Brands/Products

5 Best Gift Card Trading Apps in Nigeria in 2025

Looking for a platform to trade your gift cards? Find out the top 5 gift card trading apps in Nigeria and how to choose the right one for you.

Table of Contents

- Introduction

- Top 5 Gift Card Trading Apps in Nigeria

- Why You Should Use a Gift Card Trading App

- Criteria for Choosing a Gift Card Trading App

- How to Avoid Gift Card Trading Scams

- FAQs

- Conclusion

Gift cards are prepaid cards that contain a specific amount of money. You can use them to pay for goods or services from the brand that issues them. However, in Nigeria where the use of gift cards for purchases is limited, the best option is turn them into cash.

Trading gift cards is a great way to turn unused gift cards into cash in Nigeria. But with so many apps out there, how do you know which one to trust? Whether you’re trading iTunes, Steam, Amazon, or Google Play cards, having a reliable and secure app is essential.

This article explores the top 5 gift card trading apps in Nigeria, factors to consider before choosing an app, tips to avoid gift card trading scams, and more.

Top 5 Gift Card Trading Apps in Nigeria

When it comes to gift card trading in Nigeria, some apps standout compared to the rest. Here are the best 5 gift card trading apps in Nigeria as of 2025

- Nosh

- Cardtonic

- Prestmit

- GCBuying

- ApexPay

Let’s go deeper into what each app offers.

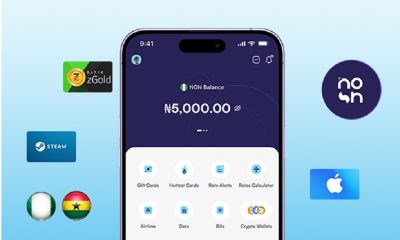

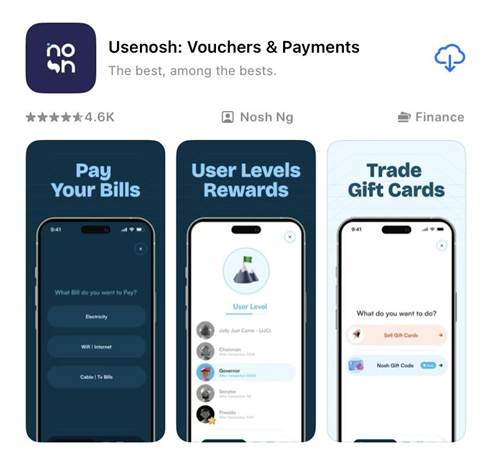

1. Nosh

Nosh is a standout app for trading gift cards in Nigeria. The platform offers high rates, fast transaction processing, and a secure platform for all users. In addition to these features, customer support is available for users 24/7.

You can trade a wide variety of gift cards on Nosh, including Steam, iTunes, Amazon, Google Play, and Visa gift cards. The app is user-friendly with a clean and intuitive interface, making it easy for anyone to trade gift cards quickly.

One of Nosh’s best features is its instant payout. Once your gift card is verified and your trade is approved, your Naira wallet is credited immediately. The app also includes a rate calculator so you can check how much you’ll earn before trading.

Nosh is available on both Google Play Store and Apple App Store, and you can also access its features through the web app if needed.

2. Cardtonic

Cardtonic is a well-known gift card trading app in Nigeria. It allows users to trade various types of gift cards and provides decent rates for each trade.

The app features an intuitive design, making it easy to navigate and complete transactions. Cardtonic’s support team is responsive, ensuring you have assistance if any issues arise. Cardtonic is available for download on both iOS and Android devices.

3. Prestmit

Prestmit is another reliable app that offers flexibility for gift card trading. On this platform, you can trade your gift cards for Naira or cryptocurrency, depending on your preference.

Prestmit supports a wide variety of gift cards and is known for its competitive rates and fast payment processing. The app is accessible on Google Play Store and Apple App Store, making it convenient for users across devices.

4. GCBuying

GCBuying is a secure and user-friendly gift card trading app in Nigeria. It supports many popular gift card brands and ensures that users get paid promptly after a successful transaction. Just like Prestmit, you can trade your gift cards for cash or crypto.

Although GCBuying is relatively new to the market unlike Nosh, Cardtonic and Prestmit, it remains a solid choice for reliable and hassle-free trading.

5. ApexPay

This app is another relatively new player in the gift card trading industry. ApexPay is a trusted platform that allows users to trade gift cards with ease. The app supports various gift cards, including iTunes, Amazon, and Google Play. ApexPay offers decent rates and ensures that payments are processed without delays.

The platform also prioritizes security, making it a safe choice for users who are cautious about online transactions.

Why You Should Use a Gift Card Trading App

Using a gift card trading app in Nigeria comes with many benefits:

1. Convenience

Using a gift card trading app simplifies the entire process of converting gift cards to cash. With just a few taps on your phone, you can trade your gift card anytime, anywhere, without having to search for buyers manually.

2. Security

Gift card trading apps prioritize secure transactions. They use advanced security features like encryption and two-factor authentication to protect your details.

3. Avoid Scams

With gift card trading apps, you avoid the risk of scams that are common with peer-to-peer (P2P) trading. Trading through a trusted app eliminates the uncertainty of dealing with unverified buyers, giving you peace of mind.

4. Prompt Payouts

Most gift card trading apps process transactions swiftly and offer instant payouts. You don’t have to wait for hours or even days to receive your money as opposed to manual trading. Once the transaction is complete, the cash is credited to your wallet.

Criteria for Choosing a Gift Card Trading App

Key factors to consider when selecting an app are rates, transaction processing times, ease of use, security and customer service.

- Rates: Always go for platforms with competitive rates. Nosh offers the highest rates for gift cards in Nigeria. You can compare rates across different websites before choosing an app.

- Transaction times: Ensure the app processes payments quickly. Nobody enjoys waiting unnecessarily to receive their money.

- Ease of Use: A user-friendly interface is essential for a smooth experience.

- Security: Prioritize apps with strong security measures and added security for users like two-factor authentication.

- Customer service: Look for apps with 24/7 customer support, a good example is Nosh. Also check that you can reach them through multiple channels like live chat, email, or phone to ensure your concerns are addressed quickly and effectively.

Now, let’s compare the five apps across these factors.

| App | Rates | Transaction time | Ease of Use | Security | Customer service |

| Nosh | High | Very fast | Very easy | Highly secure | Available 24/7 |

| Cardtonic | Good | Fast | Easy | Secure | Responsive |

| Prestmit | Good | Fast | Easy | Secure | Responsive |

| GCBuying | Decent | Good | Easy | Secure | Good |

| ApexPay | Decent | Good | Easy | Secure | Good |

How to Avoid Gift Card Trading Scams

Gift card trading is safe if you use verified apps, but here are some tips to avoid scams:

- Only trade on reputable apps like Nosh, Prestmit, Cardtonic, GCBuying or ApexPay.

- Avoid dealing with individuals or unverified platforms.

- Double-check the platform’s reviews and ratings on the App Store or Play Store.

- Never share sensitive information like your card PIN with unverified sources.

Frequently Asked Questions About Gift Card Trading Apps in Nigeria

- Which app is the best to trade gift cards in Nigeria?

The best app to trade gift cards in Nigeria depends on your preferences, but Nosh stands out for its high rates, instant payouts, user-friendly interface, and excellent customer support. Other reliable options include Cardtonic, Prestmit, GCBuying, and ApexPay, all of which offer secure and seamless trading experiences.

- What is the best gift card exchange app in Nigeria?

The Nosh app is one of the best for exchanging gift cards in Nigeria. It supports a wide range of gift cards, offers competitive rates, and ensures fast, secure transactions. Additionally, its in-app rate calculator and responsive customer support make it a preferred choice for many users.

3. How to trade gift cards to Naira?

Here’s a step-by-step guide to trading gift cards to Naira:

- Download a trusted app like Nosh from your app store.

- Create an account and log in.

- Select the type of gift card you want to sell.

- Enter the gift card details, such as card number and PIN.

- Once your transaction is verified, your Naira wallet will be credited immediately.

Final Thoughts

If you’re looking to trade gift cards in Nigeria, Nosh, Cardtonic, Prestmit, GCBuying and ApexPay

apps are the best options for 2025. While all of them are reliable, Nosh stands out for its excellent rates, fast processing, and top-notch customer service. Don’t wait – start trading with Nosh today for a seamless experience!

Brands/Products

Canal+ to Discontinue MultiChoice Streaming Service Showmax

By Adedapo Adesanya

Canal+, which now owns MultiChoice, a pay-TV firm, has announced its decision to discontinue the streaming service, Showmax.

The company said the Showmax board has made the decision to discontinue the service in the near future.

“This decision reflects our focus on strengthening our overall digital offering and ensuring long-term sustainability in an increasingly competitive streaming environment.

“Importantly, at the moment, there will be no interruption to your current service. You can continue streaming as usual, and no action is required from you at this time,” it said.

It added that it will share further details in the future, including timelines and any future steps, should they be required.

MultiChoice launched Showmax across Africa 10 years ago in August 2015 to compete with the advent of streamers like Netflix, Apple TV, Amazon’s Prime Video, Disney+ and others, which all became available on the continent and started biting into MultiChoice’s legacy pay-TV subscriber base on DStv and GOtv.

However, it soon faced some challenges and couldn’t hit its target.

In February 2024, MultiChoice, in partnership with Comcast’s NBCUniversal, relaunched Showmax, utilising the technology behind the Peacock streaming service.

The investment, which was pegged at over $300 million, still did not bear the expected fruit, with other streaming giants seeing growth over the years.

With Canal+’s takeover and its aggressive cost-cutting moves, it was no doubt that Showmax got the axe.

Regardless, it said, “Streaming remains central to our strategy. We will continue to invest in premium content, technology innovation and partnerships to deliver the best possible entertainment experience to our customers.”

Canal+ is looking to cut a combined €400 million by 2030, which will affect content.

NBCUniversal has a 30 per cent stake in Showmax as a joint venture. In its last annual results before the Canal+ takeover, MultiChoice revealed that Showmax’s trading losses had worsened by 88 per cent while revenue significantly declined.

According to the company, “The decision to axe Showmax was made by the Showmax board and reflects the continued focus of MultiChoice, a Canal+ company, on financial discipline and investment optimisation, in an increasingly competitive and capital-intensive global streaming environment.”

Since Canal+, as part of its agreement to take over MultiChoice, isn’t allowed to get rid of any staff for a period of three years, MultiChoice won’t let any Showmax staff go but will reassign them to other positions within the broader company.

MultiChoice has already started to quietly rebrand Showmax Originals as Africa Magic, M-Net, kykNET and Mzansi Magic Originals, with original series that will transition to these various DStv linear TV channels on the MultiChoice pay-TV platform.

Showmax’s closure comes two years after Amazon MGM Studios shocked Nigeria and South Africa’s creative community in January 2024 when it announced that it would stop commissioning any new local original content in Africa, and also ended already-existing development deals with a dozen production companies.

Brands/Products

Hypo Bleach Not for Drinking, But to Whiten Your White Fabric—Marketing Manager

By Modupe Gbadeyanka

The Marketing Manager of a leading bleach brand in Nigeria, Hypo Bleach, Mr Adebayo Adeyemo, has condemned the presentation of the brand as a beverage for trends, jokes, or views by influencers and bloggers.

In a statement, Mr Adeyemo said Hypo Bleach was formulated to “remove stains, whiten your white fabric, deodorise and kill 99.9 per cent of germs” and not produced as a “drink.”

“We have observed people seeming to have fun creating and sharing videos and AI-generated images designed to make Hypo look like a beverage.

“Your health and safety are serious business. We want to be unambiguous: those images are fabricated, that framing is false, and anyone encouraging others to consume Hypo, even as a joke, even for views, is putting lives at risk. It is not something to consume for the sake of trends,” the Marketing Manager stated.

He further said, “To every influencer, blogger, and content creator. Your reach is real; so is your responsibility. A trend that ends in ill-health is not a trend worth starting.”

“To every young Nigerian seeing this content, you do not have to prove anything to anyone. Not online. Not offline. Not ever. If someone is pressuring you to try this, that is not a dare. That is harm.

|If you or someone you know is struggling emotionally or feeling pressure they cannot handle, please reach out to someone you trust.

A guardian. A counsellor. A healthcare professional. Asking for help is not a weakness; it is a strength.

“Also, we urge people to prioritise their mental health. Evaluate the quality of your conversations with people. Should you notice inconsistencies in their thinking, encourage them to seek professional help. Depression is real and should be treated with utmost concern. Let’s keep social media fun, but safe,” Mr Adeyemo added.

Brands/Products

CMC Connect Plans Conference on AI in Reputational Risk Management

By Dipo Olowookere

A conference designed to examine how Artificial Intelligence (AI) is fundamentally reshaping crisis communication, institutional response systems, governance frameworks, and reputational risk management is slated to take place on Wednesday, March 25, 2026, in Lagos, at 10 am.

The event, planned by a renowned Public Relations (PR) firm, CMC Connect LLP, is themed Crisis Management in the AI Milieu: New Threats, Smarter Responses.

It is an offshoot of the company’s flagship industry initiative, Crisis Management Advocacy Month, scheduled to be held throughout March 2026.

The Minister of Communications, Innovation and Digital Economy, Mr Bosun Tijani, is expected to deliver the keynote address, while the Minister of Information and National Orientation, Mr Mohammed Idris Malagi, is the Special Guest of Honour.

Earlier in the month, the Vice President for Corporate Communications and CSR at Airtel Africa, Mr Emeka Oparah, will headline a closed-door media workshop convened exclusively for senior media executives in Lagos.

The 2026 edition will also feature strategic collaborations with the Nigerian Institute of Public Relations (NIPR) through its Monthly PR Clinics in both the Lagos and Abuja Chapters, where the Senior Corporate Communications Analyst at CMC Connect LLP, Ms Affiong Edet, will deliver a thematic presentation aligned with this year’s focus.

The initiative will also partner with the Nigerian Bar Association Section on Legal Practice through its weekly webinar series to interrogate the intersection of AI, Crisis Management, and the Law.

“Artificial Intelligence has fundamentally altered the crisis landscape. Crisis Management Advocacy Month 2026 is intentionally designed to convene cross-sector leaders to interrogate emerging risks, strengthen institutional preparedness, and promote smarter, ethical response architectures in an AI-driven environment,” the Project Coordinator, Ms Bright Emmanuel Okon, commented.

Also, the Lead Partner of CMC Connect LLP, Mr Yomi Badejo-Okunsanya, said, “In today’s digital ecosystem, crises evolve at unprecedented speed. Institutions must move beyond reactive communication toward intelligent crisis architecture. Crisis Management Advocacy Month represents our commitment to advancing national and institutional resilience in the age of AI.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn