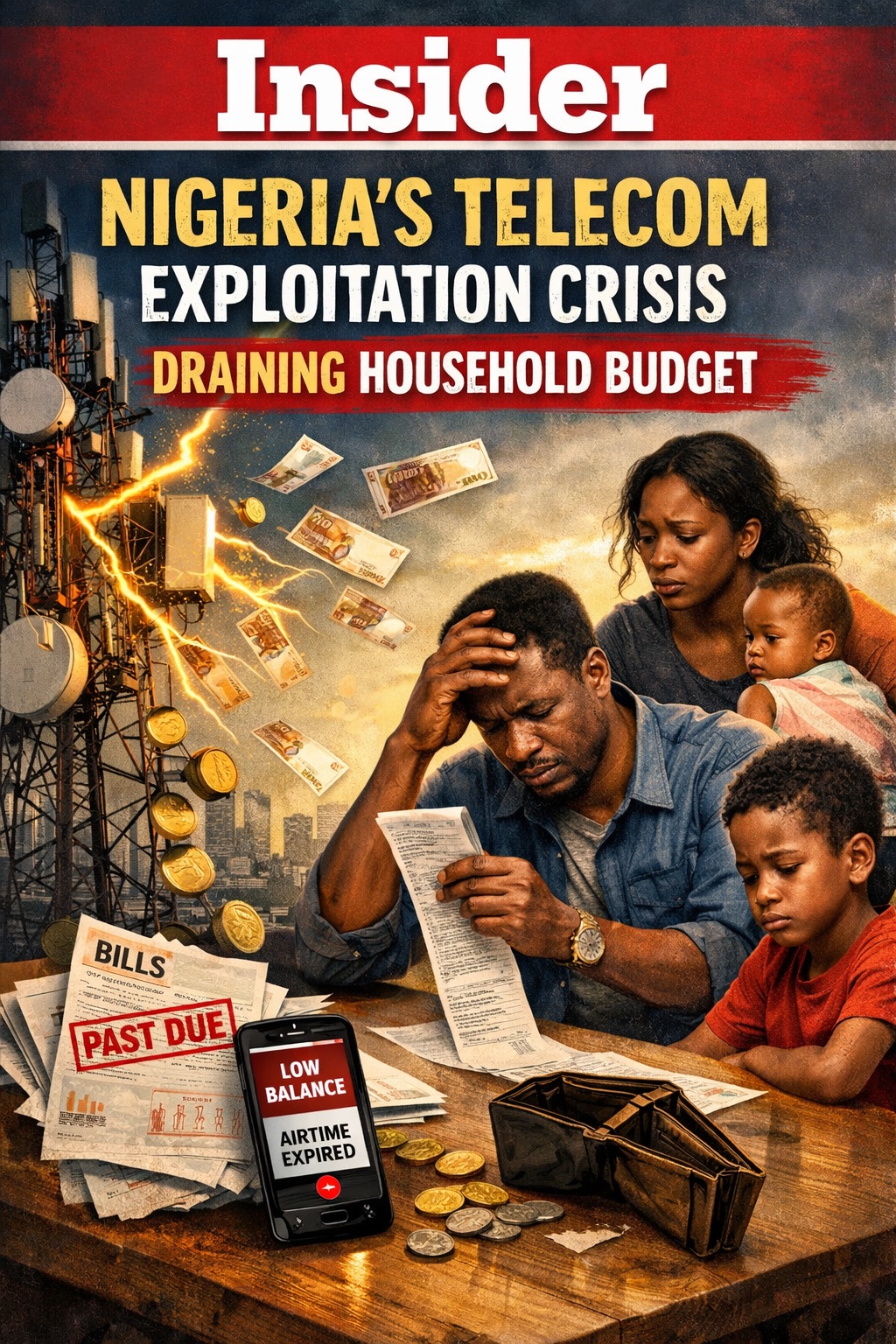

Inside Nigeria’s Telecom Exploitation Crisis Draining Household Budgets

By Blaise Udunze

For about a year now, millions of Nigerians relying on the internet to make a living have been groaning over the manipulation of airtime and data consumption that has turned into a relentless drain on household budgets. Painfully, individuals and businesses buying airtime or data increasingly feel less like paying for a service and more like entering a wager whose odds are permanently stacked against the consumer. Around the nooks and crannies of the country, across cities and rural communities alike, subscribers tell the same weary story of data that evaporates mysteriously, airtime consumed faster than reason allows, and customer care responses that sound rehearsed rather than responsive. The majority will agree that this collective frustration is not a coincidence, nor is it merely the product of careless smartphone use, because others might argue that there are several technical factors inducing rapid mobile data usage. Leave it or take it, it is the outcome of a broken ecosystem where multinational telecom companies wield immense power in an environment marked by weak institutional checks, limited transparency, and a population stretched thin by economic hardship.

The recent 50 per cent upward adjustment of telecom tariffs, later revised in policy conversations to 35 per cent, has intensified this tension, though it is not justifiable as exploitation. For millions of Nigerians already battling inflation, currency volatility, and shrinking purchasing power, the hike landed not as an economic necessity but as an additional burden. When communication costs begin to claim up to 15 per cent or, in some cases, nearly 30 per cent of the national minimum wage, something fundamental has gone wrong. Access to communication is no longer a luxury; it is the infrastructure of modern survival. Yet the price Nigerians are now paying for this access is becoming socially and economically unsustainable.

A published report showed that as of January 2025, statistics from the Nigerian Communications Commission (NCC) disclosed that there were 141 million Internet users via the narrowband (GSM), while broadband penetration stood at 45 per cent. Data consumption has increased to 1,000,930.6 terabytes.

A review of the multinational telecom companies indicated that the new tariff for MTN’s revised data prices showed the 1.8GB monthly plan now goes for N1,500, against the previous 1.5GB plan priced at N1,000. The 20GB plan has been adjusted to N7,500, up from N5,500, while the 15GB plan now costs N6,500, rising from N4,500.

Under this new pricing regime, the same would be said of Airtel as it has replaced its cheapest monthly data plan of 1.2GB plan for N1,000 with 2GB plan for N1,500. For 3GB for N2, 000 (from 1.5GB at N1, 200), 4GB for N2, 500, formerly 3GB at N1, 500, and 8GB for N3, 000 (formerly 4.5GB at N2, 000). Other adjustments include 10GB for N4, 000 (formerly 6GB at N2, 500), 13GB for N5, 000 (from 10GB at N3, 000), 18GB for N6, 000 (formerly 15GB at N4, 000) and 25GB for N8, 000 as this replaces 18GB at N5, 000.

Further, the 75GB monthly bundle, which costs N16, 000 has been renamed as plan, costing N20, 000; 100GB for two months, costing N20, 000 have been upgraded to 150GB to cost N40, 000, while 400GB for three months, which cost N50,000 is now upgraded to 480GB to cost N120,000.

The bubble burst was further complicated by a tariff increase, which is the resurgence of widespread complaints about rapid data depletion. The issue is that businesses, students, families, and professionals are now raising alarms that data bundles, which previously lasted weeks, now disappear in days or even hours, which is questionable. Another critical area affected is small and medium-sized enterprises that rely on cloud services, digital marketing, logistics platforms, and online payments, which are finding their operating costs spiralling without any justification. For many, the crux of the matter is that profitability is being quietly eroded, not by poor business decisions, but by the rising cost and unpredictability of connectivity.

The telecom operators, backed by the regulator, have responded with familiar explanations that have always favoured their unscrupulous and illicit activities, with the explanation that data, they say, depletes faster because of background applications, automatic updates, high-definition streaming, malware, faster networks, and users’ failure to manage device settings. Technically, these explanations are not false because modern smartphones are indeed data-hungry, and digital behaviour has evolved. But this defence, repeated endlessly, misses the deeper issue, as the fact is that the problem Nigerians are confronting is not simply that data is consumed; it is that the system governing how data is measured, billed, and explained is not transparent, hard to understand, unaccountable, and tilted entirely in favour of the service providers.

In Nigeria’s telecom market, operators are both the umpires and the players. They measure usage, bill customers, interpret anomalies, and adjudicate complaints, which does not create ground for fair play. Subscribers, on the other hand, are expected to accept consumption figures hook, line, and sinker, which they cannot independently verify. An unacceptable fact is that there are no universally accessible, third-party audited data meters that allow users to confirm what they have truly consumed in real time. Customers and service providers do not have equal access to information; this asymmetry creates fertile ground for silent overbilling, whether intentional or structural, and it erodes trust in a sector that should be built on transparency, not obscurity.

One critical aspect that must be addressed squarely is that the regulatory weakness compounds the problem. While the Nigerian Communications Commission possesses statutory authority, enforcement has often appeared slow, reactive, and insufficiently punitive. Penalties imposed on multinational firms with billion-dollar balance sheets rarely feel consequential. Investigations drag on, public disclosures are limited, and even when infractions are established, consumers seldom receive refunds. In such an environment, corporate restraint becomes optional. Where regulators lack teeth, corporations inevitably test boundaries.

The market structure itself offers little relief, as the market setup does not protect consumers. Nigeria’s telecom sector is effectively oligopolistic, dominated by a few large, powerful players with similar pricing models and limited incentive to compete on fairness. Tariff structures are deliberately complicated and complex, with multiple conditions and layered with bonuses, rollover conditions, expiry clauses, and promotional data that behaves differently from paid data. For the average subscriber, understanding these distinctions is exhausting. Complexity becomes a strategy, not an accident, reducing accountability while increasing revenue certainty for operators.

Though economic pressure on the telecom companies is real, and it must be acknowledged, knowing fully well that exchange rate volatility, energy costs, vandalism, and inflation have hurt profitability. Airtel’s revenue decline and MTN’s reported losses underscore the financial strain facing operators in Nigeria’s macroeconomic climate. It must be understood that corporate hardship does not justify consumer exploitation. The risk arises because multinational firms are subjected to pressure to meet global revenue targets and repatriate profits, adopt aggressive monetisation strategies in markets where regulation is weak, and consumer resistance is fragmented.

From experiences thus far, the human cost of this imbalance is becoming impossible to ignore. From students like Abiodun Yusuf, who spends most of his allowance on data that barely supports his academic needs, and also to small business owners like Cynthia Jude, whose online shop struggles to stay viable, the stories repeat themselves with unsettling consistency and outcomes. Families ration children’s screen time not out of discipline, but out of financial desperation. The adverse part that has continued is the widening of an already dangerous digital divide, as rural communities withdraw from digital platforms altogether because of exploitation.

Perhaps most telling is how quickly exploitation has been normalised in Nigeria. Many Nigerians now shrug and say, “That’s how it is.” This resignation is the greatest victory for an unfair system, and when people stop believing that fairness is possible, for this reason, exploitation becomes invisible, and abuse thrives without resistance.

Consumer advocacy groups like NATCOMS have begun to signal a shift in posture, including the possibility of court action. Labour unions have threatened boycotts. Civil society organisations warn of social and economic repercussions. These responses indicate that public patience is wearing thin. If left unaddressed, subscription apathy, however gradual, could ultimately undermine the very growth the telecom sector seeks to protect.

For a better understanding of what Nigeria faces is not merely a dispute over megabytes and tariffs, for clarity, it is a governance challenge that cuts across corporate ethics, regulatory independence, consumer empowerment and economic justice. A digital economy cannot thrive on distrust. Transparency and easily understandable data billing must become mandatory, not an aspirational goodwill promise. Independent audits should be public, regular, and credible. Complaint resolution mechanisms must be simplified, fast, and binding. Regulators must act not as mediators between equals, but as defenders of the public interest in an asymmetrical power relationship.

Equally important is consumer education, but awareness campaigns alone cannot substitute for structural reform. Digital literacy must go hand in hand with corporate accountability because the better it is understood that teaching users how to conserve data does not absolve operators from the responsibility to bill fairly and transparently.

At its core, the telecom debate reflects a large Nigerian dilemma, if not a broader problem in Nigeria, as corporate power has grown faster than institutional strength. Until regulators are truly independent and totally free from corporate and political influence, transparency is enforced by law, and consumers are recognised and treated not as passive revenue streams but as stakeholders with rights, exploitation will remain systemic rather than accidental or a series of isolated mistakes.

Communication is the bloodstream of modern society. When access to it becomes exploitative, the cost is paid not only in naira but in opportunity, dignity, and trust. Nigeria must decide whether its digital future will be built on fairness that respects consumers or allow it to rest on fatigue, frustration, and exploitation of users. The choice Nigeria makes will make more impact, and the answer will shape not just the telecom sector but the credibility of governance in an increasingly connected nation.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

Feature/OPED

Making Big Shifts: Why Africa’s Boldest Leaders Are Heading to Lagos

History has a way of rewarding leaders who recognise the moment they are in. There are seasons when refinement is enough, and there are moments when only reinvention will do. Africa’s business and leadership landscape is firmly in the latter. Economic pressures are redefining markets, technology is rewriting industries, and organisations are being forced to confront uncomfortable truths about relevance, resilience, and growth. It is within this context that the SHIFT Conference 2026 returns to Lagos, offering not just conversation, but direction.

Built around the theme Making Big Shifts, the conference speaks directly to leaders who understand that incremental progress is no longer sufficient. Across boardrooms and startups alike, leaders are being challenged to rethink how value is created, how people are led, and how institutions remain competitive in an increasingly complex global environment. SHIFT positions itself as a space for honest reflection and bold reimagination.

Curated by The Global Leadership Consultancy and founded by respected leadership thinker, Dr Sam Adeyemi, the SHIFT Conference has evolved into one of Africa’s most influential platforms for leadership and strategic thinking. Its focus is clear: to help leaders move beyond outdated assumptions and equip them with the mindset and tools required to thrive amid constant change. Dr Adeyemi has long maintained that leadership breakdown often begins not with execution, but with thinking. As he has noted, leaders cannot solve today’s problems with yesterday’s mindset, and meaningful transformation only begins when thinking shifts first.

Lagos, as Africa’s commercial heartbeat, provides a fitting backdrop for this conversation. The city’s pace, energy, and entrepreneurial drive reflect the realities leaders face daily. Following a landmark 2025 edition that attracted thousands and sparked wide-ranging conversations, the 2026 conference is expected to draw more than 4,000 participants from across Africa and the diaspora, spanning business, government, technology, finance, and the creative economy.

The speaker lineup underscores the depth of the gathering. The Chief Executive Officer, Global Leadership Consultancy, Dr Sam Adeyemi; Founder and CEO, Axxess, John Olajide and Founder and President of the Women of Destiny, Dr Nike Adeyemi, will anchor discussions that cut across leadership, enterprise, governance, and personal development. Through keynote addresses and interactive conversations, participants will be challenged to confront critical questions around scale, innovation, sustainability, and influence in a fast-evolving world.

Beyond the ideas shared on stage, the SHIFT Conference is intentionally designed as an immersive and practical experience. Attendees will engage in strategy-driven workshops, panel discussions featuring founders and technologists advancing sustainable innovation, and purposeful networking sessions that prioritise meaningful connections. Special experiences tailored for founders, CEOs, and senior executives further reinforce the conference’s focus on high-level decision-making and real-world application.

The credibility and growing influence of the SHIFT Conference are reinforced by the support of leading corporate and media partners, including Alpha Morgan Bank, BusinessDay, Patton Morgan, Jospong, and other institutional sponsors. Their involvement reflects strong confidence in the conference’s vision and its relevance to Africa’s leadership and business ecosystem.

At its core, SHIFT Conference 2026 responds to a defining question facing leaders today: how do you remain relevant in a world that refuses to stand still? The conference’s answer is clear: leaders must be willing to rethink assumptions, make bold strategic choices, and act with clarity and conviction.

For entrepreneurs seeking scale, executives reimagining strategy, public-sector leaders navigating reform, and professionals searching for direction, SHIFT offers more than inspiration. It offers perspective, practical insight, and a community of peers confronting similar challenges and choosing to lead differently.

As leadership continues to evolve, the decision facing many leaders is no longer whether change is coming, but how they will respond to it. That choice will take centre stage at the SHIFT Conference 2026 on Saturday, February 21, 2026, at Eko Hotels & Suites, Victoria Island, Lagos, where Africa’s next chapter in leadership thinking will be shaped.

Feature/OPED

PETROAN, ‘Abiku Refineries’ and the Comfort of Collapse

A sector that keeps reviving what has repeatedly failed, while resisting what works, is not trapped by fate but comforted by collapse. PETROAN’s latest outburst exposes just how invested some interests remain in Nigeria’s ritualised dysfunction.

By Abiodun Alade

Nigeria’s oil and gas sector has endured many seasons of noise masquerading as advocacy. From time to time, pressure is applied not in pursuit of reform, but in defence of habits that have outlived their usefulness. The latest episode is revealing not because it is novel, but because it exposes, with unusual clarity, the discomfort of rent-seeking intermediaries when genuine change threatens familiar margins.

That discomfort has recently found expression in the agitation by the Petroleum Products Retail Outlets Owners Association of Nigeria over comments made by Bayo Ojulari, Group Chief Executive Officer of the Nigerian National Petroleum Company Limited. In demanding his resignation, PETROAN has inadvertently illuminated a deeper problem in Nigeria’s petroleum political economy: the resistance of entrenched intermediaries to reform that narrows the space for easy rent.

Ojulari’s offence was not misconduct. It was candour. He observed, correctly, that the Dangote Petroleum Refinery has provided breathing space at a time when government-owned refineries are shut, and that the NNPC should not rush back into the familiar ritual of pouring millions of dollars into turnaround maintenance for facilities that have become monuments to waste. This is not heresy; it is prudence.

For a quarter of a century, Nigeria has chased the mirage of refinery rehabilitation. Public records suggest that between $18 billion and $25 billion has been spent on turnaround maintenance and rehabilitation of the four state-owned refineries, with little to show for it. Like the abiku of Yoruba lore, these refineries are revived with ceremony, only to relapse almost immediately. Working today, dying tomorrow. To insist that this cycle must continue, regardless of evidence, is not patriotism. It is sabotage dressed as concern.

PETROAN’s reaction is therefore instructive. In a recent statement, its spokesman, Joseph Obele, described it as “most worrisome” that there was no urgency to restart the Port Harcourt Refinery because Dangote is meeting current fuel needs. The association went further, threatening to lobby civil society groups and pursue legal options to force the removal of the NNPC GCEO should the refinery not resume operations by March 1. This is not policy engagement. It is pressure politics.

Why would a body of retailers, whose business model depends largely on buying and reselling products refined elsewhere, be so hostile to domestic refining capacity? The answer lies in incentives. Domestic refineries compress margins. They reduce arbitrage. They expose inefficiencies that thrive in scarcity. For decades, fuel importation and the dysfunction it encouraged created space for unearned profits across the value chain. Local refining threatens that arrangement.

History offers a useful parallel. In Mancur Olson’s classic work The Logic of Collective Action, he explains how small, organised interest groups often prevail over the broader public interest because they are better motivated to defend narrow gains. PETROAN’s conduct fits this pattern. It speaks loudly, often, and with confidence, but for whom does it really speak?

It is also worth recalling PETROAN’s posture during earlier periods of distress in the sector. At moments when the national oil company was accumulating unsustainable obligations, remitting little or nothing to the Federation Account and absorbing enormous costs, commendations flowed freely. Laurels were dished out even as the system bled. That era ended with the Federal Government writing off substantial debts, including about $1.42 billion and N5.57 trillion after reconciliation. Nigerians paid the price for that indulgence.

During the years when Nigeria’s petroleum sector was driven to the brink, PETROAN looked the other way. The record is clear. The national oil company captured the entire value chain, seizing crude exports, monopolising refined product imports, and then forcing the Federal Government to borrow an estimated N500 billion monthly to sustain opaque subsidy claims. By controlling nearly 90 per cent of the roughly $3 billion in monthly crude proceeds routed through the Central Bank, and combining this with subsidy payments and other shocks, fiscal space collapsed, driving the government into massive Ways and Means financing.

At the same time, refinery rehabilitation became an industry without output. About $10 billion was spent over a decade on maintenance with nothing to show for it, not even a litre of petrol. A further $3 billion was later securitised against future crude sales for yet another failed repair cycle, a sum that could have delivered dozens of modular refineries. Even after the Petroleum Industry Act prioritised Domestic Crude Obligation, compliance remained elusive, while Nigeria continued to burn scarce foreign exchange importing substandard fuel into a system with no functional midstream. These were not marginal errors but a business model that plunged the country into crisis. Throughout it all, PETROAN’s voice was conspicuously muted, generous with praise where scrutiny was required.

This is why the current agitation rings hollow. Reform always unsettles those who prospered under disorder. President Bola Tinubu’s administration has signalled, through words and decisions, that it intends to break with the old script. Ojulari’s mandate at NNPC is clear: commercial discipline, efficiency and profitability. That mandate cannot be reconciled with endless rehabilitation theatre.

There is another uncomfortable question PETROAN has not answered. What value does its leadership bring to the petroleum sector beyond television appearances and press statements? Serious business leadership is measured in assets built, jobs created and value added. Publicly available information suggests that some of the companies associated with PETROAN’s leadership are modest in scale, with limited project footprints. Allegations and controversies reported in the public domain around some of these entities, whether in the power metering space or elsewhere, only reinforce the need for caution in elevating moral authority. Perhaps PETROAN’s members would do well to examine the records of those who speak in their name before an association meant to represent many is reduced to the private estate of a few and recast as an adversary of the public interest.

This is not to say that retailers have no role in policy debate. They do. But influence must be earned through insight, integrity and alignment with the national interest. Threats and ultimatums betray a lack of confidence in argument.

Nigeria stands at a fork in the road. One path leads back to ritualised waste, institutional failure and the comfort of familiar inefficiencies. The other leads to local capacity, competition and a petroleum industry that finally works for Nigerians. The Dangote Refinery is not a silver bullet, but it is a signal that the old excuses are losing credibility.

PETROAN’s nuisance value thrives only when reformers flinch. President Tinubu has shown little appetite for cheap blackmail. Ojulari enjoys his confidence for a reason. The task before NNPC is too important to be derailed by those nostalgic for a broken system. If PETROAN wishes to be relevant in this new era, it must evolve from noise to nuance. Otherwise, history will remember it not as a defender of consumers, but as a footnote in Nigeria’s long struggle to escape the tyranny of waste.

Abiodun, a communications specialist, writes from Lagos

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn