General

Study Reveals Top Concerns of Nigerian Consumers

A report by Nielsen Holdings Plc has revealed that the Consumer Confidence Index (CCI) for West Africa presented a more positive picture in the fourth quarter of 2020.

In the NielsenIQ CCI, it was disclosed that Nigeria and Ghana recorded a slow by improved readings in the period under despite the devastating effect of COVID-19 pandemic on their respective economy.

While Nigeria had an index of 114, Ghana recorded 123 and according to the West African Managing Director of NielsenIQ, Nigeria, as the largest economy on the continent, “has managed to keep its COVID-19 infection rate relatively low in proportion to its 206-million population.

“However, its macro-economic prospects have been dampened by lower oil prices, increased food prices and rising inflation, together with a 50 per cent VAT increase in 2020. Despite these challenges, Nigerian consumers remain upbeat about their prospects.”

In the report, it was stated that there has been improved confidence around job prospects, with 58 per cent of consumers saying they will be good or excellent in the next 12 months – a 3-point increase from the previous quarter.

In terms of the state of their finances over the next 12 months, 78 per cent say they will be excellent or good, showing a substantial 11 point increase from the previous quarter.

Nigerians’ propensity to purchase has unfortunately seen a 13 point decrease to just 27 per cent of Nigerians who think now is a good or excellent time to purchase what they want or need, the study showed.

In terms of whether they have spare cash left after paying for essentials, 26 per cent of Nigerians say yes, down seven points from the previous quarter.

Once they meet their essential living expenses, however, the highest number of consumers (78 per cent) put their spare cash into savings, followed by 73 per cent who spend it on home improvements and 61 per cent who invest in stocks and mutual funds.

Squeezed wallets

Despite their more positive medium to long term outlook, their wallets remain tight with 80 per cent of Nigerians saying they have changed their spending to save on household expenses compared to this time last year.

To reduce expenses, the highest number of consumers (73 per cent) said they have deferred the replacement of major household items, 63 per cent are spending less on out of home entertainment and 56 per cent less on at-home entertainment.

Looking ahead, the top Nigerian consumer concerns over the next 12 months are their children’s education and welfare at 22 per cent, increasing food prices (16 per cent) and the economy at 11 per cent.

Within this context, these drops reflect consumers’ confidence in the macro picture in terms of food inflation and overall economic performance.

A subdued outlook

Looking at Ghana’s performance, increased consumer confidence during the last two quarters has seen its overall index rise to 123.

Fortunately, Ghanaians are still fairly optimistic in terms of their job prospects with 67 per cent saying they will be good or excellent in the next year. In terms of the state of their finances over the next 12 months, 74 per cent say they will be excellent or good

Ghanaians propensity to purchase has also seen a considerable decrease half think now is a good or excellent time to purchase what they want or need.

Only 46 per cent of Ghanaians say they have spare cash and once they meet their essential living expenses, the highest number of consumers (68 per cent) put their spare cash into savings.

This is followed by 57 per cent who say they invest in shares and mutual funds and 56 per cent on home improvements.

Curtailed spending

When asked whether they had changed their spending to save on household expenses compared to this time last year, 73 per cent of Ghanaians said yes.

To reduce expenses, the highest number (49 per cent) said delaying the replacement of major household items followed by 48 per cent spending less on new clothes and 47 per cent less on out of home entertainment.

When looking at the real-life factors that are affecting their outlook, the top consumer concern over the next 12 months is work/life balance (12 per cent), followed by increasing food prices, job security and tolerance towards other religions – all at 11 per cent.

Looking at the future outlook for Ghana, Nooy comments; “Ghana is likely to outperform the regional economic growth average in 2021 which bodes well for increased domestic demand and consumption levels.

“To benefit from these improved circumstances retailers will need to meet radically altered consumer, demands, needs and behaviours that will impact where they shop, what they buy, why they buy and how much they are willing to spend.”

General

FG Sues El-Rufai Over Alleged Interception of NSA Ribadu’s Communications

By Adedapo Adesanya

The federal government has filed a three-count charge against former governor of Kaduna State, Mr Nasir El-Rufai, over an alleged interception of communications belonging to Nigeria’s National Security Adviser (NSA), Mr Nuhu Ribadu.

Last week, Mr El-Rufai claimed in an interview that he and other unnamed individuals listened to conversations from Mr Ribadu’s phone after it was tapped by a third party. While acknowledging that such interception is technically unlawful, he argued that illegal surveillance was not unusual.

However, the federal government, through the Department of State Services (DSS), filed charges against Mr El-Rufai at the Federal High Court in Abuja.

The government stated that Mr El-Rufai admitted that he and his cohorts allegedly intercepted the NSA’s phone conversations.

In count one, the accused was alleged to have disclosed on Arise TV’s Prime Time Programme in Abuja that he and his associates unlawfully intercepted the phone communications of the National Security Adviser, which is an offence contrary to and punishable under Section 12(1) of the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act, 2024.

The second charge alleged that the accused knowingly maintained a relationship with an individual who unlawfully intercepted the phone communications of Mr Ribadu, without reporting such individual to the appropriate security agencies, an offence contrary to and punishable under Section 27(b) of the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act, 2024.

In the last charge, Mr El Rufai, together with others presently at large, is also alleged to have, sometime in 2026 in Abuja within the jurisdiction of this Court, utilised technical equipment or systems in a manner that compromised public safety and national security, thereby instilling reasonable apprehension of insecurity among Nigerians through the unlawful interception of the phone communications of the National Security Adviser, Nuhu Ribadu. The charge further relies on his admission during the February 13 interview. These acts are alleged to constitute an offence contrary to and punishable under Section 131(2) of the Nigerian Communications Act 2003.

General

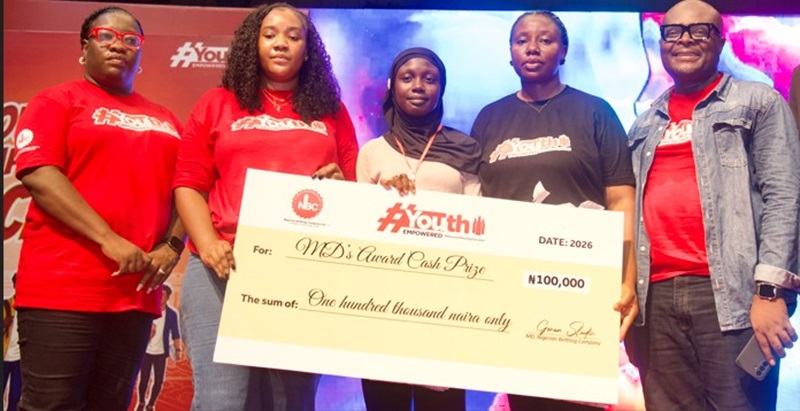

Nigerian Bottling Company Bridges Education, Employability Gap

By Modupe Gbadeyanka

The Nigerian Bottling Company (NBC) has reaffirmed its determination to bridge the gap between education and employability in the country by sustaining its flagship Youth Empowered (YE) programme.

This initiative provides hands-on learning, real-world insights, and access to career-shaping opportunities to young Nigerians.

The 2026 edition of the scheme commenced on February 2 at the University of Lagos (UNILAG), with participants mainly young people between the ages of 16 and 35.

A statement from the organisation said this year’s rollout will expand to more tertiary institutions, including the Federal University of Technology, Akure (FUTA). This follows a successful 2025 tour that reached seven cities across the country, including Makurdi, Jos, Benin, Kaduna, Asaba, Akure, and Port Harcourt.

Participants in the 2026 programme will receive training across key modules designed to support personal, professional, and business growth, including Business Life Skills, Adaptability and Resilience, Financial Literacy, Customer Service and Communication, Sales and Negotiation Skills, and Workplace Ethics.

The sessions will also feature breakout workshops on Business Planning, Project Management, and Time Management, alongside the Director’s Grant Pitch Competition, where participants can pitch their ideas for a chance to win business funding.

In addition to skills development, NBC’s People and Culture team will be present throughout the programme to identify outstanding talent for future opportunities within the organisation, further strengthening the connection between learning, employment, and long-term career growth.

One of the participants at the UNILAG training, Waliat Adedogun, who received a cash grant through the Director’s Grant Pitch Competition to support her small business, said: “Youth Empowered gave me more than training; it gave me clarity and confidence. Winning the grant means I can finally take my business idea from a dream into something real. I now feel prepared to build, grow, and create opportunities not just for myself, but for others too.”

Since its launch in 2017, the scheme has impacted more than 70,000 young Nigerians, equipping participants with practical skills, confidence, and exposure needed to succeed in today’s dynamic workplace and entrepreneurial landscape.

This year’s programme is being delivered in collaboration with Fate Foundation as the implementing partner, with funding support from The Coca-Cola HBC Foundation.

Last year, 10 beneficiaries were selected for six-month paid internships across NBC locations in Lagos, Ibadan, Asejire, and Challawa, gaining direct industry exposure.

Additionally, three outstanding participants received sponsorship for an all-expenses-paid intensive culinary training programme and were awarded N1 million each to support the launch of their businesses.

General

INEC Fixes February 20 for 2027 Presidential, NASS Elections

By Modupe Gbadeyanka

The 2027 presidential and National Assembly elections will take place on Saturday, February 20, the Independent National Electoral Commission (INEC) has revealed.

In a notice for the 2027 general polls issued on Friday, the electoral umpire also disclosed that the governorship and state assembly elections for next year would be on Saturday, March 6.

Speaking at a news briefing in Abuja today, the chairman of INEC, Mr Joash Amupitan, expressed the readiness of the commission to conduct the polls next year, which is 12 months away.

The timetable issued by the organisation for the polls comes when the federal parliament has yet to transmit the amended electoral bill to President Bola Tinubu for assent.

This week, the Senate passed the electoral bill, reducing the notice of elections from 360 days to 180 days, while the transmission of results was mandated with a proviso.

Recall that on February 4, INEC said it was ready to go ahead with preparations for the elections despite the delay in the passage of the amended electoral law of 2022.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn