Economy

More Worries for Nigeria as Brent Crude Hits $130 Per Barrel

By Adedapo Adesanya

Instead of Nigeria being joyous over the rising price of crude oil in the international market, the opposite is the case as the country may not be able to earn more from the commodity it has in abundance.

Crude oil sales account for about 90 per cent of the country’s foreign exchange (FX) earnings but the double-whammy reality of Brent crude hitting $130 per barrel is a big headache for the nation.

Following the continued conflict between Russia and Ukraine, the United States has confirmed that it is in talks with European allies to potentially sanction Russian crude oil in response to ongoing aggression in Ukraine, sending oil prices briefly above $130.

US Secretary of State Antony Blinken noted over the weekend that the country is “… now in very active discussions with our European partners about banning the import of Russian oil to our countries, while of course at the same time maintaining a steady global supply of oil.”

Analysts noted that if Russia’s oil is cut off, the market could face a 5 million barrel shortfall which could push oil prices to $200 per barrel.

The situation is compacted by stalling talks with Iran over a potential new nuclear deal.

For Nigeria, the rise in prices means the federal government will pay more money on fuel subsidy with the landing cost of petrol increasing on the back of the rise in crude oil price.

This means that the country will see an increase in the price of petrol at the pump as well as a rise in other basic needs since mobility is a critical factor in the economy.

Despite being Africa’s largest crude producer, moribund refineries coupled with infrastructural underdevelopment makes Nigeria one of the most import-dependent countries in the world.

And with the recent postponement of fuel subsidy removal by 18 months, it means that the petrol import bill and subsidy payment will increase as a result.

President Muhammadu Buhari had said rising crude oil prices presented a great opportunity for Nigeria, especially with the passage of the Petroleum Industry Act (PIA).

Represented by the Minister of State for Petroleum Resources, Mr Timipre Sylva, while speaking at last week’s 5th Nigeria International Energy Summit (NIES) in Abuja, he said there was now a level of certainty for the regulatory, administrative and fiscal framework for the industry.

“With the PIA in place, there should be no excuses. The enabling investment environment which has been the bane of the industry has been taken care of by provisions in the PIA,” the Minister stated.

This had been in the context of utilisation of gas because last month, Mr Sylva in an interview with Bloomberg, expressed fears of the impact of high oil prices on the economy.

He maintained that Nigeria’s comfort zone in terms of oil prices was between $70 and $80 per barrel.

He said, “I’m hopeful the prices will move around, maybe $80, maybe $70. We are hoping it will come down to somewhere around $70 to $80, which will be sustainable for us by the end of the year.

“We are working hard on that (production increase). What happened to us was the fact that we had to cut back at the time, and, of course, in such a way you can’t really cut back mathematically.

“So, you want to cut back 100,000 barrels that you shut out, maybe we’ll shut down about 200,000 to 300,000 barrels. So at the end of the day, we over-complied because we just couldn’t achieve it mathematically.

“In trying to cut down, we cut down too much. And now to come back, it’s not been easy for us to get the wells back to production.”

Now, it is almost double this threshold and have been projected to stoke inflationary fears which will further hamper Nigeria’s economy and as a result be felt by the average Nigerian.

Economy

LIRS Shifts Deadline for Annual Returns Filing to February 7

By Aduragbemi Omiyale

The deadline for filing of employers’ annual tax returns in Lagos State has been extended by one week from February 1 to 7, 2026.

This information was revealed in a statement signed by the Head of Corporate Communications of the Lagos State Internal Revenue Service (LIRS), Mrs Monsurat Amasa-Oyelude.

In the statement issued over the weekend, the chairman of the tax collecting organisation, Mr Ayodele Subair, explained that the statutory deadline for filing of employers’ annual tax returns is January 31, every year, noting that the extension is intended to provide employers with additional time to complete and submit accurate tax returns.

According to him, employers must give priority to the timely filing of their annual returns, noting that compliance should be embedded as a routine business practice.

He also reiterated that electronic filing through the LIRS eTax platform remains the only approved method for submitting annual returns, as manual filings have been completely phased out. Employers are therefore required to file their returns exclusively through the LIRS eTax portal: https://etax.lirs.net.

Describing the platform as secure, user-friendly, and accessible 24/7, Mr Subair advised employers to ensure that the Tax ID (Tax Identification Number) of all employees is correctly captured in their submissions.

Economy

Airtel on Track to List Mobile Money Unit in First Half of 2026—Taldar

By Adedapo Adesanya

The chief executive of Airtel Africa Plc, Mr Sunil Kumar Taldar, has disclosed that the company is still on track to list its mobile money business, Airtel Money, before the end of June 2026.

Recall that Business Post reported in March 2024 that the mobile network operator was considering selling the shares of Airtel Money to the public through the IPO vehicle in a transaction expected to raise about $4 billion.

The firm had been in talks with possible advisors for a planned listing of the shares from the initial public offer on a stock exchange with some options including London, the United Arab Emirates (UAE), or Europe.

However, so far no final decisions have been made regarding the timing, location, or scale of the IPO.

In September 2025, the telco reportedly picked Citigroup Incorporated as advisors for the planned IPO which will see Airtel Money become a standalone entity before it can attain the prestige of trading on a stock exchange.

Mr Taldar, noted that metrics continued to show improvements ahead of the listing with its customer base hitting 52 million, compared to around 44.6 million users it had as of June 2025.

He added that the subsidiary processed over $210 billion in a year, according to the company’s nine-month financial results released on Friday.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents, and partner ecosystem and remains a key player in driving improved access to financial services across Africa.

“We remain on track for the listing of Airtel Money in the first half of 2026,” Mr Taldar said.

Estimating Airtel Money at $4 billion is higher than its valuation of $2.65 billion in 2021. In 2021, Airtel Money received significant investments, including $200 million from TPG Incorporated at a valuation of $2.65 billion and $100 million from Mastercard. Later that same year, an affiliate of Qatar’s sovereign wealth fund also acquired an undisclosed stake in the unit.

The mobile money sector in Africa is expanding rapidly, driven by a young population increasingly adopting technology for financial services, making the continent a key market for fintech companies.

Economy

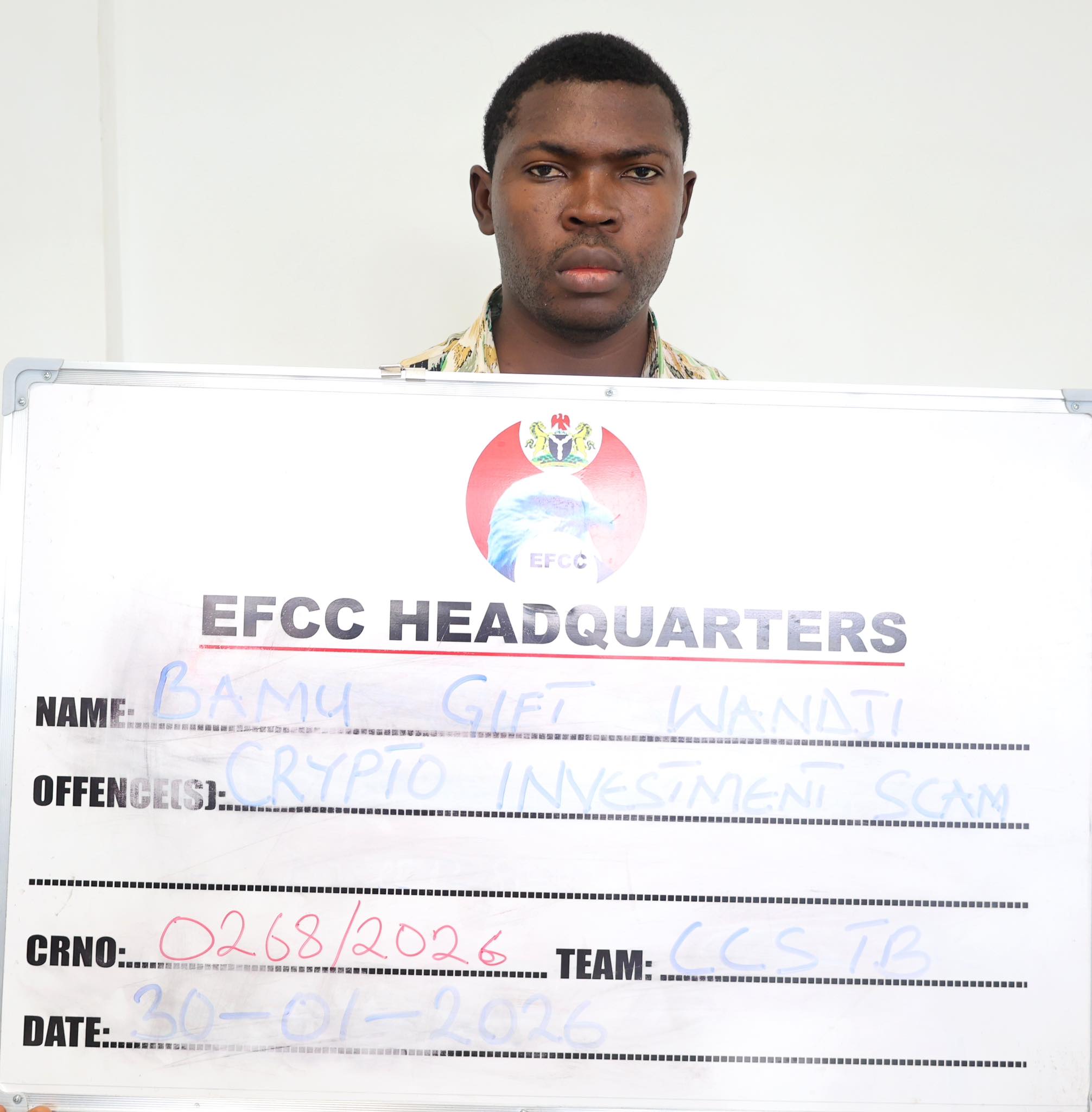

Crypto Investor Bamu Gift Wandji of Polyfarm in EFCC Custody

By Dipo Olowookere

A cryptocurrency investor and owner of Polyfarm, Mr Bamu Gift Wandji, is currently cooling off in the custody of the Economic and Financial Crimes Commission (EFCC).

He was handed over to the anti-money laundering agency by the Nigerian Security and Civil Defence Corps (NSCDC) on Friday, January 30, 2026, after his arrest on Monday, January 12, 2026.

A statement from the EFCC yesterday disclosed that the suspect was apprehended by the NSCDC in Gwagwalada, Abuja for running an investment scheme without the authorisation of the Securities and Exchange Commission (SEC), which is the apex capital market regulator in Nigeria.

It was claimed that Mr Wandji created a fraudulent crypto investment platform called Polyfarm, where he allegedly lured innocent Nigerians to invest in Polygon, a crypto token that attracts high returns.

Investigation further revealed that he also deceived the public that his project, Polyfarm, has its native token called “polyfarm coin” which he sold to the public.

In his bid to promote the scheme, the suspect posted about this on social media platforms, including WhatsApp, X (formally Twitter) and Telegram. He also conducted seminars in some major cities in Nigeria including Kaduna, Lagos, Port Harcourt and Abuja where he described the scheme as a life-changing programme.

Further investigation revealed that in October, 2025, subscribers who could not access their funds were informed by the suspect that the site was attacked by Lazarus group, a cyber attacking group linked to North Korea.

Further investigations showed that Polyfarm is not registered and not licensed with SEC to carry out crypto transactions in Nigeria. Also, no investment happened with subscribers’ funds and that the suspect used funds paid by subscribers to pay others in the name of profit.

Investigation also revealed that native coin, polyfarm coin was never listed on coin market cap and that the suspect sold worthless coins to the general public.

Contrary to the claim of the suspect that his platform was attacked, EFCC’s investigations revealed that the platform was never attacked or hacked by anyone and that the suspect withdrew investors’ funds and utilized the same for his personal gains.

The EFCC, in the statement, disclosed that Mr Wandji would be charged to court upon conclusion of investigations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn