Economy

FG Grants 10-Year Tax Incentive to Dangote

By Dipo Olowookere

A 10-year tax incentive has been granted to Dangote Group by the Federal Government after the company agreed to rehabilitate the Apapa to Oworonshoki Expressway.

Minister of Power, Works and Housing, Mr Babatunde Fashola, speaking on Friday at an event in Lagos, stated that, “We inherited a tax incentive policy for individuals to benefit from tax remission, to recover investment made in public infrastructure like roads, which other members of the public can utilise.”

Mr Fashola, who was a guest at the BusinessDay Road Construction Summit, Federal Government approved a review of the five-year limit on tax order enjoyed by the company to 10 years after Dangote agreed to work on the Apapa to Oworonshoki end of the Lagos-Ibadan Expressway.

Further explaining the rationale behind the upward review of the tax incentive, the Minister said, “The five-year limit on that tax order to a 10-year period (was) to sustain private investment in road infrastructure, because it is a long-term asset.”

According to him, pending applications from Dangote Group were not approved by the previous administration, but that this present administration has now approved them, stressing that work has commenced on the 42.9 km Obajana – Kabba road in Kogi State.

He added that on the agreement with Dangote, government was now awaiting the design of the 35km stretch excluding the portion that has been completed, about 7km, by the previous administration around Mile 2 area.

Mr Fashola noted that from the design, government will determine the cost and the scope of works which it hoped would be executed quickly.

He said government was committed to solving the Apapa and port congestion problem.

Furthermore, the Minister said government had reviewed the order by amending individual investment to include groups of individuals because not all potential investors can individually muster the resources alone but can do so as a group, and recover their pro-rated share.”

Mr Aliko Dangote is building an oil refinery in Lagos and has investments worth billions of Dollar across Africa. He is, according Forbes, Africa’s richest man.

Economy

Afriland Properties, Geo-Fluids Shrink OTC Securities Exchange by 0.06%

By Adedapo Adesanya

The duo of Afriland Properties Plc and Geo-Fluids Plc crashed the NASD Over-the-Counter (OTC) Securities Exchange by a marginal 0.06 per cent on Wednesday, December 11 due to profit-taking activities.

The OTC securities exchange experienced a downfall at midweek despite UBN Property Plc posting a price appreciation of 17 Kobo to close at N1.96 per share, in contrast to Tuesday’s closing price of N1.79.

Business Post reports that Afriland Properties Plc slid by N1.14 to finish at N15.80 per unit versus the preceding day’s N16.94 per unit, and Geo-Fluids Plc declined by 1 Kobo to trade at N3.92 per share compared with the N3.93 it ended a day earlier.

At the close of transactions, the market capitalisation of the bourse, which measures the total value of securities on the platform, shrank by N650 million to finish at N1.055 trillion compared with the previous day’s N1.056 trillion and the NASD Unlisted Security Index (NSI) went down by 1.86 points to wrap the session at 3,012.50 points compared with 3,014.36 points recorded in the previous session.

The alternative stock market was busy yesterday as the volume of securities traded by investors soared by 146.9 per cent to 5.9 million units from 2.4 million units, as the value of shares transacted by the market participants jumped by 360.9 per cent to N22.5 million from N4.9 million, and the number of deals increased by 50 per cent to 21 deals from 14 deals.

When the bourse closed for the day, Geo-Fluids Plc remained the most active stock by volume (year-to-date) with 1.7 billion units valued at N3.9 billion, followed by Okitipupa Plc with 752.2 million units worth N7.8 billion, and Afriland Properties Plc 297.5 million units sold for N5.3 million.

Also, Aradel Holdings Plc, which is now listed on the Nigerian Exchange (NGX) Limited after its exit from NASD, remained the most active stock by value (year-to-date) with 108.7 million units sold for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.5 million units worth N5.3 billion.

Economy

Naira Weakens to N1,547/$1 at Official Market, N1,670/$1 at Black Market

By Adedapo Adesanya

The euphoria around the recent appreciation of the Naira eased on Wednesday, December 11 after its value shrank against the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N5.23 or 0.3 per cent to N1,547.50/$1 from the N1,542.27/$1 it was valued on Tuesday.

It was observed that spectators’ activities may have triggered the weakening of the local currency in the official market at midweek as they tried to fight back and ensure the value of funds in foreign currencies strengthened.

The domestic currency was regaining its footing after the Central Bank of Nigeria (CBN) launched an Electronic Foreign Exchange Matching System (EFEMS) platform to tackle speculation and improve transparency in Nigeria’s FX market.

At midweek, the Nigerian currency depreciated against the Pound Sterling by N3.56 to close at N1,958.68/£1 compared with the preceding day’s N1,955.12/£1 and against the Euro, it slumped by 34 Kobo to trade at N1,612.66/€1, in contrast to the previous session’s N1,613.00/€1.

As for the black market segment, the Naira lost N45 against the American currency during the session to quote at N1,670/$1 compared with the N1,625/$1 it was traded a day earlier.

A look at the cryptocurrency market showed a recovery following profit-taking as the US Consumer Price Index report matched economist forecasts.

The news was enough to convince traders that the Federal Reserve is certain to trim its benchmark fed funds rate another 25 basis points at its meeting next week.

The move also saw Bitcoin (BTC), the most valued coin, return to the $100,000 mark as it added a 2.9 per cent gain and sold for $100,566.12.

The biggest gainer was Cardano (ADA), which jumped by 15.00 per cent to trade at $1.16, as Litecoin (LTC) appreciated by 10.4 per cent to sell for $121.76, and Ethereum (ETH) surged by 7.0 per cent to $3,929.30, while Dogecoin (DOGE) recorded a 6.7 per cent growth to finish at $0.4181.

Further, Binance Coin (BNB) went up by 5.2 per cent to $716.72, Solana (SOL) expanded by 4.6 per cent to $229.77, and Ripple (XRP) increased by 4.2 per cent to $2.43, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) closed flat at $1.00 apiece.

Economy

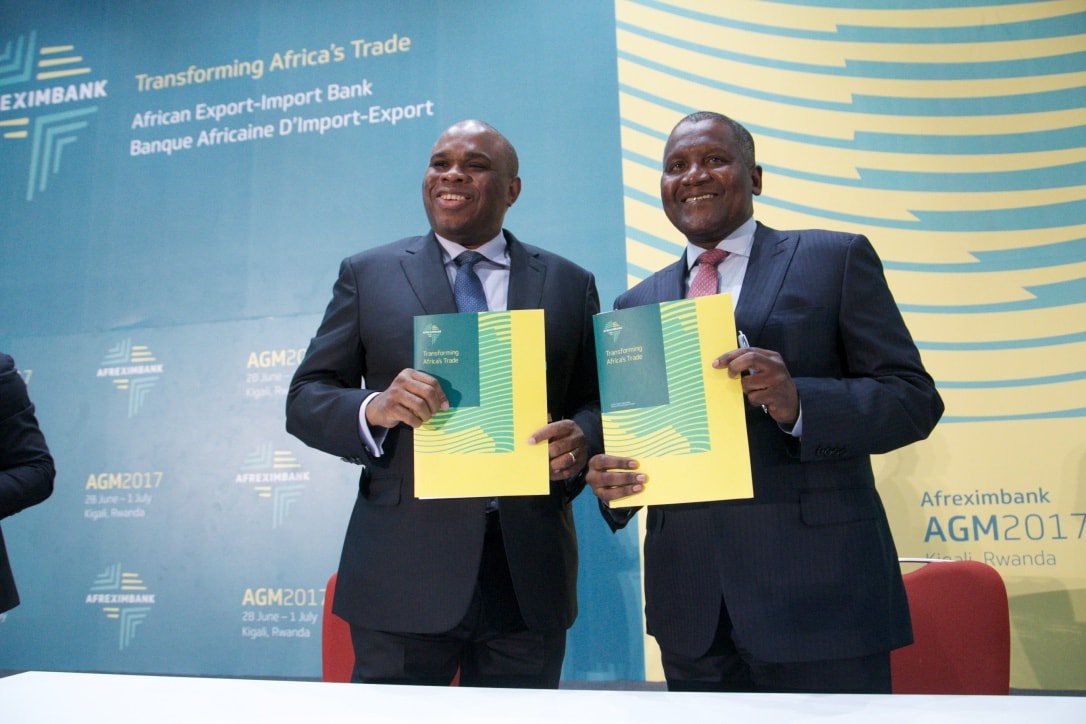

Dangote Refinery Makes First PMS Exports to Cameroon

By Aduragbemi Omiyale

The Dangote Refinery located in the Lekki area of Lagos State has made its first export of premium motor spirit (PMS) just three months after it commenced the production of petrol.

In September 2024, the refinery produced its first petrol and began loading to the Nigerian National Petroleum Company (NNPC) on September 15.

However, due to some issues, the facility has not been able to flood the local market with its product, forcing it to look elsewhere.

In a landmark move for regional energy integration, Dangote Refinery has partnered with Neptune Oil to take its petrol to neighbouring Cameroon.

Neptune Oil is a leading energy company in Cameroon which provides reliable and sustainable energy solutions.

Dangote Refinery said this development showcases its ability to meet domestic needs and position itself as a key player in the regional energy market, adding that it represents a significant step forward in accessing high-quality and locally sourced petroleum products for Cameroon.

“This first export of PMS to Cameroon is a tangible demonstration of our vision for a united and energy-independent Africa.

“With this development, we are laying the foundation for a future where African resources are refined and exchanged within the continent for the benefit of our people,” the owner of Dangote Refinery, Mr Aliko Dangote, said.

His counterpart at Neptune Oil, Mr Antoine Ndzengue, said, “This partnership with Dangote Refinery marks a turning point for Cameroon.

“By becoming the first importer of petroleum products from this world-class refinery, we are bolstering our country’s energy security and supporting local economic development.

“This initial supply, executed without international intermediaries, reflects our commitment to serving our markets independently and efficiently.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN