Education

From Okeho Ahoro to Okeho Ile: A Review of the Okeho Exodus

By Mutiat Titilope Oladejo

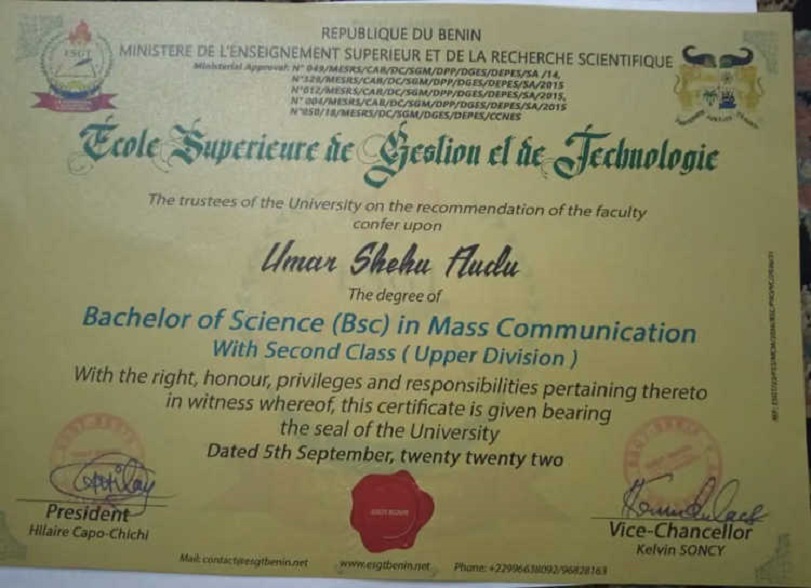

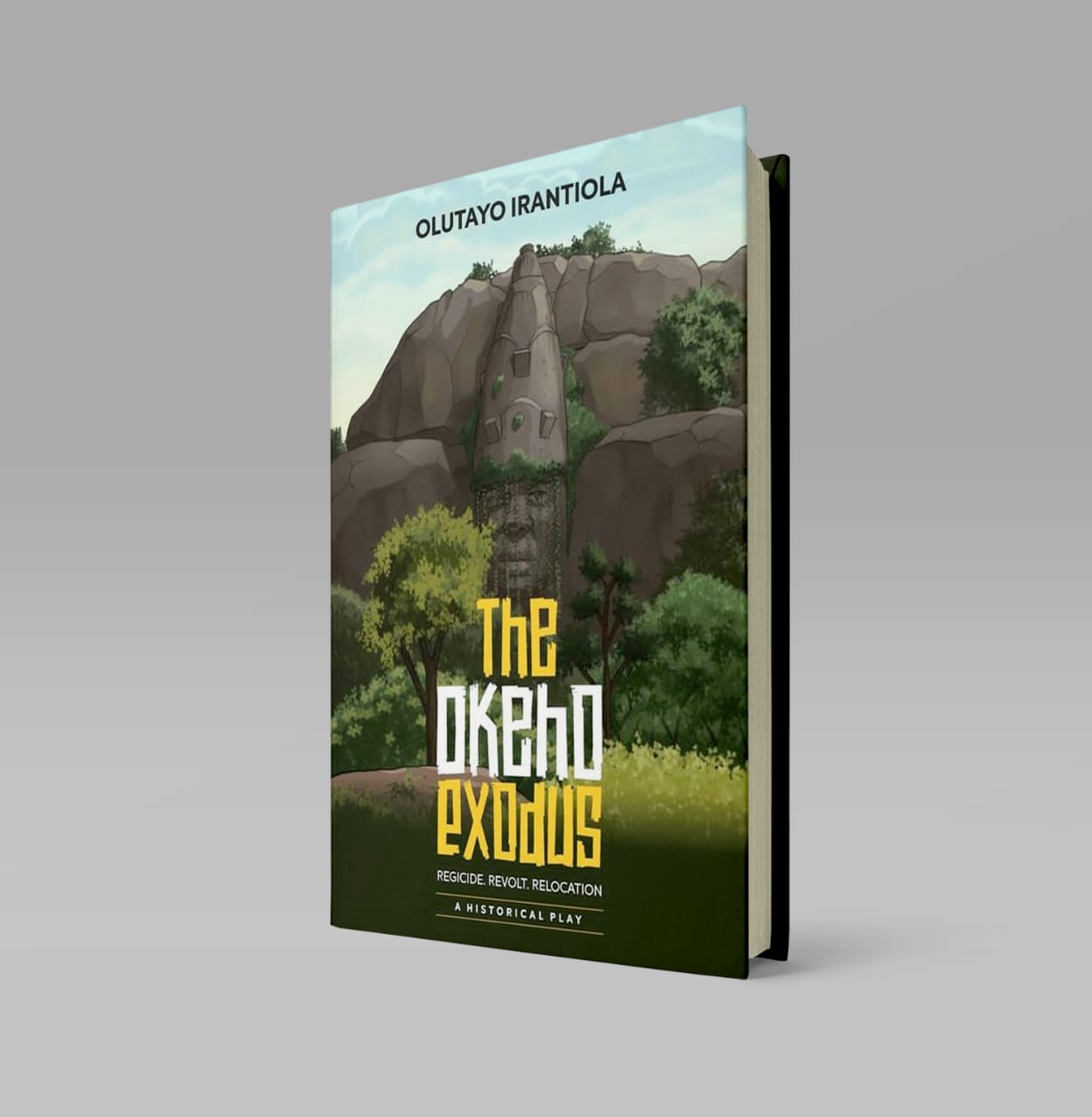

Title: Okeho Exodus: Regicide, Revolt, Relocation: A Historical Play

Playwright: Olutayo Irantiola

Publisher: Peo Davies Communications

Year of Publication: 2022

Reviewer: Dr Mutiat Titilope Oladejo

As a historian, I find it interesting to read Olutayo Irantiola ‘s book on The Okeho Exodus. I reviewed the book, and I am pleased to say that we have our story, and it is good that we can recreate them for our pleasure and for the future.

While lecturing at Emmanuel Alayande College of Education, I had the cause to visit Okeho to supervise students in teaching practice. I also visited other towns in Oke-Ogun. In my travels around Oke-Ogun, I am distraught by the level of development in that region of Oyo State. I even wonder if Ibarapa and Oke Ogun regions are ever on the map of development in Oyo State.

Okeho, a typical Yoruba town, maintained its identity to survive the nineteenth-century turmoil tensioned by the transition from the illegitimate commerce of the slave trade to the legitimate commerce of the Bible and plough.

Olutayo Irantiola’s play fiction, the Okeho-Iseyin uprising of 1916 to narrate the everyday realities of major events that aggravated the chaos. It is pertinent to note that it coincided with the period of the first World War. Britain, at this time, used colonial laws to encapsulate the colonies.

The book gave the impression that encounters with the Fulani and Dahomey already influenced the internal security issues of the town and its environs. This can’t be downplayed because the Fulani and even Nupe have years of integration into the Oke-Ogun region. Of course, Prof. Babatunde Ayeleru’s inaugural lecture gives us the impression that the Dahomey/French influence remains relevant in some parts of the Oke-Ogun region. Some doctoral students are also investigating the cross-border trade between Nigeria and Benin Republic via Oyo north.

The threats, then, made Oba Arilesire call for a common political identity between Okeho and the towns around. There was a merger that enabled cooperation against enemies. However, the death of the king and the emergence of Onjo Owolabi Olukitibi as the new king changed the status quo. Although the book gave the impression that the Ajele created havoc at this time, I disagree a bit because the Ajele was a revenue collection institution that existed since the eighteenth century. Little or nothing can the Onjo do to stop it. It is only the British policy of indirect rule that reinforced the Ajele. Taxation should not be the issue; the people were just estranged from the colonial influence on everyday life.

The uprising also emanated from rancour and mischief among the Baale. Pointedly, Baale Olele, Balogun Atilola, Alasia and Ba’Ogan were fingered as opposition to the reign of Onjo Owolabi Olukitibi. They wanted him out because he was considered an agent of colonial imposition.

The schema headed by Baale Olele was possible because the citizens preferred the traditional lifestyle. The book gave the impression that there was opposition to colonial rules against open defecation, thus compelling them to build toilets in their homes. Vaccination of children was also considered taboo as it was believed that it would affect their brains.

Courts were established, and it was considered a big threat to the existing gender relations. Women used the courts to snap out of oppression as they sought a divorce. To men, oppression is normal and should not be questioned. Statistics from the archives I used in my book: The Women Went Radical: Petition Writing and Colonial State in Southwestern Nigeria, 1900-1953, attest to this because Okeho and Iseyin had high rates of divorce in the 1940s.

Furthermore, Christianity was a threat as the custodian of traditional religion believed that the missionaries were causing havoc to the belief system. Men worked as labourers to survive the colonial economy, and the scope of authority that gave powers to the police angered them. The policemen (Akoda) were considered traitors.

Scholars have opinions on the issues, but the book sets us into an interesting fiction. Mofeyisara Oluwatoyin Omobowale, in “Okeho Uprising” in the International Encyclopedia of Revolution and Protest, concluded that the uprising was brutally suppressed. Prof. J. A. Atanda, in the article: “The Iseyin-Okeiho Rising of 1916: An Example of Socio-Political Conflict in Colonial Nigeria,” published in the Journal of Historical Society of Nigeria, 1969, affirms that taxation was not the problem but just a revolt against colonial imposition to all spheres of life.

The schema extended to Iseyin as the uprising was jointly executed to wipe out Onjo Olukitibi, the queen and the prince. Captain Ross responded swiftly by mobilizing the colonial army to capture Baale Olele and cohorts. They were sentenced to death by hanging.

The chaos led to the disruption that made colonial rule more pronounced. The people were compelled to move from Okeho Ahoro, the site of the uprising, to Okeho Ile to ensure effective monitoring by the colonial state.

I appreciate my friend for his patriotism in writing this book, the playwright and I attended Abadina College, the University of Ibadan, the University of Ilorin for undergrads and back to the University of Ibadan for postgraduate programmes.

I will like to mention that I appreciate my friends at the University of Ilorin who chose to return home after their studies. A number of them insisted they would be back home to teach, farm or work with the local government. I appreciate their patriotism! It also dawned on me that I also feel the same way about Ibadan city as my home.

Long live Oyo State!

Dr Mutiat Titilope Oladejo is of the Department of History, University of Ibadan

Education

Saint Riman of Adedokun International Schools Ota Wins InterswitchSPAK 7.0

By Modupe Gbadeyanka

A student of Adedokun International Schools, Ota, Ogun State, Saint Riman, has emerged as the overall winner of the InterswitchSPAK National Science Competition.

The 16-year-old student was crowned Nigeria’s Best STEM Student, receiving a N15 million scholarship in the InterswitchSPAK 7.0 grand finale.

InterswitchSPAK is the flagship Corporate Social Responsibility initiative of Interswitch, one of Africa’s leading integrated payments and digital commerce companies.

The programme is Nigeria’s largest STEM competition for senior secondary school students. It concluded on a high note after months of nationwide assessments, problem-solving challenges, and competitive stages involving over 18,000 registered participants.

Business Post reports that David Okorie of Caleb International College, Magodo, Lagos State, was the first runner-up, getting N10 million in scholarship, while David Solomonezemma of Deeper Life High School, Enugu State, was the second runner-up, bagging a N5 million scholarship. All winners also received brand-new laptops in addition to other exciting prizes.

While presenting the awards, the Group Marketing and Communications for Interswitch, Ms Cherry Eromosele, commended the students for their discipline, resilience, and exceptional intellectual performance.

“InterswitchSPAK was created to inspire and reward excellence in STEM education while equipping young Africans with the skills to tackle real-world challenges.

“These winners have demonstrated remarkable promise, and by supporting their education, we are reaffirming our belief in the power of young people to shape Africa’s future through innovation and science,” Ms Eromosele said.

Beyond the top three winners, other finalists received brand new laptops and exciting cash rewards for outstanding performance, alongside their teachers who were also celebrated and rewarded for their critical role in nurturing talent. This holistic approach reinforces Interswitch’s commitment to sustainable educational development through collaboration between students, educators, and institutions.

Now in its seventh year, InterswitchSPAK has become a highly respected platform, serving as a pipeline for discovering, developing, and empowering the next generation of scientists, engineers, technologists, and innovators. Through this initiative, Interswitch continues to highlight how strategic private sector investment in education can drive innovation, reward merit, and contribute meaningfully to national development.

The successful conclusion of InterswitchSPAK 7.0 underscores Interswitch’s leadership in advancing STEM education as a catalyst for socio-economic growth, preparing Nigerian students to compete confidently on the global stage while shaping Africa’s innovation-driven future.

Education

Zurich-based Sparkli Raises $5m for Generative Learning Platform

By Dipo Olowookere

A Zurich-based anti-chatbot edtech firm, Sparkli, has secured about $5 million pre-seed round for its generative learning engine designed to turn screen time into active learning expeditions that foster agency, curiosity, and future-ready skills.

The pre-seed round will allow Sparkli to scale its generative learning engine and prepare for a private beta launch in January 2026. The company is currently validating its platform through a strategic pilot with one of the world’s largest private school groups.

This partnership provides Sparkli with a powerful testing ground across a network of more than 100 schools and over 100,000 students.

Sparkli transforms the curiosities of children into multi-disciplinary, real-life journeys that foster future-ready skills, including technology, design thinking, sustainability, financial literacy, entrepreneurship, emotional intelligence, and global awareness.

The company is already positioning itself to disrupt the $7 trillion global education market, a sector widely predicted to be one of the most significant use cases for artificial intelligence.

Its approach is shaped by three shifts essential for modern childhood education, a strategy designed to solve the ‘Agency and Curiosity Gap’. First, it forces a Velocity Shift by moving away from static curriculums to real-time relevance where children explore new topics the moment they emerge.

Second, it drives an Engagement Shift by replacing the dry ‘AI chatbot wall of text’ and passive screen time (watching videos, playing video games) with a multimodal playground of visuals, voice, and playable simulations. This turns consumption into active, gamified inquiry rooted in educational value.

Finally, Sparkli prioritizes a Skills Shift that focuses on capabilities such as creativity and complex problem solving rather than memorization.

“Our goal is to build agency in the next generation. Children learn by exploring, making choices, asking questions, and discovering what inspires them. Sparkli turns screen time into a place where curiosity grows rather than fades,” the chief executive of Sparkli, Mr Lax Poojary, said.

One of the funders, Lukas Weder of Founderful, said, “Sparkli represents a step change in how children can interact with knowledge.

“The team is applying high caliber engineering and thoughtful pedagogy to a space that desperately needs innovation. Their traction with schools shows a real appetite for tools that foster curiosity and agency rather than passive consumption.”

Education

NELFUND Disburses N161.97bn to 864,798 Students in 500 Days

By Adedapo Adesanya

The Nigerian Education Loan Fund (NELFUND) has disbursed N161.97 billion to 864,798 students nationwide since the inauguration of its student loan portal on July 17, 2024, as part of efforts to expand access to tertiary education.

The Managing Director of NELFUND, Mr Akintunde Sawyerr, while briefing journalists on the progress, impact and challenges of the scheme under the President Bola Tinubu’s Renewed Hope Agenda, said it was established to ensure that no Nigerian student was denied education because of financial constraints.

According to him, the fund has so far received 1,361,011 loan applications from students across the country.

He explained that out of the N161.97 billion disbursed, N89.94 billion was paid directly to 263 tertiary institutions to cover tuition and institutional charges, while N72.03 billion was paid to students as upkeep allowances.

“As at today, 1,361,011 applications have been received, 864,798 students have so far benefited from the loan scheme, and total disbursement stands at N161.97 billion.

“These includes N89.94 billion paid directly to 263 tertiary institutions for tuition and institutional fees, and N72.03 billion paid directly to students as upkeep allowances,” he said.

He noted that the figures represented tangible impact on students and families, describing them as evidence of barriers being removed and opportunities being created.

The NELFUND boss said the agency, had over the last year, embarked on extensive sensitisation across tertiary institutions to improve awareness and access to the scheme.

He added that the focus would now expand to parents, guardians, traditional rulers and faith-based institutions.

He said this new approach was to deepen public understanding and trust in the scheme.

“Over the last year, NELFUND has undertaken extensive sensitisation and engagement across tertiary institutions nationwide.

“We have worked directly with students, school authorities, and stakeholders to drive awareness, understanding, and access to the scheme.

“However, as we move into this new phase, we recognise that deepening impact requires broader engagement.

“So this year, our focus will expand to another very important group within the NELFUND ecosystem,” he said.

On upkeep payments, the managing director disclosed that a reconciliation exercise carried out after the 2024/2025 academic session revealed that 11,685 students had outstanding upkeep payments amounting to N927.98 million.

He clarified that the outstanding payments were not due to withheld funds or policy failure, but resulted from technical and operational issues.

He said such issues include network downtime, failed transactions and unvalidated bank account details.

He also said that the NELFUND management had approved a one-time reconciliation process to resolve the cases, including direct engagement with affected students.

He further said that a grace period for updating bank details, multi-layer validation and prompt payment upon verification had also been approved.

Responding to questions on sustainability, Mr Sawyerr said that the amended student loan law removal of guarantor requirements, inclusion of upkeep allowances and the ability to raise and invest funds were key elements supporting long-term sustainability.

He added that NELFUND was also exploring partnerships with philanthropists, corporate organisations and government agencies, citing a N20 billion collaboration with the Ministry of Education on Technical and Vocational Education and Training (TVET) as an example.

Also speaking, the Executive Director of Operations, NELFUND, Mr Mustapha Iyal, said that outstanding upkeep represented about 11,000 out of more than 400,000 beneficiaries in the 2024/2025 session.

Mr Iyal said NELFUND had contacted institutions to validate student data, noting that many of the issues arose from incorrect information supplied by applicants.

According to him, feedback has been received from over 100 institutions, and payment of the outstanding upkeep allowances is expected to commence shortly.

He also disclosed that applications for the 2025/2026 academic session began in November, 2025, with over 200 institutions submitting updated data.

He said about 280,000 applications had been received from those institutions, out of which loans had already been disbursed to more than 150,000 students.

He added that upkeep payments for the new session would begin in January, explaining that upkeep allowances were tied to active academic sessions and required fresh applications each session.

On loan repayment, Mr Iyal said repayment had already commenced, with some beneficiaries who had graduated and secured employment beginning to repay their loans.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn