Economy

Selling Pressure Dominates Bond Market Monday

By Dipo Olowookere

The bond market was dominated by selling pressure in the first trading day of the new month on Monday as the bearish sentiments continued.

It was observed that initial selloffs from some offshores mostly on the 2027s and 2034s widened spreads significantly at the start of the trading session.

At the market yields advanced across most instruments, except for the JAN-2022, JUN-2019 and OCT-2019 which recorded yield declines.

Consequently, the average bond yield increased by 0.05 percent, to peg at 14.90 percent at the close of trades.

There was also some moderation in yields later in the day, following some bargain hunting by local clients on the mid tenor bonds.

The yields are expected to remain at these levels in the near term, barring a hike in OMO auction rates by the Central Bank of Nigeria (CBN) later this week.

Economy

ADC Laments Tinubu’s “Dangerous Obsession With Borrowing”

By Aduragbemi Omiyale

The new major opposition political party in Nigeria, the African Democratic Congress (ADC), has accused the administration of President Bola Tinubu of “fiscal vandalism” because of its “dangerous obsession with borrowing.”

The group, in a statement signed by its National Publicity Secretary, Mr Bolaji Abdullahi, said the National Assembly is also not helping to checkmate the President on this borrowing spree.

The party, while reacting to the approval of the $21 billion foreign loan request of Mr Tinubu a few days ago, said the country’s public debt could go beyond N200 trillion before the end of 2025, with nothing to show for it, demanding a full disclosure of all loan agreements signed over the past 10 years, insisting that Nigerians have a right to know the terms, interest rates, payment timelines, and final recipients of the loans.

“The ADC is deeply concerned by the Tinubu administration’s dangerous obsession with borrowing.

“What Nigerians are witnessing, following the approval of a fresh $21 billion in foreign loans is nothing short of a calculated decision to mortgage the country’s future just to cover up the failures of today,” the opposition party stated.

It further said, “Under President Buhari, Nigeria borrowed an average of N4.7 trillion per year, and even that caused widespread concern. But under President Tinubu, borrowing has jumped to N49.8 trillion per year. In just two years, this administration has borrowed more than ten times what Buhari borrowed in the same timeframe.

“At this rate, Nigeria’s total public debt will crash through N200 trillion before the end of the year. We are speeding toward a financial cliff, and those in charge seem to have no brakes, thinking they can borrow their way out of economic problems that require more thoughtful actions and greater fiscal discipline.

“Supporters of this government like to argue that Tinubu’s borrowing is smaller in dollar terms, just $1.7 billion annually, compared to Buhari’s $4.15 billion. But that argument collapses the moment we look at the exchange rate.

“With the Naira now in free fall, again thanks to this administration’s poor police choices, these same loans are costing the country far more. When converted to Naira, Tinubu’s foreign borrowing amounts to N25.5 trillion every year, more than Buhari’s annual average of N2.2 trillion. What we are witnessing is the deepening of a debt trap created by economic mismanagement and a collapsed currency.”

“Over $35 billion has been borrowed from external lenders alone in the last decade of the APC. This is nearly 12 times more in just 10 years.

“Our debt to the World Bank has tripled. What we owe in Eurobonds has grown eleven times over. And now, this government wants to borrow even more, pushing our foreign debt ceiling to $67 billion.

“This reckless borrowing, repeated year after year, with no plan to repay it, and no effort to use it productively, will leave our children repaying debts that they did not incur or benefit from.

“The debts have continued to mount, but infrastructures have remained poor, universities are still grossly underfunded, hospitals are still ill-equipped and electricity supply are as poor as ever.

“So, what exactly are these loans used for? This is the question that Nigerians expect the National Assembly to ask. Instead, it has continued to approve these loans without asking the hard questions, without demanding a plan, and without standing up for the Nigerian people.

“According to the Association of Small Business Owners of Nigeria, the cost of Tinubu’s borrowing is already crushing the very backbone of our economy.

“Small businesses can no longer access credit. Investors are losing confidence and pulling out. And because over 60 percent of our national income is now used to service debt, the government is turning to ordinary Nigerian families and taxing them beyond their limits.

“While other countries are fighting to reduce their debts, the APC is taking out more loans. The recent devaluation of the naira should have reduced the need for external borrowing, but instead, the government has treated it as an excuse to borrow even more,” the statement said.

Economy

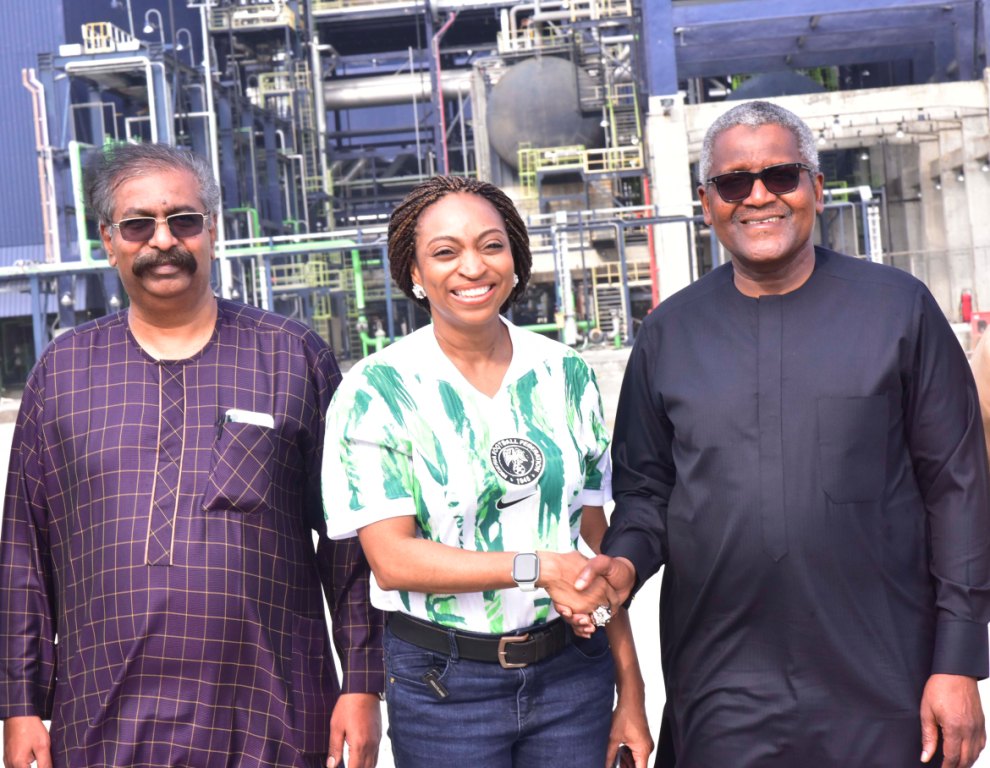

Tinubu’s Policies Restoring Investor Confidence in Nigeria’s Economy—Dangote

By Modupe Gbadeyanka

President Bola Tinubu has been praised for restoring investor confidence in the economy of Nigeria through his economic policies like the new tax laws, foreign exchange (FX) liberalisation, fuel subsidy removal and others.

The president of Dangote Group, Mr Aliko Dangote, said over the weekend that the Naira-for-Crude initiative and the Nigeria First policy were also bold and transformative steps of the current administration capable of revitalising the economy faster than expected.

“I believe we must sincerely thank His Excellency, President Bola Ahmed Tinubu, for ensuring that there have been improvements in the supply of crude oil. His insistence that all crude oil transactions be conducted in naira has been particularly commendable.

“For us to effectively meet market demand—which we can do—it is essential that crude is priced and purchased in our local currency,” Mr Dangote said when he received the Minister of Industry, Trade and Investment, Ms Jumoke Oduwole, at the $20 billion Dangote Petroleum Refinery and Petrochemicals and Dangote Fertiliser Limited in Lagos.

The businessman also disclosed that the reforms have brought a measure of stability to the naira-to-dollar exchange rate, expressing optimism that the local currency will continue to strengthen in the coming weeks as the effects of the reforms become more visible.

According to him, the improved market predictability has helped investors make sound business decisions and restored confidence in the investment climate.

“We are also beginning to see some stability in the naira-to-dollar exchange rate, which has had a positive impact. There is now less fluctuation, and this has brought a degree of predictability to the market

“For those of us in the business sector, this is a welcome development, as it allows us to plan more effectively. Looking ahead, as market conditions continue to improve, we can expect to see a more favourable exchange rate,” he said

The leading industrialist also commended the federal government for establishing a One-Stop Shop (OSS) initiative to improve coordination among regulatory and security agencies, thereby facilitating smoother operations under the Naira-for-Crude programme.

He emphasized that the OSS had significantly reduced bottlenecks and enabled the real-time resolution of issues, in line with President Tinubu’s directive.

“At present, we are not experiencing any significant issues with loading. All the relevant agencies have been brought together under one roof, including the Navy, NIMASA, NPA, and others. This coordination has greatly improved efficiency. Whenever issues arise, they are promptly addressed through the leadership of the Chairman of the Technical Committee, Mr Zack Adedeji, who is doing an excellent job,” he stated.

The business magnate further disclosed that the refinery is set to launch a new initiative involving the deployment of 4,000 CNG (Compressed Natural Gas) tankers to distribute petroleum products more efficiently and in an environmentally friendly manner. He explained that the move would reduce logistics costs and ensure Nigerians receive products at more affordable prices, closer to their locations.

On her part, the Minister reaffirmed the government’s commitment to promoting domestic investment and addressing the challenges faced by local investors.

“We are here today as a result of President Bola Ahmed Tinubu’s clear focus on domestic investment. As you are aware, we held a Domestic Investment Summit on Monday—the first of its kind. Today, we are gathered at the invitation of Aliko Dangote, a leading investor who has committed an extraordinary amount of resources to Nigeria’s development,” she said.

The Minister hailed the refinery as a landmark project, noting that even governments shy away from initiatives of such scale. She said the administration is demonstrating real support for domestic investors by taking practical steps to reduce constraints and foster growth.

“He has taken on a project of such magnitude—one that even governments often hesitate to undertake. As an administration, we do not take this lightly. We are here to show our full support for him, both as a foremost domestic investor and as a prominent champion of African investment on the global stage.

“Our support is not limited to words; we are demonstrating our commitment through action. We are encouraging other domestic investors by recognising and backing those, like Alhaji Dangote, who put Nigeria first. This is not mere rhetoric—our time, attention, and effort are fully aligned with our priorities,” she said.

Economy

Access Holdings, UBA, Japaul Account for 20.19% of NGX Weekly Trading Volume

By Dipo Olowookere

At the Nigerian Exchange (NGX) Limited last week, the trio of Access Holdings, United Bank for Africa (UBA), and Japaul Gold and Ventures respectively accounted for 20.19 per cent and 17.33 per cent of the total volume and value of shares traded by investors, with 745.391 million units valued at N19.457 billion in 15,720 deals.

According to data, the market participants bought and sold 3.691 billion equities worth N112.261 billion in 138,250 deals compared with 17.498 billion equities valued at N500.762 billion transacted in 142,082 deals a week earlier.

It was observed that the financial services industry led the activity chart with 2.127 billion stocks valued at N47.298 billion traded in 57,121 deals, contributing 57.62 per cent and 42.13 per cent to the total trading volume and value, respectively.

The agriculture sector followed with 273.694 million shares worth N12.872 billion in 11,284 deals, and the energy counter transacted 255.144 million shares worth N11.808 billion in 10,706 deals.

Sixty stocks gained weight in the week versus 49 stocks recorded in the preceding week, 43 equities depreciated compared with 54 equities a week earlier, and 44 shares closed flat, in contrast to the 44 shares reported in the previous week.

The Initiates topped the advancers’ group after it chalked up 60.82 per cent to trade at N16.13, Academy Press grew by 33.00 per cent to N9.31, Nigerian Enamelware improved by 32.68 per cent to N27.00, Wema Bank expanded by 23.60 per cent to N19.90, and Presco gained 22.53 per cent to end at N1,550.

On the flip side, Secure Electronic Technology declined by 23.97 per cent to 92 Kobo, Omatek slumped by 23.93 per cent to N1.24, Meyer plunged by 21.43 per cent to N16.50, Neimeth crumbled by 19.25 per cent to N6.50, and ABC Transport slipped by 18.76 per cent to N4.59.

At the close of transactions, the All-Share Index (ASI) and the market capitalisation appreciated by 2.18 per cent to 134,452.93 points and N85.055 trillion, respectively.

Similarly, all other indices finished higher except the ASeM index, which closed flat.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN