Brands/Products

5 Best Gift Card Trading Apps in Nigeria in 2025

Looking for a platform to trade your gift cards? Find out the top 5 gift card trading apps in Nigeria and how to choose the right one for you.

Table of Contents

- Introduction

- Top 5 Gift Card Trading Apps in Nigeria

- Why You Should Use a Gift Card Trading App

- Criteria for Choosing a Gift Card Trading App

- How to Avoid Gift Card Trading Scams

- FAQs

- Conclusion

Gift cards are prepaid cards that contain a specific amount of money. You can use them to pay for goods or services from the brand that issues them. However, in Nigeria where the use of gift cards for purchases is limited, the best option is turn them into cash.

Trading gift cards is a great way to turn unused gift cards into cash in Nigeria. But with so many apps out there, how do you know which one to trust? Whether you’re trading iTunes, Steam, Amazon, or Google Play cards, having a reliable and secure app is essential.

This article explores the top 5 gift card trading apps in Nigeria, factors to consider before choosing an app, tips to avoid gift card trading scams, and more.

Top 5 Gift Card Trading Apps in Nigeria

When it comes to gift card trading in Nigeria, some apps standout compared to the rest. Here are the best 5 gift card trading apps in Nigeria as of 2025

- Nosh

- Cardtonic

- Prestmit

- GCBuying

- ApexPay

Let’s go deeper into what each app offers.

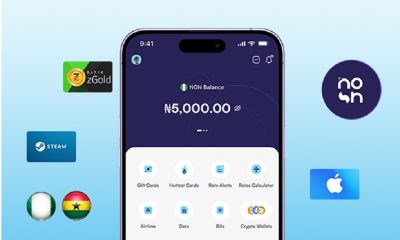

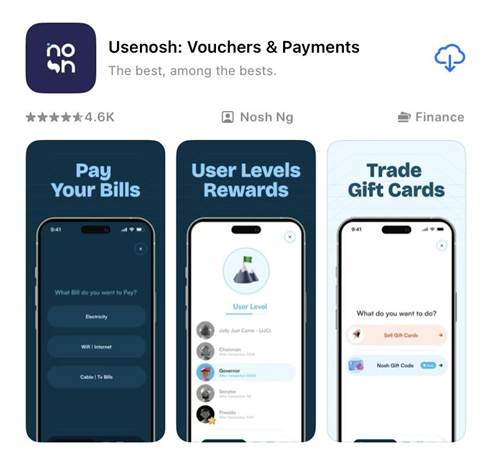

1. Nosh

Nosh is a standout app for trading gift cards in Nigeria. The platform offers high rates, fast transaction processing, and a secure platform for all users. In addition to these features, customer support is available for users 24/7.

You can trade a wide variety of gift cards on Nosh, including Steam, iTunes, Amazon, Google Play, and Visa gift cards. The app is user-friendly with a clean and intuitive interface, making it easy for anyone to trade gift cards quickly.

One of Nosh’s best features is its instant payout. Once your gift card is verified and your trade is approved, your Naira wallet is credited immediately. The app also includes a rate calculator so you can check how much you’ll earn before trading.

Nosh is available on both Google Play Store and Apple App Store, and you can also access its features through the web app if needed.

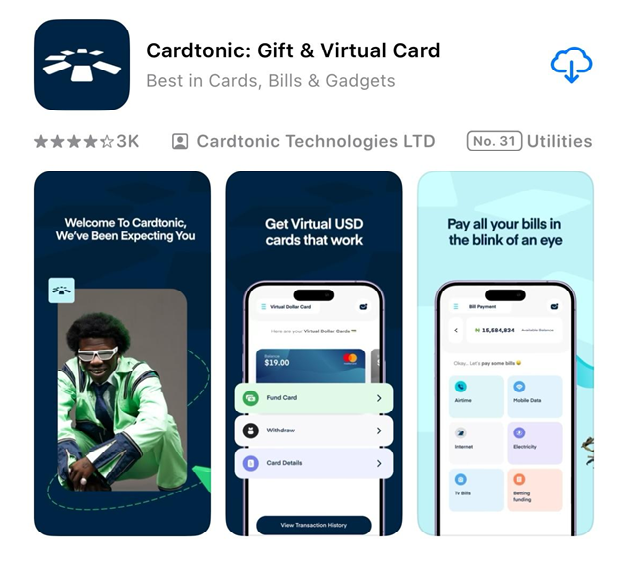

2. Cardtonic

Cardtonic is a well-known gift card trading app in Nigeria. It allows users to trade various types of gift cards and provides decent rates for each trade.

The app features an intuitive design, making it easy to navigate and complete transactions. Cardtonic’s support team is responsive, ensuring you have assistance if any issues arise. Cardtonic is available for download on both iOS and Android devices.

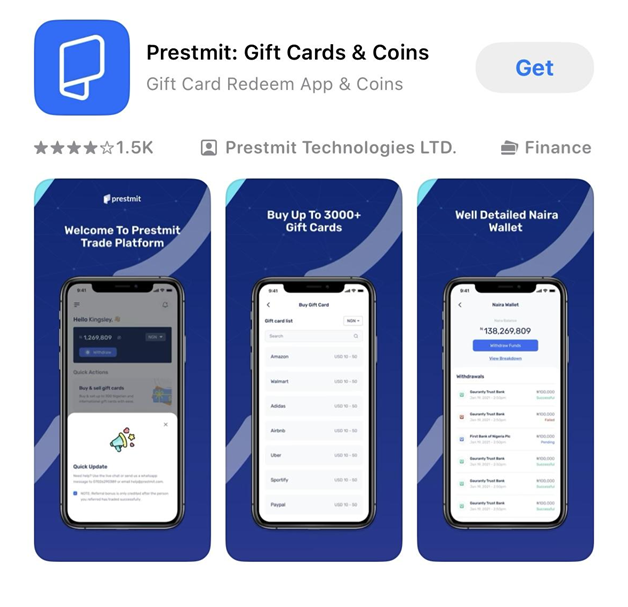

3. Prestmit

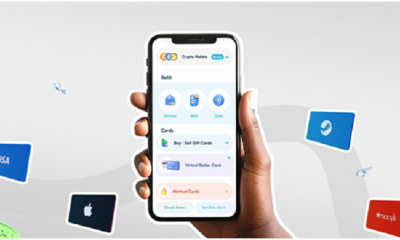

Prestmit is another reliable app that offers flexibility for gift card trading. On this platform, you can trade your gift cards for Naira or cryptocurrency, depending on your preference.

Prestmit supports a wide variety of gift cards and is known for its competitive rates and fast payment processing. The app is accessible on Google Play Store and Apple App Store, making it convenient for users across devices.

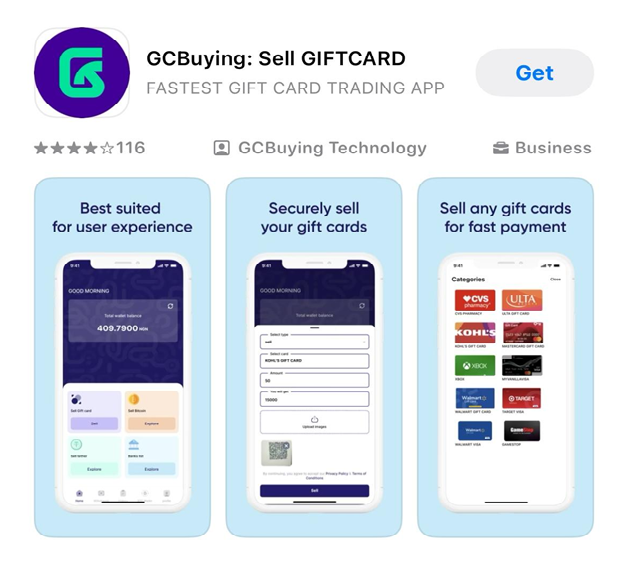

4. GCBuying

GCBuying is a secure and user-friendly gift card trading app in Nigeria. It supports many popular gift card brands and ensures that users get paid promptly after a successful transaction. Just like Prestmit, you can trade your gift cards for cash or crypto.

Although GCBuying is relatively new to the market unlike Nosh, Cardtonic and Prestmit, it remains a solid choice for reliable and hassle-free trading.

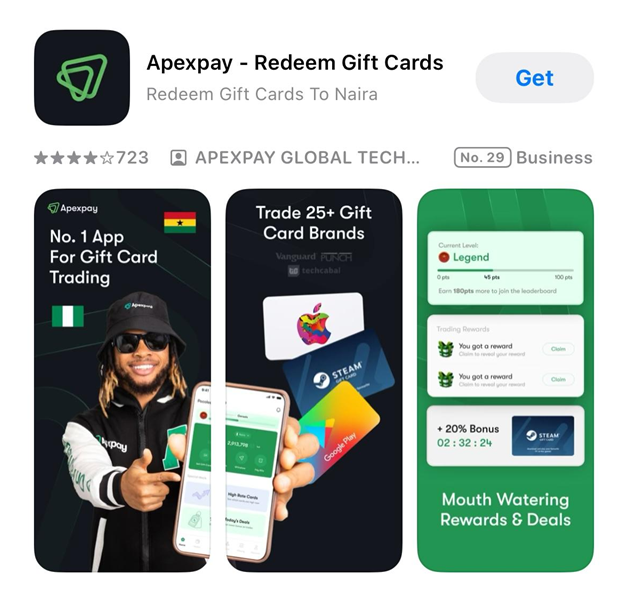

5. ApexPay

This app is another relatively new player in the gift card trading industry. ApexPay is a trusted platform that allows users to trade gift cards with ease. The app supports various gift cards, including iTunes, Amazon, and Google Play. ApexPay offers decent rates and ensures that payments are processed without delays.

The platform also prioritizes security, making it a safe choice for users who are cautious about online transactions.

Why You Should Use a Gift Card Trading App

Using a gift card trading app in Nigeria comes with many benefits:

1. Convenience

Using a gift card trading app simplifies the entire process of converting gift cards to cash. With just a few taps on your phone, you can trade your gift card anytime, anywhere, without having to search for buyers manually.

2. Security

Gift card trading apps prioritize secure transactions. They use advanced security features like encryption and two-factor authentication to protect your details.

3. Avoid Scams

With gift card trading apps, you avoid the risk of scams that are common with peer-to-peer (P2P) trading. Trading through a trusted app eliminates the uncertainty of dealing with unverified buyers, giving you peace of mind.

4. Prompt Payouts

Most gift card trading apps process transactions swiftly and offer instant payouts. You don’t have to wait for hours or even days to receive your money as opposed to manual trading. Once the transaction is complete, the cash is credited to your wallet.

Criteria for Choosing a Gift Card Trading App

Key factors to consider when selecting an app are rates, transaction processing times, ease of use, security and customer service.

- Rates: Always go for platforms with competitive rates. Nosh offers the highest rates for gift cards in Nigeria. You can compare rates across different websites before choosing an app.

- Transaction times: Ensure the app processes payments quickly. Nobody enjoys waiting unnecessarily to receive their money.

- Ease of Use: A user-friendly interface is essential for a smooth experience.

- Security: Prioritize apps with strong security measures and added security for users like two-factor authentication.

- Customer service: Look for apps with 24/7 customer support, a good example is Nosh. Also check that you can reach them through multiple channels like live chat, email, or phone to ensure your concerns are addressed quickly and effectively.

Now, let’s compare the five apps across these factors.

| App | Rates | Transaction time | Ease of Use | Security | Customer service |

| Nosh | High | Very fast | Very easy | Highly secure | Available 24/7 |

| Cardtonic | Good | Fast | Easy | Secure | Responsive |

| Prestmit | Good | Fast | Easy | Secure | Responsive |

| GCBuying | Decent | Good | Easy | Secure | Good |

| ApexPay | Decent | Good | Easy | Secure | Good |

How to Avoid Gift Card Trading Scams

Gift card trading is safe if you use verified apps, but here are some tips to avoid scams:

- Only trade on reputable apps like Nosh, Prestmit, Cardtonic, GCBuying or ApexPay.

- Avoid dealing with individuals or unverified platforms.

- Double-check the platform’s reviews and ratings on the App Store or Play Store.

- Never share sensitive information like your card PIN with unverified sources.

Frequently Asked Questions About Gift Card Trading Apps in Nigeria

- Which app is the best to trade gift cards in Nigeria?

The best app to trade gift cards in Nigeria depends on your preferences, but Nosh stands out for its high rates, instant payouts, user-friendly interface, and excellent customer support. Other reliable options include Cardtonic, Prestmit, GCBuying, and ApexPay, all of which offer secure and seamless trading experiences.

- What is the best gift card exchange app in Nigeria?

The Nosh app is one of the best for exchanging gift cards in Nigeria. It supports a wide range of gift cards, offers competitive rates, and ensures fast, secure transactions. Additionally, its in-app rate calculator and responsive customer support make it a preferred choice for many users.

3. How to trade gift cards to Naira?

Here’s a step-by-step guide to trading gift cards to Naira:

- Download a trusted app like Nosh from your app store.

- Create an account and log in.

- Select the type of gift card you want to sell.

- Enter the gift card details, such as card number and PIN.

- Once your transaction is verified, your Naira wallet will be credited immediately.

Final Thoughts

If you’re looking to trade gift cards in Nigeria, Nosh, Cardtonic, Prestmit, GCBuying and ApexPay

apps are the best options for 2025. While all of them are reliable, Nosh stands out for its excellent rates, fast processing, and top-notch customer service. Don’t wait – start trading with Nosh today for a seamless experience!

Brands/Products

Dangote Salt Gives Trucks, Cash Credits to Customers

By Aduragbemi Omiyale

Gift items worth millions of Naira were dolled out to customers by NASCON Allied Industries Plc, otherwise known as Dangote Salt.

The company splashed trucks and cash credits to 50 outstanding customers at its 2025 Customers Dinner and Awards Night in Abuja on Thursday.

One of the beneficiaries, Mr Ali Balarabe, who got a 20-ton truck and cash credit, expressed appreciation for the recognition, noting that it reflects the company’s commitment to excellence.

Mr Balarabe further pledged to sustain his loyalty and continued support, promising to remain a steadfast and devoted customer in the years ahead.

Other customers who received truckload awards and cash credits included Mr Ibrahim Achida, Muabsa Integrated Services, Fanisau Enterprises, Idris Saleh Nigeria Limited, Sani Adamu Trader, and GIA Global Concept, among others.

The president of Dangote Group, Mr Aliko Dangote, in his remarks, thanked consumers for their loyalty, and also commended the company’s board, management and staff for their unwavering dedication, professionalism, and consistent contributions to the organisation’s growth and sustained market leadership.

“Recognising customers is not just good relationship management – it is good business. It sends a clear message to our people that customer service is truly one of our core values.

“Looking ahead, we will continue to invest in brand equity, supply chain efficiency, sustainability, and digital capabilities. But these investments only create value when they are aligned with customer realities. Your continued engagement and feedback remain critical,” he said.

In his speech, the chairman of NASCON Allied Industries, Mr Olakunle Alake, said, “As a quoted company, we are accountable to shareholders, regulators and the investing public. But the confidence of the market is ultimately rooted in the performance, and market performance depends on customers who believe in our brands.”

The Managing Director of the firm, Aderemi Saka, stated that the central message of the awards night was to celebrate and appreciate the company’s customers, noting that the organisation’s success is closely tied to the growth and prosperity of its customers.

Brands/Products

IVI PR Opens Registration for IviTrybeSage Masterclass

By Modupe Gbadeyanka

Lagos-based strategic communications firm, IVI PR, has called for registration for its exclusive masterclass designed specifically for the modern PR professional known as IviTrybeSage.

A statement from the company said registration would remain open until capacity is reached. Given the exclusive nature of the IviTrybeSage programme, spaces are strictly limited to ensure an intimate, high-impact learning environment.

Interested professionals can secure their spot by completing the form via https://forms.gle/sqvTe1sNM4ure8iJ7.

Business Post gathered that the curriculum will cover brand personality and storytelling, public relations strategy, media relations, crisis management, social media and digital PR, influencer marketing, and more.

Participants will learn how to move beyond traditional press releases into the realm of strategic influence and creative storytelling, transitioning from foundational PR tactics towards the sophisticated demands of today’s global market.

IviTrybeSage is open to fresh graduates seeking the skills necessary for an upward trajectory in strategic communications, as well as entry-to-senior level PR and marketing practitioners, corporate communications executives, and ambitious agency leads.

In an era where the media landscape shifts daily, IviTrybeSage serves as a bridge between academic theory and real-world PR and communication demands. The programme focuses on providing practical, cutting-edge skills to create a pipeline of highly competent talent.

The PR industry is a dynamic field defined by rapid digital transformation and shifting audience behaviour. For PR practitioners to transition from mere messengers to high-value strategic partners, continuous skill acquisition is imperative.

Today’s practitioners must master a diverse toolkit that includes data and trend analysis, crisis management in the age of ‘cancel culture’, and strategic storytelling.

By proactively sharpening these skills, PR professionals ensure they can navigate complex algorithmic changes and evolving social trends, allowing them to protect brand reputations with precision and command a well-earned seat at the executive table.

The chief executive of IVI PR, Mr Nosa Iyamu, while commenting on the initiative, said, “In an era of noise, it is imperative that clarity is prioritised through strategic communication. The industry is evolving at breakneck speed.

“IviTrybeSage isn’t just a training session; it’s a community for those ready to lead the conversation rather than just follow it. It is for those who want to understand how to drive clarity rather than join the bandwagon of those who merely sell noise.”

Brands/Products

PR Firm Wimbart Creates Subsidiary for Africa’s Early-Stage Companies

By Adedapo Adesanya

Wimbart, an award-winning Public Relations agency specialising in business and technology sectors across Africa and emerging markets, has launched a subsidiary called Wimbart Lite, designed specifically for pre-seed and early-stage startups that have raised under $1 million.

To lead the new division, the agency has appointed Ms Maria Adediran, Associate Director and founding team member, as Head of Wimbart Lite.

Launched in 2015, Wimbart has built a strong track record across African markets, including Nigeria, Kenya, South Africa, and Egypt, specifically helping companies navigate the continent’s most complex news cycles.

As the African tech ecosystem continues to mature, competition for attention has become increasingly intense. In this environment, clear and consistent communication across online, broadcast, and print media is no longer a luxury for startups but a business necessity.

Wimbart Lite responds to this need by bridging the communications gap for early-stage companies. It provides focused, fast-turnaround support for startup teams, venture capital portfolios, and global partners seeking credible, well-positioned storytelling that cuts through a crowded media landscape.

Specifically curated for African companies that have raised under $1 million, Wimbart Lite adopts a service-led, menu-based approach built around three core strategic routes. Each route is designed to meet the communications needs of early-stage businesses as they scale visibility, credibility, and investor confidence.

The milestone announcement pack focuses on press releases and strategic media outreach to support key moments such as product launches, partnerships, and major company updates. This ensures that important developments are clearly articulated and positioned to reach relevant audiences.

The founder profile pack centres on thought leadership, using op-eds and interview pitching to amplify leadership voices. It helps founders articulate their vision, share category insights, and establish authority within their industries.

The fundraising pack delivers coordinated funding communications tailored to early-stage rounds and venture capital portfolios. It supports clear, consistent messaging during fundraising activities and includes a 15 per cent discount for portfolio companies.

Speaking on this, the chief executive of Wimbart, Ms Jessica Hope, said, “Wimbart was built in the trenches with African tech founders – before the market had fully caught up with their vision. Wimbart Lite has been in development for some time, as a service for early-stage companies who may not require full-blown month-on-month public relations support, but do need to get a news story “out there”.

“Maria is Wimbart’s day one and has grown with the company, and with dozens of African tech start-ups over the past decade; she understands exactly how to turn a good story into something that actually travels.”

With over a decade of experience across consumer and corporate PR, Ms Adediran has led multi-market campaigns for VCs and high-growth companies from early-stage to unicorn, including Andela, M-KOPA, TLcom, and Kobo360. As Head of Wimbart Lite, she will set the division’s vision and lead its growth, overseeing new business and delivery standards.

The new Head of Wimbart Lite added, “I joined Wimbart at a time when African tech was still small enough that a $1M raise felt like a massive milestone for the whole ecosystem. Now that the market has matured, early-stage teams are put under the microscope much earlier. Wimbart Lite exists to turn real work and traction – early milestones, partnerships, and fundraises – into a clear, credible story the ecosystem can understand and trust.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn