Economy

$1.2b Debt: Etisalat, Banks Hold Talks in London

By Modupe Gbadeyanka

On Friday, officials of Etisalat Nigeria had a meeting with some Nigerian banks in London to discuss ways of paying back the $1.2 billion loan it received from them in 2013.

Earlier this year, the banks involved in this matter had made attempts to take over the company, but the Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) intervened and stopped the moved, suggesting another amiable way of resolving the issue.

The $1.2 billion medium-term facility was signed by Etisalat Nigeria to refinance a $650 million loan and fund the modernisation of its network.

However, the GSM network provider is battling hard to repay the debt, especially with the foreign exchange crisis in Nigeria as well as recession.

On Friday, both parties met in London to talk on the restructuring of the $1.2 billion debt.

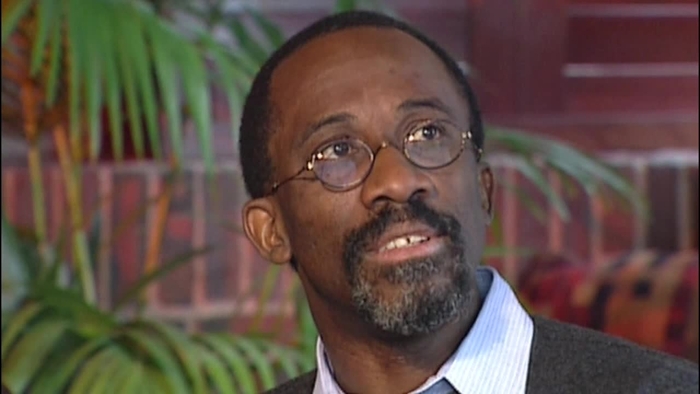

This was confirmed by the Managing Director of Access Bank, Mr Herbert Wigwe.

Etisalat is believed to owe Access Bank N40 billion and GTBank N42 billion.

It is also believed that Etisalat Nigeria wants the banks to convert the Dollar portions of the loans to Naira, but the lenders are against this.

It was gathered that the telecoms firm is making this request to help it overcome the shortage of forex at the interbank market.

But the CBN and the NCC want this issue quickly solved so as not to send the wrong signals to investors, especially foreign investors.

Economy

UK Backs Nigeria With Two Flagship Economic Reform Programmes

By Adedapo Adesanya

The United Kingdom via the British High Commission in Abuja has launched two flagship economic reform programmes – the Nigeria Economic Stability & Transformation (NEST) programme and the Nigeria Public Finance Facility (NPFF) -as part of efforts to support Nigeria’s economic reform and growth agenda.

Backed by a £12.4 million UK investment, NEST and NPFF sit at the centre of the UK-Nigeria mutual growth partnership and support Nigeria’s efforts to strengthen macroeconomic stability, improve fiscal resilience, and create a more competitive environment for investment and private-sector growth.

Speaking at the launch, Cynthia Rowe, Head of Development Cooperation at the British High Commission in Abuja, said, “These two programmes sit at the heart of our economic development cooperation with Nigeria. They reflect a shared commitment to strengthening the fundamentals that matter most for our stability, confidence, and long-term growth.”

The launch followed the inaugural meeting of the Joint UK-Nigeria Steering Committee, which endorsed the approach of both programmes and confirmed strong alignment between the UK and Nigeria on priority areas for delivery.

Representing the Government of Nigeria, Special Adviser to the President of Nigeria on Finance and the Economy, Mrs Sanyade Okoli, welcomed the collaboration, touting it as crucial to current, critical reforms.

“We welcome the United Kingdom’s support through these new programmes as a strong demonstration of our shared commitment to Nigeria’s economic stability and long-term prosperity. At a time when we are implementing critical reforms to strengthen fiscal resilience, improve macroeconomic stability, and unlock inclusive growth, this partnership will provide valuable technical support. Together, we are laying the foundation for a more resilient economy that delivers sustainable development and improved livelihoods for all Nigerians.”

On his part, Mr Jonny Baxter, British Deputy High Commissioner in Lagos, highlighted the significance of the programmes within the wider UK-Nigeria mutual growth partnership.

“NEST and NPFF are central to our shared approach to strengthening the foundations that underpin long-term economic prosperity. They sit firmly within the UK-Nigeria mutual growth partnership.”

Economy

MTN Nigeria, SMEDAN to Boost SME Digital Growth

By Aduragbemi Omiyale

A strategic partnership aimed at accelerating the growth, digital capacity, and sustainability of Nigeria’s 40 million Micro, Small and Medium Enterprises (MSMEs) has been signed by MTN Nigeria and the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN).

The collaboration will feature joint initiatives focused on digital inclusion, financial access, capacity building, and providing verified information for MSMEs.

With millions of small businesses depending on accurate guidance and easy-to-access support, MTN and SMEDAN say their shared platform will address gaps in communication, misinformation, and access to opportunities.

At the formal signing of the Memorandum of Understanding (MoU) on Thursday, November 27, 2025, in Lagos, the stage was set for the immediate roll-out of tools, content, and resources that will support MSMEs nationwide.

The chief operating officer of MTN Nigeria, Mr Ayham Moussa, reiterated the company’s commitment to supporting Nigeria’s economic development, stating that MSMEs are the lifeline of Nigeria’s economy.

“SMEs are the backbone of the economy and the backbone of employment in Nigeria. We are delighted to power SMEDAN’s platform and provide tools that help MSMEs reach customers, obtain funding, and access wider markets. This collaboration serves both our business and social development objectives,” he stated.

Also, the Chief Enterprise Business Officer of MTN Nigeria, Ms Lynda Saint-Nwafor, described the MoU as a tool to “meet SMEs at the point of their needs,” noting that nano, micro, small, and medium businesses each require different resources to scale.

“Some SMEs need guidance, some need resources; others need opportunities or workforce support. This platform allows them to access whatever they need. We are committed to identifying opportunities across financial inclusion, digital inclusion, and capacity building that help SMEs to scale,” she noted.

Also commenting, the Director General of SMEDAN, Mr Charles Odii, emphasised the significance of the collaboration, noting that the agency cannot meet its mandate without leveraging technology and private-sector expertise.

“We have approximately 40 million MSMEs in Nigeria, and only about 400 SMEDAN staff. We cannot fulfil our mandate without technology, data, and strong partners.

“MTN already has the infrastructure and tools to support MSMEs from payments to identity, hosting, learning, and more. With this partnership, we are confident we can achieve in a short time what would have taken years,” he disclosed.

Mr Odii highlighted that the SMEDAN-MTN collaboration would support businesses across their growth needs, guided by their four-point GROW model – Guidance, Resources, Opportunities, and Workforce Development.

He added that SMEDAN has already created over 100,000 jobs within its two-year administration and expects the partnership to significantly boost job creation, business expansion, and nationwide enterprise modernisation.

Economy

NGX Seeks Suspension of New Capital Gains Tax

By Adedapo Adesanya

The Nigerian Exchange (NGX) Limited is seeking review of the controversial Capital Gains Tax increase, fearing it will chase away foreign investors from the country’s capital market.

Nigeria’s new tax regime, which takes effect from January 1, 2026, represents one of the most significant changes to Nigeria’s tax system in recent years.

Under the new rules, the flat 10 per cent Capital Gains Tax rate has been replaced by progressive income tax rates ranging from zero to 30 per cent, depending on an investor’s overall income or profit level while large corporate investors will see the top rate reduced to 25 per cent as part of a wider corporate tax reform.

The chief executive of NGX, Mr Jude Chiemeka, said in a Bloomberg interview in Kigali, Rwanda that there should be a “removal of the capital gains tax completely, or perhaps deferring it for five years.”

According to him, Nigeria, having a higher Capital Gains Tax, will make investors redirect asset allocation to frontier markets and “countries that have less tax.”

“From a capital flow perspective, we should be concerned because all these international portfolio managers that invest across frontier markets will certainly go to where the cost of investing is not so burdensome,” the CEO said, as per Bloomberg. “That is really the angle one will look at it from.”

Meanwhile, the policy has been defended by the chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr Taiwo Oyedele, who noted that the new tax will make investing in the capital market more attractive by reducing risks, promoting fairness, and simplifying compliance.

He noted that the framework allows investors to deduct legitimate costs such as brokerage fees, regulatory charges, realised capital losses, margin interest, and foreign exchange losses directly tied to investments, thereby ensuring that they are not taxed when operating at a loss.

Mr Oyedele also said the reforms introduced a more inclusive approach to taxation by exempting several categories of investors and transactions.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn