Technology

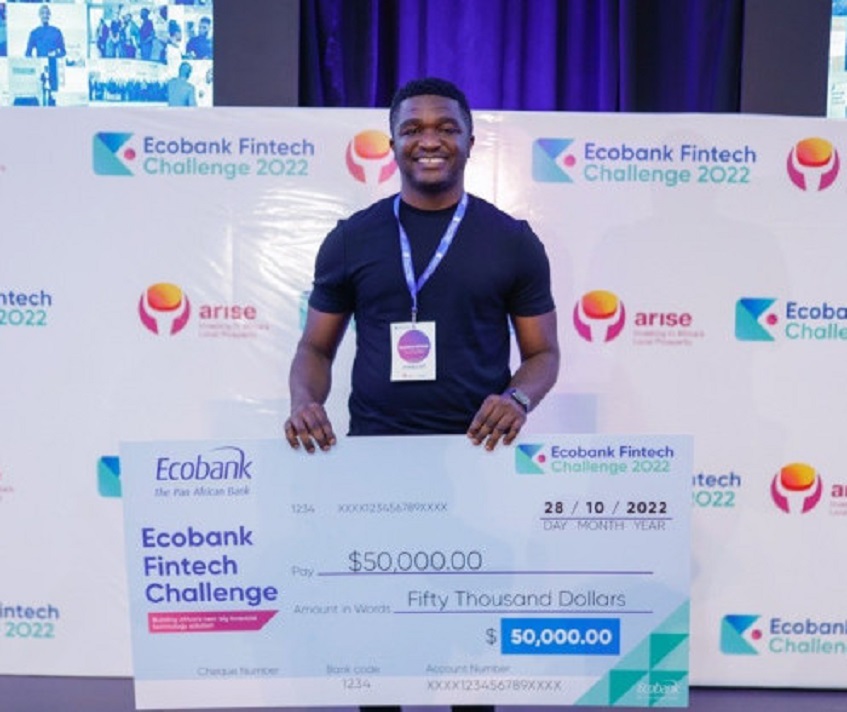

Nigeria’s Touch and Pay Wins $50,000 Ecobank Fintech Challenge Prize

By Adedapo Adesanya

Nigeria-based fintech, Touch and Pay, has won the 2022 edition of the Ecobank Fintech Challenge.

This announcement was made at the grand finale on Friday at Ecobank’s headquarters in Lomé.

At an event presided over by Mr Cina Lawson, Togo’s Minister of Digital Economy and Transformation, Touch and Pay was given a $50,000 cash prize, the largest no-strings attached fintech cash prize in Africa.

Touch and Pay processes microtransactions across Africa, such as paying for bus journeys. Today, the company has over 2 million users who help 500,000 people make payments daily.

The winner and the other five finalists were also inducted into the Ecobank Fintech Fellowship – a unique programme that gives the Fintech Fellows the opportunity to explore potential commercial partnerships with the Bank, such as integrating with Ecobank’s pan-African banking platforms and scaling their fintech businesses across Ecobank’s 33 African markets.

Mr Ade Ayeyemi, Chief Executive Officer, Ecobank Group, while congratulating the finalists, said: “This year’s six finalists have set the bar high at this Grand Finale. Their innovations are revolutionising the financial payments landscape in Africa and advancing financial inclusion. It is an honour for the Ecobank Group to partner with them and jointly transform the financial landscape of our continent.”

Mr Ayeyemi also expressed Ecobank’s “profound appreciation to all our partners especially Arise, the gold sponsor of the 2022 Challenge, as well as to the Jury who worked tirelessly to evaluate the finalists and select the winner.”

On his part, Mr Gavin Tipper, the CEO of Arise, a gold partner and co-sponsor of the challenge, said: “Arise extends its congratulations to the finalists and the winner for the creativity and innovation they displayed.

“The Ecobank Fintech Challenge has become an important platform for supporting fintech innovators and encouraging bold solutions to advancing financial inclusion in Africa. The talent on offer in this year’s pool of finalists once again exceeded expectations, and we look forward to seeing how the different products transform financial services on the continent.”

Expressing his delight, Mr Oluwole Michael, CEO of Touch and Pay, said, “We at Touch and pay (TAP) are excited about the opportunity given to us to work with Ecobank, a pan-African bank operating across Africa. This plugs into our vision of helping 250m Africans process cash-based transactions digitally, making them truly cashless and providing true credit facilities for merchants, retailers, and customers.”

In addition to the pitch by each of the six finalists and a keynote address by Mr Cina Lawson, highlights at the Grand Finale included panel discussions on sustaining and deepening investor interest in African Fintech in the face of the global economic crisis. There were discussions on what investors, Fintech companies and governments should do.

There were also discussions towards ensuring fintech-friendly regulations that accelerate start-up growth and maturity in Africa.

Almost 4,000 start-ups have participated in the five editions of the Ecobank Fintech Challenge since it was launched in 2017. Since then, 52 Fintechs have been inducted into the Ecobank Fintech Fellowship. The 2022 Challenge was supported by partners including Arise, Konfidants, Tech Cabal, Africa Fintech Network and ALX Ventures.

Technology

Expert Reveals Top Cyber Threats Organisations Will Encounter in 2026

By Adedapo Adesanya

Organisations in 2026 face a cybersecurity landscape markedly different from previous years, driven by rapid artificial intelligence adoption, entrenched remote work models, and increasingly interconnected digital systems, with experts warning that these shifts have expanded attack surfaces faster than many security teams can effectively monitor.

According to the World Economic Forum’s Global Cybersecurity Outlook 2026, AI-related vulnerabilities now rank among the most urgent concerns, with 87 per cent of cybersecurity professionals worldwide highlighting them as a top risk.

In a note shared with Business Post, Mr Danny Mitchell, Cybersecurity Writer at Heimdal, said artificial intelligence presents a “category shift” in cyber risk.

“Attackers are manipulating the logic systems that increasingly run critical business processes,” he explained, noting that AI models controlling loan decisions or infrastructure have become high-value targets. Machine learning systems can be poisoned with corrupted training data or manipulated through adversarial inputs, often without immediate detection.

Mr Mitchell also warned that AI-powered phishing and fraud are growing more sophisticated. Deepfake technology and advanced language models now produce convincing emails, voice calls and videos that evade traditional detection.

“The sophistication of modern phishing means organisations can no longer rely solely on employee awareness training,” he said, urging multi-channel verification for sensitive transactions.

Supply chain vulnerabilities remain another major threat. Modern software ecosystems rely on numerous vendors and open-source components, each representing a potential entry point.

“Most organisations lack complete visibility into their software supply chain,” Mr Mitchell said, adding that attackers frequently exploit trusted vendors or update mechanisms to bypass perimeter defences.

Meanwhile, unpatched software vulnerabilities continue to expose organisations to risk, as attackers use automated tools to scan for weaknesses within hours of public disclosure. Legacy systems and critical infrastructure are especially difficult to secure.

Ransomware operations have also evolved, with criminals spending weeks inside networks before launching attacks.

“Modern ransomware operations function like businesses,” Mitchell observed, employing double extortion tactics to maximise pressure on victims.

Mr Mitchell concluded that the common thread across 2026 threats is complexity, noting that organisations need to abandon the idea that they can defend against everything equally, as this approach spreads resources too thin and leaves critical assets exposed.

“You cannot protect what you don’t know exists,” he said, urging organisations to prioritise visibility, map dependencies, and focus resources on the most critical assets.

Technology

NCC Begins Review of National Telecommunications Policy After 26 Years

By Adedapo Adesanya

In a consultation paper released to the public, the commission said it is seeking input from stakeholders, including telecom operators, tech companies, legal experts, and the general public, on proposed revisions designed to reposition Nigeria’s telecommunications framework to match current digital demands. Submissions are expected by March 20, 2026.

The NTP 2000 marked a turning point in Nigeria’s telecom landscape. It replaced the 1998 policy, introducing full liberalisation and a unified regulatory framework under the NCC, and paved the way for the licensing of GSM operators such as MTN, Econet (now Airtel), and Globacom in 2001 and 2002.

Prior to the NTP, the sector was dominated by Nigerian Telecommunications Limited (NITEL), a government-owned monopoly plagued by obsolete equipment, low teledensity, and poor service. At the time, Nigeria had fewer than 400,000 telephone lines for the entire country.

However, the NCC noted that just as the 1998 policy was overtaken by global developments, the 2000 framework has become structurally misaligned with today’s telecom reality, which encompasses broadband, 5G networks, satellite internet, artificial intelligence, and a thriving digital economy worth billions of dollars.

“The rapid pace of technological change and emerging digital services necessitate a comprehensive update to ensure the policy continues to support economic growth while protecting critical infrastructure,” the Commission stated.

The review will target multiple chapters of the policy. Key revisions include: Enhancements on online safety, content moderation, digital services regulation, and improved internet exchange protocols; a modern framework for satellite harmonisation, coexistence with terrestrial networks, and clearer spectrum allocation to boost service quality, and policies to address fiscal support, reduce multiple taxation, and lower operational costs for operators.

The NCC is also proposing entirely new sections to the policy to address emerging priorities. Among the key initiatives are clear broadband objectives aimed at achieving 70 per cent national broadband penetration, with a focus on extending connectivity beyond urban centres to reach rural communities.

The review also seeks to formally recognise telecom infrastructure, including fibre optic cables and network masts, as Critical National Infrastructure to prevent vandalism and enhance security.

In addition, the commission is targeting the harmonisation of Right-of-Way charges across federal, state, and local governments, alongside the introduction of a one-stop permitting process for telecom deployment, designed to reduce bureaucratic delays and lower operational costs for operators.

According to the NCC, the review aims to make fast and affordable internet widely accessible. “The old framework was largely voice-centric. Today, data is the currency of the digital economy,” the commission said, highlighting the need to close the urban-rural broadband divide.

The consultation process is intended to gather diverse perspectives to ensure the updated policy reflects current technological trends, market realities, and consumer needs. By doing so, the NCC hopes to maintain the telecommunications sector’s role as a key driver of economic growth and digital inclusion.

Technology

FG to Scrutinise MTN’s $2.2bn Full Take Over of IHS Towers

By Adedapo Adesanya

The Minister of Communications, Innovation and Digital Economy, Mr Bosun Tijani, says the Nigerian government is assessing MTN Group’s acquisition of IHS Towers to ensure the deal aligns with Nigeria’s telecommunications development goals.

On Tuesday, MTN Group said it has agreed to acquire the remaining 75.3 per cent stake in IHS Holding Limited in an all-cash deal valued at $2.2 billion. The deal will be funded through the rollover of MTN’s existing stake of around 24 per cent in IHS, as well as about $1.1 billion in cash from MTN, roughly $1.1 billion from IHS’s balance sheet, and the rollover of no more than existing IHS debt.

Mr Tijani, in a statement, said the administration of President Bola Tinubu has spent the past two years strengthening the telecom sector through policy clarity, regulatory support, and engagement with industry stakeholders, boosting investor confidence and sector performance.

“Recent financial results from key operators show improved profitability, increased investment in telecoms infrastructure, and operational stability across the sector,” he said.

“These gains reflect the resilience of the industry and the impact of government reforms.”

The minister added that telecommunications infrastructure is critical for national security, economic growth, financial services, innovation, and social inclusion.

“We will undertake a thorough assessment of this development with relevant regulatory authorities to review its impact on the sector,” Mr Tijani said.

He added that the review aims to ensure market consolidation or structural changes, protect consumers, safeguard investments, and preserve the long-term sustainability of the telecom industry.

Mr Tijani also said the government remains committed to maintaining a stable and forward-looking policy environment to keep Nigeria’s telecommunications sector strong and sustainable, in line with the administration’s broader digital economy vision.

Upon completion, the transaction will see MTN transition from being a minority shareholder in IHS to a full owner. It will also see IHS exit from the New York Stock Exchange and become a wholly owned subsidiary of MTN.

For MTN, the deal represents a decisive shift as data demand surges and digital infrastructure becomes increasingly strategic with a booming digitally-oriented youth population on the continent.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn