Economy

QNET Assists Entrepreneurs in Tanzania

By Modupe Gbadeyanka

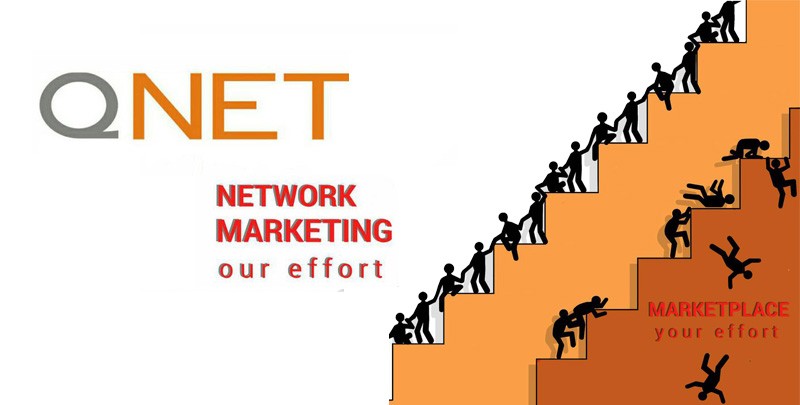

A company of Asian heritage and a part of the US $200 billion global direct selling industry, QNET, is entering the buoyant direct selling sector in Eastern Africa, and expects to offer world class quality consumer products and to elevate standards of living by garnering the spirit of entrepreneurship to all individuals, even those with little business background.

QNET’s product offering include a wide range of world-acclaimed lifestyle and wellness products such as personal care, nutrition, cosmetics, home care and body, water energies, jewellery and watches as well as holiday packages.

QNET, optimizing its existing e-commerce platform currently has three easily accessible local agents in West Africa, namely Mali, Cote d’Ivoire and Burkina Faso. These agents serve as the liaison between QNET, its Independent Representatives (IRs) and customers with their enquiries, delivery of products and the display of product range so as to enable people to view for themselves some of the products sold online. QNET is planning to engage a local agency in Tanzania soon to provide the best customer service in the country.

“QNET is proud to be in Tanzania and is committed to working closely with the local government officials and authorities to create more entrepreneurial opportunities for the local community. Direct selling which is the marketing and selling of products directly to consumers away from a fixed retail location, provides people a great alternative platform to join entrepreneurship” said Mr. David K Sharma, Advisor to QNET Board of Directors.

In addition to offering quality consumer products, ranging from health and home care to online education courses, and more, QNET firmly believes that there is nothing more empowering to individuals than the financial freedom that a career in the direct selling industry provides, and believes that the people of Tanzania, with their ambition and strong sense of entrepreneurship, will appreciate the quality consumer products that QNET offers and the business opportunities for self-development.

QNET started getting online purchases for its products from Africa since 2007. Today there are thousands of Tanzanian citizens who have also registered to market and promote QNET online products as IRs. The top selling products for QNET in Tanzania are Wellness products, household items such as water filtration systems, health and wellness products, online education learning (such as business courses, marketing courses and business English courses) as well as luxury products like watches and jewellery.

“Our best selling Products include HomePure, a water filtration system as well as AirPure, our air purifier, addresses a real need for clean water and clean air in many developing countries. In developed markets QVI Holidays, a vacation membership and holiday getaway product, tends to be quite popular with those wanting to take rejuvenating breaks. For busy professionals who are interested in continuing their education but have no time, we offer e-learning courses on a number of topics. We also have an expert selection of lifestyle-friendly food supplements for long life and vitality called LifeQode which we recently introduced in Tanzania” explained Mr Sharma.

“QNET is always respectful of the local laws and is fully obliged to the commercial laws and consumer laws of Tanzania. QNET also has policies and procedures that all its IRs must strictly adhere to its code of marketing and promotion of QNET products ethically,” noted, Mr. Sharma.

Mr Sharma assured potential entrepreneurs in Tanzania of QNET’s continued support through training and education of IRs with a view to developing their professional skills with special focus on personal growth and development.

“We believe that financial success alone is not enough. In order for us to make an impact, we need to develop people to be better human beings so that they can use their success to contribute to their local communities”, he added.

Globally, the World Federation of Direct Selling Associations (WFDSA), which QNET is affiliated through the Direct Selling Associations of Singapore, Malaysia, the Philippines and Indonesia, reported unprecedented sales and engagement with 6.4% growth generating close to US$ 200 billion in 2015. WFDSA said that in the past three years, the industry has seen a compound annual growth rate of 6.5 percent. It also noted that behind direct selling’s positive growth trend are millions of entrepreneurs marketing an array of products and services.

With direct selling gaining popularity, Tanzania is seen to have huge potential to become a leading market in the African region.

Economy

FAAC Disburses 1.727trn to FG, States Local Councils in December 2024

By Modupe Gbadeyanka

The federal government, the 36 states of the federation and the 774 local government areas have received N1.727 trillion from the Federal Accounts Allocation Committee (FAAC) for December 2024.

The funds were disbursed to the three tiers of government from the revenue generated by the nation in November 2024.

At the December meeting of FAAC held in Abuja, it was stated that the amount distributed comprised distributable statutory revenue of N455.354 billion, distributable Value Added Tax (VAT) revenue of N585.700 billion, Electronic Money Transfer Levy (EMTL) revenue of N15.046 billion and Exchange Difference revenue of N671.392 billion.

According to a statement signed on Friday by the Director of Press and Public Relations for FAAC, Mr Bawa Mokwa, the money generated last month was about N3.143 trillion, with N103.307 billion used for cost of collection and N1.312 trillion for transfers, interventions and refunds.

It was disclosed that gross statutory revenue of N1.827 trillion was received compared with the N1.336 trillion recorded a month earlier.

The statement said gross revenue of N628.972 billion was available from VAT versus N668.291 billion in the preceding month.

The organisation stated that last month, oil and gas royalty and CET levies recorded significant increases, while excise duty, VAT, import duty, Petroleum Profit Tax (PPT), Companies Income Tax (CIT) and EMTL decreased considerably.

As for the sharing, FAAC disclosed that from the N1.727 trillion, the central government got N581.856 billion, the states received N549.792 billion, the councils took N402.553 billion, while the benefiting states got N193.291 billion as 13 per cent derivation revenue.

From the N585.700 billion VAT earnings, the national government got N87.855 billion, the states received N292.850 billion and the local councils were given N204.995 billion.

Also, from the N455.354 billion distributable statutory revenue, the federal government was given N175.690 billion, the states got N89.113 billion, the local governments had N68.702 billion, and the benefiting states received N121.849 billion as 13 per cent derivation revenue.

In addition, from the N15.046 billion EMTL revenue, FAAC shared N2.257 billion to the federal government, disbursed N7.523 billion to the states and transferred N5.266 billion to the local councils.

Further, from the N671.392 billion Exchange Difference earnings, it gave central government N316.054 billion, the states N160.306 billion, the local government areas N123.590 billion, and the oil-producing states N71.442 billion as 13 per cent derivation revenue.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

Economy

Naira Trades N1,533/$1 at Official Market, N1,650/$1 at Parallel Market

By Adedapo Adesanya

The Naira appreciated further against the United States Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) by N1.50 or 0.09 per cent to close at N1,533.00/$1 on Friday, December 13 versus the N1,534.50/$1 it was transacted on Thursday.

The local currency has continued to benefit from the Electronic Foreign Exchange Matching System (EFEMS) introduced by the Central Bank of Nigeria (CBN) this month.

The implementation of the forex system comes with diverse implications for all segments of the financial markets that deal with FX, including the rebound in the value of the Naira across markets.

The system instantly reflects data on all FX transactions conducted in the interbank market and approved by the CBN.

Market analysts say the publication of real-time prices and buy-sell orders data from this system has lent support to the Naira in the official market and tackled speculation.

In the official market yesterday, the domestic currency improved its value against the Pound Sterling by N12.58 to wrap the session at N1,942.19/£1 compared with the previous day’s N1,954.77/£1 and against the Euro, it gained N2.44 to close at N1,612.85/€1 versus Thursday’s closing price of N1,610.41/€1.

At the black market, the Nigerian Naira appreciated against the greenback on Friday by N30 to sell for N1,650/$1 compared with the preceding session’s value of N1,680/$1.

Meanwhile, the cryptocurrency market was largely positive as investors banked on recent signals, including fresh support from US President-elect, Mr Donald Trump, as well as interest rate cuts by the European Central Bank (ECB).

Ripple (XRP) added 7.3 per cent to sell at $2.49, Binance Coin (BNB) rose by 3.5 per cent to $728.28, Cardano (ADA) expanded by 2.4 per cent to trade at $1.11, Litecoin (LTC) increased by 2.3 per cent to $122.56, Bitcoin (BTC) gained 1.9 per cent to settle at $101,766.17, Dogecoin (DOGE) jumped by 1.2 per cent to $0.4064, Solana (SOL) soared by 0.7 per cent to $226.15 and Ethereum (ETH) advanced by 0.6 per cent to $3,925.35, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN