Economy

Nigeria Raked $32.6bn from Oil/Gas in 2018—Audit

Adedapo Adesanya

Nigeria achieved a 55 percent increase in earnings from the oil and gas sector in 2018, the Nigerian Extractive Industries Transparency Initiative (NEITI) has announced.

In a statement signed by the agency’s Director, Communications and Advocacy, Mr Orji Ogbonnaya Orji, it was disclosed that inflows gotten from the sector amounted to $32.6 billion compared to $20.9 billion recorded on 2017.

NEITI added in its latest oil and gas industry audit that $16.6 billion of the payments were made from companies, while the balance of about $16 billion was from sales of crude oil and gas.

The report showed that in the last five years, there was an inflow of $24.8 billion in 2015, which represents a 54.6 percent decrease when compared to the $54.6 billion that was achieved in 2014 which further dropped by 31.2 percent to $17.1 billion in 2016 when the country entered into a recession due to oil price crash.

In 2017, there was a recovery as it increased by 23 percent to $20.9 billion in 2017 and to $32.6 billion in 2018.

It was disclosed that a total sum of $19.9 billion was transferred directly to the federation account from the total sum earned in 2018, while $5.21 billion and $4.04 billion were transferred into Joint Venture (JV) Cash Call Account and Nigerian National Petroleum Corporation (NNPC) designated accounts respectively.

It was further added that $2.1 billion and $1.4 billion were transferred to third parties project financing accounts and subnational transfers respectively.

According to the report, the total crude oil produced for 2018 was 701 million barrels, which signifies a 1.5 percent increase when compared with the 690 million barrels achieved in 2017.

NEITI noted that a sum of N2.2 trillion was realized as proceeds from sales of domestic crude oil allocation in 2018, out of which N28.3 billion were dreducted for crude and product losses; N138.95 billion for pipeline repairs and maintenance cost; and N722.3 billion as fuel subsidy.

Total crude oil losses due to theft and sabotage in 2018 totaled 3.3 million barrels as against the 16.8 million barrels recorded in 2017.

Oil and gas industry contributed 7.8 percent to the Gross Domestic Product (GDP) in 2018. It contributed $19.1 billion in absolute terms to exports in 2018. This represents 30% of the total exports of $62.5 billion.

NEITI has also announced plans to release the 2019 audit report this year so it can clear the backlogs of audits of the extractive sector and subsequently making the reports more timely and relevant.

Economy

Nigeria’s Non-Oil Exports Grow 24.75% to $1.791bn in Q1 2025

By Adedapo Adesanya

The Nigerian Export Promotion Council (NEPC) has announced a 24.75 per cent increase in the value of the country’s non-oil exports, reaching a total of $1.791 billion in the first quarter of 2025.

It stated that the amount surpassed the $1.436 billion generated in the first quarter of 2024.

The Executive Director of the council, Mrs Nonye Ayeni, disclosed the figures while addressing the journalists in Abuja on Monday.

She said the significant growth reflects the resilience and diversification of Nigeria’s export sector beyond crude oil, a shift aimed at reducing the country’s reliance on oil revenue.

According to her, the surge in non-oil exports was driven by increased economic activity in the Agriculture, Manufacturing, and Solid Minerals sectors.

On the US 14 per cent trade tariff, the council says it was positive for the country, adding that it was an opportunity to focus on value addition and increased competitiveness in the global market.

Recall that Nigeria has reiterated plans to boost its non-oil revenues with the Minister of Industry, Trade and Investment, Mrs Jumoke Oduwole, saying the country was stepping up its diversification efforts.

Earlier this month, the Trade Minister said the nation would tackle this challenge with pragmatism, aiming to boost non-oil exports and strengthen economic resilience under President Bola Tinubu’s Renewed Hope Agenda.

Mrs Oduwole had said the US remains a key partner, with bilateral trade reaching N31.1 trillion from 2015 to 2024.

The measures taken by the US presents destabilising challenges to price competitiveness and market access, especially in emerging and value-added sectors vital to our diversification agenda,” the minister explained.

“Government is implementing a range of interventions in policy, financing, infrastructure, and diplomacy to help Nigerian businesses remain competitive amidst regional and global tariff hikes,” Mrs Oduwole said as she outlined Nigeria’s response.

Economy

Nigeria Missing in Top 10 Safest Countries for Foreign Investment List

By Dipo Olowookere

A new report which listed the Top 10 Safest Countries for Foreign Investment has excluded Nigeria despite the efforts of the administration of President Bola Tinubu to make the country the preferred place to do business.

Since assuming office on May 29, 2023, Mr Tinubu has carried out some economic reforms aimed to attract investors to Nigeria, including the liberalisation of the foreign exchange (FX) market, removal of petrol subsidy, and streamlining the tax regime, among others.

In a recent study by Atmos, top 30 countries were identified based on economic stability, investment attractiveness, and political and economic stability.

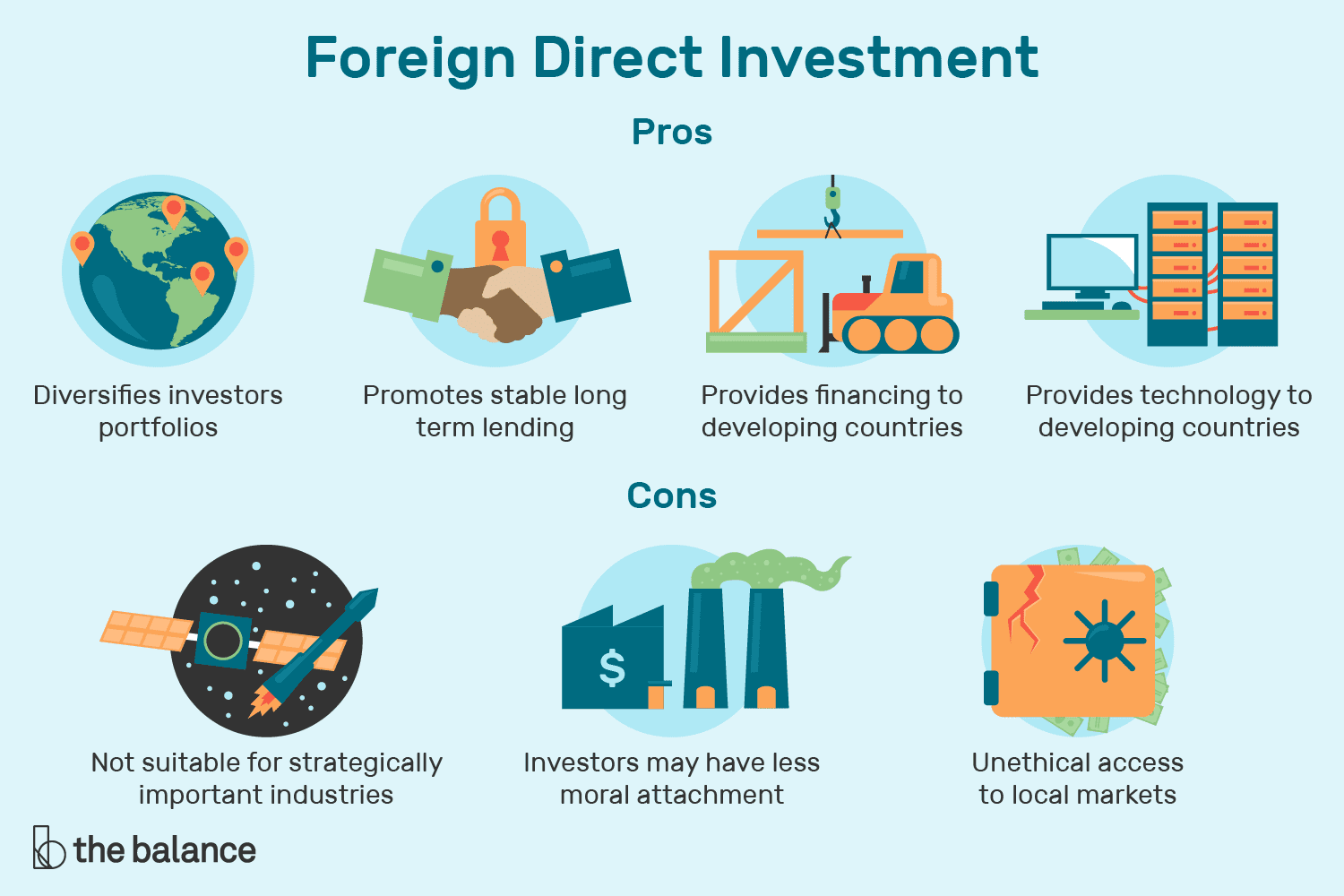

In the outcome of the research made available to Business Post on Monday, it was stated that countries were evaluated using six metrics: economic stability rank, political stability score, global peace index, investment attractiveness, foreign direct investments (FDI), and GDP per capita. These metrics were ranked, with the top country receiving a score of 100.

“When evaluating investment potential, it’s clear that economic strength alone doesn’t paint the full picture.

“Political stability and a peaceful environment are equally essential in fostering a climate that attracts long-term investment. Investors are drawn to countries where risks are minimized and confidence in future growth is high, making these factors just as critical to a nation’s financial appeal,” the chief executive of Atmos, Mr Nick Cooke, stated.

Switzerland led the ranking as the lowest risk country to invest in, with a score of 100. It featured exceptional economic fundamentals and the highest GDP per capita among the top-ranked countries at nearly $100,000. Switzerland demonstrates balance across all metrics, ranking 2nd in economic stability while maintaining excellent political stability (1.07) and peace index scores (1.33).

Singapore followed in 2nd with a score of 90.21, standing out with the highest investment attractiveness (82.4) among the top three nations and exceptional foreign direct investment inflows of over $175 million, outperforming Switzerland in this metric. The city-state’s strategic position in Southeast Asia, combined with its second-place economic stability ranking, creates a powerful investment hub. Singapore’s global peace index of 1.3 is the best among all ranked countries, reflecting its excellent security environment.

The third of the list was Canada with a score of 89.53, demonstrating exceptional investment attractiveness (86.6) and solid political stability (0.82). Canada’s balanced approach to foreign investment has resulted in substantial foreign direct investment (FDI) inflows exceeding $47 million, positioning it as a reliable North American investment alternative. The country maintains strong economic fundamentals, offering a reasonable GDP per capita of $53,431.

Japan ranked 4th with a score of 88.77, featuring the highest investment attractiveness score (86.8) among all countries in the index. The Asian country has an excellent political stability (0.951) and a strong peace index rating (1.33), creating a secure environment for foreign capital. Despite having a lower GDP per capita than other top-five nations at $33,766, Japan’s economic resilience and technological innovation continue to attract nearly $20 million in foreign investments.

The 5th place was occupied by Germany with a score of 86.32. As Europe’s largest economy, Germany maintains excellent economic stability (ranked 3rd), following Switzerland and Singapore, and a strong investment attractiveness (84.6). With GDP per capita exceeding $54K and foreign direct investments approaching $20 million, Germany represents the centerpiece of European investment security.

Denmark is the 6th-lowest risk country to invest in, with a score of 84.38, featuring an impressive GDP per capita of $68,453 and excellent political stability (0.85). Denmark’s peace index of 1.3 places it among the safest nations globally, though its relatively modest FDI figures of $4.5 million reflect its smaller market size. The Nordic nations’ consistent economic policies and transparent business environment remain key strengths for investors seeking stability.

In the 7th, Australia scored 84.08, balancing strong political stability (0.921) with excellent investment attractiveness (81.9). Australia has attracted substantial foreign direct investments exceeding $32.5 million, second only to Singapore among the top ten countries. Australia has attracted $32.5 million in foreign investments, substantially higher than Denmark and second only to Singapore. It also offers a GDP per capita of $64,820 with a relatively stronger peace index (1.525) compared to several preceding countries.

Norway was in 8th with a score of 82.44. With the second-highest GDP per capita at $87,925, Norway only trails Switzerland in this metric. It maintains solid political stability (0.89) and investment attractiveness (78.8), though its economic stability rank (11th) is the lowest among the top ten countries. The Nordic nation has attracted over $10.7 million in foreign investments despite its relatively small market size.

The United Arab Emirates took the 9th position with a score of 80.71, claiming the top position in economic stability among all countries in the index. The UAE combines this economic strength with moderate political stability (0.681) and substantial foreign investments exceeding $22.3 million. At the same time, its relatively weaker peace index score (1.979) and lower investment attractiveness (59.6) compared to other top nations prevent a higher overall ranking.

The 10th spot was grabbed by New Zealand with a score of 76.96, featuring excellent peace index ratings (1.31) but faces challenges with its economic stability ranking (18th) and modest foreign investment inflows of $3.59 million. The country’s investment attractiveness score of 63.0 is significantly lower than that of other top-ranked nations, reflecting its geographical isolation and smaller market size.

Economy

NASD Exchange Drops 0.53% in Week 17 of 2025 Amid High Trading Volume

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange decreased by 0.53 per cent on a week-on-week basis in Week 17 of the 2025 trading year.

This depleted the market capitalisation of the bourse by N10.14 billion in the four-day trading week to N1.914 trillion from the N1.924 trillion recorded in the previous week and the NASD Unlisted Securities Index (NSI) slid by 17.32 points to 3,269.06 points from the 3,286.38 points posted in Week 16.

There were only four trading days last week due to the Easter break stretching into the new week, though the market witnessed a higher turnover.

The volume of securities bought and sold by the market participants soared by 293,055.9 per cent to 3.9 billion units from the 1.33 million units recorded a week earlier, and the value of shares skyrocketed by 33,661.6 per cent to N9.9 billion from the N29.35 million achieved in the preceding week.

The most traded security by value for the week was Infrastructure Credit Guarantee (InfraCredit) Plc with N9.5 billion, Geo-Fluids Plc recorded N355.4 million, FrieslandCampina Wamco Nigeria Plc traded N7.2 million, Central Securities Clearing System (CSCS) Plc transacted N3.8 million, and Afriland Properties Plc posted N2.5 million.

Also, InfraCredit Plc was the most traded instrument by volume with 3.7 billion units, Geo-Fluids Plc transacted 207.7 million units, UBN Property Plc recorded 1.04 million units, FrieslandCampina Wamco Nigeria Plc traded 0.201 million units, and CSCS Plc exchanged 0.178 million units.

Five securities ended on the losers’ table, with FrieslandCampina Wamco Nigeria Plc leading after shedding 6.0 per cent to end at N35.37 per share compared with the previous week’s N37.64 per share.

Further, 11 Plc fell by 3.8 per cent to close at N236.25 per unit versus N245.50 per unit, UBN Property Plc lost 3.2 per cent to trade at N2.10 per share versus N2.17 per share, CSCS Plc declined by 1.8 per cent to N21.71 per unit from N22.10 per unit, and Afriland Properties Plc slumped by 0.1 per cent to N17.78 per share from N17.80 per share.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN