Banking

CIBN to Revamp Banking Practice in Nigeria With A-TEAM Initiative

By Aduragbemi Omiyale

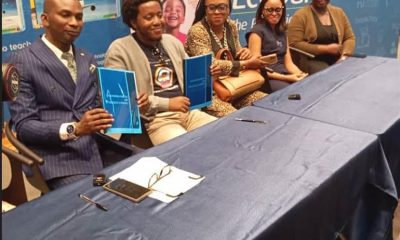

A strategic initiative aimed to revamp banking practice in Nigeria has been introduced by the Chartered Institute of Bankers of Nigeria (CIBN).

The new plan with the acronym A-TEAM means Accelerated Development; Technology and Digital Enhancement; Engagement for Growth; Accountability and Transparent Leadership and Membership Drive for Value.

As part of efforts for its successful implementation, the CIBN is seeking collaborations with financial institutions in the country.

Recently, the President/Chairman of Council, CIBN, Mr Bayo Olugbemi, visited Ecobank Nigeria and he said the A-TEAM initiative will benefit stakeholders in the banking sector.

He applauded Ecobank’s consistent support for the institute over the years to ensure the realisation of its mandate of determining the standards of knowledge and skills development for those seeking to become members of the banking profession.

“We applaud Ecobank Academy as the first corporate member to become a member of the Global Business School Network and for the consistent support for the realisation of the institute’s mandate of determining the standards of knowledge and skills to be attained by persons seeking to become members of the banking profession.

“We, therefore, seek Ecobank’s collaboration and enlistment in our Endowment/Prize Awards in any subject of interest; support towards the renovation of Abuja Bankers’ House; support for the establishment of banking museum by donating artefacts and other relevant materials; and to participate actively in training programmes of the institute,” Mr Olugbemi said.

Further, he congratulated Ecobank Nigeria and the Ecobank Group on winning several International awards, which includes the Best Retail Bank in Nigeria by Asian Banker; Africa’s Best Bank for Corporate Responsibility by Euromoney (Ecobank Group); African Bank of the Year (African Banker); Innovation in Financial Services Award from African Banker (Ecobank Group); EMEA Finance African Banking Awards 2020.

Responding, the Managing Director of Ecobank Nigeria, Mr Patrick Akinwuntan, pledged more support and collaboration with the institute, restating that Ecobank will continue to contribute to the efforts of the organisation to become top class and remain relevant globally.

“For us at Ecobank, we are extremely proud CIBNs efforts at ensuring public discourse on the future of the Nigeria economy and the banking and finance industry.

“This is not in isolation of the ethics, professionalism, accountability, transparency, good corporate governance without losing focus of harnessing the opportunities technology has provided in the new world order. Be assured of our maximum support and collaboration at all times,” he said.

Mr Akinwuntan also identified with the efforts of the institute to raise the bar of competency and capacity building in the industry, stressing that with sound professional conduct, every banker will be held in high esteem.

He said Ecobank was working assiduously to ensure a majority of its staff become members of the institute, adding that the bank will also provide more mentees and mentors in its mentorship programme.

“We have a medium to long term programme to ensure all Ecobank Nigeria staff become chartered members of the institute.

“At Ecobank, we take human capacity development very seriously. Some of our staff that wrote the last examinations are now chartered members of the Institute.

“We will also ensure bulk subscription of our staff. We will be nominating 30 mentors and 100 mentees to participate in the second mentorship programme,” he assured.

Banking

PremiumTrust Bank Meets N200bn Recapitalisation Target

By Adedapo Adesanya

One of Nigeria’s youngest banks, Premium Trust Bank, said it has met the N200 billion minimum capital requirement for commercial banks with national reach in the country.

The bank, which was founded in 2022, achieved the feat ahead of the March 2026 deadline set by the the Central Bank of Nigeria (CBN) under Governor Yemi Cardoso.

The threshold was met by Premium Trust following a successful capital raise of rights issue and private placement offerings.

Commenting on the achievement, the chief executive of Premium Trust Bank, Mr Emmanuel Efe Emefienim, described the development as a watershed for the bank.

“Exceeding the N200 billion capital requirement is a defining moment in the bank’s journey,” he said in a statement.

“This achievement coming in just three years of the bank’s existence is a reflection of our superior financial performance since inception, unwavering commitment to operational excellence, and the trust reposed in us by our shareholders, customers, and regulators.

“As Nigeria’s fastest-growing bank, we are uniquely positioned to not only lead the sector but to continue delivering outstanding value and growth for our stakeholders,” he added.

Mr Emefienim said with this feat, the lender is better positioned to expand its operations, deepen its market share, and continue to deliver cutting-edge banking solutions that cater to the diverse needs of individuals, businesses, and corporate clients across Nigeria.

The bank noted that it is positioned to further broaden its footprint, deepen financing in critical sectors such as infrastructure and agriculture, and remain at the forefront of innovation in Nigeria’s financial sector.

The bank said its growth is a testament to its clear strategic vision, strong leadership, and unwavering commitment to advancing Nigeria’s economic development.

Building on its strengthened capital base, Premium Trust will continue to anticipate and meet the evolving needs of its customers while consolidating its position as an emerging leader in the Nigerian Banking Industry.

In just three years of operations, the bank had expanded its business across all the country’s geo-political zones, reflecting its rapid growth and commitment to accessibility.

By setting new benchmarks in service delivery and leveraging technology-driven solutions, the bank hopes to shape the future of banking in the country.

Banking

Stanbic IBTC Insurance Hosts Second Annuitant Forum

By Modupe Gbadeyanka

Stakeholders in the underwriting sector are currently discussing how the working group of Nigeria can plan for the rainy days, especially when they no longer have the strength to run around to make ends meet.

They are attending the second edition of Stanbic IBTC Insurance Annuitant Forum being held virtually with the theme Making the Most of Life in Retirement.

Retirement is often viewed as a new beginning, an opportunity to enjoy the fruits of one’s lifetime work.

The subsidiary of Stanbic IBTC Holdings Plc organised this programme in line with its mission to support clients through every stage of life.

The virtual format ensures wider access, allowing retirees and those planning for retirement to engage in meaningful, interactive discussions on topics that matter most, ranging from health and wellness, estate planning, and expert insights on securing a fulfilling retirement.

Participants can look forward to discussions on long-term income strategies, the vital role of insurance in maintaining financial stability and how organisations can better support their staff’s retirement journeys. The event will also touch on lifestyle aspects such as wellness, leisure, and personal growth; reinforcing the idea that retirement is a time to thrive.

“Retirement is a significant milestone that should be embraced with purpose, security and fulfilment. Unfortunately, many are unprepared for the realities that come with this phase.

“Our goal with this forum is to provide both retirees and employers with practical guidance and holistic advice, helping them navigate this new chapter confidently,” the chief executive of Stanbic IBTC Insurance, Mr Akinjide Orimolade, stated.

The Stanbic IBTC Insurance Annuitant Forum has become an important platform for the organisation to connect with its retirees, strengthen relationships, and reaffirm its leadership in retirement planning solutions.

By hosting the event virtually, the company is committed to making this resource accessible to retirees nationwide, ensuring that no one is left behind in planning for a rewarding retirement.

Banking

PenCom Blacklists First Trust Mortgage Bank, AG Mortgage Bank, 5 Others

By Aduragbemi Omiyale

Seven mortgage banks operating in Nigeria have been blacklisted by the National Pension Commission (PenCom) over non-compliance with housing loan guidelines.

In a circular dated August 11, 2025, signed by the Head of Benefits and Insurance Department, Obiora Ibeziako, the regulator directed the Pension Fund Administrators (PFAs) and Pension Fund Custodians (PFCs) to immediately stop accepting or processing equity contribution applications from the real estate banks.

It was learned that the lenders failed to generate the loans for which pension funds had been approved.

According to the notice, the affected institutions as Jigawa Savings & Loans Limited, FHA Mortgage Bank Limited, Delta Trust Mortgage Bank Limited, AG Mortgage Bank Limited, Infinity Trust Mortgage Bank Plc, First Trust Mortgage Bank Limited, and Mutual Alliance Mortgage Bank Limited.

“Following the cited letter, the commission instructs that Pension Fund Administrators, including Closed Pension Fund Administrators and Pension Fund Custodians, immediately stop accepting or processing equity contribution applications submitted by the following Primary Mortgage Banks,” a part of the disclosure stated.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN