Showbiz

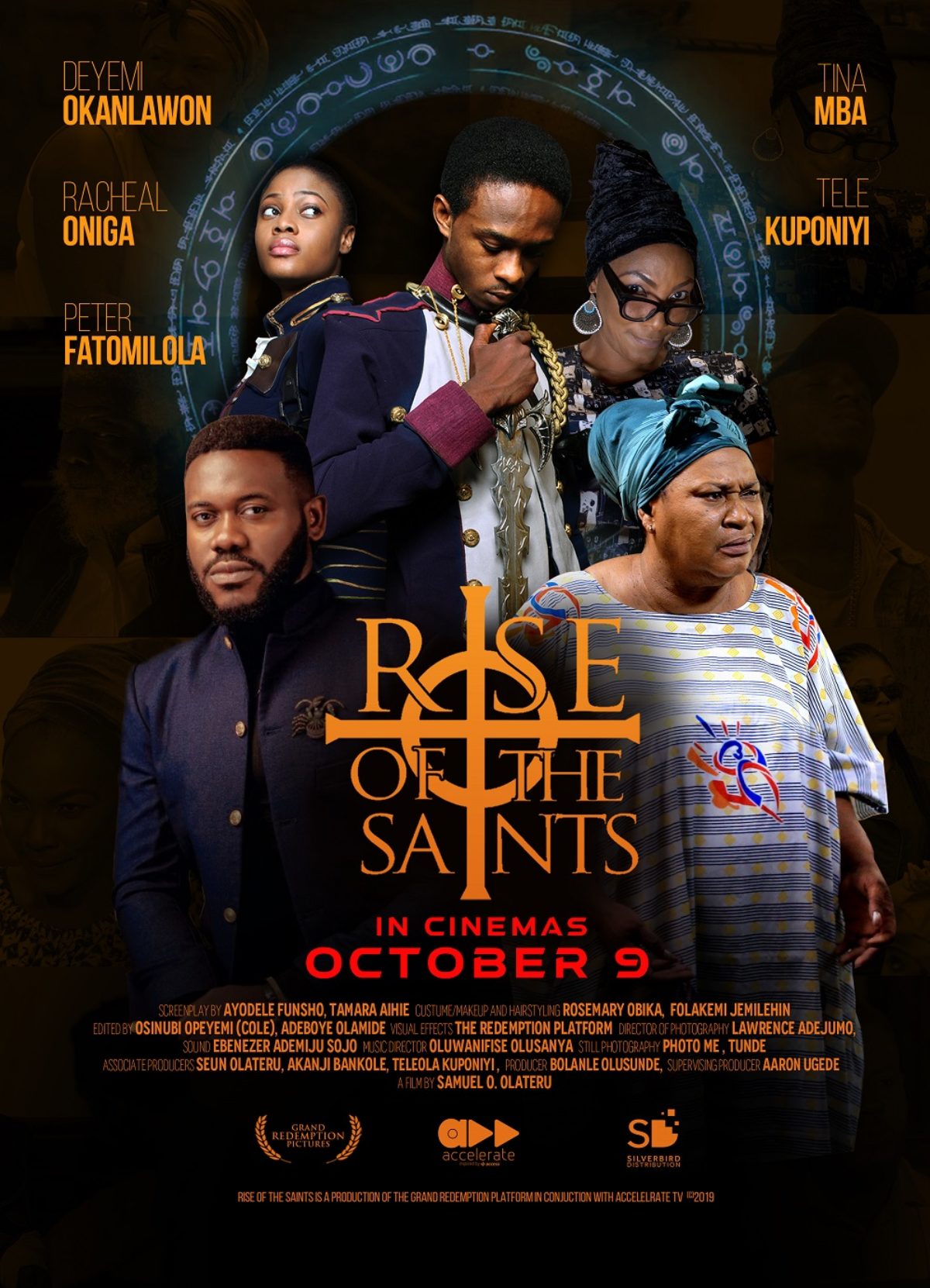

Rise of the Saints Gets October 9 Cinema Release Date

By Modupe Gbadeyanka

From Friday, October 9, 2020, movie lovers will have the opportunity to see a new flick, Rise of the Saints at cinemas across the country.

The new feature-length film was produced by Grand Redemption Platform and co-produced by Accelerate TV.

The flick was originally scheduled for release on April 17, 2020, but due to the COVID-19 pandemic and the lockdown measures put in place by the federal government, the release was pushed forward.

Rise of the Saints featured veterans in the Nigerian movie industry fondly called Nollywood like Rachel Oniga, Tina Mba, Peter Fatomilola, and Deyemi Okonlawon as well as newcomer, Teleola Kuponiyi, who makes his acting debut playing the lead character in the story.

A statement issued by the producers explained that the film is a fictitious spin on events that took place centuries after the happenings in the account of the legend of Moremi Ajasoro, Princess of the Yoruba people, are reported to have occurred.

It was stated that before the cinema release date, a special viewing with industry stakeholders will take place at the Filmhouse IMAX cinemas, Lekki.

According to the statement, Rise of the Saints is distributed by Silverbird Film Distribution.

Watch the trailer below:

Showbiz

Movie Classics You’ll Love to Watch This Holiday Season on GOtv

The holidays have a way of bringing out our inner child, don’t they? The twinkling lights, the aroma of jollof rice, and the irresistible pull of family traditions—all wrapped up in a comforting cocoon of nostalgia. GOtv is turning back the clock this festive season with a lineup of timeless classics that will take you down memory lane while providing bellyfuls of laughter, adventure, and joy. Here’s your guide to the throwback magic airing on GOtv Channel 3, M-Net Movies 4.

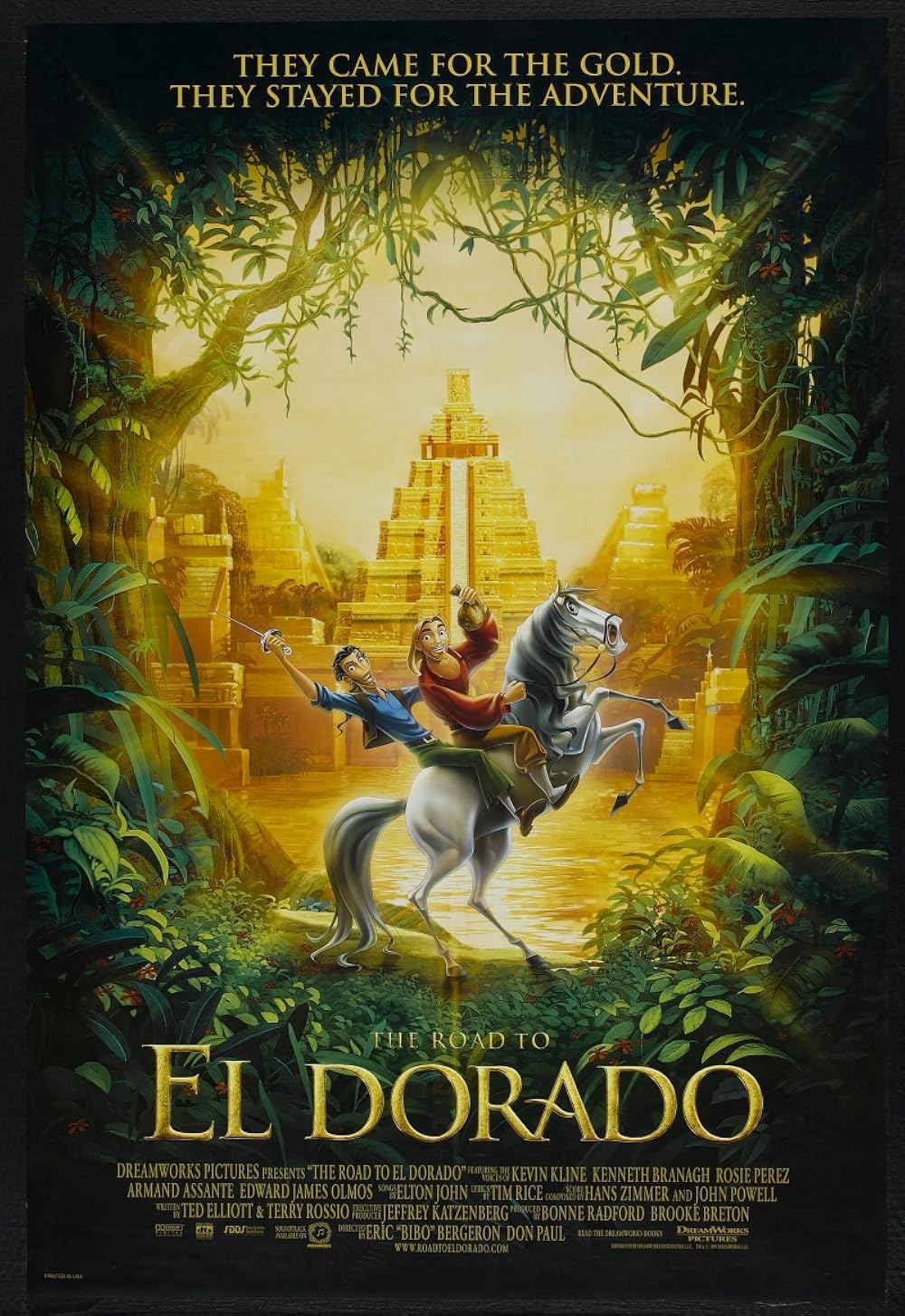

The Road to El Dorado

“Gold, glory, and endless laughs!”

Embark on an animated adventure that’s as gold-filled as it is hilarious. The Road to El Dorado follows two loveable rogues, Tulio and Miguel, as they stumble upon the legendary city of gold. With its vibrant visuals, catchy tunes, and laugh-out-loud moments, this film is a treasure trove of holiday fun. Perfect for anyone who wants a mix of humour, mischief, and heart. Don’t miss it on Monday, December 23rd, at 10:15 am.

Yogi Bear

“Who stole the picnic basket this time?”

Grab your picnic baskets and prepare for some “beary” funny antics with everyone’s favourite bear and his sidekick, Boo-Boo. Yogi Bear is the embodiment of cosy, family-friendly entertainment. Watch as the duo tries to save their beloved Jellystone Park in a story filled with clever schemes, laugh-out-loud moments, and warm holiday vibes. Tune in on Wednesday, December 25th, at 10:25 am.

Austin Powers: The Spy Who Shagged Me

“Groovy, baby!”

Yeah, baby, yeah! Kick up the festive fun with Austin Powers: The Spy Who Shagged Me. This groovy comedy brings the laughs with its over-the-top characters, outrageous one-liners, and a dash of 60s flair. It’s not your traditional holiday movie, but it’s a wild ride that’s sure to inject some unexpected spice into your festive viewing schedule. Catch it on Monday, December 23rd, at 4:15 pm.

Shark Tale

“Underwater fun with a splash of laughs!”

What happens when you mix a talking fish, underwater mobsters, and Will Smith’s undeniable charm? You get Shark Tale—an underwater comedy adventure like no other. This late-night delight is packed with vibrant animation, catchy tunes, and an unforgettable message about staying true to yourself. Watch it on Monday, December 23rd, at 11:55 pm.

Daddy Day Care & Daddy Day Camp

“When dads take the reins, chaos follows!”

Who says dads can’t do it all? Eddie Murphy takes on the hilarious challenge of running a daycare in Daddy Day Care, while Daddy Day Camp sees the chaos ramp up in the great outdoors. These back-to-back comedies are brimming with laughable parenting mishaps, heartwarming moments, and plenty of holiday cheer. Back-to-back fun airs on Wednesday, December 11th, at 3:15 pm and 4:50 pm.

Relive the Joy Only on GOtv

Whether you’re looking to laugh, reminisce, or simply escape into a world of fun, GOtv’s festive lineup of throwbacks is your ticket to holiday bliss. Don’t miss the chance to make new memories with these classic gems.

Subscribe now to unlock a world of exciting entertainment! Take advantage of the GOtv Supa Plus Golden Window and pay just N13,900 instead of N15,700. Upgrade, subscribe, or reconnect via the MyGOtv app or dial *288#. For on-the-go viewing, don’t forget to download the GOtv Stream App and enjoy your favourite classics anytime, anywhere.

Let the nostalgia flow and the laughter echo this festive season—it’s all happening on GOtv!

Showbiz

Holiday Preview: Festive Season Programmes to Watch Out for on GOtv

Imagine it’s Christmas. The aroma of jollof rice wafts through the air, kids run around in matching outfits, and the TV is tuned to GOtv Channel 3, M-Net Movies 4. But this isn’t just any Christmas morning—this one’s about to go wild. A mischievous cat wreaking havoc, Matilda bending spoons with her mind, and Babe, the pig, proving why kindness trumps all.

This year, GOtv is turning your festive lineup into a whirlwind of unforgettable stories that will leave you laughing, crying, and cheering—all in one sitting. Here’s a guide to some of the festive season movies that will make your holiday season not just merry but downright legendary.

Dr. Seuss’ The Cat in the Hat

Dr. Seuss’ The Cat in the Hat

“Chaos has never been this entertaining!”

What happens when a family’s holiday preparations meet a six-foot-tall cat with a penchant for mischief? Absolute pandemonium! From balancing teetering stacks of furniture to unleashing his Thing 1 and Thing 2 accomplices, the Cat pushes the boundaries of holiday cheer. Did you know this whimsical character has sparked debates about his “anarchic” influence for decades?

This Christmas, let the Cat in the Hat remind you that sometimes, a little chaos is needed to bring families together. Catch this iconic film on Thursday, December 19th, at 12:15 pm.

Matilda

Matilda

“Who says kids can’t save Christmas?”

Matilda Wormwood may be small, but her courage and wit are larger than life. Remember the scene where she finally takes a stand against Miss Trunchbull? That’s not just a victory—it’s a moment that defines resilience. This heartwarming classic proves that even the tiniest among us can create the biggest miracles.

Gather the family and let Matilda inspire a holiday spirit filled with courage, imagination, and just a touch of telekinesis. This family favourite airs on Wednesday, December 25th, at 3:00 pm.

Babe & Babe: Pig in the City

Babe & Babe: Pig in the City

“From farmyard hero to city superstar!”

What could be more festive than the tale of a pig who defies the odds? Babe’s journey to prove his worth is a story that echoes the true spirit of the holidays: kindness, determination, and belief in oneself. In Babe: Pig in the City, the stakes are raised as our lovable hero ventures into an urban jungle.

These tales are more than entertaining—they’re a gentle reminder to embrace every family member, even the most unlikely ones. Catch Babe on Monday, December 23rd, at 8:35 am, and don’t miss the sequel, Babe: Pig in the City, airing the next day, Tuesday, December 24th, at 9:00 am.

Cloudy with a Chance of Meatballs

Cloudy with a Chance of Meatballs

“Let it rain… cheeseburgers?”

What if your holiday feast literally fell from the sky? This imaginative adventure takes festive indulgence to a whole new level. Whether it’s giant pancakes or spaghetti tornadoes, Cloudy with a Chance of Meatballs brings a colourful twist to the festive spirit. But beyond the fun, it’s a heartfelt story about family, innovation, and the courage to dream big. Join the adventure on Sunday, December 22nd, at 2:25 pm

Problem Child & Problem Child 2

Problem Child & Problem Child 2

“When holiday chaos meets Junior…”

Imagine this: one kid, two parents, and endless mayhem. Problem Child introduces us to Junior, the walking definition of “holiday surprises.” In the sequel, the laughs double as Junior’s antics escalate to new heights. It’s hilarious, nostalgic, and a perfect reminder that no family gathering is complete without a little drama. Watch the chaos unfold on Tuesday, December 24th, at 1:55 pm, followed by even more antics in Problem Child 2 at 3:25

Your Holiday Starts Here

This Christmas, GOtv isn’t just delivering entertainment; it’s creating moments you’ll treasure forever. From whimsical chaos to heartwarming tales, M-Net Movies 4 on Channel 3 has it all.

So grab a plate of Christmas jollof, huddle up with your loved ones, and let the holiday magic unfold on screen. And don’t forget to tune in to GOtv Channel 3 to catch these festive classics.

Don’t miss the chance to make your holiday season unforgettable. Subscribe, upgrade, or reconnect now through the MyGOtv App or dial *288#. This Christmas is not just about the presents—it’s about the stories that bring us together.

Showbiz

All Set for Stanbic IBTC Pension Managers’ FUZE 3.0 Festival

By Modupe Gbadeyanka

Barring any unforeseen circumstances, all roads will lead to the Livespot Entertarium in Lekki, Lagos for the Stanbic IBTC Pension Managers’ FUZE Talent Show 3.0 on Saturday, December 21, 2024.

The festival is the biggest talent extravaganza in Nigeria. It is a platform that celebrates the country’s creativity and innovation.

According to the organisers, the programme promises to be a game-changing platform for unveiling Nigeria’s next generation of young talents.

The FUZE 3.0 festival features a prize pool of N50 million and an esteemed panel of judges, including industry icons like Funke Adepoju, Akinwande Akinsulire, Don Flexx, and Korede Bello.

With the theme Light it Up, this event is more than just a competition; it is a movement that celebrates Nigerian creativity in music, dance, fashion, and technological innovation.

“We are not merely hosting a talent show; we are creating a platform that amplifies the extraordinary potential of Nigerian youths in music, dance, fashion, and technology.

“The FUZE Festival is designed to showcase this potential, providing a vibrant space where young talent can shine, connect, and collaborate; ultimately fostering innovation and creativity within our communities.

“By celebrating diverse artistic expressions, the festival aims to inspire the next generation of leaders and change-makers in Nigeria,” the chief executive of Stanbic IBTC Pension Managers, Mr Olumide Oyetan, said.

Globally acclaimed Nigerian musical powerhouses that embody the excellence and vibrant energy of the Nigerian entertainment industry, Wande Coal, BNXN and Qing Madi, will be on stage to thrill guests and participants and electrify the atmosphere with their chart-topping hits.

This celebration is expected to birth new Nigerian talents with the potential to make a global impact after their grooming stages.

The event will include a unique holiday shopping festival. Premium Nigerian and international brands in fashion, beauty, personal care, tech, food, and beverage will display their quality goods and products for all holidaymakers and fun-seekers looking for amazing seasonal discounts on special gift items.

The exhibition area will be more than a shopping destination; it will be an immersive experience that complements the talent show’s vibrant atmosphere.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN