General

Why Power Sector Privatisation in Nigeria has Failed—Egbin Power Chairman

**Targets 5000MW Generation in 5 Years

By Dipo Olowookere

Egbin Power Plc is the largest privately owned power generation company in Sub-Saharan Africa and accounts for over 20 percent of power generated in Nigeria.

In this interview, Mr Kola Adesina, Chairman, Egbin Power Plc speaks about the firm’s experience post privatisation, expansion plans and other issues in the nation’s power sector.

The new management took over the affairs of Egbin in November 2013. Where is the company today in its post-privatization plan

Despite these challenges, we have achieved and exceeded our post-privatization targets. From less than 400MWs, Egbin is generating 1,100 MW and shall hit 1,320 MWs in April 2018. Ordinarily, about 220MW that we began to overhaul should have been back since last year if the N140 Billion we are being owed by NBET had been paid. Now, we are struggling to ramp up our capacity because of liquidity challenges and growing and unsustainable debt. Evacuation of the electricity we generate has been a challenge too. Today, the plant can generate about 1,100MWs, but we cannot evacuate more than 600 MWs, because of frequency issues from the transmission end of the sector. The Transmission Company of Nigeria says the DISCOs are not receiving power. Therefore, they have to drop the load. For Egbin to break even and continue to operate well, we should be evacuating a minimum of 800 MWs every day.

What have you achieved so far

It has not been all smooth sailing. I make bold to say that Egbin has raised the performance bar in the sector through continuing investments in human capital and infrastructure resulting in ongoing drive for sustainable performance and expansion. We have had to contend with policy summersault and operational challenges occasioned by defaults in contractual obligations from Day One, the absence of a cost reflective regime, FOREX variance of over N200 per naira and inflation rate that rose from 8% at takeover to 18-19%, as well as debts owed to us by Nigerian Bulk Electricity Trader, NBET. Therefore, the considerable improvement Egbin has made, using the loan acquired in dollars to provide the infrastructure to generate the electricity, appears lost, because the company has not been able to recover its cost. The loan was in dollars, but power tariff is in the local currency. Therefore, what Egbin has lost between the time of acquisition and today is so depressing. The company has lost over 200% from each Naira invested in the acquisition of the plant. However, we remain committed to the project of lighting up Nigeria, this is what motivated our acquisition bid and we will most certainly surpass our targets ultimately.

How do you deal with debts owed by government agencies

Ordinarily, that’s simple! Just ask all MDAs to have prepaid meters. With that, those that have credits on their meters would have electricity. Once the credit is exhausted and no replenishment, then no electricity. I believe the government is doing its best in terms of getting the MDAs debts settled, but they can still do more to support a metering arrangement that will make payment by the MDAs seamless whilst accelerating ongoing efforts at settling the legacy debts. The DISCOs who have so much odds stacked against them also have debts to settle under a system where all the performance enablers have not been provided. The same DISCOs would be told not to raise the tariff beyond a certain threshold when you know the critical parameters that produce the tariff are not right, and as such the real tariff is not being charged. Yet, the authorities and all stakeholders acknowledge that money is required to upgrade the transformers, restructure the distribution lines, provide meters to consumers, etc.

How about plans to commence expansion of Egbin 2

We believe in Nigeria. From the beginning, we had articulated a vision to bring light to Nigeria. As part of that vision, we said from Day One that we will double the capacity of Egbin. But, how do you do that with all these challenges, including serious liquidity crisis, uneven playing field, policy summersault by government and mounting debts. The DISCOs would want to distribute electricity. But, they are limited by the tariffs and the differentials in the agreements they signed and the ones being implemented. They need all the enablers in place to perform optimally. We are determined to forge head believing that everything would come together soon.

Are you going to look from private capital to forge ahead

Obviously, that’s what we are doing.

So, where are you looking at

We have been engaging several partners in the quest for raising more capital. We are currently in discussions with some respected International organisations on various partnership models.

Where would that take you to

That would give us 3,120 MWs in four years’ time. But, we hope to attain a 5,000MW capacity in the next five years. Beyond Nigeria, we are making forays into other parts of Africa, where we plan to have strong footprints under the Sahara Group Electrifying Africa initiative. We have gone to Tanzania. We are making efforts to get into other nations we see as hubs. Recently, the Bureau for Public Enterprises said about 37% of privatized entities since its inception are not working. Nigerians say most of these entities may be in the power sector. Perhaps this is the best way to start.

What’s your view about the state of the sector today

At the moment, the power sector could do with more collaboration and synergy among all stakeholders to consolidate and enhance the gains from the privatization exercise.

How do you mean

The challenges in the sector are not only well known, but well documented. The system is not properly aligned to deliver service as desired. The sector is a value chain including all the players – gas suppliers, electricity generation, transmission and distribution companies. All stakeholders need to align properly to deliver electricity constantly to consumers. Today, a significant increase in gas supply has resulted in a ramp up in electricity supply from most of the power generation companies. Equally, there is significant growth in transmission capacity. Most the transmission projects previously uncompleted have now been completed. The wheeling capacity of transmission has improved proportionately to about 7,000 megawatts, MW of electricity. But, there’s a wide gap in what we are delivering. That’s where the challenge is. Electricity business is a global business. It’s nothing unique to Nigeria. The variables and enablers are known globally. There must be gas availability in the desired quantity and what can be piped from the location it is produced to the power plant. As long as one can do that optimally, there will be availability of electricity. The generation company must also have the capacity to take the gas and use in producing the power for the transmission company to be able to give the various distribution entities. But, it is evident from the state of the industry today that there are gaps. From the gas suppliers, a lot of money is invested in the development of gas fields, provision of infrastructure and supply facilities. They would need to recover their costs. The moment they cannot recover their investment, the appetite to continue to develop the gas fields would drop. To survive, they would begin to look for alternative markets where gas can be economically priced. From the generation perspective, the GENCOs import most of its machines and spare parts used in generating electricity. Again, don’t forget electricity is a regulated business in the country. There is a document called multi-year tariff order that puts into context different parameters for the tariffs charged by the GENCOs, Transco and DISCOs. The day the tariff is lower than the cost of production in the entire value chain, failure begins to set in. That is the position we have today in the Nigerian power sector. The gaps we are seeing is regulatory in nature, because the system is completely regulated, in terms of the standards, quality, pricing and operators activities. Pricing relates directly with availability of liquidity. If the commodity is appropriately priced, the production process would be oiled to continue to produce.

What do you think needs to be done to move to the next level

We need to dimension in the fullest essence possible what it would take to supply electricity – in terms of technical, legal, commercial, regulation, pricing, liquidity, infrastructure, spare parts and equipment, etc. When the market has been properly dimensioned, in terms of requirements for gas-fired, hydro and renewable plants, along with all the enablers in the true state they should be, all parties would then agree on each of their roles. Government should be committed to face the critical parameters involving monetary policies on interest rates on loans, exchange rate and inflation rate. These could be pegged at a certain levels to allow the power sector bring in the required infrastructure. But, we need to quickly dimension the issue of pricing for the sector to have stability in supply.

If you were to be government, what would you do to make the sector work

If government wants to industrialize Nigeria, it can say the cost of goods and services should not be high. A critical component of the analysis to achieve that agenda would be adequate electricity supply as a policy. I will say goods and services must be made to be competitive to allow export, or encourage industrial users of electricity to activate the country’s economy. With that, I would have aligned the country’s energy policy with industrial policy, by bringing down cost in order to unleash industrialization. Again, I would ensure that government helps to reduce the inefficiencies that make operators unable to provide cost-effective electricity. Government should not default in obligations.

If you were to adjust the regulatory environment, which area would you focus on

A regulator’s job is made easier under a climate of reasonable certainty. Where there is high degree of uncertainty, regulatory functions becomes almost impossible. Today, we have a seemingly better regulatory environment, despite challenges here and there. In the past we had significant policy summersault that did not allow for adequate planning. There shouldn’t be any disconnect between policy and regulation.

What about the issue of tariff structure for gas supply

There are three strategies here. Total energy driven market that allows costs to be fed in and priced, with the regulator’s role only to ensure that nobody makes excessive profit. But, free market is not practicable now. On the other hand, I will say: Let government provide these services. But, we know government alone cannot provide these services. This is where the public-private partnership comes in. Government can say the entire value chain of the energy sector is the only way Nigeria could become economically great. Then government could say: How do I help the players deliver electricity to consumers efficiently, effectively in a sustainable manner. The value chain starts with gas supply for the thermal plants. Without gas supply the entire value chain is useless. Government needs to sit down with everybody in the sector and dimension the requirements for the sector to succeed and accept the incremental stages the sector will go through and how to get there. After that, we can look at the financial and investment sides for the industry to have commercially viable price that would give the desired support and the expected result. Then, the realities of all the parties would be documented in a masterplan that would drive the entire energy sector value chain. Then, there must be that commitment to agreements. I always like to adopt an holistic and unified approach in looking at this issue. That is what is required to make the system work well. There must be regular gas to generation side of the value chain to deliver power optimally. Gas must not treated in isolation. Everything that would enable more electricity to be delivered to consumers must be resolved holistically. The more GENCOs are able to deliver power, the more money they make. This is why Egbin 2 expansion project is in the works to position the nation’s largest power plant for the growth we envision in the power sector in Nigeria and across the continent.

Privatization of the power sector was seen as the magic bullet that would change everything

Wrong.

Why did you say that

Because the Nigerian power sector is like the human body. When one has headache, it’s because of certain misalignment of one body organ against another, for which the headache is just a symptom. If one buys a pain reliever to treat the headache, one would be engaging in self-deceit. The proximate cause of the headache has not been dealt with. Providing half solution is worse, as is being done today. If one does not know the cause of the problem, chances are that one would be running around in circles, looking for scapegoats. Everybody in the power sector has been looking for who to blame for the problems. Nobody has taken time to know what the proximate cause of providing stable electricity in Nigeria is. The truth is simply that there is a serious misalignment in the system. This is where the problem is. The day there is an alignment of all the relevant players and elements in the power sector working together in synergy, electricity will become available on a regular basis.

But privatization seems not to have solved our problems

Yes, because of the misalignment I have talked about. Yet, in Egbin Power station where I am the Chairman, when it was privatized, it was generating about 400 MWs of electricity. Today, Egbin is generating 1,100 MW. In terms of contribution to the national grid, Egbin has increased its capacity significantly post-privatization. Without government putting in any money, the company has been able to get funding that has lifted the plant from what it was to what it is today. But, the mistake that was made by government after privatization was that the amount harvested from the exercise should have been reinvested in the system for the upgrade of the infrastructure. If government, with all the resources at its disposal, handled the system for over 53 years and could not provide all the infrastructure and meter all the customers, how would the same government expect the private sector to do all that in just five years of privatization, even with a growing population?

General

Deep Blue Project: Mobereola Seeks Air Force Support

By Adedapo Adesanya

The Director General of the Nigerian Maritime Administration and Safety Agency (NIMASA), Mr Dayo Mobereola, is seeking enhanced cooperation between the agency and the Nigerian Air Force (NAF) with the aim of strengthening tactical air support within the Deep Blue project.

During a courtesy visit last week, Mr Mobereola told the Chief of Air Staff, Air Marshall S. K. Aneke at the NAF Headquarters in Abuja, that the Air Force was a strategic partner in enhancing maritime security in Nigeria and sustaining the momentum of the Deep Blue Project’s success.

According to the DG, “We are here to seek the Air Force’s support, given the importance of tactical air surveillance to the Deep Blue Project. Nigeria is the only African country with a record of zero piracy within the last 4 years. The Deep Blue Project platforms have been used to achieve zero piracy and sea robberies in the Gulf of Guinea, and we need your collaboration to sustain this momentum”.

He further emphasised that international trade depends on security, which is why vessels prefer to go to or transit through countries where they are secured. “With the traffic we have now, we need to show more security might through collaboration to strengthen our trade viability because of the risks attached to our route. We need these collaborations to sustain what we have achieved so far with the Deep Blue Project”.

The NIMASA DG expressed hope that the collaboration with the Nigeria Air Force will reduce response time.

On his part, the Chief of Air Staff, Air Marshall S.K. Aneke, noted that the Air Force desires to be “a very supportive and collaborative partner with NIMASA and is ready to match the Agency step by step and side by side to achieve the desired results.”

He noted that “collaboration between NIMASA and the Nigerian Air Force under the Deep Blue Project can be strengthened through a joint strategic framework, integrated command structures, and a standing steering committee to ensure shared objectives and accountability.

“Establishing a joint maritime domain awareness fusion cell will enable real-time intelligence sharing, synchronised surveillance, and faster response to maritime threats and ensure sustained operational effectiveness across Nigeria’s territorial waters and exclusive economic zone,” he said, according to a statement.

The Air Force Chief added that the Air Force can also support NIMASA outside the Deep Blue Project operations by providing its own ISR platforms, tactical air support, and rapid airborne deployment for interdictions and search and rescue missions.

While thanking the NIMASA DG for the basic trainings the Agency has provided the aircraft pilots under the Deep Blue Project, Air Marshall Aneke also highlighted areas of operational challenges needing NIMASA’s attention to include bridging the communication gap between NAF operators and NIMASA, higher level and in-depth maintenance trainings, readily available fueling of aircrafts to avoid delays on missions, and provision of flying kits among others.

He therefore pledged the Air Force’s collaboration and assured that the request by NIMASA has been noted and that things will begin to move at thrice its speed going forward.

General

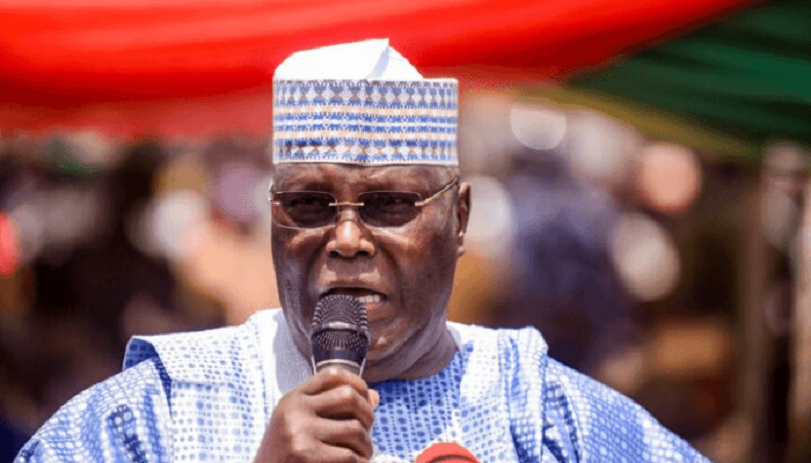

Nigeria’s Democracy Suffocating Under Tinubu—Atiku

By Modupe Gbadeyanka

Former Vice President, Mr Atiku Abubakar, has lambasted the administration of President Bola Tinubu for the turnout at the FCT Area Council elections held last Saturday.

In a statement signed by his Media Office, the Adamawa-born politician claimed that the health of Nigeria’s democracy under the current administration was under threat.

According to him, “When citizens lose faith that their votes matter, democracy begins to die. What we are witnessing is not mere voter apathy. It is a direct consequence of an administration that governs with a chokehold on pluralism. Democracy in Nigeria is being suffocated slowly, steadily, and dangerously.”

He warned that the steady erosion of participatory governance, if left unchecked, could inflict irreversible damage on the democratic fabric painstakingly built over decades.

“A democracy without vibrant opposition, without free political competition, and without public confidence is democracy in name only. If this chokehold is not released, history will record this era as the period when our hard-won freedoms were traded for fear and conformity,” he stressed.

Mr Atiku said the turnout for the poll was below 20 per cent, with the Abuja Municipal Area Council (AMAC) recording 7.8 per cent.

He noted that such civic participation in the nation’s capital, the symbolic heartbeat of the federation, is not accidental, as it is the predictable outcome of a political environment poisoned by intolerance, intimidation, and the systematic weakening of opposition voices.

The presidential candidate of the People’s Democratic Party (PDP) in the 2023 general elections stated that the ruling All Progressives Congress (APC) under Mr Tinubu has pursued a deliberate policy of shrinking democratic space, harassing dissenters, coercing defectors, and fostering a climate where alternative political viewpoints are treated as threats rather than contributions to national development.

He called on opposition parties and democratic forces across the country to urgently close ranks and forge a united front, declaring, “This is no longer about party lines; it is about preserving the Republic. The time to stand together to rescue and rebuild Nigeria is now.”

General

Nigeria Eyes Full Entry into Council of Palm Oil Producing Countries

By Adedapo Adesanya

Nigeria is set to validate a technical committee report geared towards transitioning the country from observer status to full membership of the Council of Palm Oil Producing Countries (CPOPC) in April.

Mr Abubakar Kyari, Minister of Agriculture and Food Security, said this when the council’s mission visited him over the weekend in Abuja, noting that the ministry had constituted a technical committee to consider how the country would seamlessly transit from observer country to membership in CPOPC based on its strategic importance in palm oil production.

“We are conscious of the fact that the palm oil value chain is very strategic for us and identified it as an export crop that can drive foreign exchange for the country and ensure good health in terms of consumption.

“We are conscious of the fact that we need the support of CPOPC countries to provide the country with a new variety of seeds that are climate-smart and resistant so that they can be produced by farmers in the country,” he said.

Mr Alphonsus Inyang, President, National Palm Produce Association of Nigeria (NPPAN), said being a member of CPOPC Nigeria would target over 10 million tonnes of oil palm between 2026 and 2050.

“We are also targeting 2.5 million hectares from among Nigeria households who are out to produce one hectare each, geared towards a N20 trillion annual economy within this period from among Nigeria households.

“We are working side by side with the big players who will be developing plantations,” he said.

The Secretary-General of CPOPC, Ms Izzana Salleh, said the council’s mission to Nigeria was to see how the country could transit from observer status to full membership, among others

She said that the status of the country as an observer nation since 2024 would expire by November.

Ms Salleh assured the country of the council’s readiness to support its vision to strengthen domestic production, enhance food security and build a competitive and sustainable palm oil supply chain.

The official emphasised that being a member of the council would strategically position Nigeria for a greater future regarding oil palm production.

According to her, the visit is to strengthen the council’s engagement with Nigeria, including potential membership in CPOPC.

She said: “The council’s mission to Nigeria aims to advance both Nigeria’s national ambitions and Africa’s collective voice in global agricultural discussions.

“CPOPC was established to promote cooperation among producing nations, empower smallholders, advance sustainability, and ensure fair, science-based global dialogue on vegetable oils.

She emphasised that being a member of the council would strategically position the country for greater future prospects regarding oil palm production and the value chain, as well as export.

“We are ready to support Nigeria’s vision to strengthen domestic production, enhance food security, and build a competitive and sustainable palm oil supply chain,” she said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn