Economy

MPC Meeting: Considerations and Policy Options

By FSDH Research

Is Expansionary Monetary Policy Appropriate?

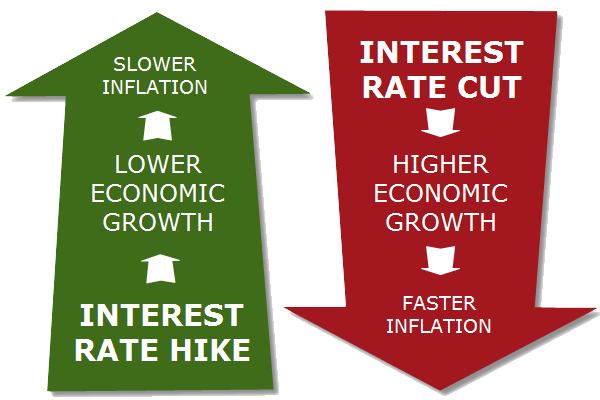

We expect the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) to hold rates at the current levels when it meets on January 23-24, 2017. Although the inflationary pressure and weak exchange rate justify a rate hike, it may be a difficult policy given the need to implement policies to boost growth in the economy.

The CBN will continue to use the Open Market Operations (OMO) to manage liquidity to achieve the desired goals in the short-term. At its November 2016 meeting, the MPC maintained the Monetary Policy Rate (MPR) at 14%, with the asymmetric corridor at +200 basis points and -700 basis points; retained the Cash Reserve Requirement (CRR) and Liquidity Ratio (LR) at 22.50% and 30% respectively.

The International Monetary Fund (IMF) stated that economic activity is projected to improve in 2017 especially in emerging market economies. This is contained in its latest World Economic Outlook (WEO) Update for January 2017. The IMF projects global growth at 3.4% in 2017, from an estimated growth of 3.16% in 2016. Advanced economies are projected to grow by 1.9% in 2017, from 1.6% in 2016, led by growth in the United States (U.S). The IMF projects a growth of 4.5% for the Emerging Markets and Developing Economies from an estimate of 4.1% in 2016, as policy stimulus and improvements in commodity prices aid growth.

The new administration in the U.S. led by Mr. Donald Trump has promised to embark on expansionary fiscal policy to build infrastructure and lower taxes. This policy may drive inflation rate in the U.S beyond the 2% target set by the Federal Open Market Committee (FOMC) of the U.S Federal Reserve (The Fed).

The FOMC may respond by a rate hike faster than earlier anticipated. Consequently, global yields may rise with a possible capital flight from other countries into the U.S. The appropriate monetary mitigant in Nigeria under this situation is a tight monetary policy.

The IMF estimates Gross Domestic Product (GDP) contraction in Nigeria in 2016 at 1.5%, but to grow by 0.8% in 2017. The Nigerian economy has been plagued with a number of macroeconomic issues, as well as insecurity in certain parts of the country that are now experiencing some relief. There is still foreign exchange shortages as a result of lower export revenue linked to the drop in oil price and production. There is an improvement in Nigeria’s economic outlook because of the increase in oil output and the impact of the supply cut by the Organization for Petroleum Exporting Countries (OPEC). In the short-term, a hold decision will be appropriate.

The inflationary pressure still persists in Nigeria, as we expect the January 2017 inflation rate to increase further from the December 2016 figure. The inflation rate increased in December 2016 to 18.55%, from 18.48% in November 2016. The inflation rate in the medium term would be driven by the base effect from previous higher prices, expected good food crop harvest and, possible increase in electricity tariff and pump price of Premium Motor Spirit (PMS). Given the outlook of inflation rate between now and the next MPC meeting, a rate cut will be counter-productive.

The decision of the OPEC and some non-OPEC countries for coordinated cuts in oil output agreed in

November 2016 has led to a significant boost to oil prices. The average price of Bonny Light was $54.21/b in December 2016, up by 19.27% from $45.45/b in November 2016.

The price of Bonny Light crude oil also increased by 17.44% to US$55.09b as at January 17, 2017 from US$46.91/b on November 22, 2016. The secondary data from the OPEC shows that Nigeria’s oil output decreased by 7.23% to 1.54mbd in December 2016, from 1.66mbd as at November 2016. The ongoing talks in the Niger Delta region and the provision for the amnesty programme in Budget 2017 could restore oil output.

The external reserves increased consistently after the last MPC meeting in November 2016. The 30-day moving average external reserves increased by 11.51% from $24.50bn as at November 22, 2016 to $27.32bn as at January 17, 2017. The increase in oil production from September 2016 up till November 2016 boosted the external reserves. The support from the African Development Bank (AfDB) contributed to the external reserves. A rate cut may lead to capital flight. Thus, we expect the MPC to hold rates while it awaits complementary fiscal policy support.

The Naira depreciated at the inter-bank and parallel markets between the last MPC Meeting and January 17, 2017. It recorded a marginal depreciation of 0.08% at the inter-bank market to close at $1/N305.25 on January 17, 2017 from $1/N305 on November 22, 2016. The premium between the inter-bank and parallel markets averaged about N181 after the last MPC meeting in November 2016. The parallel market rate also depreciated by 6.12% to $1/N498.50 on January 17, 2017 from $1/N468 on November 22, 2016. A rate cut may lead to further depreciation in the value of the Naira.

The average yields on the 182-day and 364-day Nigerian Government Treasury Bills (NTBs) increased to 19.17% and 22.98% in December 2016, compared with 19.11% and 22.85% respectively in November 2016.

The 91-day

NTB closed unchanged at 14.50% in December 2016. The yields on the NTBs sold on January 04, 2017 were at 14.51%, 19.17% and 22.98% on the 91-day, 182-day and 364-day NTBs, respectively. However, the average yield on the 16% June 2019; 16.39% FGN Bond January 2022 and 10% July 2030 increased to 15.65%, 15.71% and 15.86% in December 2016 from 14.99%, 15.26% and 15.61% in November 2016. They stood at 16.37%, 16.10% and 16.30% as at January 18, 2017. The increase in yields reflects the current rising inflation rate and weak exchange rate.

The monetary aggregates and credits to the private sector grew in the first ten months of the year, and above the target rates for 2016. The growth in credit was mainly from the impact of devaluation of the Naira. The broad money supply (M2) increased by 11.21% to N22.28trn in October 2016, from N20.03trn in December 2015; an annualized growth of 13.45%. The provisional growth benchmark for 2016 is 10.98%.

The narrow money (M1) grew by 16.94% to N10.02trn in October 2016, from the end-December 2015 figure. Net Domestic Credit (NDC) also grew by 23.89% in the same period; an annualized growth of 28.67%. The provisional benchmark growth for 2016 is 17.94%. The credit to government increased by 280.06% during the period.

Similarly, credits to the private sector grew by 23.24% for October 2016, compared with December 2015; an annualized growth of 27.89%. The benchmark growth for 2016 is 13.28%.

Looking at the economic developments in the country and the impact of the external developments on the Nigerian economy, we expect the MPC to hold rates at the current levels. If the peace in the Niger Delta region is maintained, oil output may increase. This will increase exports and inflow of foreign exchange.

The need for the Federal Government Nigeria (FGN) to borrow aggressively may reduce and interest rate and inflation rate may drop. All these may take a couple of months to happen.

Economy

PenCom Extends Deadline for Pension Recapitalisation to June 2027

By Aduragbemi Omiyale

The deadline for the recapitalisation of the Nigerian pension industry has been extended by six months to June 2027 from December 2026.

This extension was approved by the National Pension Commission (PenCom), the agency, which regulates the sector in the country.

Addressing newsmen on Thursday in Lagos, the Director-General of PenCom, Ms Omolola Oloworaran, explained that the shift in deadline was to give operators more time to boost the capital base, dismissing speculations that the exercise had been suspended.

“The recapitalisation has not been suspended. We have communicated the requirements to the Pension Fund Administrators (PFAs), and we expect every operator to be compliant by June 2027. Anyone who is not compliant by then will lose their licence,” Ms Oloworaran told journalists.

She added that, “From a regulatory standpoint, our major challenge is ensuring compliance. We are working with ICPC, labour and the TUC to ensure employers remit pension contributions for their employees.”

The DG noted that engagements with industry operators indicated broad acceptance of the policy, with many PFAs already taking steps to raise additional capital or explore mergers and acquisitions.

“You may see some mergers and acquisitions in the industry, but what is clear is that the recapitalisation exercise is on track and the industry agrees with us,” she stated.

PenCom wants the PFAs to increase their capital base and has created three categories, with the first consists operators with Assets Under Management of N500 billion and above. They are expected to have a minimum capital of N20 billion and one per cent of AUM above N500 billion.

The second category has PFAs with AUM below N500 billion, which must have at least N20 billion as capital base.

The last segment comprises special-purpose PFAs such as NPF Pensions Limited, whose minimum capital was pegged at N30 billion, and the Nigerian University Pension Management Company Limited, whose minimum capital was fixed at N20 billion.

Economy

Three Securities Sink NASD Exchange by 0.68%

By Adedapo Adesanya

Three securities weakened the NASD Over-the-Counter (OTC) Securities Exchange by 0.68 per cent on Thursday, December 18.

According to data, Central Securities Clearing System (CSCS) Plc led the losers’ group after it slipped by N2.87 to N36.78 per share from N39.65 per share, Golden Capital Plc depreciated by 77 Kobo to end at N6.98 per unit versus the previous day’s N7.77 per unit, and FrieslandCampina Wamco Nigeria Plc dropped 19 Kobo to sell at N60.00 per share versus Wednesday’s closing price of N60.19 per share.

At the close of business, the market capitalisation lost N16.81 billion to finish at N2.147 billion compared with the preceding session’s N2.164 trillion, and the NASD Unlisted Security Index (NSI) declined by 24.76 points to 3,589.88 points from 3,614.64 points.

Yesterday, the volume of securities bought and sold increased by 49.3 per cent to 30.5 million units from 20.4 million units, the value of securities surged by 211.8 per cent to N225.1 million from N72.2 million, and the number of deals jumped by 33.3 per cent to 28 deals from 21 deals.

Infrastructure Credit Guarantee Company (InfraCredit) Plc remained the most traded stock by value with a year-to-date sale of 5.8 billion units valued at N16.4 billion, followed by Okitipupa Plc with 178.9 million units transacted for N9.5 billion, and MRS Oil Plc with 36.1 million units worth N4.9 billion.

Similarly, InfraCredit Plc ended as the most traded stock by volume on a year-to-date basis with 5.8 billion units traded for N16.4 billion, trailed by Industrial and General Insurance (IGI) Plc with 1.2 billion units sold for N420.7 million, and Impresit Bakolori Plc with 536.9 million units exchanged for N524.9 million.

Economy

NGX Index Crosses 150,000 points as Market Cap Nears N96trn

By Dipo Olowookere

The All-Share Index (ASI) of the Nigerian Exchange (NGX) Limited has again crossed the 150,000-point threshold on Thursday as the demand of for local intensifies.

The market was up by 0.35 per cent during the session, with the NGX index inching higher by 520.23 points to 150,363.05 points from the previous day’s 149,842.82 points and the market capitalisation climbed by N332 billion to N95.857 trillion from N95.525 trillion.

During the session, the consumer goods index grew by 1.23 per cent, the banking counter expanded by 0.56 per cent, and the energy sector appreciated by 0.05 per cent.

However, the insurance industry went down by 0.23 per cent, while the commodity and the industrial goods sectors closed flat.

Nestle Nigeria gained 10.00 per cent to trade at N1,958.00, Guinness Nigeria improved by 9.98 per cent to N289.70, Aluminium Extrusion Industries rose by 9.76 per cent to N11.25, DAAR Communications soared by 9.20 per cent to 95 Kobo, and Mecure Industries surged by 9.13 per cent to N55.00.

On the flip side, Stanbic IBTC lost 9.33 per cent to settle at N95.20, Lasaco Assurance went down by 9.09 per cent to N2.50, Africa Prudential slipped by 8.82 per cent, Austin Laz depreciated by 8.82 per cent to N12.40, and Sterling Holdings crashed by 6.12 per cent to N6.90.

There were 35 price gainers and 26 price losers yesterday, implying a positive market breadth index and bullish investor sentiment.

During the session, a total of 839.8 million equities valued at N32.8 billion exchanged hands in 23,211 deals compared with the 5.9 billion equities worth N216.2 billion traded in 25,205 deals a day earlier, indicating a decline in the trading volume, value, and number of deals by 85.77 per cent, 84.83 per cent, and 7.91 per cent apiece.

The day’s busiest stock was First Holdco with a turnover of 385.6 million units sold for N15.6 billion, FCMB traded 76.0 million units worth N805.3 million, Lasaco Assurance exchanged 43.6 million units valued at N111.8 million, Access Holdings transacted 29.6 million units worth N616.8 million, and Chams sold 24.8 million units valued at N75.4 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn