General

Okorie Hails Tinubu’s Decision to Stop Borrowing for Projects

By Bliss Okperan

A former presidential candidate and founder of the All Progressives Grand Alliance (APGA), Mr Chekwas Okorie, has commended President Bola Tinubu for deciding to stop borrowing to finance the budget deficit, especially for projects across the country.

The immediate past President of Nigeria, Mr Muhammed Buhari, was known for his love for borrowing funds to fund national projects such as railways, roads and others despite criticisms from various quarters.

He left the nation with huge debts, at over N70 trillion, including Ways and Means of over N20 trillion.

However, the administration of Mr Tinubu has promised not to follow the path of his predecessor.

The Minister of Finance and Coordinating Minister for the Economy, Mr Wale Edun, while addressing journalists recently, said the federal government has no plan to borrow money from local or foreign organizations for national projects.

In an interview with The Guardian, Mr Okorie urged Nigerians to be optimistic about the President’s performance, and to look at his productivity within his 100 days in office, saying the decision to stop borrowing should be commended and sustained.

“It is reassuring that the President has committed to not borrowing any more to fund national projects,” the politician said.

He also appealed to Nigerians to give Mr Tinubu more time for his policies to mature, expressing optimism that Nigeria will be great again.

“Most of President Tinubu’s bold initiatives will mature into fruition and impact positively on the majority of the people over time,” he stated.

Mr Okorie disclosed that the actions of Mr Tinubu in the first 100 days in office have shown that he would be better than Mr Buhari.

“Given where we are coming from, I would rather make an objective appraisal of the Tinubu administration after his first year in office.

“He has effectively used his first 100 days in office to lay a solid foundation, set the stage, and point to the direction of what is to be expected.

“Such clarity of direction is what has been lacking in the past. This will help the private sector to plan their investment strategies without the fear of sudden and unexpected dislocations,” the APGA chieftain said.

General

Power Outage in Nigeria as National Grid Collapses

By Aduragbemi Omiyale

Nigeria is currently experience a cut in power supply after the national grid collapsed for the 11th time in 2024.

This is the first time in over a month as the last time the nation witnessed a nationwide shut down in electricity supply was on November 7, 2024.

Before then, the country was experiencing an incessant collapse of the grid, which prompted the federal government to set up a team to address the issue.

However, just when Nigerians were thinking they will not witnessed another national grid collapse in the year, it issue reared its ugly head again.

On Wednesday afternoon, most of the energy distribution companies suffered power outage, prompting them to inform their customers of the situation.

One of the DisCos, Ikeja Electric Plc, in a message to electricity consumers under its franchise area, said, “Please be informed that we experienced a system outage today, December 11, 2024, at about 13:32 hours affecting supply within our network.

“Restoration of supply is ongoing in collaboration with our critical stakeholders. Kindly bear with us.”

Recall that on Tuesday, in a report, Google listed national grid as one of the top trending searches by Nigerians this year.

General

NLNG to Replace Vessels in Move Towards Decarbonisation, Sustainability

By Adedapo Adesanya

The Nigerian LNG Limited (NLNG), which produces Nigeria’s Liquified Natural Gas (LNG) and natural gas liquids (NGLs) for export, is planning to replace all its vessels with modern ships within the next decade.

This was disclosed by Mr Nnamdi Anowi, the General Manager of Production, NLNG, during the World Leaders’ Panel session on Tuesday in Berlin, Germany, as part of the 2024 World LNG Summit and Awards.

Speaking at the event themed “Achieving the Balance Between Energy Security and Decarbonisation,” he said the company which was incorporated in 1989 was making plans to boost its vessels to ensure proper transportation of gas for export.

“We are making significant strides in our shipping operations. Over the next 10 years, we aim to transition from our current steam-powered vessels to modern ships.

“Earlier this year, we took a major step by entering into a long-term chapter of our first modern ship Aktoras, and we are already planning to acquire a second ship next year,” he said.

On the critical issue of net zero emissions, Mr Anowi said that NLNG aspires to achieve net zero emissions by 2040.

According to him, this goal is attainable through implementing a combination of solutions that include operational efficiency, natural sinks/offset projects, carbon capture and storage (CCS), net zero expansion, digital solutions and shipping efficiency.

“Our pathway to net zero aligns with Nigeria’s target of reaching net zero by 2060, while many major players in the industry are aiming for 2050.

“We are actively expanding our initiatives in this area, including several low-carbon projects,” he explained.

Regarding Liquefied Petroleum Gas (LPG), Anowi noted that the company had committed 100 per cent of its LPG production (propane and butane) to the Nigerian market.

He pointed out the urgent need for cleaner energy, citing a report that revealed that not less than 100,000 Nigerians died yearly from smoke inhalation caused by cooking with firewood, predominantly affecting women and children.

“This underscores our commitment to sustainability. It’s important to recognise that about 80 per cent of Africans lack access to cleaner energy.

“When discussing sustainability, we can not overlook the necessity of providing energy to these communities,” he added.

He further elaborated on NLNG’s strategy, stating, “Our objective at Nigeria LNG is to maintain safety, enhance capacity, foster growth, and future-proof our business.

“The recent transformation programme includes a rebranding initiative, evidenced by the unveiling of a new logo and the company’s renewed purpose: providing energy for life’s sustainability.

Mr Anowi also noted that NLNG was working diligently to improve its production capacity from 23 million tons to 30 million tons through its Train 7 Project.

“We are actively engaging with stakeholders and the government to ensure our LNG trains are filled by the end of next year,” he said.

On sustainability, Mr Anowi explained that 75 per cent of NLNG’s emissions result from its operations, with the remaining 25 per cent coming from its shipping activities.

He emphasised the importance of measurement, reduction, avoidance and mitigation strategies in their sustainability efforts.

He said that the company was also exploring CCS opportunities through partnerships with the government and other international oil companies.

“We are in the early stages of CCS implementation, assessing potential reservoirs for this purpose,” he said.

In terms of renewable energy, Anowi said that NLNG was investigating solar power projects at its offices in Abuja and Port Harcourt as part of its broader sustainability initiatives.

“We are committed to abatement efforts and are collaborating with experienced private companies to explore carbon credit opportunities.

“We must balance sustainability with affordability and reliability in energy supply.

“The African region must progress at its own pace, prioritising immediate energy needs before addressing long-term sustainability goals,” he explained.

General

National Grid, Mr Ibu Among Top Trending Searches by Nigerians in 2024

By Dipo Olowookere

Many events happened in 2024 in Nigeria but a few shook the nation because of their impact on residents of the country.

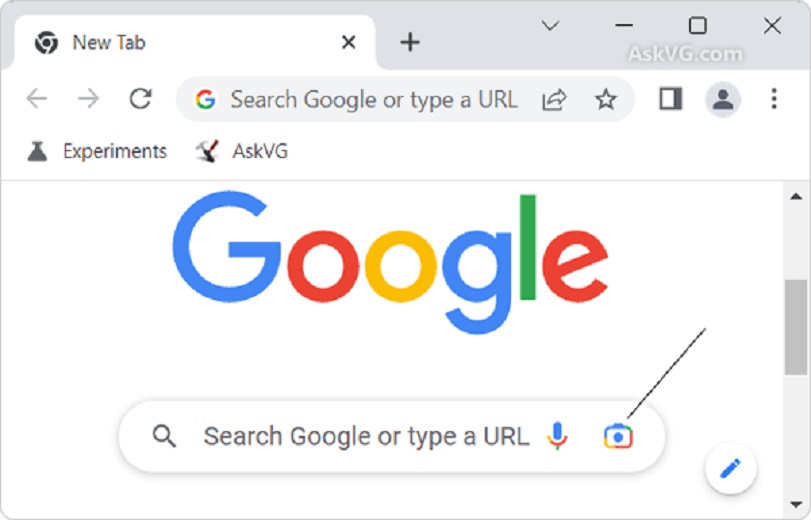

According to a report released by Google, the incessant collapse of the national grip, which plunged the nation into darkness, was among trending searches on its platform.

In the report made available to Business Post on Tuesday, the tech giant said this year’s results show a continued interest in the political and economic landscape, with searches related to the US elections, the new national anthem.

“The 2024 Year in Search offers a unique lens into the questions, interests, and conversations that shaped the lives of Nigerians this year.

“From cultural milestones to pressing concerns, these insights reflect how Search continues to be a valuable tool for users to navigate and better understand their world,” the Communications and Public Affairs Manager for Google West Africa, Taiwo Kola-Ogunlade, stated.

Google’s 2024 Year in Search for Nigeria showcased the most popular searches, notable individuals, actors, musicians, topics, questions, and other subjects that captured Nigerians’ attention in the year.

Google’s Year in Search is an annual analysis that reveals the top trending lists and also spotlights what the world searches to see, learn, and do.

The music scene in 2024 was marked by a surge in popularity for artists like Shallipopi and Khaid, who also featured prominently in the overall personalities list. The top trending song was “”I Don’t Care” by Boy Spyce”, followed closely by “Ozeba” and “Commas” by Ayra”. Nigerians also showed a keen interest in understanding the lyrics of various songs, with “Ogechi lyrics”, “Ozeba lyrics”, and “Omemma by Chandler Moore lyrics” leading the searches in the lyrics category.

This year, Nigerians continued to demonstrate a strong interest in entertainment with movies like “A Tribe Called Judah”, “Treasure In The Sky”, and “Damsel” topping the movie charts. The top TV series that captured the interest of Nigerian netizens included “Supacell”, “My Demon”, and “Queen of Tears”. In the culinary world, Nigerians explored diverse recipes with “Pornstar Martini recipe” leading the searches.

Concerns about personal well-being and global events were also reflected in search trends. Questions like “How much is dollar to naira today?”, “How to get perfectly defined curls for African hair?”, and “Who won the US presidential election?” topped the list of queries. Nigerians were curious about the meaning of words like “demure,” “steeze,” and “pet peeves,” turning to Search for answers.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN