Jobs/Appointments

Chevron, BP, Total Set to Sack Workers

By Adedapo Adesanya

Oil giants are downsizing their workforce after suffering losses due to the global slump in demand for oil because of the coronavirus crisis.

British oil company, BP Plc, on Monday, June 8 announced plans to cut 10,000 jobs due to the global slump having paused redundancies during the peak of the pandemic, but told staff today that around 15 percent will leave by the end of the year.

BP Chief Executive Officer, Mr Bernard Looney, blamed a drop in the oil price for the cut, saying, “The oil price has plunged well below the level we need to turn a profit.”

“We are spending much, much more than we make – I am talking millions of dollars, every day,” he added.

However, not only BP is doing some cropping as French oil and gas outfit, Total, may also downsize its workforce after the company suffered a whopping $12 billion deficit in its revenues forecast.

The company has stated its plan to adopt a cost-cutting mechanism to match the deficit, while maintaining that it anticipates a $12 billion revenue shortfall due to a fall in oil prices caused by the COVID-19 outbreak.

Chevron is also one of the major oil giants that have suffered revenue shortfall. It had already announced the plan to sack over 6,000 staff in its global operations.

The latest announcement of $12 billion deficit by Total CEO, Mr Patrick Pouyanne, is significantly higher than a previous deficit forecast of $9 billion. The increase is expected to force Total to devise deeper cost-cut measures.

According to Mr Pouyanne, Total had expected oil prices to stand at around $60 per barrel this year, but with prices currently at around the $30 per barrel during its forecast, the company faces a much bigger shortfall.

“It is globally at least $12bn that we believe we must cover through our action plan due to the crisis,” Mr Pouyanne, said in an interview with Reuters.

The oil and gas industry has been regarded as one of the worst-hit sectors globally with oil revenues dwindling beyond expected margins while workers disengagement continues.

The COVID-19 pandemic impact has shattered the crude oil demand as the majority of the oil and gas services end-user industries witnessed a slowdown amid lockdowns.

It has been estimated by analysts that the current damage caused in the sector by the coronavirus pandemic will lift in 2021 as the global economy is expected to face a -3 percent contraction this year.

Jobs/Appointments

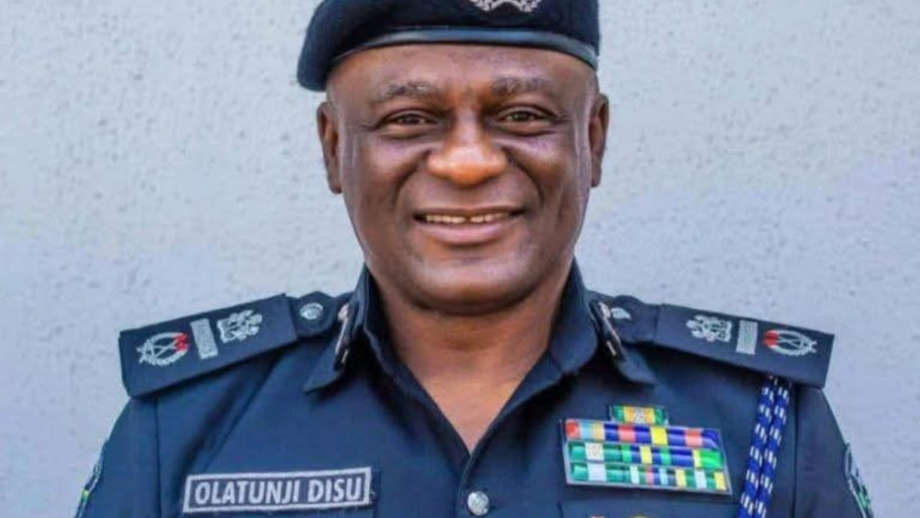

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

Jobs/Appointments

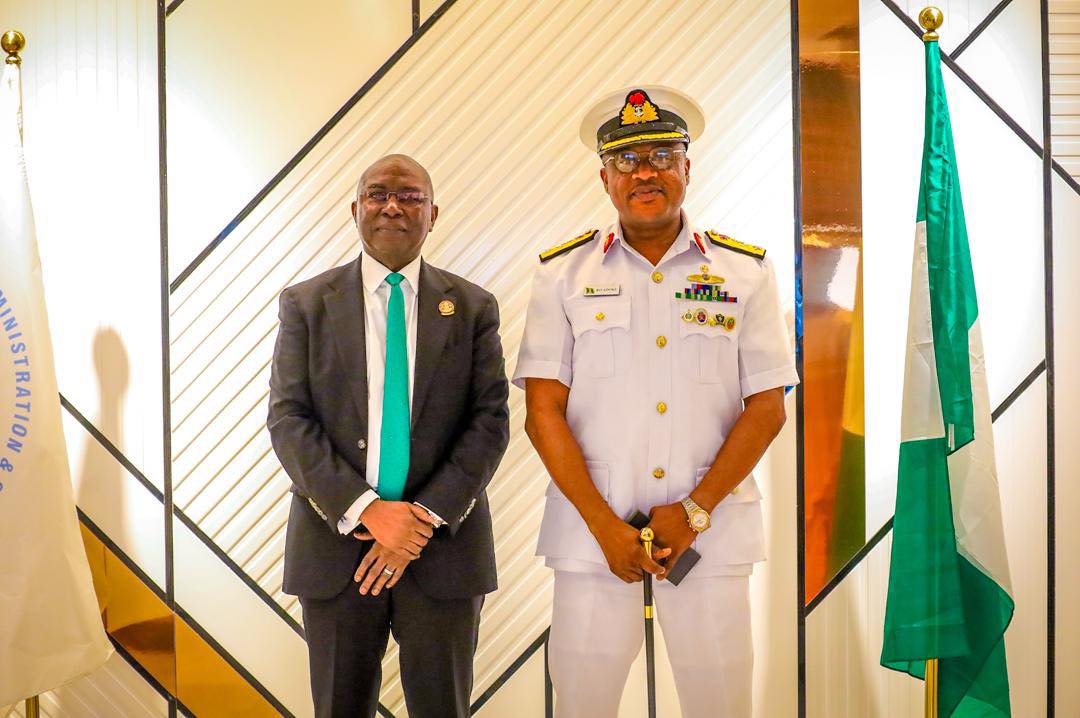

NIMASA Gets New Maritime Guard Commander

By Modupe Gbadeyanka

A new Commander of the Maritime Guard Command has been appointed for the Nigerian Maritime Administration and Safety Agency (NIMASA), and he is Commodore Reginald Odeodi Adoki.

His appointment was approved by the Chief of the Naval Staff, Vice Admiral Idi Abbas, a statement from NIMASA confirmed.

He was chosen to replace Commodore H.C Oriekeze, who has been redeployed by naval authorities.

Commodore Adoki, a principal Warfare Officer specialising in communication and intelligence, brings 25 years of experience in the Nigerian Navy covering training, staff and operations.

As a seaman, he has commanded NNS Andoni, NNS Kyanwa and NNS Kada. It was under his command that NNS Kada undertook her maiden voyage, sailing from the country of build (the United Arab Emirates) into Nigeria.

He was commissioned into the Nigerian Navy in 2000 with a BSc in Mathematics. He has since earned a Master’s in International Law and Diplomacy from the University of Lagos and an MSc in Terrorism, Security and Policing atthe University of Leicester, England.

He is currently pursuing a PhD in Defence and Security Studies at the National Defence Academy (NDA). He is a highly decorated officer with several medals for distinguished service.

Welcoming the new MGC Commander to the agency, the Director General of NIMASA, Mr Dayo Mobereola, expressed confidence in Mr Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA in strengthening operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn