Economy

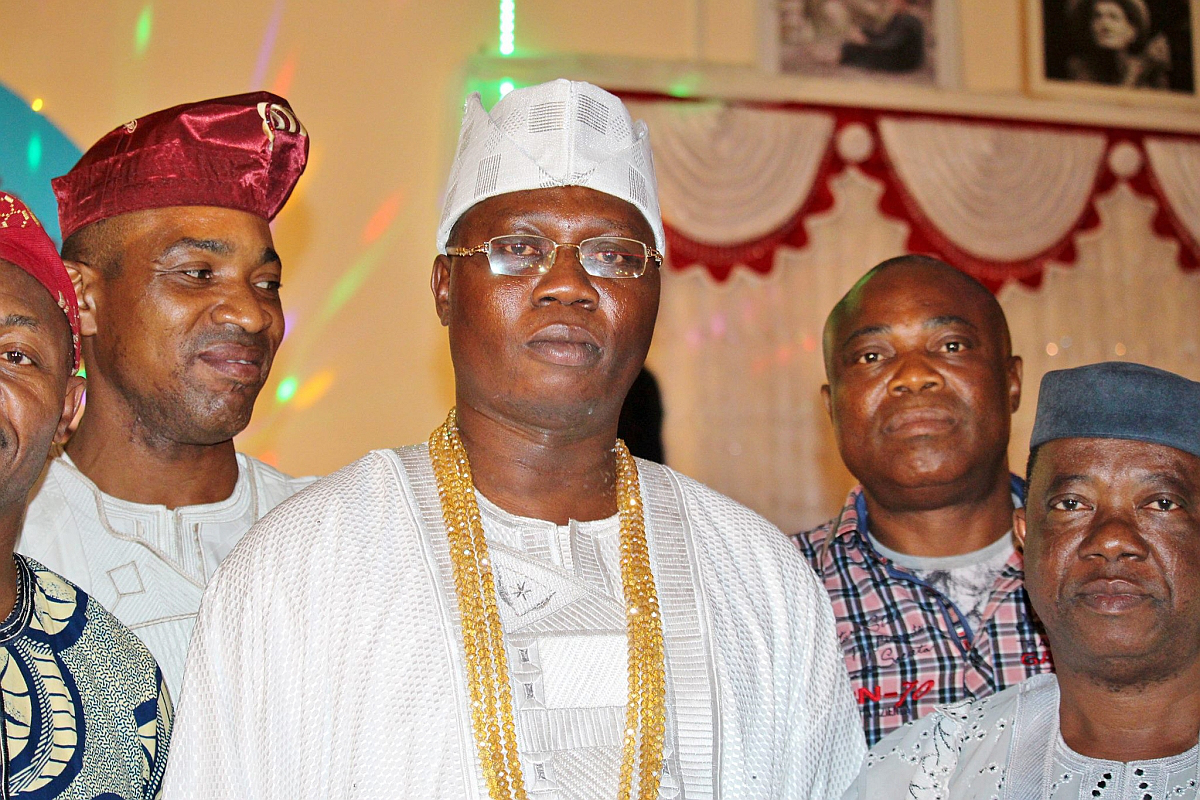

Gani Adams to Launch OPC Investment Arm

By Modupe Gbadeyanka

National Coordinator of the Oodua People’s Congress (OPC), Otunba Gani Adams, has revealed that an investment arm of the ethnic organization would be launched in the coming months.

Speaking during the week at the National Coordinating Council Meeting of Ikorodu West Chapter in Lagos, Mr Adams said a 700-seater capacity ultra-modern event centre would be commissioned in Mushin area of Lagos next month.

The OPC leader also said before the end of the year, a 3-star hotel belonging to the OPC would be commissioned in Abeokuta, Ogun state capital and a befitting 3-storey secretariat in the heart of Ikeja, Lagos state capital would also be unveiled.

“I am glad to announce to you that next month (October), we will commission our 700-seater capacity event centre in Mushin.

“Also before the end of the year, we will commission a 3-star hotel in Abeokuta and 3-storey secretariat in Ikeja,” Mr Adams declared, receiving rousing cheers from OPC leaders, members and other eminent dignitaries who graced the occasion.

He said the group could muster the enormous resources for the investments due to financial management dexterity and discipline of leadership of OPC.

Mr Adams said if he had yielded to the intense pressure from some elements within the OPC who insisted on sharing the proceeds from the pipeline protection contract awarded to the group by the previous government, OPC would not have had any investments.

He said contrary to the erroneous views people hold about OPC, he said the organization is peopled by responsible men and women who are patriotic and God-fearing.

He said politicians who maliciously labelled OPC as a violent, ethnic militia group were the real sponsors of violence and patrons of thugs.

According to him, they can hardly gathered 1000 people without pandemonium.

On the just concluded Yoruba Summit held in Ibadan, the OPC National Coordinator said he had never witnessed such gathering that paraded the array of finest, illustrious sons and daughters of Yoruba land since he became social and cultural justice crusader in 1993.

Mr Adams said those who condemned the far-reaching resolutions of the summit were enemies of the Yoruba race adding that were collaborators with those who were hell-bent in frustrating the collective destiny of the Yoruba nation.

He insisted that regionalism remains the viable form of government that will accelerate the growth of each region and eliminate the mutual suspicion which fuels tension and strife among various ethnic nations comprising Nigeria.

Mr Adams recalled that incursion of the military into Nigeria’s political space in 1966 disrupted the structure that would ensure harmony among the people of Nigeria. He said it was at that period that the western Nigeria witnessed its best developments.

He said, “After 1957 when Chief Obafemi Awolowo built Cocoa House, the first 25-storey building in Africa, no governor has achieved anything close to that feat ever since. We must go back to regionalism”.

Apparently referring to those accusing proponents of restructuring and true federalism of being sponsored, Mr Adams said nobody can buy his conscience not even with whopping N3 billion.

Economy

FG Unveils Industrial Policy to Raise Manufacturing Contribution to 25%

By Adedapo Adesanya

The federal government plans to boost the manufacturing sector’s contribution to the Nigerian economy to 15 per cent by 2030 and 25 per cent by 2035, from its current 8.2 per cent.

This was revealed in the newly launched Nigeria Industrial Policy (NIP), which was unveiled by the Federal Ministry of Industry, Trade and Investment (FMITI).

According to data, the sector employs 13 million Nigerians, mainly in food processing, cement production, textiles, pharmaceuticals, and the automotive industry.

The FG stated that the aim of NIP frameworks is “to drive economic growth, reduce dependence on oil exports, and promote sustainable development” and contribute to achieving Nigeria’s aspiration of attaining the $1 trillion economy by 2030.

The government said the plan would “accelerate Nigeria’s industrial transformation by leveraging its natural and human capital to promote inclusive, sustainable, and competitive manufacturing, deepen economic diversification, and generate mass employment through innovation, infrastructure development, investment, and export.”

It explained that the policy direction of its NIP is anchored on the development of four sectors, namely metals and solid minerals, oil and gas, construction, and manufacturing.

Over the past decade, the agro-allied industry has contributed an average of 25 per cent (27 per cent rebased) to Nigeria’s real GDP and currently accounts for 35 per cent of total employment. It serves as a primary source of raw materials for key manufacturing sectors, including food processing, leather goods, and textiles, reinforcing its pivotal role in driving industrial linkages and inclusive economic development.

The report noted, however, that the industry faces challenges such as limited mechanisation and outdated farming techniques, post-harvest losses, and insecurity.

The government assured that relevant legal and institutional frameworks are in place to address key challenges such as inadequate power supply, low access to finance, and competition from cheap imported products, limiting the performance of the sector.

The Minister of State, FMITI, Mr John Owan Enoh, described the NIP as “a comprehensive framework that reaffirms our national resolve to diversify the economy, create inclusive prosperity, and secure Nigeria’s rightful place as a leading industrial hub in Africa and the wider global economy.”

The government said that each of the four sectors comprises multiple sub-sectors that offer strategic opportunities for industrial development.

“These sectors have been prioritised due to strong comparative advantages, potential to generate large-scale employment, and deepen local value addition and expand exports.

“The future outlook for the industry is bright with abundant natural resources, massive investment in the development of Special Economic Zones (SEZs), the growing market size, and participation of Nigeria in AfCFTA and ECOWAS Trade Liberalisation Scheme (ETLS)”, the report added.

Economy

Financial Inclusion Drives Economic Growth—Smartcash CEO

By Dipo Olowookere

The chief executive of Smartcash Payment Service Bank (PSB), Mr Ayotunde Kuponiyi, has stressed the importance of financial inclusion to any nation’s economy.

Speaking with journalists in Lagos on Tuesday, he said the country will always experience economic growth when the majority of its citizens are financially included.

According to him, this is why the Central Bank of Nigeria (CBN) has intensified its efforts to drive financial inclusion in the country to about 80 per cent.

“Financial inclusion is important because when 80 per cent of your population is included financially, it then ensures growth in the economy,” he said at the unveiling of the nationwide marketing campaign of Smartcash titled No Be Cho Cho Cho.

“We have about 40 million or 50 million Small and Medium Enterprises (SMEs) in Nigeria, and a number of them don’t have bank accounts, but when they are included financially, they have access to finance, borrowing, and then grow their income.

“As the industry grows, they employ more hands (job creation), and when this happens, the government earns more revenue from taxes paid by the employed persons, which the government then uses to improve the standard of living of the citizens. Infrastructure will also be provided by the government. This is why financial inclusion is extremely important,” Mr Kuponiyi stated.

Commenting on the new campaign, the Smartcash boss said it reflects a broader philosophy of accountability in digital finance, with the zero-charge model, which eliminates fees on transfers and bill payments.

“Through our flagship zero-charge service, we promise no fees on P2P transfers or bill payments. Furthermore, our savings account offers 15 per cent per annum compounded interest, paid daily without penalties. Unlike conventional banks, we charge you nothing, ensuring your money truly works for you,” he averred, stressing that the zero-fee does not apply to the stamp duty charged by the federal government on transactions above N10,000.

He stated that the initiative centres on the three pillars of reliability, transparency and demonstrable service delivery and addresses what the company describes as a widening trust gap in Nigeria’s digital payments market.

Mr Kuponiyi also revealed that beyond consumer banking, the platform is also expanding its footprint through a nationwide network of agents that facilitate transactions and financial services in underserved communities.

Smartcash is the digital financial services platform of Airtel Nigeria, which is a subsidiary of Africa Plc, operating across 14 countries.

Economy

Oil at $85 Could Boost Nigeria’s External Balance Account—Bloomberg

By Adedapo Adesanya

Nigeria has been identified as one of the winners of an oil windfall following the US and Israel’s war on Iran.

According to Bloomberg Economics, the rise in prices will improve the current account balance of just three sub-Saharan African economies.

Bloomberg Economics’ Ms Yvonne Mhango wrote in a report on Thursday that if oil stays at about $85 a barrel, Angola, Nigeria and Ghana will see their current account balance improve, while the Democratic Republic of Congo, South Africa and Kenya will be among the worst-hit.

“For most African economies, higher oil prices mean weaker currencies and renewed inflationary pressure, which could put rate hikes back on the table,” she said.

According to the analyst, Nigeria, which is Africa’s largest oil producer, will not only gain from crude sales but from fuel exports.

Bloomberg Economics data showed that Nigeria’s current account balance could benefit by as much as 2.3 per cent of gross domestic product (GDP), second only to Angola’s 3.3 per cent and Ghana’s 0.2 per cent.

Already, the 650,000-barrel-a-day Dangote oil refinery has raised the prospect of sending more product to Europe if the price is right.

Dangote is offering up to 44,000 metric tons of jet fuel for loading March 20-22, as well as at least 40,000 tons of gasoil with a maximum sulphur content of 50 parts per million for loading March 15-30.

However, countries like Africa’s largest economy – South Africa – may face challenges if India and Oman, two of its biggest fuel suppliers, cut down on exports. It may see a -1.0 per cent hit to its current account balance.

South African consumers are bracing for fuel costs to increase in April, according to Central Energy Fund data, while traders moved to price in a chance of an interest-rate hike later this month.

Following US and Israeli strikes on Iran over the weekend and retaliatory moves by the Islamic Republic, global crude prices have adjusted sharply.

The Strait of Hormuz, a narrow shipping lane between Iran and Oman, through which roughly a fifth of global oil supply normally passes, has been blocked completely by Iran.

As of press time, Brent crude, which Nigeria prices its crudes is trading up at 2.3 per cent at $83.23. Nigerian crude grades, Brass River and Qua Iboe, are selling at $87 per barrel.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn