Economy

CACOL Defends Corruption Petition Against Suspended SEC DG

By Dipo Olowookere

A non-political, non-religious, and non-profit making organization, Centre for Anti-Corruption and Open Leadership (CACOL), which filed a petition to the Economic and Financial Crimes Commission (EFCC) against the suspended Director General of Securities and Exchange Commission, Mr Mournir Haliru Gwarzo, has visited the anti-graft agency to defend its allegations against the SEC boss.

A statement signed on Monday by the Executive Chairman of CACOL, Comrade Debo Adeniran, disclosed that the visit was sequel to an invitation to the group by the EFCC on the petition of corruption levelled against Mr Gwarzo.

It was gathered that Mr Adeniran spent about an hour at the EFCC’s office in Abuja, where he met with the Head of investigating team at the Capital Market Unit of the EFCC.

“We responded to the invitation of the Economic and Financial Crimes Commission, EFCC today (Monday) to adopt (defend) our petition against Mr Gwarzo.

“We are delighted that the EFCC responded promptly, and is enthusiastic to investigate the subject of our petition. We intend to follow through with this process and we will not be distracted by all the attempts by Mr Gwarzo and his cronies to make us back down drawing on absurd and unconnected straws to whip up sentiment in the media.

“Those who know us know we do not just take up a cause, when we do, we are tenacious in our pursuit and we approach our campaigns with independence of mind,” the CACOL boss was quoted as saying in the statement.

Mr Adeniran further disclosed that the allegations against Mr Gwarzo have been before various people in government for months unattended to until CACOL took up the issue.

“We commend the Finance Minister, Mrs Kemi Adeosun for the courage to take the issue up after others have looked the other way for months. We urge her to be steadfast in the face of various attempts to blackmail her into dropping the investigations into the allegations.

“If she musters the tenacity to follow through on this investigation as she did with fighting the cabal behind the ghost workers who almost bled the nation to death with false wage bills, then history would be kind to her,” he said.

Comrade Adeniran further disclosed that even as CACOL was preparing to make its defence appearance before the EFCC, it has just received more mind boggling documents relating to various corrupt practices by the Mr Gwarzo.

It will be recalled that the organization, CACOL, petitioned President Muhammadu Buhari, the Senate President, the Speaker of the House of Representatives, the relevant Committees in the Senate and House of Representatives and the various anti-corruption agencies to order a thorough audit of the finances of the Commission under Mr Gwarzo following the allegations of corruption.

The DG is alleged to have engaged in series of anti-establishment manipulations to enrich himself through acts that are at variance with civil service rules and regulations.

It was alleged that Mr Gwarzo has been running SEC as his personal business and appoints companies with links to him and some of his cronies in office as contractors who provide services to the Commission.

Some of the companies listed to have links with Mr Gwarzo, his wife and other cronies are: Outbound Investment Ltd, RC NO. 807317; Medusa Investments Limited, RC NO. 326829; Northwind Environmental Services. REG NO BN2389176; and Micro-Technologies LTD RC NO. 173805.

Others are Tida International Ltd RC NO. 26414; Outlook Communications; AcromacNig Ltd RC NO. 10687864; Balfort International Investment Ltd RC NO. 109153; and Interactiven Worldwide Nigeria Ltd RC NO. 779442.

On January 2, 2013, Mr Gwarzo was appointed an Executive Commissioner in the Securities and Exchange Commission for a four-year tenure. Before the expiration of the four-year deal, Mr Gwarzo was elevated as the Director General of the Commission on May 22, 2015.

But consequent upon resumption of office as the Director General of SEC, Mr Gwarzo ordered the payment of a severance benefit to himself to the tune of N104.9 million.

Comrade Adeniran restated the call on President Muhammadu Buhari to take immediate steps to constitute a Board for the Securities and Exchange Commission as provided for in the extant laws establishing the Commission.

“The Investment and Securities Act (ISA) 2007 which gives the Commission its current powers also made a provision for the appointment of a nine (9) member Board to be headed by a Chairman. The idea of the Board is to, amongst other things, ensure that no Director General of the Commission can become a law onto himself or herself and act without appropriate checks by the Board” President Buhari must ensure this is done without further delay,” he said.

Considering the high probability of atrocities being committed unchecked under the present circumstance in which the SEC has functioned without a Board, CACOL called on President Muhammadu Buhari through the Finance Minister to order a thorough audit of the finances of the Commission and penalize everyone found guilty of fraudulent activities.

Economy

Wema Bank Joins NGX Banking Index as Flour Mills Exits Consumer Goods, Others

By Aduragbemi Omiyale

The review of the market indices by the Nigerian Exchange (NGX) Limited has led to the removal of Flour Mills Nigeria from the NGX 30, industrial goods, pension, Pension board and the Meristem value indices.

The end-of-the-year review, according to a statement made available to Business Post, took effect at the opening of the market on Thursday, January 2, 2025.

The NGX 30 index saw the removal of Guinness Nigeria, Sterling Holdings, and Total Nigeria and the inclusion of Conoil, International Breweries, Oando and Transcorp Power.

Also, Golden Guinea Breweries joined the consumer goods index, as the banking index welcomed Wema Bank and witnessed the exit of Sterling Holdings.

Further, the insurance index recorded the addition of Guinea Insurance and

International Energy Insurance and the removal of Lasaco Assurance and Mutual Benefits Assurance, as the industrial goods remained unchanged.

It was observed that the energy index welcomed Aradel Holdings, MRS Oil and Oando and said goodbye to Japaul, as Aradel Holdings and Transcorp Power joined the pension index after Cadbury Nigeria left.

The NGX Lotus Islamic index had Aradel Holdings coming on board as Dangote Sugar left as the corporate governance and Afrinvest Bank Value indices remained intact, with Aradel Holdings added to the NGX Pension Broad index.

In the notice, the Afrinvest Div Yield index welcomed Red Star Express after FCMB Group and Dangote Cement exited, and FCMB Group joined the Meristem Growth index after the duo of Access Holdings and Zenith Bank were removed.

Lastly, the trio of Access Holdings, Dangote Sugar and Zenith Bank were put into the Meristem Value index and the quartet of AIICO Insurance, Nigerian Breweries, FCMB Group and Flour Mills exited.

The chief executive of NGX, Mr Jude Chiemeka, reiterated that the exchange continues to blaze the path to becoming Africa’s foremost Securities Exchange with innovation and product developments that deepen the market and boost liquidity, thus connecting Nigeria, Africa, and the world.

Also, the Head of Trading and Products at the bourse, Abimbola Babalola, emphasized that NGX indices are developed, managed, and rebalanced semi-annually to allow investors to track market movements efficiently and manage their investment portfolios properly.

Designed using the market capitalization methodology, the indices are rebalanced semi-annually on the first business day in January and July, respectively.

Economy

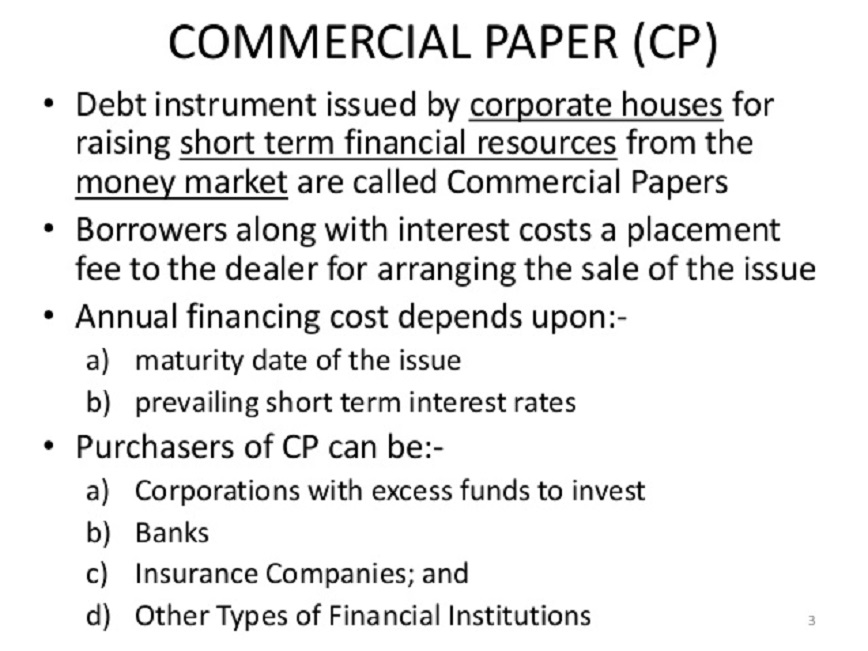

FMDQ Resumes Admission of Commercial Paper Issuance

By Adedapo Adesanya

FMDQ Securities Exchange has resumed admission services in the Nigerian Commercial Paper (CP) market after an earlier suspension on December 30.

This followed the release of new rules on the issuance of financial instruments by the Nigerian capital regulator, the Securities and Exchange Commission (SEC).

“This Market Notice is issued as an update to MN-50 (Suspension of FMDQ Exchange’s Admission Services in the Nigerian CP Market), to notify all stakeholders of FMDQ Securities Exchange Limited (“FMDQ Exchange” or the “Exchange”) of the immediate resumption of the Exchange’s securities admission services in the Nigerian commercial paper (“CP”) market,” a statement on Friday said.

A commercial paper is short-term, unsecured promissory notes not backed by collaterals issued by companies to raise funds for immediate needs.

The SEC is now stepping in to ensure that there are some efficiencies in the issuance by approved bodies to avoid sharp practices and opacity.

The recent suspension applied to applications for which the filing of all relevant documentation has been completed, applications for which the filing of all relevant documentation is yet to be completed, as well as prospective and ongoing CP offers under active CP Programmes.

Now, FMDQ Exchange will immediately resume its securities admission services in the Nigerian CP market pending the finalisation of the ongoing engagements with the Commission on the operationalisation of the New Rule on the Issuance of Commercial Papers released by the market regulator.

The exchange also announced that it has returned to the status quo prior to the release of MN-50, and thus resumed the processing of new and ongoing applications in respect of prospective CP Programme registrations, revisions/extensions and issuances/quotations.

It added that it would provide relevant updates and further developments in respect of the above to market participants in due course.

Economy

Stanbic IBTC PMI Shows Rise in Business Activity First Time in Six Months

By Modupe Gbadeyanka

For the first time in six months, the Nigerian private sector recorded an improvement in business conditions, with a 52.7-point reading in the Stanbic IBTC Bank Purchasing Managers’ Index (PMI) in December 2024.

It was observed that overall business conditions improved as new orders increased for the second month running and renewed expansions were seen in output, employment and purchasing, though the inflation rate remained elevated.

Business Post reports that in the previous month, the index stood at 49.6 points signalling a solid improvement in the health of the private sector that was the most pronounced since January 2024.

“In line with the increase in economic activity usually associated with the festive season in Nigeria, the private sector activity moved above the 50-point psychological threshold for the first time in six months, settling higher at 52.7 in December from 49.6 in November – its most pronounced improvement since January 2024.

“This improved private sector activity reflects renewed expansions in output, purchasing, and employment level. New orders also increased for the second consecutive month, with the latest increase being the highest since May 2024, reflecting an improvement in consumer demand.

“Nonetheless, while some firms increased employment in response to the higher new orders, others reported having to let staff go due to difficulties paying wages.

“Elsewhere, output (54.8 points vs November: 49.6) ended a five-month sequence of decline, with survey participants linking the rise in activity to increased customer numbers. Growth was recorded across each of the four broad sectors covered by the survey. Meanwhile, input prices remained elevated in December – prices increased across all four monitored sectors, with the most pronounced increase in the manufacturing sector.

“As a result, output prices also remained elevated in December and ticked higher from that seen in November,” the Head of Equity Research West Africa at Stanbic IBTC Bank, Mr Muyiwa Oni, said.

“We maintain our expectation that the broad economy is likely to maintain the Q3:24 growth momentum in Q4:24, supported by a festive-induced increase in economic activity and sustained improvement in crude oil production.

“On balance, we estimate the economy to grow by 3.24% y/y in real terms in Q4:24 and adjust our 2024 growth estimate upward to 3.2% (previously: 3.1%). Over the medium term, some firms were optimistic of improvements in access to funding, helping them to invest in business expansions, while others were hopeful of an improvement in economic conditions in 2025, and a softening of inflationary pressures,” he added.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN